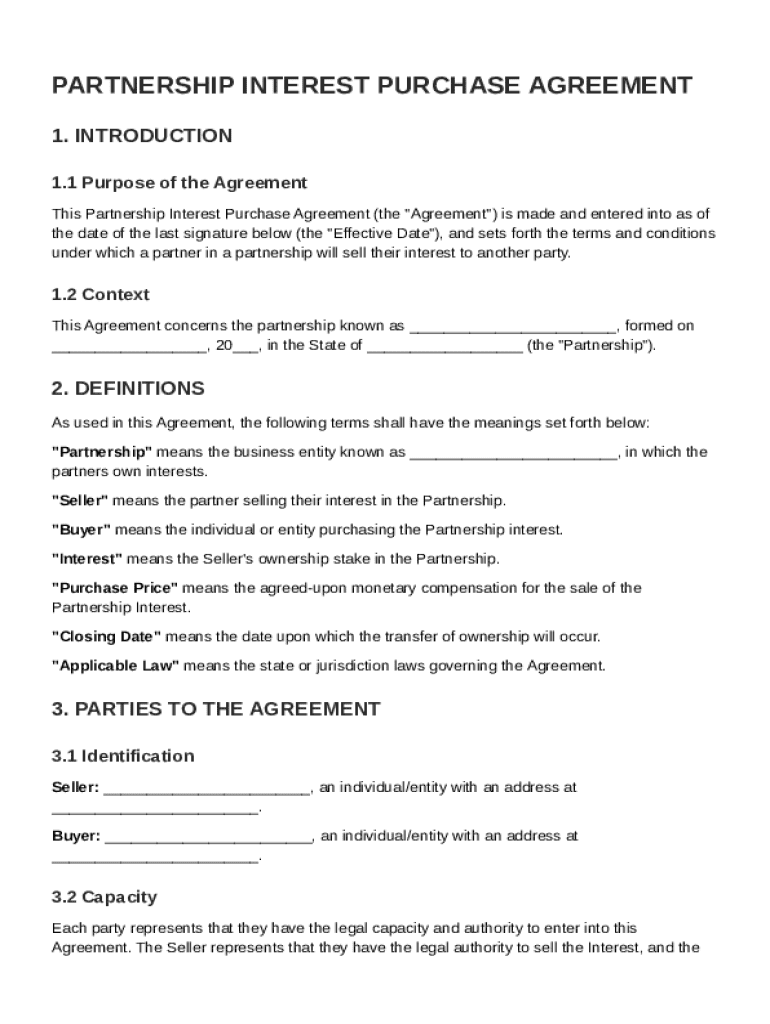

Partnership Interest Purchase Agreement Template free printable template

Show details

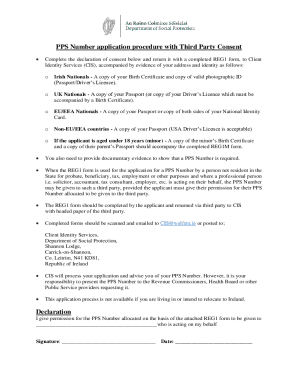

This document outlines the terms and conditions under which a partner in a partnership sells their interest to another party, including definitions, parties involved, terms of sale, and closing obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Partnership Interest Purchase Agreement Template

A Partnership Interest Purchase Agreement Template is a legal document used to outline the terms and conditions under which one partner sells their ownership interest in a partnership to another party.

pdfFiller scores top ratings on review platforms

I really have needed a tool like this to turn a number of internal business documents into fillable forms. Do not want to have to buy a typewriter to do the tasks PDF filler can do so easily. Without any training I have been able to do the basic functions just fine. I would be interested in furthering my skills be learning how to do more sophisticated editing or creation.

Its "the perfect" software. Easy to use without any guess work. It's hard to find a product as simple as this one in today's market. Thumbs up to the folks who created this.

Already submitted my survey. Your attention to my needs was timely and perfect!

It has been perfect for what I needed to use it for and to edit documents.

Its great, would love to know we are using it to its full potential:)

PDFfiller has made sending documents for signatures sooo EASY!

Who needs Partnership Interest Purchase Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Partnership Interest Purchase Agreement Template form

What is a Partnership Interest Purchase Agreement?

A Partnership Interest Purchase Agreement is a legal document that outlines the terms and conditions for the sale and transfer of a partnership interest from one party to another. It serves to protect the rights of both the seller and the buyer and ensures clarity in the transaction, which is crucial in legal dealings.

-

The main goal of this agreement is to facilitate clear communication between parties, clarify ownership rights, and stipulate the financial terms involved.

-

Having a formal agreement helps avoid disputes and ensures that all parties are aware of their obligations and rights, ultimately leading to smoother transactions.

-

The seller is responsible for transferring their interest and ensuring the buyer understands what they are acquiring, while the buyer must perform due diligence to verify the value of the interest being purchased.

Why do you need a Partnership Interest Purchase Agreement?

The necessity of a Partnership Interest Purchase Agreement arises from various circumstances, including partnerships undergoing changes or restructuring. This agreement can help avert potential disagreements and ensure compliance with relevant laws.

-

Evaluate the existing partnership dynamics, assess the financial health of the partnership, and ensure all parties have clear expectations.

-

In industries like real estate or finance, formal agreements can vary in complexity and requirements, often guided by specific regulatory frameworks.

-

Different regions may impose varying legal stipulations for partnerships, making it essential to understand local laws before drafting the agreement.

What are the key definitions involved in the agreement?

Understanding key terms used in the Partnership Interest Purchase Agreement is critical for clarity. These terms define the rights, responsibilities, and expectations of the parties involved.

-

A formal arrangement in which two or more parties manage and operate a business together.

-

The seller is the designated party transferring their partnership interest, while the buyer is the party acquiring that interest.

-

The total amount agreed upon for the transaction, encompassing various valuation methods.

-

The date when the sale is finalized and ownership is officially transferred.

-

The legal framework that governs the partnership agreement, typically dictated by the jurisdiction where the partnership operates.

How to identify the parties involved in the agreement?

Identifying the parties to the Partnership Interest Purchase Agreement is an essential step. Both seller and buyer must disclose critical information to establish their legal status and authority.

-

Include legal name, business structure, and verification of authority to sell the interest.

-

Collect the buyer's legal name, financial capability to acquire the interest, and their authority if acting on behalf of another entity.

-

Both parties must provide identification and confirm their intent and capacity to enter into the agreement.

What details should be included regarding the subject matter of the agreement?

The subject matter of the Partnership Interest Purchase Agreement refers specifically to the interest being sold. Clear descriptions are necessary to avoid potential conflicts and confusion.

-

Explicitly state what partnership interest is being sold, including percentage ownership and any associated rights.

-

The seller must confirm they have the right to sell the interest and ensure it is free from any claims.

-

Clarify whether a full or partial interest is being sold, as this impacts the rights and responsibilities of the buyer.

What terms of sale and transfer should be outlined?

The terms of sale and transfer outline the financial and procedural aspects of the transaction. Clear documentation of these details can help prevent misunderstandings.

-

Outline how the purchase price is calculated, including appraisals or agreed-upon formulas.

-

Specify the timeline for completing the transaction and transferring ownership, including necessary inspections or approvals.

-

Provide a variety of accepted payment methods, such as bank transfers, checks, or third-party financing options.

How to ensure legal compliance and governing law?

Legal compliance is critical when drafting a Partnership Interest Purchase Agreement. Knowledge of the applicable laws that govern the agreement is essential to avoid legal issues.

-

Identify and outline the laws that will govern the agreement, ensuring all parties are aware and compliant.

-

Investigate any specific legal requirements based on the region and industry, as these can vary significantly.

-

Highlight potential penalties or issues that may arise if the agreement does not meet legal standards.

What steps are involved in filling out the Partnership Interest Purchase Agreement?

Filling out the Partnership Interest Purchase Agreement requires careful attention to detail. Following a structured approach can help ensure accuracy and completeness.

-

Follow a detailed checklist that aligns with the sections of the agreement to avoid omissions.

-

Be cautious not to misrepresent details, as inaccuracies can lead to legal complications.

-

Leverage tools such as pdfFiller for easy editing, electronic signatures, and document management for simplification.

How can collaboration enhance the agreement process?

Collaboration is key when multiple parties are involved in drafting the Partnership Interest Purchase Agreement. Using effective tools can enhance the drafting process.

-

Using platforms like pdfFiller allows teams to edit the document in real-time and share feedback efficiently.

-

Real-time collaboration enhances communication and ensures all parties are aligned throughout the agreement drafting process.

-

Maintain clear records of document changes and updates, which helps avoid confusion or redundancy.

What are best practices for post-agreement management?

Once a Partnership Interest Purchase Agreement is signed, proper management is essential to ensure compliance and accessibility.

-

Both physical and digital copies of the agreement should be stored securely to prevent loss or unauthorized access.

-

Ensure all parties fulfill their obligations as per the agreement to maintain a positive partnership dynamic.

-

With pdfFiller, you can easily track changes and ensure compliance with version documents over time.

How to fill out the Partnership Interest Purchase Agreement Template

-

1.Start by downloading the Partnership Interest Purchase Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the structure to ensure understanding of the sections.

-

3.Fill in the date of the agreement at the top of the document.

-

4.Enter the names and addresses of both the seller and buyer in the designated fields.

-

5.Detail the specific percentage or share of the partnership being sold, including any relevant identification numbers.

-

6.Outline the purchase price and acceptable payment methods in the financial section.

-

7.Include any necessary terms and conditions concerning the transfer, such as liabilities or obligations.

-

8.Review all filled sections for accuracy, ensuring all information is current and correct.

-

9.Sign and date the completed agreement at the designated signature lines.

-

10.Save your work and print copies for all parties involved as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.