Non Disclosure for Merger Or Acquisition Agreement free printable template

Show details

This document outlines the terms for the protection and usage of confidential information exchanged between parties during discussions related to a potential merger or acquisition.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Non Disclosure for Merger Or Acquisition Agreement

A Non Disclosure for Merger Or Acquisition Agreement is a legal document ensuring that parties involved in a merger or acquisition do not disclose confidential information to third parties.

pdfFiller scores top ratings on review platforms

Not experienced enough. l like it, but never used it before, so learning my way around

Pop-ups during the filling process are very annoying and unnecessary. They obstruct one's ability to view the fillable fields on the form.

I am able to view, edit, and convert pdf documents. This was easy, even for someone that is not very tech shabby like me.

Love that you can take any form and fill it out on filler. Only down fall the text box some times moves.

very user friendly; started using right away & learning along the way which is all I have time for right now.

This is an amazing asset to any business.

Who needs Non Disclosure for Merger Or Acquisition Agreement?

Explore how professionals across industries use pdfFiller.

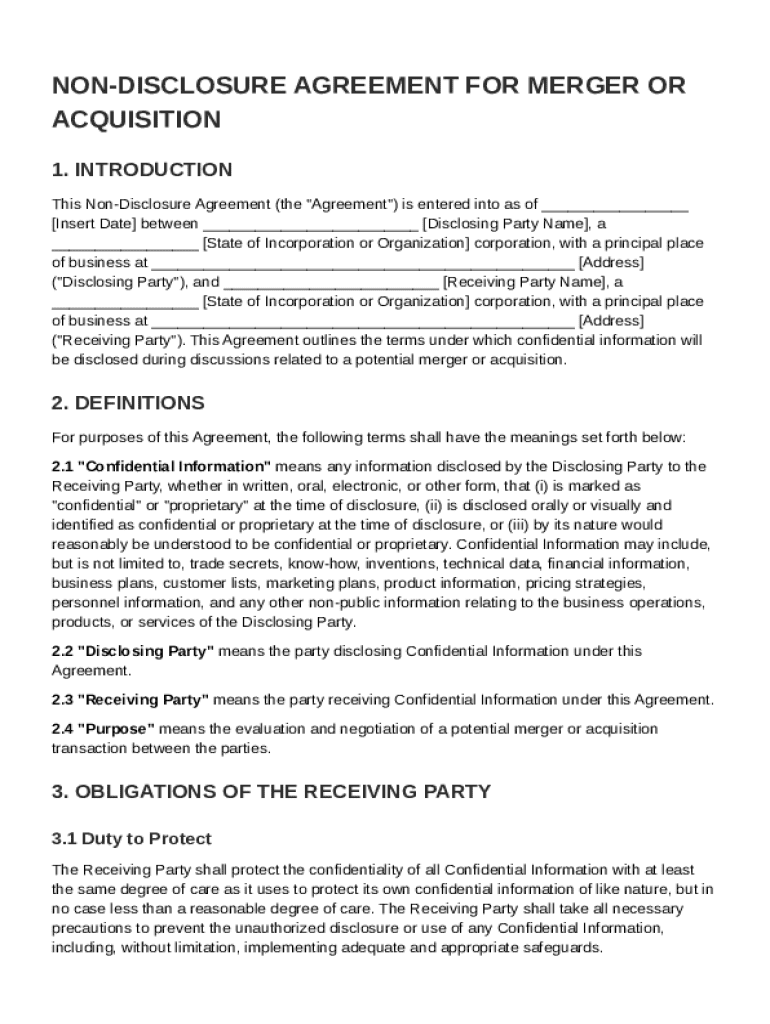

Non-Disclosure Agreement for Merger or Acquisition Guide

In any business transition such as a merger or acquisition, a Non-Disclosure Agreement (NDA) is vital to protect sensitive information. Understanding the structure and importance of a Non-Disclosure for Merger Or Acquisition Agreement form can safeguard both parties involved during the transaction. This guide provides insights on creating and managing such agreements effectively.

What is a Non-Disclosure Agreement?

A Non-Disclosure Agreement (NDA) is a legally binding contract that establishes a confidential relationship between parties. In the context of mergers and acquisitions, an NDA ensures that sensitive information shared between the parties remains private and is not disclosed to third parties. This is particularly important for safeguarding trade secrets, financial data, and other proprietary information.

-

NDAs are essential to prevent financial losses and legal disputes that could arise from unauthorized disclosures.

-

The primary parties involved are the Disclosing Party, who shares the information, and the Receiving Party, who agrees to protect it.

What are the core components of an NDA?

A Non-Disclosure Agreement comprises several critical components that dictate the terms of confidentiality and obligations for both parties. This typically includes definitions of what constitutes 'Confidential Information,' the roles of both the Disclosing Party and the Receiving Party, and the purpose behind the NDA.

-

The NDA should clearly outline what information is considered confidential and protected.

-

It must articulate the responsibilities of the Disclosing Party and the Receiving Party concerning the confidential information.

-

Clearly state why the confidentiality agreement is necessary, focusing on the merger or acquisition context.

What terminology is essential in NDAs?

Understanding the terminology used in Non-Disclosure Agreements is crucial for both parties to avoid misunderstandings. Familiarity with terms like 'Confidential Information', 'trade secrets', and 'proprietary information' helps ensure all parties know what is protected under the agreement.

-

This includes any non-public information that parties want to protect.

-

Trade secrets refer to formulas, practices, processes, or designs that provide a business advantage, while proprietary information refers to data owned by a company that provides a competitive edge.

-

Terms such as 'Evaluation' for assessing trade or services and 'Negotiation' denote discussions leading towards a potential agreement are important to include.

How do you create your NDA?

Creating an effective Non-Disclosure for Merger Or Acquisition Agreement form requires careful attention to detail. Start by identifying key parties involved, defining the terms of confidentiality and explicitly stating the purpose and scope of the NDA to avoid ambiguity.

-

Clearly define the Disclosing and Receiving Parties to avoid confusion in the agreement.

-

Outline specific terms of confidentiality which parties must adhere to.

-

The purpose should clearly state why the information is shared and what the receiving party can do with it.

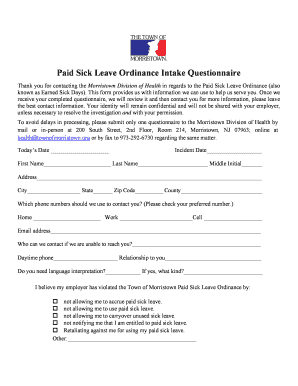

How should you fill out the NDA form?

Filling out the Non-Disclosure for Merger Or Acquisition Agreement form correctly is crucial for its effectiveness. Utilize interactive tools available on platforms like pdfFiller to streamline the creation process. Provide accurate party details and ensure all essential terms are represented clearly to avoid misinterpretation.

-

Platforms like pdfFiller provide easy-to-use tools for creating and completing your NDA form.

-

Carefully input correct information for both parties as errors can lead to legal complications.

-

Clearly specify what each party is obligated to do to uphold confidentiality.

What are the best practices for NDA management?

Managing an NDA effectively is just as important as drafting one. Best practices include securely storing NDAs in a cloud-based platform like pdfFiller, utilizing collaboration features, and monitoring expiration dates to ensure they are renewed or updated as needed.

-

Use cloud platforms to ensure NDAs are protected from unauthorized access.

-

Utilize tools for teams to collaborate efficiently on confidentiality agreements.

-

Have reminders in place for NDA expirations to prevent lapses in confidentiality.

What are the steps to finalize and sign the NDA?

Finalizing your Non-Disclosure for Merger Or Acquisition Agreement form involves ensuring all parties have accurately reviewed the document. Use eSigning features on pdfFiller for quick execution and make sure both the Disclosing and Receiving Parties sign to enforce the agreement legally.

-

Make use of electronic signing tools to streamline the signing process.

-

Both parties must sign the NDA to ensure that it is enforceable in court.

-

Store the signed NDA securely on pdfFiller to ensure it is readily accessible.

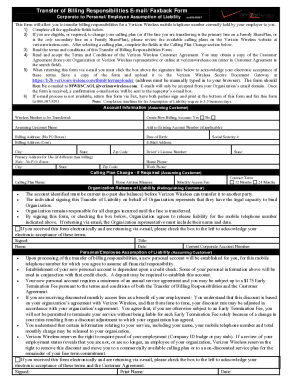

How to fill out the Non Disclosure for Merger Or Acquisition Agreement

-

1.Obtain the Non Disclosure for Merger Or Acquisition Agreement template from pdfFiller.

-

2.Open the template in pdfFiller by uploading a file or selecting from the available documents.

-

3.Begin by filling in the date at the top of the document to establish when the agreement takes effect.

-

4.Identify the parties involved by entering their full legal names and addresses in the specified fields.

-

5.Clearly define the scope of confidential information that will be protected under the agreement in the designated section.

-

6.Set the duration for which the confidentiality obligations will remain in effect, typically specified in months or years.

-

7.Include any exceptions to confidentiality in the appropriate section, such as information already publicly known or disclosed by mutual consent.

-

8.Review the obligations imposed on both parties regarding the handling of confidential information to ensure clarity and understanding.

-

9.Finalize the agreement by having all parties sign and date the document, ensuring that witnesses or notary public are included if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.