Parent Child Loan Agreement Template free printable template

Show details

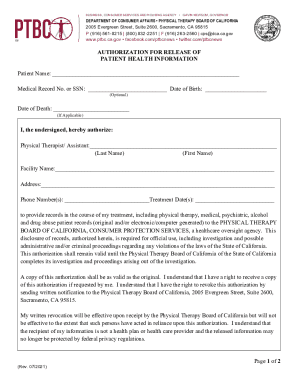

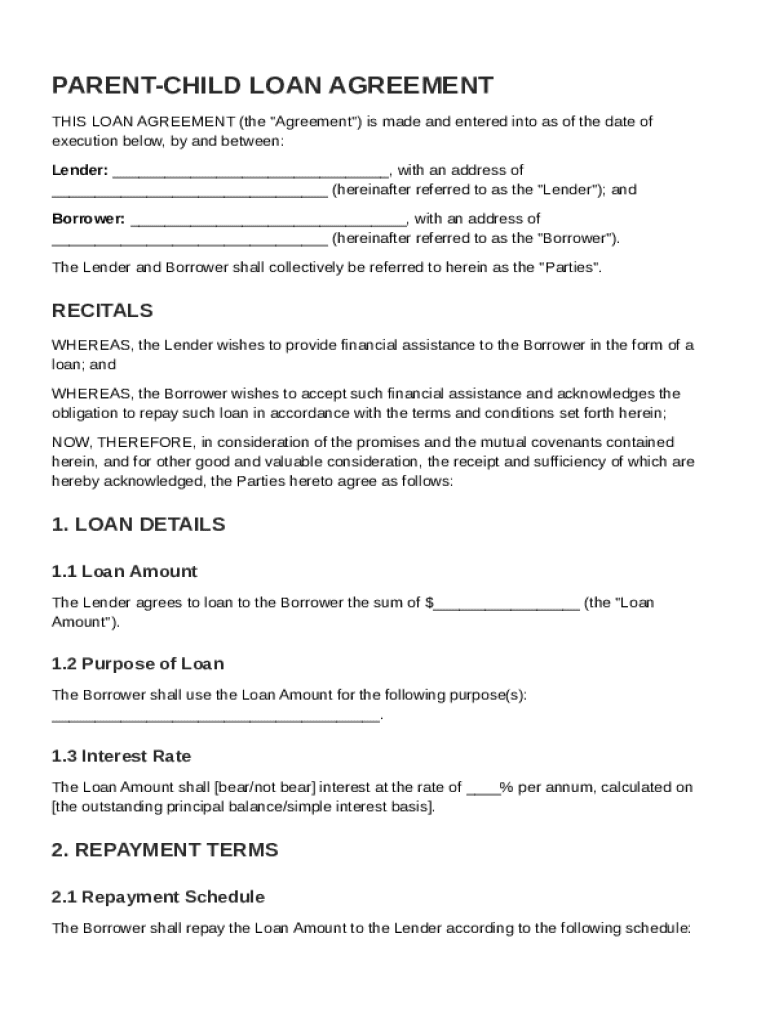

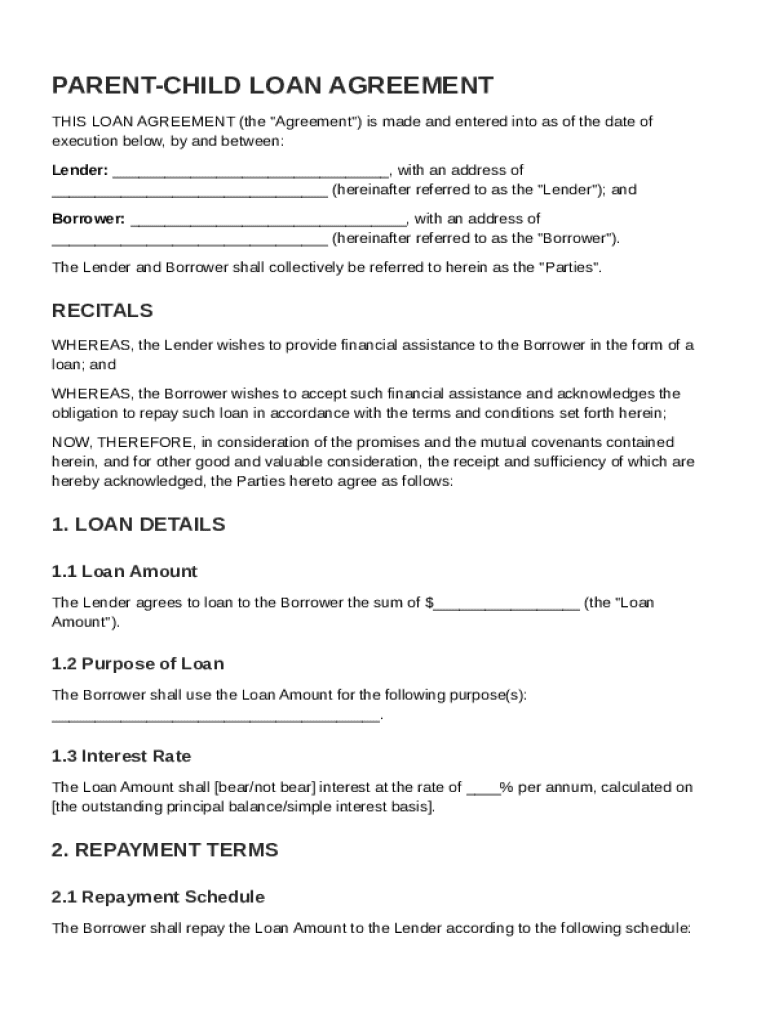

This document is a loan agreement between a lender and a borrower, detailing the terms and conditions of a loan, including loan amount, purpose, interest rate, repayment terms, rights and responsibilities,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Parent Child Loan Agreement Template

A Parent Child Loan Agreement Template is a legal document outlining the terms and conditions of a loan provided by a parent to their child.

pdfFiller scores top ratings on review platforms

Easy to use!

Easy to use! All interfaces worked well

good to use

good to use. but it has a watermark alongside my digital signature. don't know why.

AWESOME & EASY

it is a good website

IT IS EASY TO WORK WITH

It is a much needed service and PDFfiller.

Who needs Parent Child Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Parent Child Loan Agreement Guide

How to fill out a Parent Child Loan Agreement form

Filling out a Parent Child Loan Agreement involves understanding the document's key sections, discussing terms with family members, and ensuring compliance with legal standards. Use interactive tools available on pdfFiller to streamline this process.

What is a Parent Child Loan Agreement?

A Parent Child Loan Agreement is a formal contract between a parent and a child regarding a loan arrangement. It defines the terms of the loan, including the amount borrowed, repayment schedule, and interest rates, ensuring both parties have clear expectations.

-

To document the financial arrangement formally, which helps in resolving any future disputes.

-

Serves as a binding contract, providing legal protection to both the lender and borrower.

-

Includes specifics about the loan's principal amount, repayment conditions, and the agreed-upon interest rate.

Why should you consider using a Parent Child Loan Agreement?

Using a Parent Child Loan Agreement can lead to improved clarity regarding loan terms, which helps maintain family relationships during financial transactions. It also provides potential tax benefits to both the lender and the borrower.

-

Clearly articulated terms prevent misunderstandings and provide a point of reference.

-

Having a formal agreement ensures that family members preserve their relationships even while dealing with money.

-

Proper documentation can help both parties understand their tax liabilities, especially concerning interest income.

What is included in a sample Parent Child Loan Agreement?

Sample Parent Child Loan Agreements may include several sections that outline the loan's terms. These clauses help ensure that both the borrower and lender are protected and have clear expectations.

-

Typically includes details about the loan amount, repayment terms, and any applicable interest.

-

Includes default provisions, collateral agreements, and specific payment arrangements.

-

Provides templates for expressing the loan terms, including how payment schedules should be structured.

How to fill out a Parent Child Loan Agreement?

Filling out a Parent Child Loan Agreement requires a methodical approach. Utilize interactive form-filling tools provided by pdfFiller to avoid errors commonly encountered in such documents.

-

Collect all required information about the loan terms, parties involved, and payment details before starting.

-

Take advantage of tools that guide you through filling out the document accurately and efficiently.

-

Double-check entries for accuracy, especially regarding payment terms and interest rates.

What are the repayment terms in a Parent Child Loan Agreement?

Repayment terms are critical in a Parent Child Loan Agreement, dictating how and when the borrower must pay back the loan. Understanding these terms helps ensure compliance and prevents misunderstandings.

-

Can be structured as lump sum payments or installments, depending on the agreement.

-

Should specify acceptable payment methods such as bank transfers or checks.

-

Include clauses that outline the implications and processes for early loan repayment.

What are the legal considerations for Parent Child Loans?

It is essential to understand the legal landscape surrounding family loans to ensure proper compliance. Different states may have specific rules that dictate how these loans must be structured.

-

Requirements can vary significantly, so it's vital to consult local laws governing family loans.

-

Collect and present documentation that complies with state laws for family loans.

-

Failing to formalize a family loan can result in tax liabilities or disputes later on.

How to manage your Parent Child Loan Agreement?

Managing a Parent Child Loan Agreement efficiently is crucial for ongoing compliance and relationship maintenance. Tools on pdfFiller allow for easy editing, signing, and storing of documents.

-

pdfFiller provides easy-to-use tools to edit and sign PDF documents securely.

-

Family members can discuss and revise loan terms collaboratively using shared tools.

-

Store and manage your agreements in a secure, accessible cloud environment.

How to fill out the Parent Child Loan Agreement Template

-

1.Download the Parent Child Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller.

-

3.Begin by entering the names and contact details of both the parent (lender) and child (borrower).

-

4.Specify the loan amount clearly in the designated section.

-

5.Set the interest rate, if applicable, or indicate if the loan is interest-free.

-

6.Determine the repayment schedule, including the due dates for payments and the total repayment period.

-

7.Outline any consequences for defaulting on the loan, such as late fees or legal actions.

-

8.Add any additional terms or conditions relevant to the loan agreement.

-

9.Review all entered information carefully for accuracy before finalizing.

-

10.Save the completed document and share it with the involved parties for their signatures.

What is the best way to lend money to an adult child?

Before agreeing to lend money to an adult child, Steinberg recommends talking to your partner, if you have one, whether that person is the child's parent or not. Once everyone is in agreement, go over the terms and make sure it's clear how much support you'll be providing and whether or when you expect to be paid back.

How to write a family loan agreement?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

How to lend money to a family member?

Use a Promissory Note for less formal agreements Often family members use Promissory Notes when lending money to one another. Much like a Loan Agreement, a Promissory Note documents the legally binding promise that a borrower makes to pay back a loan.

How to write a simple loan agreement template?

Loan Agreement Template Interest Rate. The Parties agree the Interest Rate for this loan shall be _% to be accrued monthly. Loan Term. This Loan shall be for a period of _ years/months. Repayment. The Parties agree the Borrower shall pay the Lender $ per month on the day of each month.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.