Payday Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender agrees to loan money to a borrower and the borrower\'s obligations to repay that loan.

We are not affiliated with any brand or entity on this form

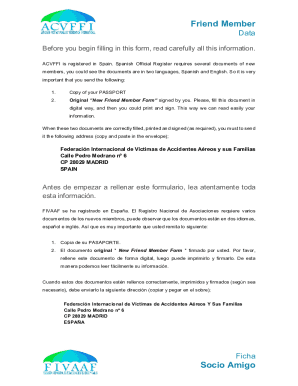

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payday Loan Agreement Template

A Payday Loan Agreement Template is a legal document outlining the terms and conditions of a short-term cash loan, typically with high interest rates.

pdfFiller scores top ratings on review platforms

It seems like a long process but maybe it won't after I've had time to play!!!

this apps is just great, is an real good tool

Just what I needed for taking care of my fathers affairs after his death. Convenient, easy, and inexpensive. Thanks.

For the first time...it is a good investment!!! Jorge S. Round Rock, TX

Easy to use and saves so much time. just love it!

The program requires no OCR software which in my experience creates lots of problems for most "Form Filler" software I have tried to use in the past.

Who needs Payday Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Payday Loan Agreement Template

Filling out a payday loan agreement template form requires precise attention to detail to ensure legal compliance and protect both parties involved in the transaction.

What is a payday loan agreement?

A payday loan agreement is a legal contract between a lender and a borrower, outlining the terms of a loan intended to be paid back by the next payday. Understanding its importance is critical, as it protects both parties by defining obligations and rights which help avoid misunderstandings.

-

A payday loan agreement serves as a formal understanding of the lending terms, including how much money is borrowed and when it needs to be repaid.

-

These agreements are essential to ensure there are clear expectations set between the lender and borrower, thus safeguarding all parties involved.

-

Failure to adhere to the terms can lead to legal consequences, highlighting the necessity for understanding each component of the agreement.

How does the payday loan process work?

Obtaining a payday loan involves a straightforward process that requires several key steps to ensure eligibility. Understanding the process can help streamline your experience and secure the funds efficiently.

-

The first step typically includes selecting a lender, followed by submitting an application that outlines your need for the loan.

-

Documentation such as proof of income and identification is necessary prior to application approval.

-

Most lenders will have a credit check process that helps determine whether you qualify for the loan based on your financial history.

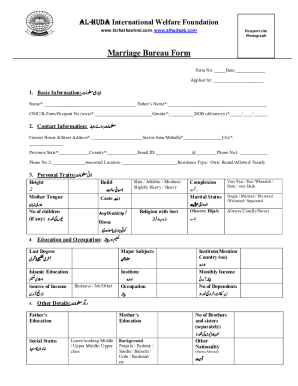

What does a payday loan agreement template include?

Knowing the elements included in a payday loan agreement is vital for both preparers and signers. Understanding these components helps individuals navigate their responsibilities more effectively.

-

The agreement must include accurate details for both the lender and the borrower, such as names and contact information.

-

Essential components such as the loan amount, interest rate, and duration must be clearly stated.

-

Understanding how and when funds are disbursed, as well as specifying repayment schedules, is crucial for managing expectations.

How to complete the payday loan agreement?

Completing the payday loan agreement entails filling in both personal and loan-specific details meticulously. Here’s a guide to help you fill out the form correctly.

-

Provide necessary personal information such as name, address, and contact information for both the lender and borrower.

-

Clearly outline the amount being borrowed, the applicable interest rate, and the timeframe for repayment.

-

It’s important to recognize how the payments are structured—whether it’s a lump sum or installment basis—and schedule payments accordingly.

What common pitfalls should be avoided?

Every contract carries risks; however, there are common pitfalls associated with payday loans that can lead to unfavorable outcomes. Awareness of these pitfalls can significantly reduce risk.

-

Being aware of the consequences of defaulting on a payday loan is crucial, as it may lead to further financial strain.

-

Always read the agreement thoroughly and take necessary precautions before signing, ensuring you are comfortable with the terms.

-

Recognizing indicators of predatory lending practices can prevent you from entering into an unfavorable agreement.

How can pdfFiller enhance the documentation process?

Using pdfFiller's document management system adds efficiency to the payday loan process by allowing users to edit, eSign, and manage their documents seamlessly.

-

pdfFiller provides tools to easily edit and customize your payday loan agreement, ensuring that all elements meet individual needs.

-

The platform allows for secure electronic signatures, streamlining the finalization of your loan agreements.

-

For team-based agreements, pdfFiller enables collaboration, allowing multiple users to contribute and finalize the document.

What types of loan agreements exist?

Awareness of various types of loan agreements can help in choosing the right one for your financial needs. Understanding these differences is essential in selecting the most suitable option.

-

Payday loans differ significantly from other types of loans, typically offering shorter terms and higher interest rates.

-

Selecting the right agreement depends on personal financial circumstances, preferences, and borrowing requirements.

-

Critical variables include interest rates, repayment terms, and relevant legalities that may affect your decision.

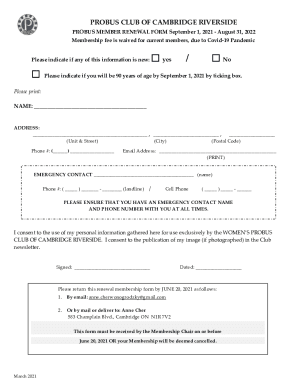

What final considerations should be made?

Before signing the payday loan agreement, it’s imperative to conduct a thorough review of the terms and their compliance with local laws. This ensures clarity and legal adherence.

-

Ensure that the terms align with local regulations, offering you protection under the law.

-

Engaging with legal or financial advisors can provide clarity and reassurance regarding the terms of the agreement.

-

Understanding your rights and obligations can empower you while making sure you are safeguarded while entering the agreement.

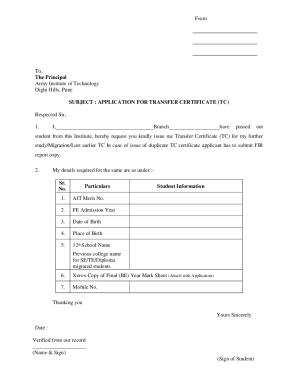

How to fill out the Payday Loan Agreement Template

-

1.Open your pdfFiller account and upload the Payday Loan Agreement Template.

-

2.Begin by entering the borrower's name and contact information in the designated fields.

-

3.Next, input the lender's details, including name and business address.

-

4.Specify the loan amount being provided, ensuring it complies with state regulations.

-

5.Set the interest rate applicable to the loan, making sure to adhere to legal limits.

-

6.Outline the repayment terms, including the due date and any late fees, if applicable.

-

7.If relevant, add any collateral information to secure the loan.

-

8.Review all entered data for accuracy and completeness before finalizing.

-

9.Once finished, save the document, and either print or email it to the borrower for their signature.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How to write up a loan agreement?

What does a Loan Agreement include? The location. Details about the lender and borrower. The loan amount and loan date. Interest and late fees. The repayment method. Collateral and insurance.

How to draw up a simple loan agreement?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

What is the unsecured loan contract?

An unsecured loan agreement is a legal contract between a lender and a borrower that agrees to fund a loan without requiring collateral.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.