Note Agreement Template free printable template

Show details

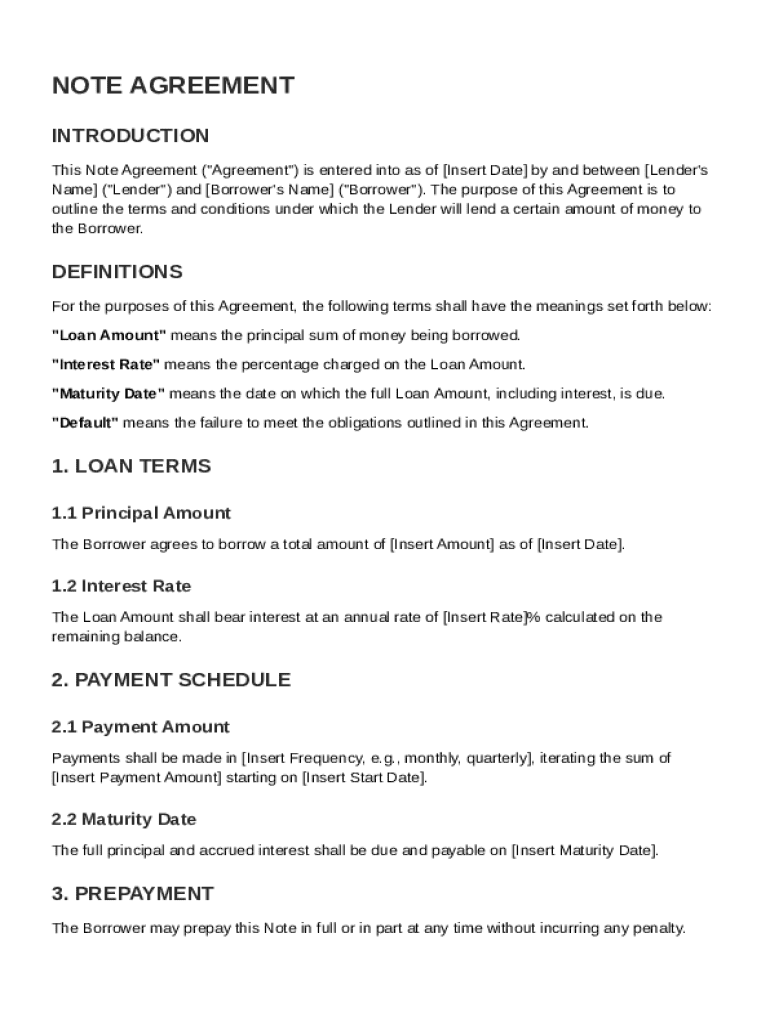

This Agreement outlines the terms and conditions for the lending of money from the Lender to the Borrower, detailing repayment terms, interest rates, and consequences of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Note Agreement Template

A Note Agreement Template is a legal document used to outline the terms of a loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

PDF Filler is very convenient and well thought through. Now, if it only integrated with my tax return online service provider and auto-populated forms, ditto all others, it would be perfect.

just learning, fairly easy for the new guy in the office to learn.Any problems just watch utub.

I would like to know more about this and how to use this correctly.

It is nice to have all the features in one place

PDF Filler has saved me a lot of time and money. I deal with contract and paperwork on a daily basis. Before I got PDF Filler I had to run to my office print ,fill in blanks ,scan and emailback. Now i just upload to PDF Filler and type the changes i need for my paperwork .Thanks Angie

good, but would like to know how to use it more efficiently.

Who needs Note Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Note Agreement Template on pdfFiller

How to fill out a Note Agreement Template form

Filling out a Note Agreement Template form involves identifying key parties, specifying loan amounts, and determining terms such as interest rates and payment schedules. Utilize pdfFiller’s cloud-based tools for an efficient, seamless experience in editing and signing your document.

What are note agreements?

A Note Agreement is a legal document that outlines the terms of a loan between a lender and a borrower. It serves to protect the interests of both parties by detailing the repayment plan and obligations. Proper documentation is crucial in financial transactions to avoid misunderstandings and disputes.

-

A note agreement formalizes the loan process, ensuring transparency and security.

-

Typically includes a Lender (the one providing funds) and a Borrower (the one receiving funds).

-

Proper documentation helps in enforcing terms and protecting rights during repayment.

What are the essential components of a note agreement?

A Note Agreement should include several key components that provide clarity and structure to the loan terms. These components can significantly influence the transaction's outcome.

-

This defines how much the borrower is requesting and is crucial for both parties to understand.

-

Specifying how interest is calculated ensures both parties are aligned on financial expectations.

-

This is the date by which the loan must be repaid, important for planning repayment schedules.

-

Clarifying key terms helps avoid conflicts and ensures all parties understand their obligations.

How to draft your note agreement?

Drafting a comprehensive Note Agreement starts with identifying the involved parties and outlining the loan specifics. Using pdfFiller's tools simplifies this process with customizable templates.

-

Clearly state the names of the Lender and Borrower at the beginning of the document.

-

Include the exact loan amount requested and the interest rate that will apply.

-

Define when payments are due and the maturity date of the loan.

-

Allow for prepayments, which can benefit the borrower in avoiding excess interest.

-

Utilize editing features to customize the agreement according to specific needs.

How to establish a payment schedule and terms?

A clear payment schedule ensures that both parties understand their obligations and the timing of payments. Detailing the payment amount and frequency can prevent future disputes.

-

Specify the amount to be paid during each installment.

-

Include specific due dates for payments, ensuring clarity.

-

Outline the penalties for late payments, which can help deter defaults.

What is default and what remedies exist?

Understanding what constitutes default in a Note Agreement is critical for both parties. Defining specific conditions will help in managing expectations.

-

A borrower may default if they fail to make payments on time or adhere to other terms.

-

The lender may have options like re-negotiating terms or initiating legal action.

-

These clauses protect the rights of lenders and ensure that consequences of default are understood.

Why are governing law and jurisdiction significant?

Selecting the governing law for a Note Agreement is essential for ensuring compliance with applicable regulations. This choice can impact how the agreement is enforced.

-

The governing law dictates how disputes will be resolved and which rules apply.

-

Different regions may have unique laws that affect personal loans.

-

Understanding local laws will assist in preventing legal complications.

How to handle amendments and assignments?

Amendments and assignments are important aspects of managing a Note Agreement. Clear procedures must be established to ensure both parties are protected.

-

Changes should be documented in writing and signed by both parties to remain valid.

-

Understand how assignments might impact either party; selling rights can alter obligations.

-

For clarity, amendments should be documented clearly, preventing future disputes.

How does pdfFiller assist in utilizing your Note Agreement?

pdfFiller offers a robust suite of document management tools that empower users to draft, edit, and sign their Note Agreement online. This seamless integration enhances collaboration between parties.

-

Users can manage their documents easily from anywhere, thanks to pdfFiller’s cloud services.

-

The platform provides step-by-step instructions for completing Note Agreements.

-

pdfFiller’s collaborative features improve communication between lenders and borrowers.

In conclusion, a well-prepared Note Agreement Template form is crucial for ensuring clarity and security in financial transactions. By understanding the components and utilizing tools like pdfFiller, both lenders and borrowers can engage in successful agreements while managing risks effectively. Whether drafting a new agreement or amending an existing one, keep in mind the importance of legal accuracy and clarity.

How to fill out the Note Agreement Template

-

1.Start by opening the Note Agreement Template in pdfFiller.

-

2.Enter the date at the top of the document where indicated.

-

3.Fill in the lender's information, including name, address, and contact details.

-

4.Next, enter the borrower's details similarly.

-

5.Specify the loan amount in the designated section.

-

6.Indicate the interest rate applicable to the loan.

-

7.Fill in the repayment schedule, including due dates and payment amounts.

-

8.If applicable, include any conditions or clauses relevant to the loan agreement.

-

9.Review the completed document for accuracy.

-

10.Save your changes and download the filled template or share it with the relevant parties for signatures.

How to write an agreement note?

How to write an agreement letter Title your document. Provide your personal information and the date. Include the recipient's information. Address the recipient and write your introductory paragraph. Write a detailed body. Conclude your letter with a paragraph, closing remarks, and a signature. Sign your letter.

How do I write a simple promissory note?

What to include in a promissory note Amount of money borrowed (principal amount) Amount to be repaid (principal and interest) When and how often payments will be made (payment schedule, or “due dates”) Interest rate and repayment specifics. Time frame and maturity date (date the loan will be fully repaid)

What is the difference between a note and an agreement?

Promissory notes are more suited to smaller, informal, and unsecured lending, whereas loan agreements are better for complicated situations involving more significant sums of money. However, occasionally, lenders and borrowers may wish to include both a promissory note and a loan agreement.

Does Microsoft Word have a promissory note template?

Begin by locating a suitable promissory note template. You can find templates within Word's template library or download them from reputable online sources. Look for templates that adhere to legal standards and include essential sections such as identification of parties, loan amount, payment terms, and interest rates.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.