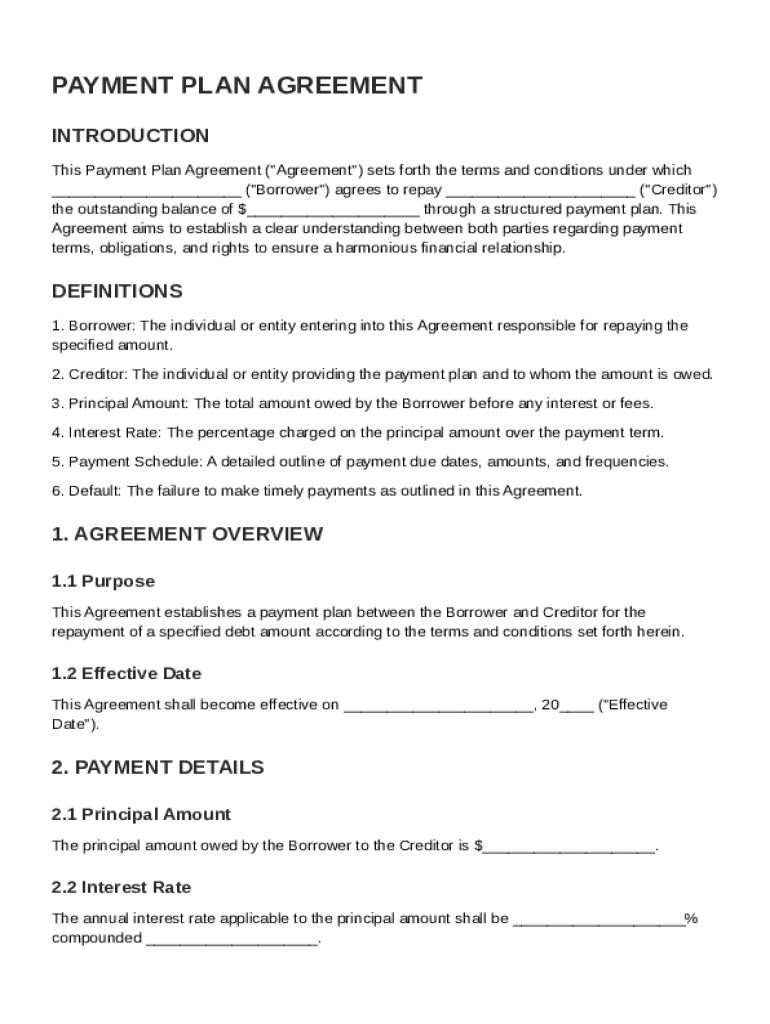

Payment Plan Agreement Template free printable template

Show details

This document outlines the payment plan terms and conditions between a borrower and creditor for the repayment of a debt amount.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Plan Agreement Template

A Payment Plan Agreement Template is a formal document outlining the terms and conditions under which a debtor agrees to repay a debt in installments.

pdfFiller scores top ratings on review platforms

all done.it was easy! thanks you are!thanks GOD!!!

I like the program but I wish the font could be more customized - I cannot edit the font size and it appears very small when the document is printed.

love it. really has helped me a tremendous amount

Works as well as I expected. User friendly and online chat support was also helpful when I ran into an issue loading my docs.

Just started using it and so far it seems very user friendly.

Your support person was a great help and had answers to all my questions.

Who needs Payment Plan Agreement Template?

Explore how professionals across industries use pdfFiller.

Payment Plan Agreement Guide

How does a payment plan agreement work?

A Payment Plan Agreement is a legally binding contract outlining the terms under which a borrower agrees to repay a debt to a creditor. The purpose is to provide a structured approach for repayment, making it easier for individuals to manage their debt.

Using a structured payment plan can benefit both parties significantly. It creates clarity surrounding payment expectations while allowing borrowers to manage their finances without risking default.

What are the key components in a payment plan agreement?

-

The borrower is the individual or business responsible for repaying the debt as per the agreement's terms.

-

The creditor is the party that lent the money, detailing their rights and responsibilities throughout the agreement.

-

This is the original sum of money being borrowed, which remains a crucial element of the payment plan.

-

Understanding how interest rates are applied helps borrowers calculate the total amount to be repaid.

-

A clear outline of payment due dates and amounts is essential for both parties to prevent misunderstandings.

-

These clauses define the consequences for missed payments, protecting both parties in the event of issues in repayment.

How to create your payment plan agreement?

-

Determine when the payment plan agreement will go into effect, establishing a clear start for all terms.

-

Specify exactly what the borrower owes each installment, ensuring clear expectations.

-

Clearly identify how often payments are to be made—weekly, bi-weekly, or monthly—to keep the plan manageable.

-

Provide options for making payments that suit both parties to ensure smooth transactions.

-

This includes the principal and the total with interest considerations, providing full transparency.

What are the steps to filling out your payment plan agreement form?

-

Follow comprehensive guidelines for completing the form available on pdfFiller to avoid mistakes.

-

Utilize the interactive tools provided by pdfFiller to simplify document editing and ensure accuracy.

-

Ensuring accuracy in each section is critical for the validity of the payment plan agreement.

What common mistakes should you avoid in payment plan agreements?

-

Missing essential details can invalidate the agreement and result in disputes later.

-

Failing to include default clauses may lead to difficulties for both parties, particularly if payments are missed.

-

Not clearly outlining payment schedules and amounts can cause confusion and potential default.

How to manage your payment plan agreement effectively?

-

Maintaining thorough records of payments made helps both parties stay aligned on the agreement.

-

Be proactive in monitoring the agreement and adjusting terms as necessary to reflect changing circumstances.

-

Open lines of communication with the creditor regarding difficulties can prevent misunderstandings and foster trust.

How can pdfFiller enhance your payment plan agreement experience?

-

Explore pdfFiller's platform for easy document management from anywhere, enhancing accessibility for users.

-

Utilizing eSignature functionality streamlines the signing process, making it faster and more efficient.

-

Collaborate with team members through pdfFiller to ensure all parties are on board with the terms of the agreement.

How to fill out the Payment Plan Agreement Template

-

1.Open the Payment Plan Agreement Template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in your name and contact information as the creditor.

-

4.Provide the debtor's name and contact information in the designated fields.

-

5.Specify the total amount owed by the debtor.

-

6.Outline the payment amount that the debtor will pay each installment.

-

7.Detail the frequency of payments (e.g., weekly, monthly).

-

8.Include the start date for the first payment and any applicable end date.

-

9.Add any fees or interest associated with missed payments if applicable.

-

10.Review all entered information for accuracy.

-

11.Sign and date the agreement where indicated.

-

12.If needed, send the completed payment plan to the debtor for their records.

How to write a payment plan contract?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How do I offer someone a payment plan?

Explain the total cost of your services and the proposed length of time the payment plan will run. Outline the payment schedule, including the due date for each work milestone and the expected payments. Discuss any interest or fees that may be associated with the plan, including how you calculate those costs.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

How to write a proposal letter for a payment plan?

Be specific: Clearly describe the proposed payment plan, including amounts, intervals, and total duration. Use professional language: Maintain a respectful tone to foster understanding and cooperation. Provide context: Briefly explain the circumstances that led to the request to build credibility and goodwill.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.