Notarized Loan Agreement Template free printable template

Show details

This document outlines the terms of a loan agreement between a borrower and lender, detailing loan amount, interest rate, repayment schedule, and default conditions.

We are not affiliated with any brand or entity on this form

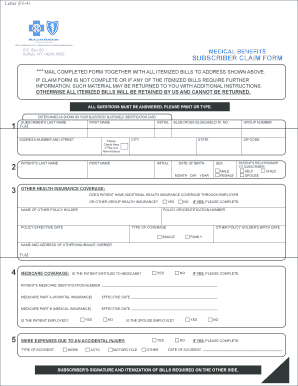

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

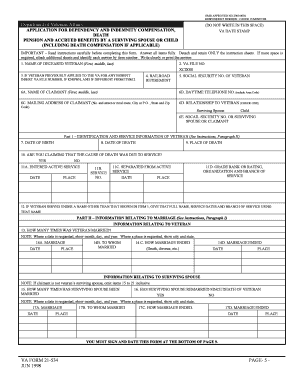

What is Notarized Loan Agreement Template

A Notarized Loan Agreement Template is a legal document that outlines the terms of a loan and is verified by a notary public to ensure authenticity.

pdfFiller scores top ratings on review platforms

If I figure out how to use it, I will love it.

Its is user friendly and easy to navigate

I like the program It is not too complicated. The monthly fee is a bit too high I am not certain that I will be able to keep it past the free trial period. $20 per month is way off the mark; unless you have lots of cash flow. Just seems like $6-$8 per month would be more in line with the value of the product.

I've been looking for a dynamic, low-price PDF editor like this for 30+ years. It's just what I need - no more, no less.

Fast and relatively easy to use PDF software that fits my filing needs!

Well I am still learning a lot of stuff but I like how easy this is to fill and edit and save document that are useful for me. thanks

Who needs Notarized Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Notarized Loan Agreement Template

How does a notarized loan agreement work?

A notarized loan agreement is a formal document that outlines the terms of a loan between a borrower and lender. This type of agreement must be signed in the presence of a notary public, who verifies the identities of the parties involved, ensuring the document is legitimate and enforceable. The notarization adds an additional level of legality, making it a preferred choice for those seeking security in their financial agreements.

The primary benefit of using a notarized loan agreement is that it provides a clear and legally binding record of the terms agreed upon, which can prevent misunderstandings and disputes in the future. A well-structured agreement helps both parties by outlining their obligations, including repayment schedules and interest rates.

What are the key components of a notarized loan agreement?

-

Clearly define the exact amount being borrowed, which is critical for both parties' understanding of the obligation.

-

Specify the interest rate applicable to the loan to avoid any future disputes regarding payment amounts.

-

Indicate when the loan must be repaid in full, creating a timeline for the borrower.

-

Incorporate key terminologies such as 'Default' and 'Principal' to clarify their meanings within the context of the agreement.

-

Mention the intended purpose of the loan, providing additional context about how the funds will be used.

-

Outline any specific conditions or stipulations tied to the loan, helping to delineate the expectations for both parties.

How can complete the notarized loan agreement template?

-

Carefully complete all fields in the loan agreement template, ensuring accuracy in personal and financial details.

-

Utilize editing tools available via pdfFiller to modify template sections to suit your specific agreement terms.

-

Once filled out, schedule a meeting with a notary public to sign the document, making sure to bring identification.

-

After notarization, retain a signed copy for your records, as it is essential for future reference.

Why is it important to have accurate loan terms?

Accurate loan terms ensure that both the lender and borrower have a mutual understanding of the financial agreement. Incorrect or vague terms can lead to confusion and disputes, making it crucial to define the interest rate clearly and set a realistic repayment schedule. A transparent agreement not only protects the lender’s investment but also ensures that the borrower fully comprehends their obligations.

-

Identifying fair and legal interest rates protects the borrower from predatory lending while ensuring the lender receives a fair return.

-

A well-planned repayment schedule considers the borrower’s ability to repay and prevents defaults.

-

Ensuring clear language throughout helps prevent misunderstandings, which is beneficial in avoiding legal actions in case of a dispute.

How do notarized loan agreements compare to other financial instruments?

-

A notarized loan agreement typically involves a notary public, while a promissory note is simply a written promise to pay without a formal witnessing.

-

Select a notarized agreement over informal loans when handling significant sums or when the lender requires a greater legal assurance.

-

Notarized agreements provide enforceability in court and proof of authenticity, making them safer compared to standard loan agreements.

What interactive tools does pdfFiller offer?

-

pdfFiller provides features that enable users to create, edit, and manage loan documents effortlessly.

-

Users can collaborate in real-time with team members, ensuring everyone involved is aligned with the terms before finalizing.

-

eSignatures allow for a legally recognized method of signing the document digitally, streamlining the process.

What common mistakes should avoid in loan agreements?

-

Failure to fill in critical fields, such as the loan term or repayment amount, can render the agreement unenforceable.

-

Miscalculating interest or misrepresenting rates can lead to litigation and financial disputes.

-

Using ambiguous terms may result in different interpretations of the agreement, causing potential conflicts.

How can adapt the template for specific regions or industries?

-

Be aware of your state's or region's specific requirements regarding loan agreements to ensure compliance.

-

Different types of loans, such as personal vs. business loans, may require specific clauses to suit their nature.

-

The notarization process can vary; understanding local rules ensures that your agreement is valid.

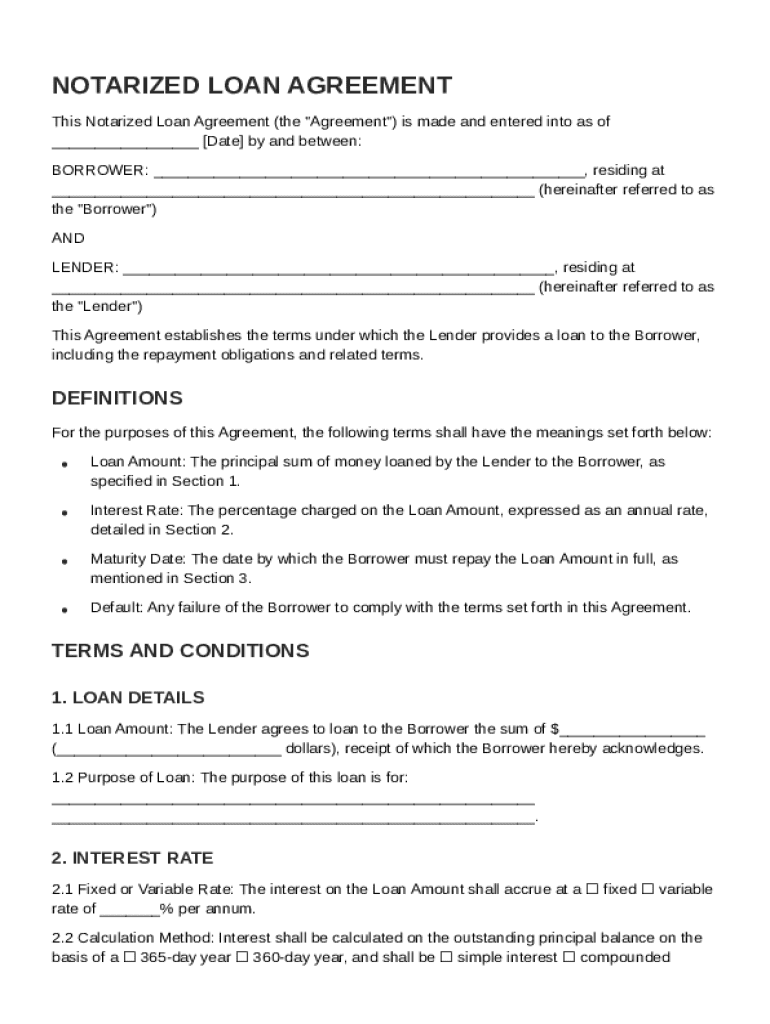

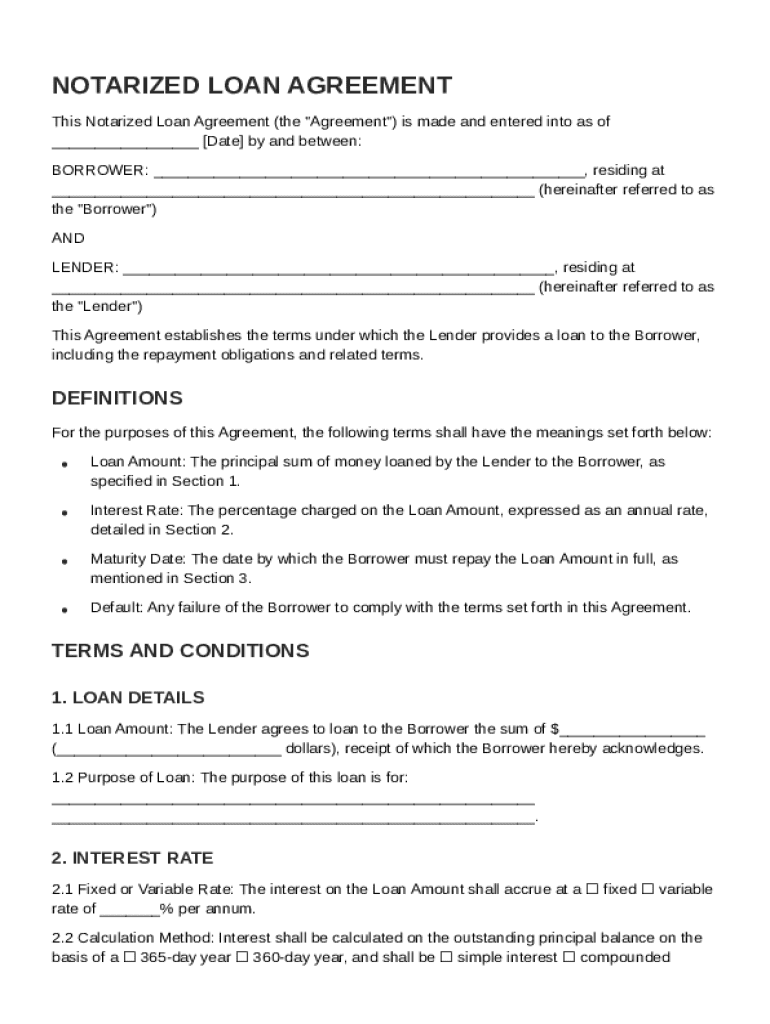

How to fill out the Notarized Loan Agreement Template

-

1.Download the Notarized Loan Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editor.

-

3.Begin by filling in the lender's and borrower's names and contact information.

-

4.Enter the loan amount clearly and specify the interest rate, if applicable.

-

5.Detail the repayment schedule, including start dates and intervals.

-

6.Include any collateral or security details if the loan is secured.

-

7.Add clauses regarding default, prepayment penalties, and dispute resolution.

-

8.Ensure all parties sign and date the document in the designated areas.

-

9.Select the notary section for verification; ensure it's completed and signed.

-

10.Save the completed document and download or print it as needed.

How to write a simple loan agreement template?

Loan Agreement Template Interest Rate. The Parties agree the Interest Rate for this loan shall be _% to be accrued monthly. Loan Term. This Loan shall be for a period of _ years/months. Repayment. The Parties agree the Borrower shall pay the Lender $ per month on the day of each month.

How much is the notarial fee for a loan agreement in the Philippines?

Although the Supreme Court has discouraged excessive notarial fees, it is common practice that for major financial contracts, the notarial fee could range from PHP 500 to several thousand pesos, particularly if the loan amount is large and the agreement is complex.

Which is better, a promissory note or a loan agreement?

In most cases, only one of these will be necessary. Promissory notes are more suited to smaller, informal, and unsecured lending, whereas loan agreements are better for complicated situations involving more significant sums of money.

How should a loan agreement be signed?

The agreement should be signed & dated by the parties. The signatures of the parties should be witnessed by an independent 3rd party who should give their full details & address.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.