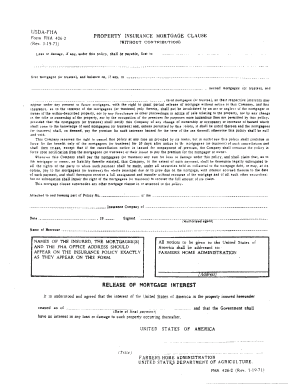

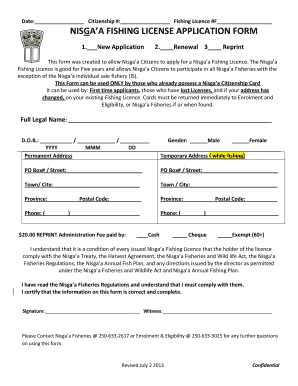

Money Loan Agreement Template free printable template

Show details

This Money Loan Agreement outlines the terms and conditions under which a lender will loan money to a borrower, including the loan amount, interest rate, repayment schedule, and other obligations

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Loan Agreement Template

A Money Loan Agreement Template is a legal document outlining the terms and conditions under which money is lent to a borrower.

pdfFiller scores top ratings on review platforms

New user! Very user friendly. Made things so much easie

This program is super user friendly, I am very satisfied with this product, I higgly recommend it!!!!!!

Works great on my PC and I love being able to sign and submit signatures from my tablet. Unfortunately, I'm not able to open my forms on my tablet.

it's very helpful and I enjoy the services of creating your own document, searching for documents.

FIRST TIME USER, EXCEED MY EXPECTATIONS!

Good Service , thank you

Mahmoud mahmoud

Who needs Money Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Money Loan Agreement Template form

Understanding the Money Loan Agreement

A money loan agreement is a formal document outlining the terms between a lender and a borrower. This structured agreement is crucial as it minimizes misunderstandings, defines responsibilities, and highlights mutual expectations. Moreover, understanding the legal implications of a loan agreement can protect both parties in case of disputes.

What are the key components of a Money Loan Agreement?

-

Clearly state the names and contact details of both parties involved.

-

Define the total loan amount and whether it’s in a single sum or installments.

-

Specify if the rate is fixed or variable, as this significantly affects repayment.

-

Detail the repayment timeline, including when payments are due and the frequency (monthly, quarterly, etc.).

-

Incorporate clauses explaining what happens if payments are missed, including penalties or legal actions.

How do you draft your Money Loan Agreement?

Drafting a Money Loan Agreement can be straightforward when following a structured approach. Start with a clear outline and fill in each section methodically. Utilize tools like pdfFiller, which offers interactive features that simplify document creation. However, be cautious of common pitfalls such as leaving out key terms or using ambiguous language, which can lead to disputes.

What payment terms should be included in your Money Loan Agreement?

-

Specify whether repayments will occur monthly, quarterly, or annually to avoid confusion.

-

Detail how payments will be made, including acceptable payment forms (checks, bank transfers, etc.).

-

Clarify the penalties for late payments or defaults to deter breaches of the agreement.

How do you negotiate loan agreement terms?

Negotiation is a critical phase in forming a loan agreement. Aim for a fair interest rate by researching current market trends. Address potential repayment concerns upfront and be transparent about financial capabilities. Using pdfFiller, you can collaborate with all parties in real-time, allowing for seamless adjustments to the agreement.

How can pdfFiller assist in loan agreement management?

pdfFiller empowers users with features to manage loan agreements effortlessly. It allows for easy digital signing and document tracking, ensuring all changes are documented. This cloud-based platform simplifies the eSigning process and offers crucial tips on maintaining version control of your agreements.

What are the risks of not complying with legal standards in loan agreements?

Forgetting to comply with legal requirements can have serious consequences. Each region has specific laws governing loan agreements, and non-compliance can lead to invalid agreements or legal disputes. It’s advisable to consult with legal professionals for complex situations to ensure all aspects are covered.

How to fill out the Money Loan Agreement Template

-

1.Download the Money Loan Agreement Template from pdfFiller.

-

2.Open the template using the pdfFiller editor.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the full names and contact information of both the lender and borrower in the designated fields.

-

5.Specify the amount of money being lent in clear terms.

-

6.Outline the interest rate, if applicable, and the repayment schedule, including due dates and payment methods.

-

7.Include any additional terms or conditions relevant to the loan, such as collateral or default consequences.

-

8.Review the agreement for accuracy and clarity, making sure both parties understand all terms.

-

9.Save the filled document as a new file before printing.

-

10.Print two copies of the signed agreement for both the lender and borrower to keep.

How to write a money loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

How to write a money agreement format?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

How to write an agreement to pay back money?

Key elements of a repayment agreement Parties involved. Clearly define the lender and borrower, including their contact information. Loan amount and interest. Specify the principal amount and any interest to be charged. Repayment schedule. Late fees: Outline any penalties for late payments. Default terms. Governing law.

What is the agreement to borrow money?

The Lender agrees to lend to the Borrower and the Borrower agrees to borrow from the Lender for the purposes specified in Article 2 hereof and on the terms and conditions contained herein, a sum not exceeding Rs. __/-_ (Rupees __ only). The said sum is hereinafter referred to as “the Loan”.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.