Last updated on Feb 17, 2026

Options Agreement Template free printable template

Show details

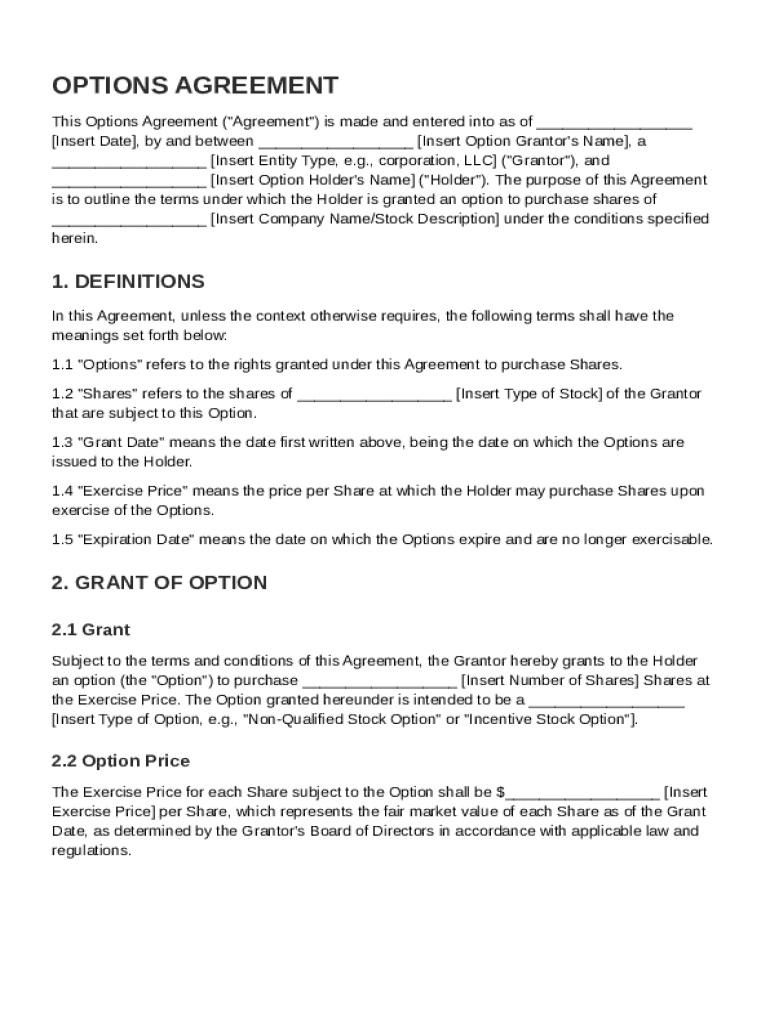

This Options Agreement outlines the terms under which an option to purchase shares is granted to the Holder by the Grantor, specifying definitions, grant conditions, exercise methods, and rights of

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Options Agreement Template

An Options Agreement Template is a legal document outlining the terms under which one party can purchase stock options from another party under specified conditions.

pdfFiller scores top ratings on review platforms

Great to use. Did not send all forms to the IRS. Difficult to save in the program.

Came in handy when I needed it the most. My scanner was not working and I needed to complete an important document.

This service was extremely helpful when I was in a pinch for an assignment for work! Loved being able to combine multiple PDF's into one cohesive document, as well as edit, add text, and highlight on my existing PDF. Easy to use and user-friendly!

PDF filler has been the most flexible, user friendly pdf editor I've found.

Sometimes the save or getting to documents is confusing

Has saved a lot of time and running around as we are shift workers and not available at same time to sign and fill in papers. Easy to use and mobile app was handy for business.

Who needs Options Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to options agreement template forms

How does an options agreement work?

An Options Agreement Template serves as a formal contract that grants individuals the right, but not the obligation, to purchase a company's shares at a predetermined price within a specific timeframe. This agreement is crucial for stakeholders, including employees and investors, as it outlines the terms under which stock options can be exercised. By using a comprehensive template, users can ensure that all vital information is included, which reduces ambiguity and enhances legal protection for all parties involved.

What are the key components of an options agreement?

-

Essential terms include options, shares, grant date, exercise price, and expiration date. Understanding these keywords helps in interpreting the agreement accurately.

-

Each component plays a vital role in the execution and understanding of the agreement—misinterpretation of these terms can lead to legal complications.

-

Consulting legal advisors ensures that all components conform to applicable laws, safeguarding both the optionee and the company.

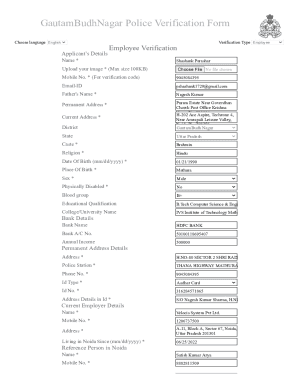

How to fill out your options agreement?

Filling out an Options Agreement Template requires attention to detail to prevent errors and ensure compliance. Begin by inserting the date, along with the names of the option grantor and holder. This step-by-step approach not only ensures accuracy but also reinforces the legal standing of the document.

-

Accurate documentation begins with the correct date to validate the agreement.

-

Clearly state the option grantor and holder's full names for identification.

-

Ensure compliance by carefully reviewing the completed template against the original requirements.

What factors determine the right type of option?

Choosing between Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs) involves understanding each type's tax implications, eligibility requirements, and potential benefits. While NSOs are more flexible, ISOs provide favorable tax treatment for certain eligible employees. Weighing these considerations carefully can lead to better decisions aligning with both individual and organizational financial goals.

-

More widely applicable and flexible, but subject to ordinary income tax upon exercise.

-

Tax advantages if specific conditions are met, but with stricter eligibility criteria.

-

Each option type must comply with IRS regulations to avoid penalties or liabilities.

Why are vesting schedules important?

Vesting schedules are critical as they define when an option holder can exercise their options, aligning their incentives with company performance. Common structures, such as cliff vesting or graded vesting, can impact how employees view their long-term commitment to the company. Not adhering to these schedules may result in the loss of rights to options, emphasizing the importance of understanding the terms outlined in the Options Agreement.

-

Options vest after a predetermined period, incentivizing retention before benefits are realized.

-

Allows options to vest incrementally over time, encouraging continued service.

How to set an exercise price?

Establishing the exercise price is crucial as it determines the cost to the holder upon exercising the option. This price is typically based on the fair market value at the time of grant. The Board of Directors plays an essential role in this process, considering legal implications and company valuation to set an equitable price that reflects market conditions.

-

Utilize external appraisals or market comparisons to establish a reasonable exercise price.

-

Ensures that exercise pricing aligns with corporate governance guidelines.

-

Failure to adhere to fair market standards can lead to tax penalties for both the company and the optionee.

What are expiration dates and their significance?

Expiration dates are pivotal as they define the window in which options can be exercised. Missing the expiration date can lead to forfeiture of options, which underscores the importance of thorough record-keeping and setting reminders. Calculating these dates correctly ensures that holders maintain their rights.

-

They impose time-limits on options, necessitating attention from both the holder and grantor.

-

Typically set at 10 years from the grant date, but specifics can vary by agreement.

-

Could result in loss of options, impacting financial planning and rewards.

How can pdfFiller help manage your options agreement?

pdfFiller offers robust features for managing your Options Agreement template. With tools for editing, signing, and storing important documents, users can maintain a streamlined approach to their documentation needs. Collaborative features enable teams to work together efficiently, a testament to pdfFiller’s commitment to empowering users on a single, cloud-based platform.

-

Easily customize your options agreement template to fit specific circumstances.

-

Ensure legal validity with secure electronic signatures.

-

Invite team members to review and edit documents together in real-time.

How to fill out the Options Agreement Template

-

1.Download the Options Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editing interface.

-

3.Begin by filling out the date to establish when the agreement is effective.

-

4.Enter the names and addresses of both the option grantor and option holder in the designated fields.

-

5.Specify the type of option being granted (e.g., incentive stock option, non-qualified stock option).

-

6.Indicate the total number of shares that the option holder has the right to purchase.

-

7.Set the purchase price per share (exercise price) in the required section.

-

8.Outline the vesting schedule, if applicable, detailing when the option holder may exercise their options.

-

9.Include any expiration date for the options to ensure clarity on their validity period.

-

10.Review the completed document for accuracy and ensure all terms are clear and legally compliant.

-

11.Save your filled agreement and share it with the relevant parties for signatures if needed.

How to write an option agreement?

The option agreement should specify the price or the method for calculating the price. The price can either be a fixed amount or based on an agreed formula (such as market value at the time of exercise, for example). If a variable price is agreed, Seller's will often wish to agree a minimum price.

What is an option agreement?

An option agreement is a contract between a landowner and a developer where the developer has the opportunity (but not an obligation) to purchase land from the landowner with a certain time frame.

What is the standard option agreement?

An option agreement is made between a writer and a producer and grants the producer an exclusive option to buy the rights in the writer's work. A “shopping” agreement allows the producer to represent the work but gives the producer fewer rights than an option and typically lasts for a shorter period.

What is an example of an option contract?

Financial example 1: XYZ stock is currently trading at $50 per share. You believe that the price of XYZ stock will rise to $60 per share in the next month. You decide to buy a call option on XYZ stock with a strike price of $55 and an expiration date of one month from today. The cost of the option contract is $100.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.