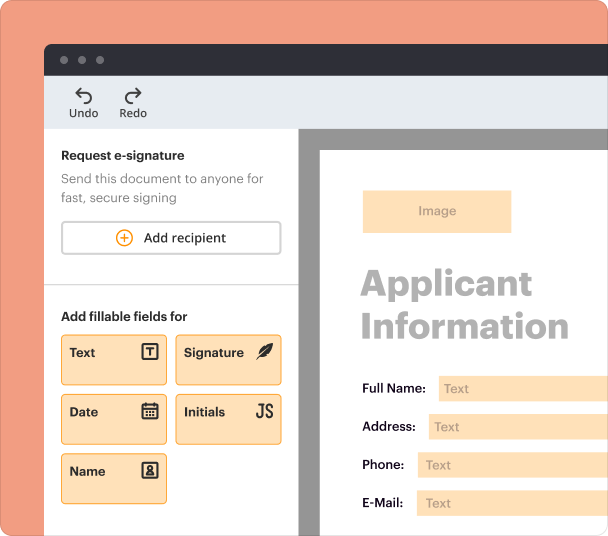

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Mortgage Loan Agreement Template

Show details

This document is a legal agreement between a borrower and a lender specifying the terms under which a loan is secured by a mortgage on real estate. It includes definitions, loan details, interest

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

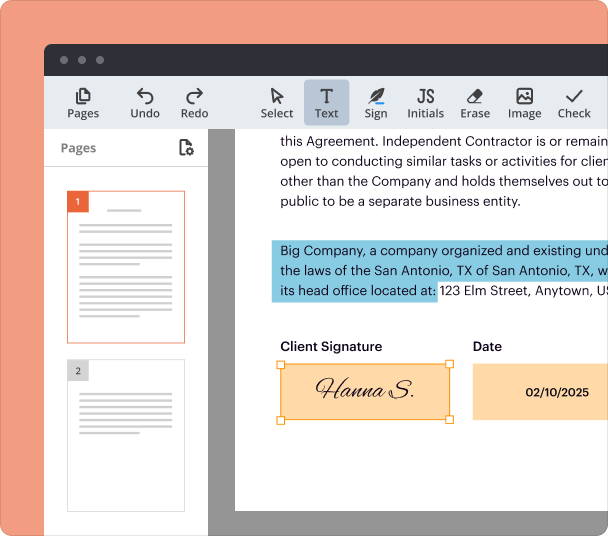

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

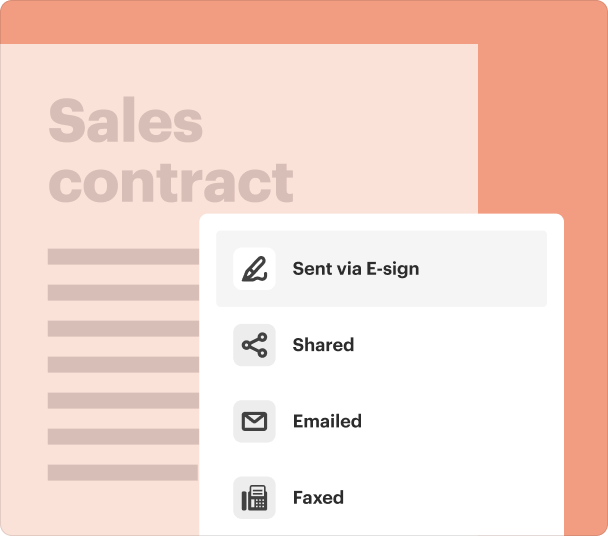

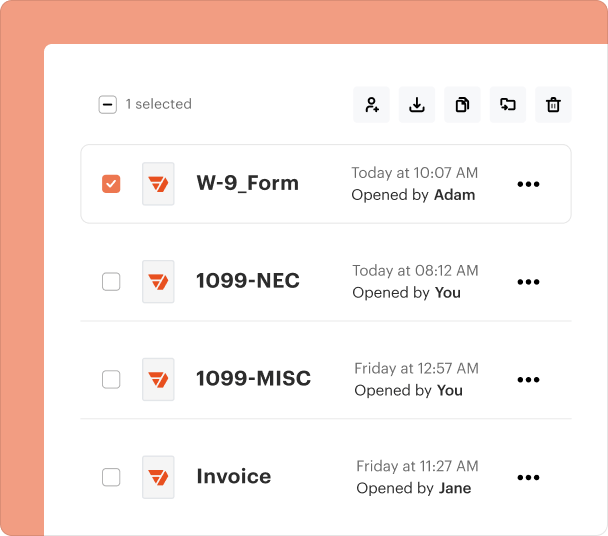

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about mortgage loan agreement template

Here you will find essential tips and guidance on how to effectively edit and fill out the Mortgage Loan Agreement Template to suit your specific needs.

How to edit mortgage loan agreement template

With pdfFiller, editing the Mortgage Loan Agreement Template is straightforward and efficient:

-

1.Click on the ‘Get form’ button on this page to access the Mortgage Loan Agreement Template.

-

2.If you don’t already have an account, you will need to create one. Simply follow the prompts to sign up using your email address or social media account.

-

3.Once logged in, upload the Mortgage Loan Agreement Template to your pdfFiller dashboard.

-

4.Use the intuitive tools available to edit any text, add new sections, or adjust formatting as needed.

-

5.Save your changes and download the updated document when you’re satisfied with your edits.

How to fill out mortgage loan agreement template

Completing the Mortgage Loan Agreement Template correctly is crucial for ensuring legal compliance and clarity in your agreement. Here's how you can do it effectively:

-

1.Start by clicking on the ‘Get form’ button on this page to obtain the Mortgage Loan Agreement Template.

-

2.After accessing the form, review the document to familiarize yourself with its structure and required information.

-

3.Carefully enter your personal details and the specifics of the loan in the respective fields.

-

4.Ensure that all necessary financial information, including loan amounts and interest rates, are accurately filled out.

-

5.Specify the terms and conditions of the loan, including repayment schedules, if applicable.

-

6.Double-check all entries for accuracy and completeness before proceeding to the next step.

-

7.Use the eSignature feature within pdfFiller to sign the document electronically.

-

8.Save your completed Mortgage Loan Agreement Template and store it securely for your records.

All you need to know about mortgage loan agreement template

This section provides a comprehensive overview of the Mortgage Loan Agreement Template, clarifying its significance and use.

What is a mortgage loan agreement template?

A Mortgage Loan Agreement Template is a legal document that outlines the terms and conditions of a mortgage loan between a lender and a borrower. This template serves as a foundation for customizing the agreement based on the specific terms negotiated.

Definition and key provisions of a mortgage loan agreement template

The Mortgage Loan Agreement Template typically encompasses various provisions essential for defining the responsibilities of both parties involved. Key provisions often include:

-

1.Identification of the borrower and lender

-

2.Details of the property being mortgaged

-

3.Loan amount and interest rate

-

4.Repayment terms and schedule

-

5.Penalties for late payments

-

6.Provisions for default and foreclosure

When is a mortgage loan agreement template used?

A Mortgage Loan Agreement Template is utilized when an individual or business is seeking financing for purchasing real estate. It serves to formalize the loan terms, ensuring both parties are protected and clear on their commitments throughout the loan duration.

Main sections and clauses of a mortgage loan agreement template

The Mortgage Loan Agreement Template is structured into several main sections, ensuring clarity and legal compliance. These sections typically include:

-

1.Introduction: Details about the parties involved

-

2.Loan Details: Specifies the mortgage amount and terms

-

3.Interest Rate: Outlines the rate applied to the loan

-

4.Payment Schedule: Dates and amounts due for repayments

-

5.Default Conditions: What constitutes a default and repercussions

-

6.Miscellaneous Provisions: Any additional agreements or stipulations

What needs to be included in a mortgage loan agreement template?

For a comprehensive and enforceable Mortgage Loan Agreement Template, ensure the following elements are included:

-

1.Name and contact information of the borrower and lender

-

2.Legal description of the property

-

3.Total loan amount and interest rate terms

-

4.Detailed repayment schedule and payment methods

-

5.Clauses on escrow accounts or insurance requirements

-

6.Conditions for prepayment or penalties for late payment

-

7.Signatures from both parties to authenticate the agreement

How do I make a simple loan agreement?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

What is a mortgage loan contract?

A mortgage loan is a contract by which one party, the lender (usually a bank) transfers a fixed sum of money to the other party, the borrower, so that the latter can use it for a fixed period of time subject to payment of a fee represented by the interest.

How to create a simple mortgage?

Firstly, they are created by executing a mortgage deed, which outlines the terms and conditions of the mortgage agreement. Secondly, the mortgagee (lender) has the right to sell the property without the intervention of the court in case of default by the mortgagor (borrower).

How to write a mortgage note?

The note should include the full name of each borrower and any co-signers that will be responsible for the repayment of the loan. It should also include the name of the legal name of the noteholder. If this is a business entity, the name of the business should be listed. The property address must be included.

pdfFiller scores top ratings on review platforms

It was easy to use and did everything I needed.

Could be a tad bit more intuitive, single editing interface, but so far the best web based app we've tried

This has been a life saver and I am so glad a friend told me about this

I use it every time I have forms to fill: I spare time and headaches! Pdffiller solved me a lot of problems.

Came in handy when i needed it most and i thank you so much!!!

I am enjoying this service. Makes working with PDF's much faste

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.