Mortgage Assumption Agreement Template free printable template

Show details

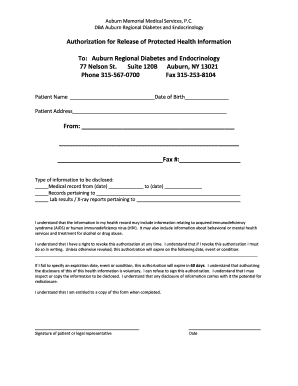

This document outlines the terms and conditions under which a Borrower assumes an existing mortgage from a Lender for a specific property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Mortgage Assumption Agreement Template

A Mortgage Assumption Agreement Template is a legal document that allows a buyer to take over the mortgage obligations of a seller's property.

pdfFiller scores top ratings on review platforms

PDF filler is easy to use and great tool

Flexible, easy to use, well supported, fully featured.

I am frequently frustrated with pdfs. This takes the sting out because even I can navigate!

Love the professionalism of the completed forms and ease of use

Easy to use, and documents look so much nicer typed than handwritten

I'll give a full review once I have completed the work. So far, I am pleased with most of its functionalities.

Who needs Mortgage Assumption Agreement Template?

Explore how professionals across industries use pdfFiller.

Mortgage Assumption Agreement Template Guide

To fill out a Mortgage Assumption Agreement Template form, start by gathering essential information about the parties involved. Ensure clarity on the terms of the mortgage and obligations. Accurate completion is crucial for the agreement to be legally binding.

What is a Mortgage Assumption Agreement?

A Mortgage Assumption Agreement allows a buyer to take over the seller's existing mortgage. This agreement is pivotal in real estate transactions because it can save the buyer money on interest rates if the original mortgage has favorable terms. Understanding this concept is essential for both parties to ensure a smooth transition.

-

Mortgage: A legal agreement between a lender and borrower securing a loan against property.

-

Assumption: Taking over another party's obligations and rights under an existing mortgage.

-

Assumed Obligations: Responsibilities the buyer agrees to uphold such as loan payments.

-

Default: A failure to fulfill the mortgage obligations, leading to potential foreclosure.

What are the key components of the agreement?

A Mortgage Assumption Agreement must clearly outline several key components for clarity and legality. The essential parties involved include the borrower and lender, whose rights must be stated explicitly to avoid confusion. Recitals provide the necessary background information, establishing context for the agreement.

-

Essential Parties Involved: Identification of the borrower who will assume the mortgage and the lender.

-

Recitals: A section that details pertinent background information related to the existing mortgage.

-

Terms of Assumption: Clearly defined acceptance, obligations, and responsibilities of the new borrower.

-

Default: Information concerning conditions that would lead to a default and the consequences thereof.

How do you fill out the Mortgage Assumption Agreement?

Completing a Mortgage Assumption Agreement Template form requires attention to detail. Following a step-by-step guide ensures that all necessary components are covered without errors. Each field must be filled accurately to maintain the legal validity of the document.

-

Step-by-Step Guide: Follow detailed guidelines for completing your agreement correctly.

-

Individual and Team Instructions: Whether filling individually or as a group, adhere to the same stringent standards.

-

Common Errors to Avoid: Familiarize yourself with common mistakes that can invalidate the agreement.

-

Importance of Accurate Information: Validity hinges on the precision of the entered data.

How to edit and manage the agreement?

Managing your Mortgage Assumption Agreement effectively is essential for maintaining up-to-date conditions. Utilizing tools like pdfFiller makes collaborative editing seamless and secure. The platform also offers options to save, share, and ensure legal acceptance through eSigning.

-

Utilizing pdfFiller’s Tools: Edit documents easily with user-friendly features designed for precision.

-

Collaborative Features for Teams: Work collectively on documents with built-in sharing functionalities.

-

How to Save, Share, and Store: Implement strategies for safely managing and securing your agreements.

-

eSigning the Document: Ensure legal compliance with a trusted electronic signature option.

What legal compliance and considerations should be noted?

Understanding the legal ramifications surrounding a Mortgage Assumption Agreement is crucial to avoid misunderstandings. Compliance with regulatory requirements in your region can vary, necessitating awareness of specific state laws. Non-compliance can lead to serious financial implications, making knowledge paramount.

-

Regulatory Requirements in [region]: Familiarize yourself with local regulations that may affect your agreement.

-

State-Specific Legalities: Be aware of nuances in state laws that pertain to mortgage assumptions.

-

Implications of Non-Compliance: Understand the consequences of failing to adhere to legal standards.

How to fill out the Mortgage Assumption Agreement Template

-

1.Download the Mortgage Assumption Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Fill in the date at the top of the document where indicated.

-

4.Enter the names and addresses of both the buyer and seller in the designated fields.

-

5.Input the property description, including the address and legal description, in the appropriate area.

-

6.Specify the loan amount being assumed and the remaining balance on the mortgage.

-

7.Fill in the lender's name and contact information as required.

-

8.Review all entered information for accuracy before proceeding.

-

9.Save the completed document to your account or download it in your preferred format.

-

10.If necessary, share the agreement with relevant parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.