Payment Arrangementpayment Agreement Template free printable template

Show details

This document outlines the terms and conditions for the repayment of an outstanding obligation between a Debtor and a Creditor.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Arrangementpayment Agreement Template

A Payment Arrangement Agreement Template is a document that outlines the terms of a payment plan between a creditor and a debtor to settle outstanding debts.

pdfFiller scores top ratings on review platforms

I would like to attend a webinar just not right now. Im busy.

its good

great, but I am not use it often to make a payment

wonderfull

As a first time user

As a first time user, I found the process to be fairly simple and easy to navigate.

great to convert pdf to word doc

great to convert pdf to word doc

Who needs Payment Arrangementpayment Agreement Template?

Explore how professionals across industries use pdfFiller.

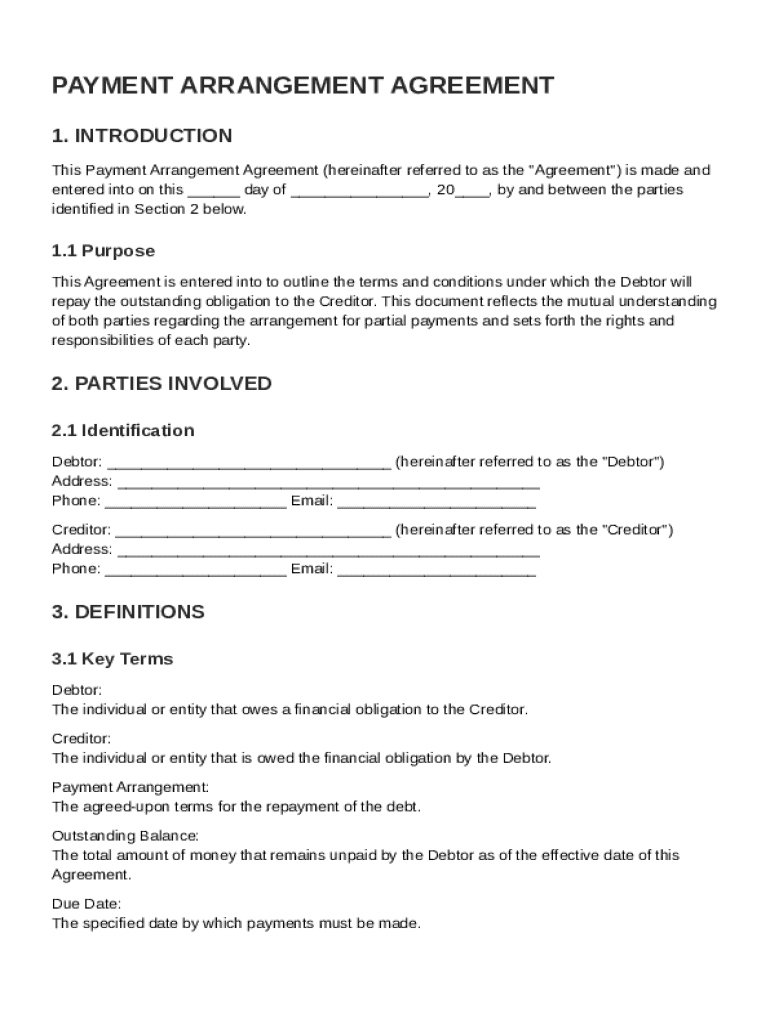

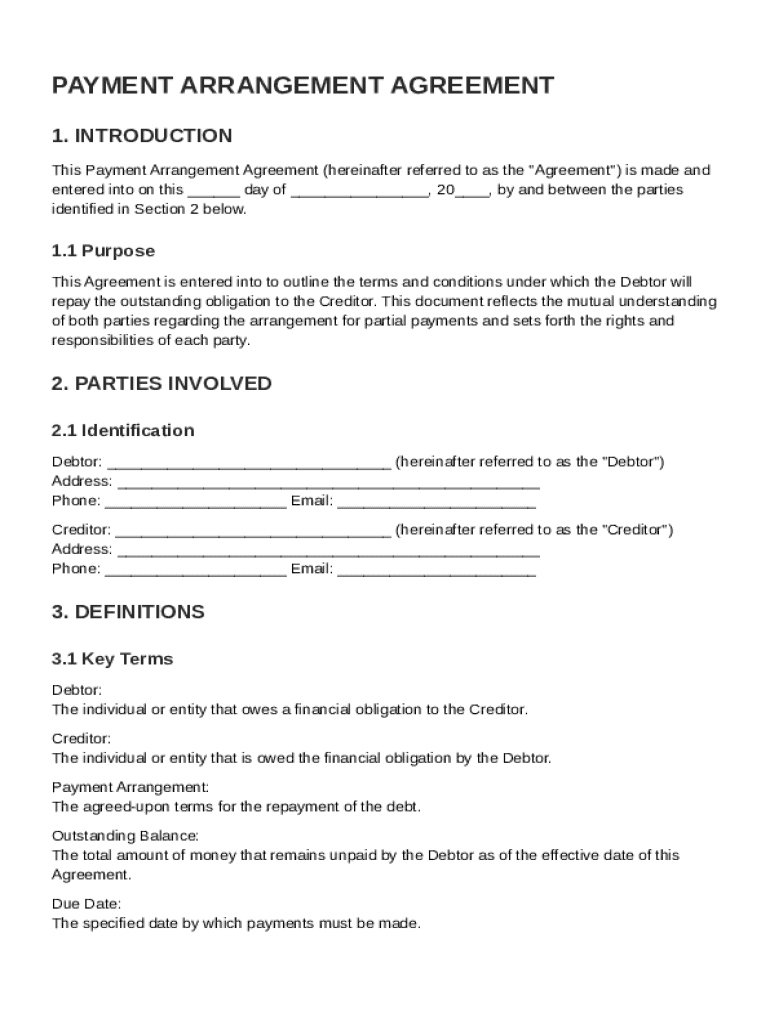

Comprehensive Guide to Payment Arrangement Agreement Templates

In today's financial landscape, a Payment Arrangement Agreement can provide a structured way to manage debts. This document outlines the terms under which a debtor agrees to repay their outstanding debt to a creditor. Understanding how to fill out a Payment Arrangement Agreement form is crucial for both parties involved.

What is a Payment Arrangement Agreement?

A Payment Arrangement Agreement is a legally binding contract between a debtor and a creditor that details how a debtor will repay their obligation over time. These agreements are vital tools that help facilitate repayment, often providing flexibility to debtors while protecting the rights of creditors. It's important to consider legal compliance when drafting these agreements to ensure enforceability.

What are the essential elements of a Payment Arrangement Agreement?

-

Clearly state who the debtor and creditor are, including their legal names and contact information.

-

Define important terms such as 'Outstanding Balance,' 'Due Date,' and 'Payment Arrangement' to avoid ambiguity.

-

Outline common clauses like payment methods, penalties for missed payments, and conditions for modification.

How do you fill out a Payment Arrangement Agreement?

Filling out a Payment Arrangement Agreement involves several steps. Firstly, you need to enter the details about all parties involved, including their names, addresses, and contact information. It is crucial to highlight important fields like the outstanding amount, payment frequency, and due dates. Lastly, ensure the terms are clear and enforceable to avoid future disputes.

How to structure payment terms in your agreement?

-

Determine a reasonable payment amount that fits the debtor's financial situation.

-

Decide whether payments will be made weekly, bi-weekly, or monthly to maintain clarity.

-

Set clear due dates for both the initial payment and subsequent ones to avoid confusion.

How can you edit and customize your Payment Arrangement Agreement?

Using pdfFiller’s tools, users can easily edit Payment Arrangement Agreement templates. You can incorporate additional clauses as needed to suit specific circumstances or preferences. Once the adjustments are made, you can save and export the customized agreements in various formats, making document management efficient.

What is the process for signing and managing a Payment Arrangement Agreement?

Understanding the electronic signing process with pdfFiller is essential for finalizing agreements. You can collaborate with multiple parties seamlessly, allowing everyone involved to sign the document electronically. Proper management entails tracking payments and ensuring adherence to terms set forth in the agreement.

What common pitfalls should you avoid when drafting Payment Arrangement Agreements?

-

Avoid unclear terms that may lead to misinterpretation or disputes.

-

Ensure all parties sign the agreement to validate its enforceability.

-

Be aware of regional laws and regulations that may affect the agreement's legitimacy.

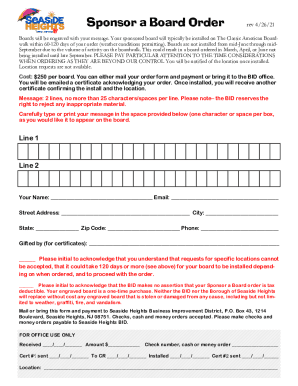

How to fill out the Payment Arrangementpayment Agreement Template

-

1.Obtain the Payment Arrangement Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller platform.

-

3.Begin by filling in the debtor's personal information at the top, including name, address, and contact number.

-

4.Next, enter the creditor's details, including their name and contact information.

-

5.Define the total amount of debt owed and the payment plan, specifying the number of installments and due dates.

-

6.Indicate any interest or fees associated with the payment plan.

-

7.Both parties should read through the agreement carefully to ensure mutual understanding of the terms.

-

8.Have both parties sign and date the document where indicated.

-

9.Save the completed document and download or send it via email as needed.

How to write a payment arrangement?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How do I write a payment plan agreement template?

A Payment Plan Agreement should include the following details: Names and contact information of both the creditor and debtor. Description of the debt being repaid. Total amount owed. Payment schedule, including due dates and amounts. Interest rate (if applicable) Consequences of late or missed payments.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

How do you write payment terms in an agreement?

When writing your payment terms, strive for clarity and precision. Ambiguities in your terms can lead to misinterpretations, delayed payments, or disputes. State clearly when payment is due, any early payment discounts, and late payment penalties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.