Non Disclosure for Financial Ination Agreement Template free printable template

Show details

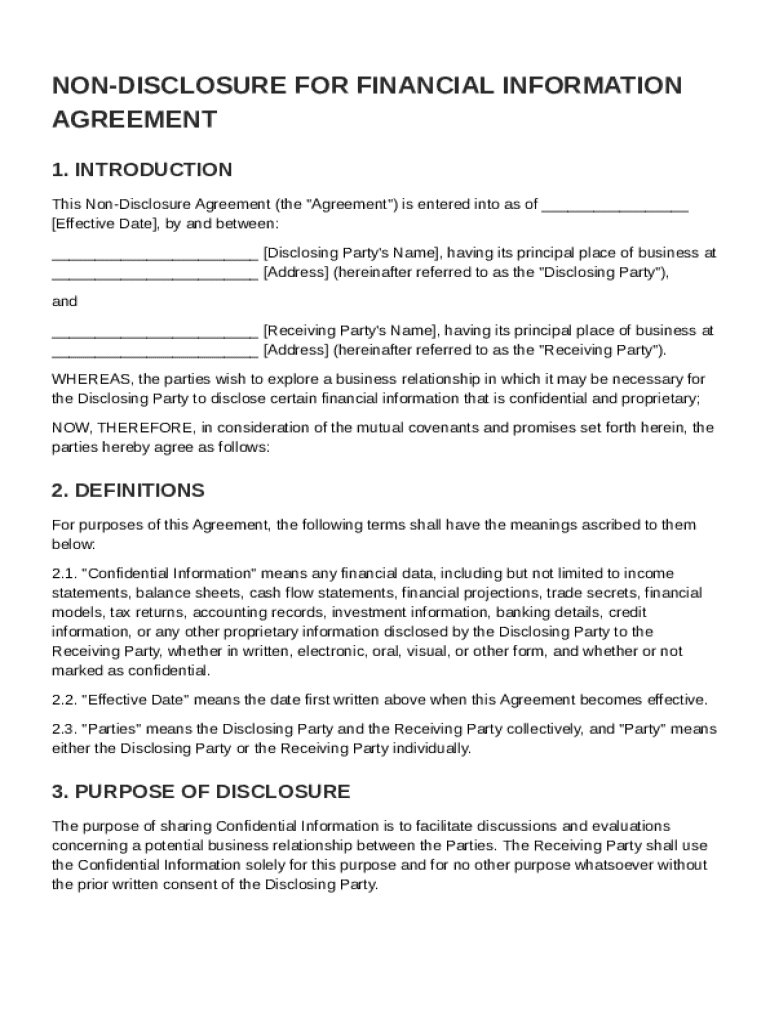

This document outlines the terms of a NonDisclosure Agreement between parties to protect confidential financial information that may be shared in the context of exploring a business relationship.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Non Disclosure for Financial Ination Agreement Template

A Non Disclosure for Financial Information Agreement Template is a legal document designed to protect sensitive financial information shared between parties.

pdfFiller scores top ratings on review platforms

I really enjoy that you can take care of all my document needs on this one site

great. easy to use. convenient. would recommend.

Thanks for the help, PDF filler was easy to use.

I LOVE IT ALREADY...MAKES LIFE SO MUCH EASIER.

I do like this helper. Easy to use. I will try this tool for a couple of months.

Great for finding almost any document you need to file!

Who needs Non Disclosure for Financial Ination Agreement Template?

Explore how professionals across industries use pdfFiller.

Non Disclosure for Financial Information Agreement Template

A Non Disclosure for Financial Information Agreement Template serves as a crucial document in safeguarding sensitive financial data from unauthorized disclosure. This guide will provide you with a clear understanding of NDAs, their components, and how to fill out such templates effectively using resources like pdfFiller.

What are non-disclosure agreements (NDAs)?

A non-disclosure agreement (NDA) is a legally binding contract that establishes a confidential relationship between parties. It is essential in the financial context to protect sensitive information and ensure compliance with regulatory standards.

-

In the realm of financial information, an NDA is designed to prevent the recipient from disclosing any proprietary or sensitive data shared by the disclosing party.

-

NDAs are crucial for businesses and individuals alike, as they maintain confidentiality, preserve competitive advantages, and establish trust during financial negotiations.

-

NDAs are generally enforceable as long as they meet specific legal requirements, including clear definitions of confidential information and reasonable duration of confidentiality.

What are the components of a financial information NDA?

-

A well-structured NDA should include key clauses such as purpose of the agreement, definition of confidential information, and the effective date.

-

Each clause serves a specific purpose. For example, the 'Purpose' clause outlines the intent of sharing information, while the 'Confidential Information' clause clearly defines what information is protected.

-

Common terms include 'Confidentiality,' 'Disclosing Party,' and 'Receiving Party,' which clarify roles and should be defined clearly to avoid ambiguity in financial disclosures.

How to fill out the financial NDA template?

Completing a financial NDA template can be straightforward with the right approach. Using tools like pdfFiller can enhance the process significantly.

-

Begin by identifying the parties involved, then proceed to fill in the specific terms regarding confidentiality, including the definition of confidential information.

-

pdfFiller provides interactive form functionalities that allow users to edit, sign, and share the document seamlessly, making the process user-friendly.

-

Double-check all fields for accuracy and ensure that the agreement complies with relevant legal standards to avoid disputes.

What are the confidentiality obligations of the receiving party?

Receiving parties are subject to strict confidentiality obligations as laid out in the NDA. They must take reasonable steps to protect confidential information from unauthorized use and disclosure.

-

These include safeguarding the information and ensuring that it is accessible only to authorized personnel within their organization.

-

Best practices for maintaining confidentiality entail proper document management, limited access to sensitive information, and regular training for employees.

-

Breach of confidentiality can lead to severe consequences including legal action, financial penalties, and reputational damage in the financial sector.

What are the permitted uses and disclosures of confidential information?

The NDA should clearly delineate the permitted uses and disclosures of confidential information. This provides a roadmap for the receiving party to operate within while avoiding potential missteps.

-

It is crucial to specify how the receiving party can use the disclosed information, such as for business analysis or project purposes only.

-

Circumstances under which disclosures may occur include legal requirements or consent from the disclosing party, emphasizing the need for precise wording in the NDA.

-

Exact language used in NDAs regarding permitted uses can prevent misunderstandings and protect both parties' interests in financial transactions.

How to draft and negotiate a financial NDA?

When drafting an NDA, it is important to consider various factors. Engaging in negotiations can set the groundwork for a mutual understanding between both parties.

-

Consider including clarity in definitions, limitation of liability, and duration clauses to ensure a comprehensive agreement.

-

Common negotiation points include the definition of confidential information and the duration of confidentiality, as these can significantly affect both parties.

-

Utilizing pdfFiller allows users to manage drafts and feedback in real-time, making the negotiation process smoother and more efficient.

What are the legal compliance and best practices for NDAs?

Legal compliance is critical when drafting NDAs, particularly in the financial sector where regulations may vary by region. Adhering to best practices ensures the agreement holds up legally.

-

Identify region-specific legal requirements that may influence the enforceability of the NDA, including local laws on confidentiality and financial disclosures.

-

Best practices include consulting legal experts, using clear and unambiguous language, and periodically reviewing NDAs to ensure compliance with changing laws.

-

Access to legal advice and pre-established templates specific to the financial industry can streamline the NDA creation process.

How to fill out the Non Disclosure for Financial Ination Agreement Template

-

1.Begin by downloading the Non Disclosure for Financial Information Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the pre-filled sections.

-

3.Fill in the names and addresses of the parties involved in the agreement, ensuring accurate spelling and contact details.

-

4.Specify the duration of the confidentiality period in the designated section.

-

5.Clearly describe the financial information that is deemed confidential within the document.

-

6.Include any exceptions to confidentiality if applicable, such as information already in the public domain.

-

7.Review the agreement for clarity and completeness to ensure all necessary details are captured.

-

8.Once the document is fully filled out, save your changes and download a copy for your records.

-

9.Consider sending a copy to each party involved for their review and signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.