Loan With Guarantor Agreement Template free printable template

Show details

This document outlines the terms, conditions, and responsibilities related to the loan provided by the Lender to the Borrower, with a guarantor.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan With Guarantor Agreement Template

A Loan With Guarantor Agreement Template is a legal document that outlines the terms and conditions under which a guarantor agrees to secure a loan on behalf of the borrower.

pdfFiller scores top ratings on review platforms

Its very user friendly. I haven't had any issues with PDFfiller nor have I run into a problem not being capable of completing my tasks at hand.

Great, but I would like more information on utilization.

y

In your own words, please tell us about your experience with PDFfiller

Superou minhas expectativas.

Good experiance .Still finding my way.

Who needs Loan With Guarantor Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Loan With Guarantor Agreement Template on pdfFiller

In this guide, you'll learn how to effectively use a Loan With Guarantor Agreement Template, an essential document for securing loans with a guarantor’s backing. This template simplifies the loan agreement process by clearly outlining the responsibilities of all parties involved.

A Loan With Guarantor Agreement is an invaluable tool for borrowers seeking financial assistance, providing security for lenders. With the help of pdfFiller, you can easily fill out, edit, and manage your documents online.

To successfully fill out the Loan With Guarantor Agreement Template, ensure you input accurate details and understand the responsibilities of all parties involved including the borrower, creditor, and guarantor.

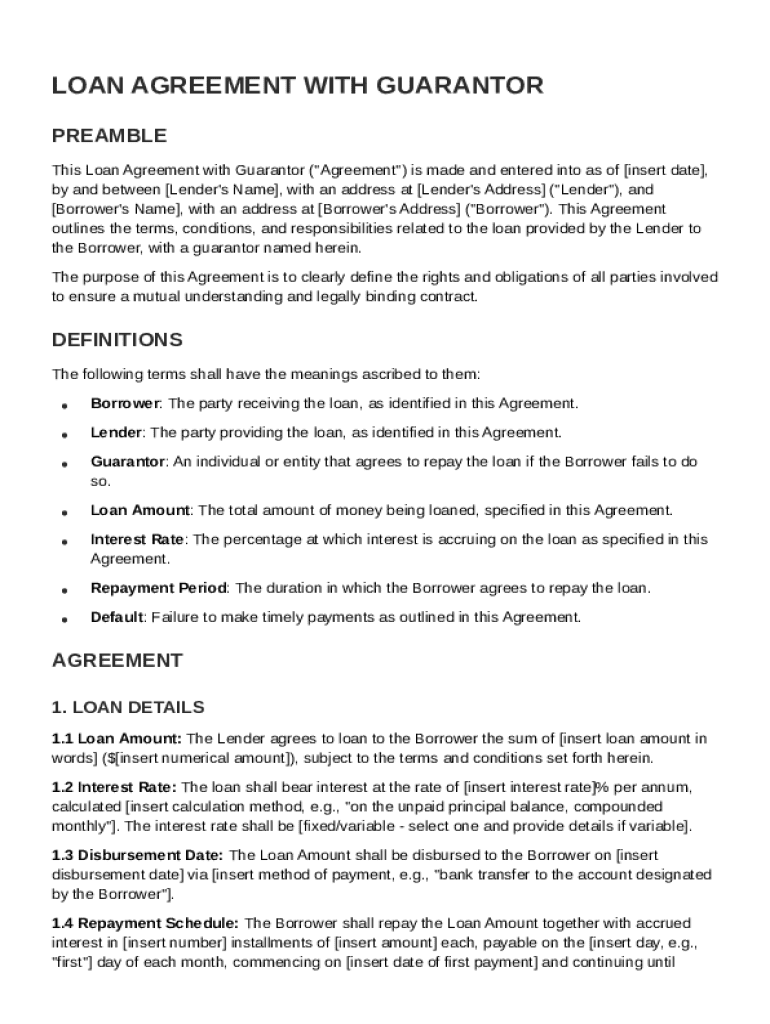

What is a Loan With Guarantor Agreement?

A Loan With Guarantor Agreement is a contract where a third party, the guarantor, agrees to be responsible for the repayment of a loan if the borrower defaults. This provides additional security to the lender, ensuring that they can recover their funds even if the borrower fails to fulfill their obligation.

-

Having a guarantor can make securing loans easier for individuals with poor credit or limited financial history, enhancing their borrowing potential.

-

It is advisable to use a Loan With Guarantor Agreement in situations where the borrower’s creditworthiness may be in question or when larger loan amounts are involved.

What are the key components of the loan agreement?

A structured Loan With Guarantor Agreement contains several key components crucial for ensuring clarity and legal compliance. These components outline the responsibilities and rights of all parties involved.

-

Clearly states who is involved in the agreement, including the lender, borrower, and guarantor, to avoid confusion.

-

Includes vital definitions such as loan amount, interest rate, repayment period, and default criteria, ensuring that all parties understand their obligations.

-

Details the rights and responsibilities of each party and outlines the consequences of defaulting on the agreement.

How to fill out the Loan With Guarantor Agreement Template?

Filling out the Loan With Guarantor Agreement Template accurately is crucial for ensuring all parties are correctly identified and their responsibilities outlined.

-

Accurately fill in the preamble with names and specific dates, ensuring clarity around who the parties are.

-

Consider financial needs, ability to repay, and market interest rates when deciding the loan amount.

-

Understand the difference between fixed and variable interest rates and choose the one that best suits the loan agreement.

-

Specify how the loan will be disbursed and the agreed-upon payment method, whether it's direct deposit or check.

How can pdfFiller tools help manage your loan agreement?

pdfFiller provides cloud-based tools that simplify document management. These features enhance collaboration, ensure compliance, and streamline the filling process, making managing loan agreements easy.

-

Edit, eSign, and collaborate with team members, all from a single platform for optimal convenience.

-

Real-time tracking of revisions helps keep all parties informed and manages changes efficiently.

-

Share your Loan Agreement securely with involved parties using trusted, encrypted processes.

What compliance considerations should you keep in mind?

Compliance with local regulations is critical when creating a Loan With Guarantor Agreement. Understanding the legal landscape ensures that the agreement is enforceable and protects all parties.

-

Stay informed about local laws which may affect the terms of the Loan With Guarantor Agreement.

-

Regularly review and update your agreement to comply with changing laws, ensuring it remains legally binding.

-

Establish processes for verifying the identity and creditworthiness of the guarantor to minimize risk.

What next steps should you take after signing your agreement?

Once the Loan With Guarantor Agreement is signed, it's essential to establish a clear repayment process and maintain communication among the lender, borrower, and guarantor.

-

Ensure all parties understand the repayment timelines and methods; this helps avoid future complications.

-

Regular updates and discussions between all parties can prevent misunderstandings and ensure everyone is informed.

-

Create a clear plan for managing defaults, including notification processes and potential legal avenues.

How to fill out the Loan With Guarantor Agreement Template

-

1.Download the Loan With Guarantor Agreement Template from pdfFiller.

-

2.Open the template using the pdfFiller platform.

-

3.Begin by entering the borrower's full name and address in the designated fields.

-

4.Next, input the loan amount and the interest rate applicable.

-

5.Fill in the guarantor's details, including name, address, and relationship to the borrower.

-

6.Specify the repayment terms, including payment schedule and penalties for default.

-

7.Review all entered information for accuracy before finalizing.

-

8.Sign the document electronically as the borrower and the guarantor.

-

9.Finally, save the completed agreement and share it with all involved parties.

How to write a guarantor form for a loan?

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

How to fill out a loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to get a personal loan with a guarantor?

How to apply for a guarantor personal loan Choose your guarantor. Find someone willing to act as your guarantor. Research your loan options. Once you've done this, you'll be able to assess the products on offer from our partnered lenders. Prepare your documentation. Apply with your guarantor. Sign the loan agreement.

How to draft a guarantee agreement?

The Guarantor(s) declare that the Guarantor(s) has/have not received any security from the Borrower for the giving of this guarantee and the Guarantor(s) agree that so long as any moneys remain owing by the Borrower to the Bank or any liability incurred by the Bank remains outstanding, the Guarantor(s) will not take

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.