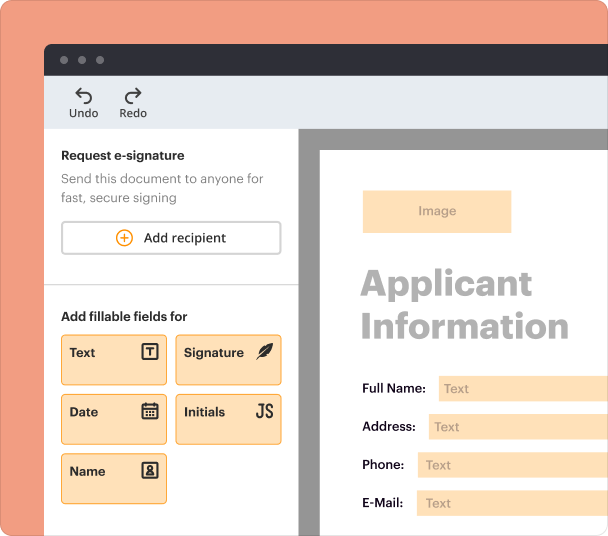

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Paye Settlement Agreement Template

Show details

This agreement establishes the terms and conditions under which the Employer and HMRC agree to settle the Employer\'s PAYE obligations for the specified tax year, including relevant tax amounts and

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

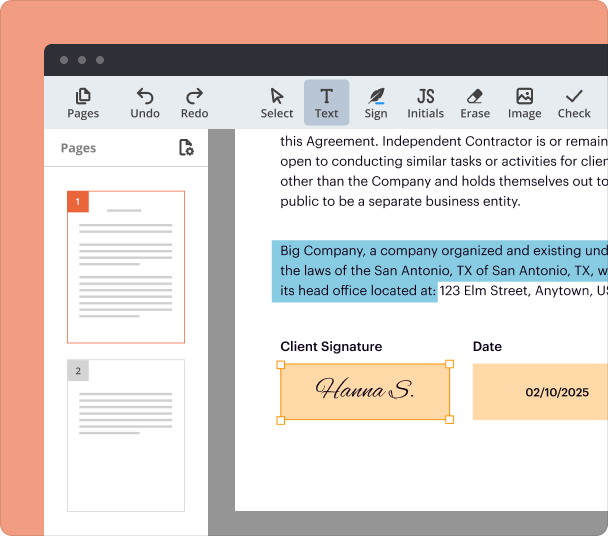

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

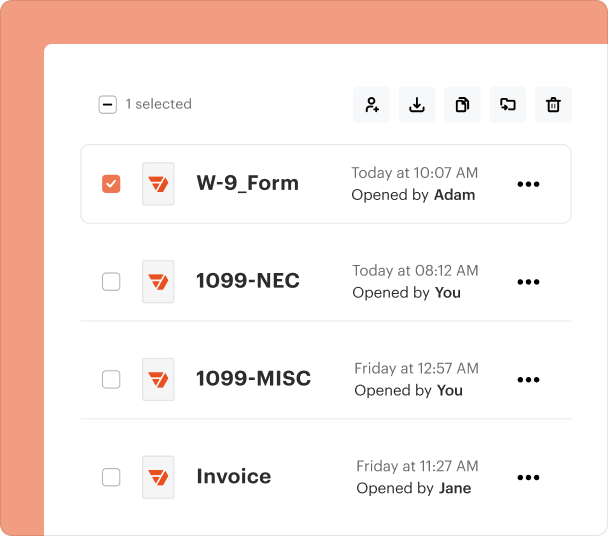

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Paye Settlement Agreement Template

Here, you'll find detailed information on how to effectively edit and fill out the Paye Settlement Agreement Template using pdfFiller.

How to edit Paye Settlement Agreement Template

Editing the Paye Settlement Agreement Template is straightforward with pdfFiller’s intuitive tools:

-

1.Click ‘Get form’ on this page to access the Paye Settlement Agreement Template.

-

2.Create a free pdfFiller account by providing your email address and setting a password.

-

3.Log into your new account and select the form you want to edit.

-

4.Utilize the editing tools on the left side to add, remove, or modify text as needed.

-

5.Once you've made the necessary changes, save your document to your pdfFiller account or download it directly to your device.

How to fill out Paye Settlement Agreement Template

Filling out the Paye Settlement Agreement Template correctly is crucial for clarity and compliance. Here’s how to do it easily:

-

1.Click ‘Get form’ on this page to obtain the Paye Settlement Agreement Template directly from pdfFiller.

-

2.Log into your pdfFiller account or create a new one if you don’t have an account yet.

-

3.Open the Paye Settlement Agreement Template that you accessed.

-

4.Begin by filling in the necessary personal or business information as requested on the form.

-

5.Ensure all information is accurately entered to avoid issues with your agreement.

-

6.Review the filled form to confirm all segments are completed and correct.

-

7.Save your progress frequently to prevent any loss of information.

-

8.Once completed, download or print the filled form for your records.

All you need to know about Paye Settlement Agreement Template

This section provides essential information related to the Paye Settlement Agreement Template, ensuring you understand its purpose and usage.

What is a Paye Settlement Agreement Template?

The Paye Settlement Agreement Template is a legal document used by employers to agree on how to manage employees' tax obligations in relation to certain benefits. This template ensures clarity in how these payments are handled and reported for tax purposes.

Definition and key provisions of a Paye Settlement Agreement Template

Understanding the key provisions is vital. The Paye Settlement Agreement typically contains:

-

1.Details of the employer and the employees involved.

-

2.Definitions of the benefits subject to the agreement.

-

3.The agreed tax treatment and reporting obligations.

-

4.Signatures of the involved parties to validate the agreement.

When is a Paye Settlement Agreement Template used?

This template is used by employers when they want to settle the tax obligations for certain non-cash benefits provided to employees. It is particularly beneficial when employers aim to simplify the tax reporting process for minor benefits.

Main sections and clauses of a Paye Settlement Agreement Template

The main sections typically include:

-

1.Introduction of parties involved

-

2.Description of the benefits covered

-

3.Tax responsibility clauses

-

4.Signatures and effective date of the agreement

What needs to be included in a Paye Settlement Agreement Template?

To ensure the agreement is complete and legally binding, it should include:

-

1.The names and addresses of the employer and employee.

-

2.A clear description of the benefits provided.

-

3.The agreed method for settling taxes.

-

4.The duration of the agreement.

-

5.Signatures of all parties involved.

How do I submit the PAYE settlement agreement calculation?

The easiest way to do this is online. 'Tell HMRC the value of items in your PAYE Settlement Agreement' is a service for employers to submit their yearly calculations online. The PSA1 form can be submitted digitally for the 2021 to 2022 tax years onward.

Can you submit a PSA online?

You can apply to get a PAYE Settlement Agreement ( PSA ) online. If you're unable to apply online, you can apply by post.

How do I cancel a PSA?

If you want to cancel your PSA , ask the office that issued your PSA to send you a P626. Fill in the return slip section of the P626 and send it to HMRC . If you've applied to cancel your PSA , HMRC will cancel it on the date you put on the return slip.

How to pay PSA settlement?

Pay a PAYE Settlement Agreement Overview. Direct Debit. Approve a payment through your online bank account. Make an online or telephone bank transfer. By debit or corporate credit card online. At your bank or building society. By cheque through the post. Check your payment has been received.

pdfFiller scores top ratings on review platforms

okkk

HOW TO MAJE MONEY USING THIS NETWORK.

Excellent!

I needed a HIPAA compliant PDF editor and found this one. Lost the document I was working on but was helped by chat and got it back. Very relieving!

awsm app

Recruiter

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.