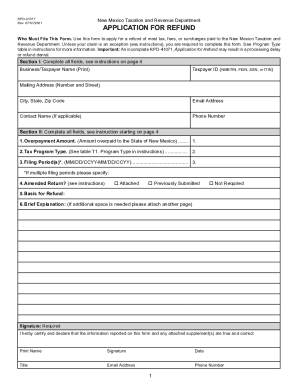

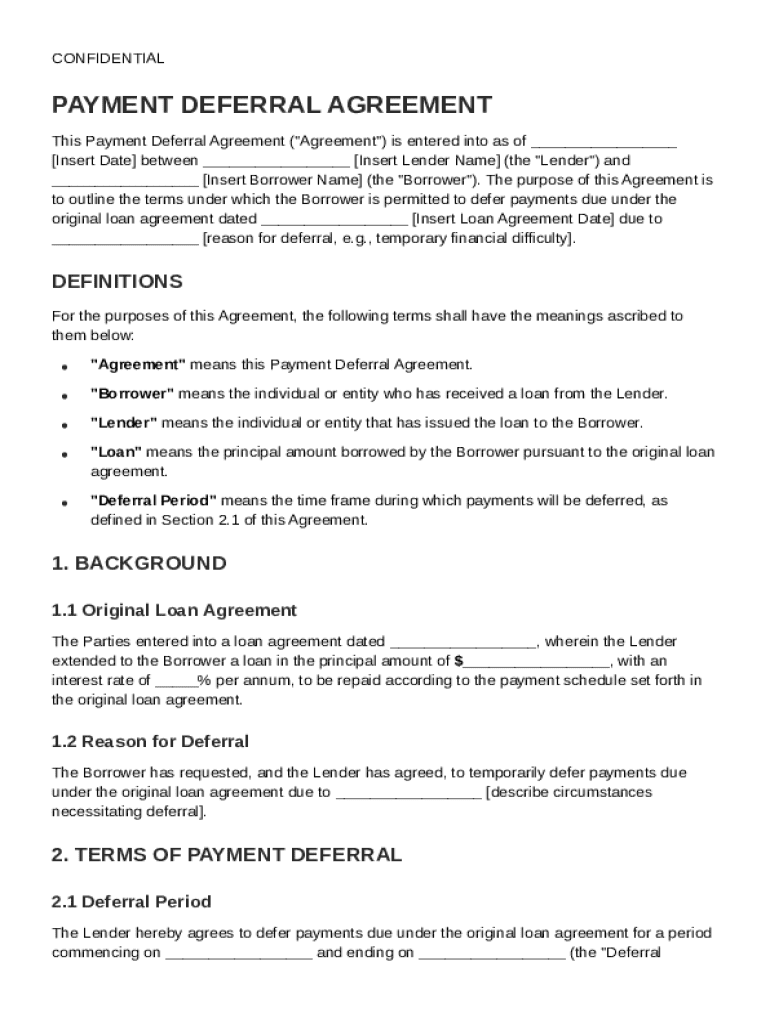

Payment Deferral Agreement Template free printable template

Show details

This Agreement outlines the terms for deferring payments due under an original loan agreement between a Lender and a Borrower due to temporary financial difficulty.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Deferral Agreement Template

A Payment Deferral Agreement Template is a legal document that allows a borrower to postpone their payment obligations for a specified period under agreed terms.

pdfFiller scores top ratings on review platforms

muy buena

GREAT

I love that I can make my own documents and it has so many different things two use for making whatever you need perfect

It is great

Works awesome!

most of it is pretty simple and works wonderfully

Who needs Payment Deferral Agreement Template?

Explore how professionals across industries use pdfFiller.

Payment Deferral Agreement Template Guide

A Payment Deferral Agreement Template is crucial for individuals facing temporary financial hardships. It enables borrowers to postpone their loan payments and find relief during tough circumstances. This guide will walk you through the essential elements, usage, and best practices for creating and managing this important document.

Understanding the need for a Payment Deferral Agreement

A Payment Deferral Agreement is a legal document that allows borrowers to delay their loan payments for a specified period. Such agreements are typically necessary in times of financial distress, enabling borrowers to manage their cash flow without defaulting on their obligations.

-

This agreement is applicable when individuals face situations like job loss, medical emergencies, or unforeseen expenses that affect their ability to make timely payments.

-

A deferral agreement helps borrowers maintain their financial stability by preventing loans from going into default or causing further financial strain.

Key components of the Payment Deferral Agreement

A well-structured Payment Deferral Agreement includes various essential components that ensure clarity and protection for both lender and borrower. These elements help define the terms and enforce the agreements legally.

-

Clearly state the date the agreement becomes effective and identify the parties involved—namely the lender and the borrower.

-

Key terms like ‘Loan’, ‘Deferral Period’, ‘Borrower’, and ‘Lender’ must be defined to avoid misunderstandings.

-

It’s important to restate the loan details to which the deferral applies, ensuring that all parties are aligned on the terms.

Step-by-step instructions to fill out the agreement

Filling out a Payment Deferral Agreement requires careful attention to detail to ensure accuracy and legal compliance. Here’s how to do it effectively:

-

Begin by accurately inputting the current date and the full names of the lender and borrower to establish a formal basis for the agreement.

-

Include clear details about the loan, such as the amount owed and the interest rate associated with it.

-

Candidly describe the circumstances necessitating the payment deferral for transparency and legal protection.

Terms of payment deferral

The terms of the deferral are critical in defining how the agreement affects the repayment schedule. Specifics about the deferral period and the payments involved must be addressed.

-

Clearly define the start and end dates of the deferral period to establish clear expectations.

-

Indicate the total amount that will be subject to deferral, making clear which payments are affected, such as principal, interest, or both.

-

Specify how interest will be calculated during the deferral period, as it may accrue or be waived depending on agreements.

Collaborative features of pdfFiller for managing agreements

pdfFiller provides a powerful platform for managing Payment Deferral Agreements with ease and efficiency. The collaborative tools can enhance how you interact with your documents.

-

Users can easily edit and sign the Payment Deferral Agreement digitally, saving time and eliminating the need for printing.

-

Share the document with involved parties through integrated tools for seamless collaboration and communication.

-

Access documents anytime and anywhere with pdfFiller’s secure cloud storage, allowing for easy modifications.

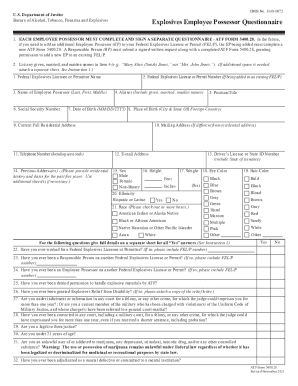

Legal considerations and compliance

It's crucial to consider the legal framework surrounding Payment Deferral Agreements. Each region may have specific requirements that must be adhered to.

-

Review the legal requirements governing payment deferral agreements within your region to ensure compliance and avoid complications.

-

Ensure compliance by consulting legal professionals who can provide insight on local regulations impacting such agreements.

-

Understanding the repercussions of failing to adhere to the original loan agreement after the deferral is essential to avoid legal penalties.

Finalizing the agreement

Finalizing a Payment Deferral Agreement is a critical step in reinforcing the commitments made by both parties. This stage ensures that everyone understands their rights and responsibilities.

-

Complete all necessary sections of the agreement, ensuring not to omit any key details important for clarity.

-

Both parties should review and confirm their understanding of the agreement, ensuring mutual consent.

-

Ensure that both parties keep copies of the finalized agreement for their records, which is essential for future reference.

Exploring alternatives to Payment Deferral Agreements

If a Payment Deferral Agreement does not meet your needs, it is essential to explore other options available to manage financial difficulties effectively.

-

Consider alternatives such as loan restructuring, refinancing, or income-driven repayment plans based on your financial situation.

-

Analyze how these alternatives compare with a payment deferral agreement in terms of long-term financial impact and feasibility.

-

In complex situations, it may be beneficial to seek professional financial advice to understand the best course of action.

How to fill out the Payment Deferral Agreement Template

-

1.Navigate to pdfFiller and select the Payment Deferral Agreement Template.

-

2.Download the template or open it in the editor.

-

3.Fill in the date at the top of the document where indicated.

-

4.Enter the names and addresses of both the borrower and lender in the designated fields.

-

5.Specify the amount of the payment being deferred and the original due date.

-

6.Outline the new payment schedule, including the start date for resumed payments.

-

7.Include any interest terms during the deferral period if applicable.

-

8.Add any specific conditions that must be met by the borrower or lender during the deferral period.

-

9.Review all entries for accuracy and completeness before finalizing the document.

-

10.Save the completed agreement and consider sending copies to all parties involved.

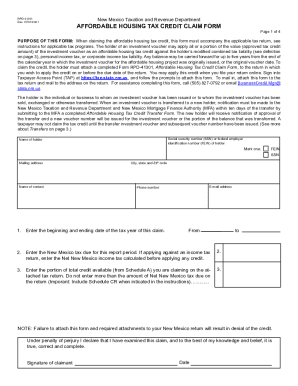

What is a payment deferral agreement?

Authored by Timi Joy Jorgensen, PhD. Payment deferral is a financial tool that allows borrowers to postpone missed payments, typically moving them to the end of their loan term. It's a solution designed to help people catch up on overdue obligations without immediate repayment.

What is a deferred payment agreement?

A deferred payment agreement is a type of loan that homeowners can use to pay for their care home or nursing home. It's designed for people who cannot afford their weekly care costs because most of their money is tied up in the value of their home and they don't want to sell their home straight away.

How to write a payment plan agreement?

Clearly Define the Terms: Clearly state the amount of the debt, the repayment schedule, and any interest or fees involved. This ensures that both parties are aware of their obligations. Include Late Payment Consequences: Specify the consequences of late or missed payments, such as additional fees or penalties.

What is an example of a standard of deferred payment?

Example. Consider a scenario where you purchase a car on a finance agreement, agreeing to pay the dealer a certain amount of money each month for the next five years. In this case, the currency (let's say U.S. dollars) acts as the standard of deferred payment.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.