Payment Schedulepayment Agreement Template free printable template

Show details

This document outlines the payment schedule that a Debtor agrees to follow in order to fulfill their financial obligations to a Creditor, detailing definitions, parties involved, payment terms, consequences

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

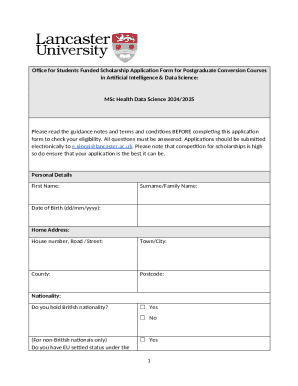

What is Payment Schedulepayment Agreement Template

A Payment Schedule Payment Agreement Template is a legal document outlining the terms of repayment between a borrower and lender, including payment amounts and due dates.

pdfFiller scores top ratings on review platforms

SIMPLE TO USE

great

PDFfiller work well for my business

It was perfect for completing my estate planning draft for my WILL.

Very Simplistic and convenient

EXCELLENT

Who needs Payment Schedulepayment Agreement Template?

Explore how professionals across industries use pdfFiller.

Everything You Need to Know About Payment Schedule Agreements

How to fill out a Payment Schedulepayment Agreement Template form

Filling out a Payment Schedule Agreement form involves gathering necessary information like names, payment amounts, and due dates. It's essential to outline payment terms clearly to avoid misunderstandings. Tools like pdfFiller can facilitate editing and collaboration, making the process seamless.

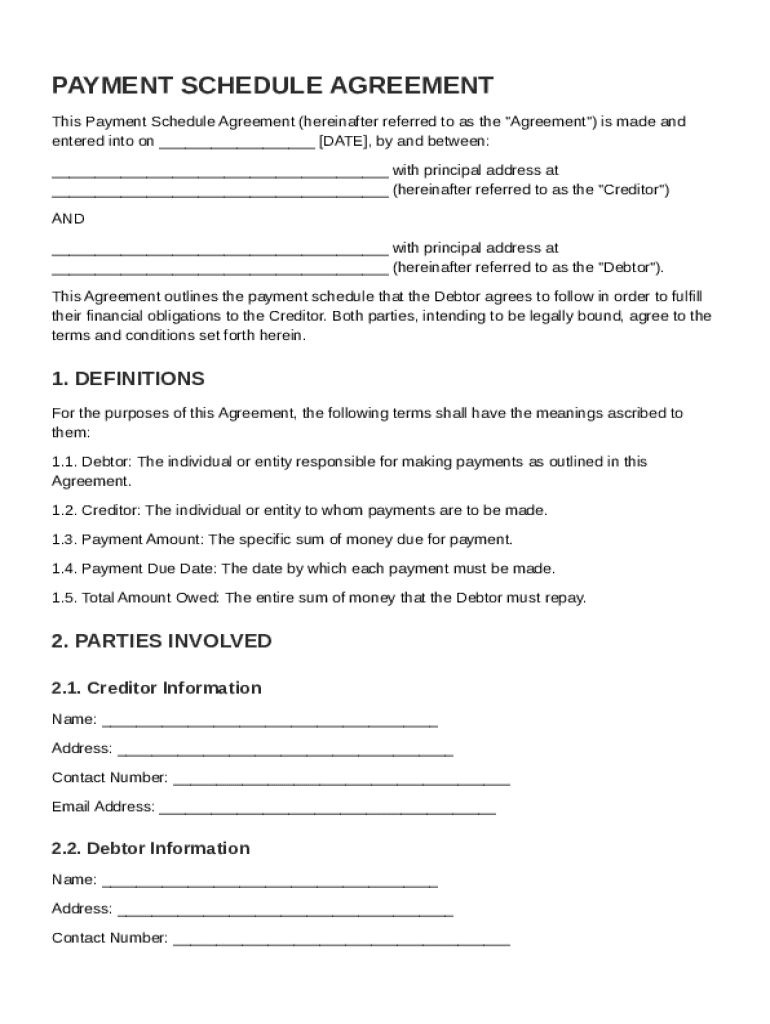

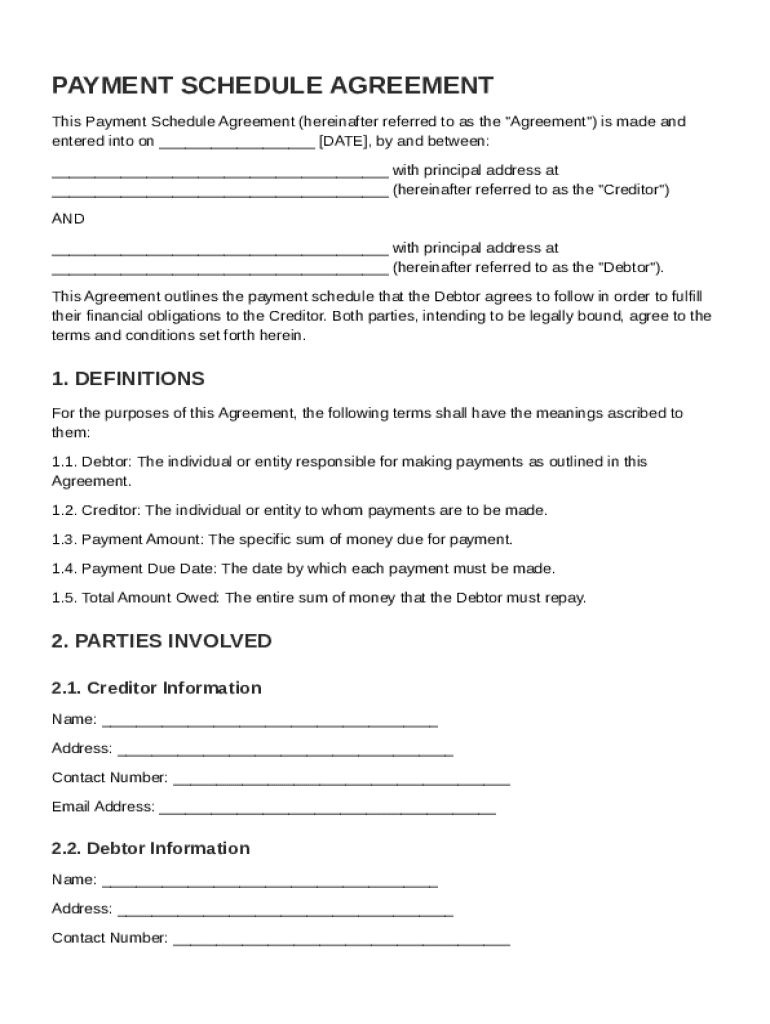

Understanding the payment schedule agreement

A Payment Schedule Agreement defines the terms under which payments are made between a creditor and a debtor. Having a formal payment schedule is crucial, as it helps both parties understand their obligations and reduces the risk of disputes.

-

This agreement specifies the payment terms, including amounts and dates, between the parties involved.

-

A well-defined schedule fosters clarity and accountability in financial dealings.

-

Payment schedules are common in various financial arrangements, including loans and contracts.

What are the key components of a payment schedule agreement?

Key components of a Payment Schedule Agreement include information about both the creditor and debtor, as well as terms that define how and when payments will occur.

-

Names and contact information of both parties involved in the agreement.

-

Clarity on terms like debtor, creditor, payment amount, payment due date, and total amount owed.

-

Outlines the total amount, scheduled payments, and frequency, such as weekly or monthly.

How to create your payment schedule agreement – step by step

Creating a Payment Schedule Agreement can be straightforward if you follow a structured approach.

-

Collect names, addresses, and contact information from all parties involved.

-

Clearly define the total amount owed, the proposed payment schedule, and due dates.

-

Decide how payments will be made, whether by check, bank transfer, or online payment systems.

How to fill out the payment schedule agreement template

Using tools like pdfFiller, you can easily fill out and customize the Payment Schedule Agreement Template. This tool makes it simple to enter all required details and ensure accuracy.

-

Access the platform to modify your document conveniently online.

-

Make sure to accurately enter names, amounts, and due dates to avoid confusion.

-

Utilize electronic signatures for legal validation and to expedite the agreement process.

What are the payment frequency options?

Choosing a payment frequency is crucial as it affects the debtor's cash flow and total repayment amount.

-

Common options include weekly, bi-weekly, monthly, or quarterly payments.

-

Different frequencies can influence the total interest paid over the loan period.

-

Parties may negotiate a frequency that suits their financial circumstances.

What are late fees and penalties?

Late fees act as deterrents for missed payments, helping maintain the integrity of the Payment Schedule Agreement.

-

Late fees encourage timely payments and can be significant if not understood.

-

They may be a flat fee or a percentage of the overdue amount.

-

Setting reminders and utilizing automatic payments can prevent unforeseen delays.

How to manage your payment schedule?

Effective management of your payment schedule is vital for maintaining financial health.

-

Manage and store your documents effectively in one central location.

-

Utilize shared access features to keep everyone updated on payment statuses.

-

Regularly reviewing your payment schedule helps you stay on top of obligations.

Exploring related tools and resources

Accessing additional resources can simplify the process of creating and managing your Payment Schedule Agreement.

-

Locate the template efficiently to kickstart your agreement process.

-

Combining various documents can enhance the completeness of your agreements.

-

Utilize pdfFiller’s extensive library of tools for efficient document management.

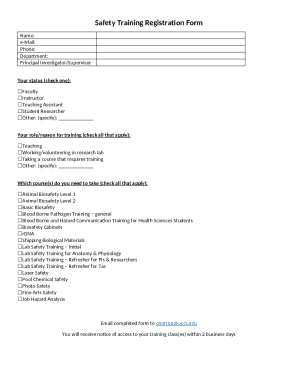

How to fill out the Payment Schedulepayment Agreement Template

-

1.Download the Payment Schedule Payment Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editor.

-

3.Begin by entering the names and contact information of both parties involved in the agreement.

-

4.Specify the total amount to be paid along with the interest rate if applicable.

-

5.Outline the payment schedule, including the frequency (e.g., monthly, quarterly), amounts, and due dates.

-

6.Add sections for late fees or penalties if payments are missed.

-

7.Review all entered information to ensure accuracy and clarity.

-

8.Save your completed document and consider sending it for signatures electronically if required.

How to write a payment plan agreement?

Clearly Define the Terms: Clearly state the amount of the debt, the repayment schedule, and any interest or fees involved. This ensures that both parties are aware of their obligations. Include Late Payment Consequences: Specify the consequences of late or missed payments, such as additional fees or penalties.

How do you write payment terms in an agreement?

When writing your payment terms, strive for clarity and precision. Ambiguities in your terms can lead to misinterpretations, delayed payments, or disputes. State clearly when payment is due, any early payment discounts, and late payment penalties.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

How to draw up a contract for payment?

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.