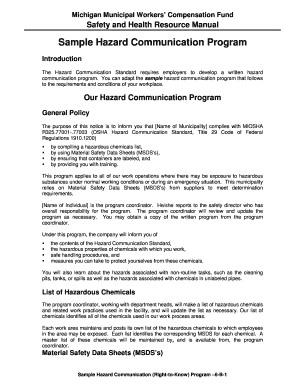

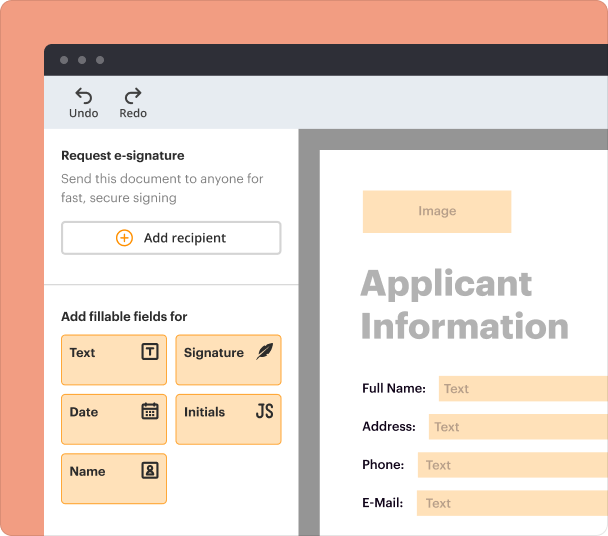

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Payment Term Agreement Template free printable template

Show details

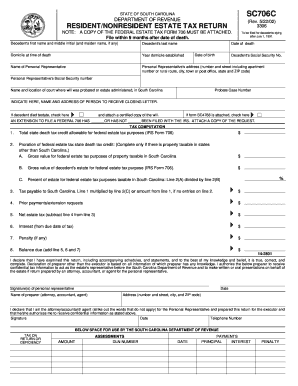

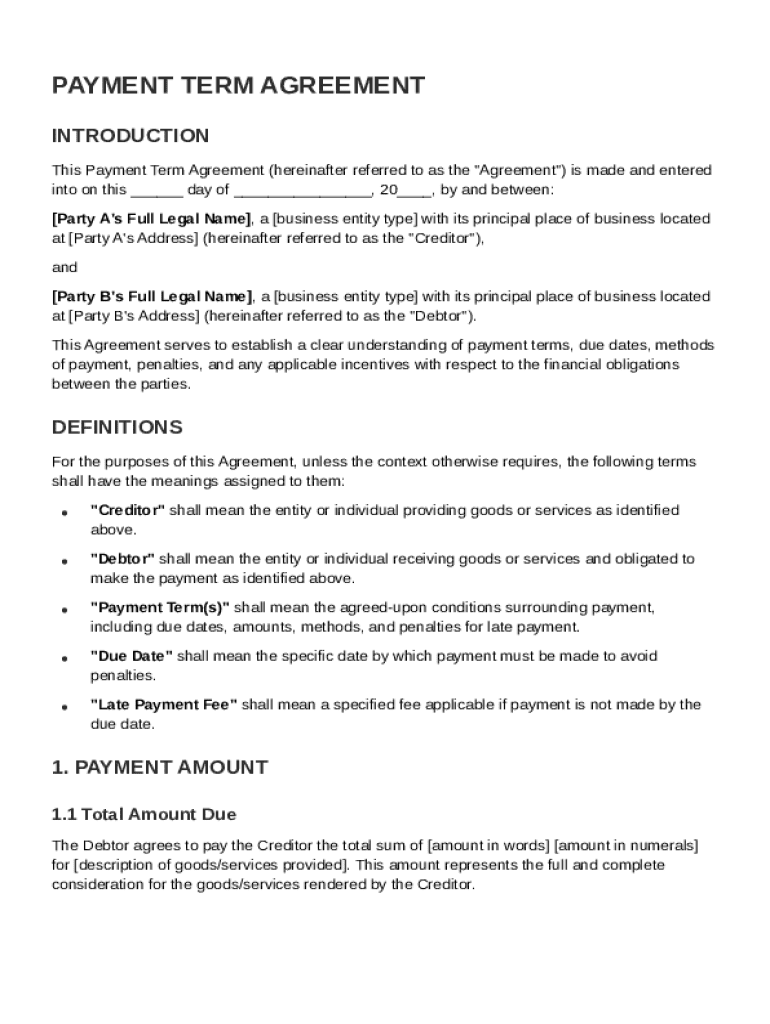

This document establishes the financial obligations between a creditor and debtor regarding payment terms, due dates, methods of payment, penalties for late payment, and applicable discounts and incentives.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

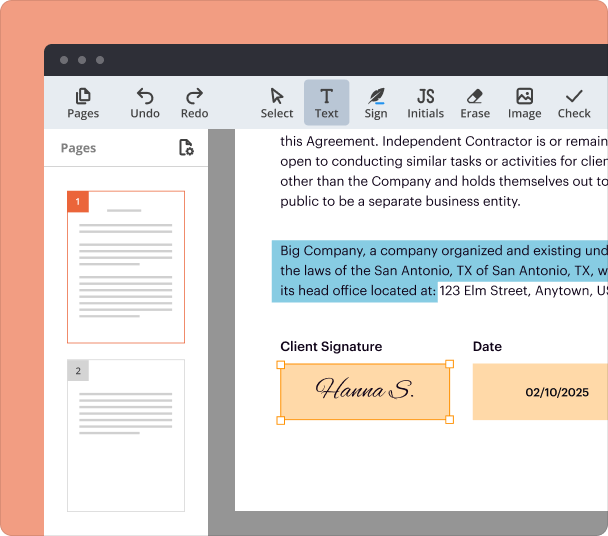

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Payment Term Agreement Template

Here you'll find essential information on how to use the Payment Term Agreement Template effectively.

How to edit Payment Term Agreement Template

Edit your Payment Term Agreement Template with ease using pdfFiller's cloud-based platform. Follow these steps:

-

1.Click the 'Get form' button on this page to access the Payment Term Agreement Template.

-

2.Create an account on pdfFiller if you haven’t already, or log into your existing account.

-

3.After signing in, locate your form in the document library.

-

4.Open the form and use the editing tools available to make the necessary modifications.

-

5.Once your edits are complete, save the changes to your document, ensuring all alterations are stored securely.

How to fill out Payment Term Agreement Template

Filling out the Payment Term Agreement Template accurately is crucial for establishing clear payment terms. The best way to obtain this template is by clicking ‘Get form’ on this page. Here’s how you can fill it out:

-

1.Click the ‘Get form’ button to access the Payment Term Agreement Template.

-

2.Download the template to your device, or open it directly within pdfFiller.

-

3.Begin by entering your name and contact information in the designated fields.

-

4.Clearly outline the payment terms, including amounts and due dates.

-

5.Specify any penalties for late payments, if applicable.

-

6.Review the agreement to ensure all terms are correctly stated and understood.

-

7.Sign the document electronically or print it out to sign manually.

-

8.Save the completed agreement in your pdfFiller account for future reference.

All you need to know about Payment Term Agreement Template

This section provides a detailed overview of the Payment Term Agreement Template to help you understand its significance and usage.

What is a Payment Term Agreement Template?

A Payment Term Agreement Template is a document that outlines the terms of payment for goods or services between parties. It serves as a formal agreement, detailing the specific conditions under which payment will be made, including amounts and timelines.

Definition and key provisions of a Payment Term Agreement

The Payment Term Agreement includes vital provisions to safeguard both parties involved. Below are some key elements:

-

1.Payment amounts

-

2.Payment due dates

-

3.Interest rates on late payments

-

4.Penalties for non-compliance

-

5.Processes for dispute resolution

When is a Payment Term Agreement used?

This agreement is commonly used in business transactions where goods or services are provided before payment is received. It is essential for freelancers, contractors, and businesses establishing clear financial responsibilities with clients or suppliers.

Main sections and clauses of a Payment Term Agreement

The main sections of a Payment Term Agreement include:

-

1.Parties involved

-

2.Description of services or goods provided

-

3.Payment terms and conditions

-

4.Late payment penalties

-

5.Signature lines for all parties

What needs to be included in a Payment Term Agreement?

To ensure the agreement is comprehensive and effective, include the following:

-

1.Full names and addresses of all parties

-

2.Detailed payment terms including amounts and frequency

-

3.Terms regarding late payments and interest rates

-

4.Confidentiality clauses, if necessary

-

5.Governing law under which the agreement is created

How do you write payment terms in an agreement?

When writing your payment terms, strive for clarity and precision. Ambiguities in your terms can lead to misinterpretations, delayed payments, or disputes. State clearly when payment is due, any early payment discounts, and late payment penalties.

How to write a payment agreement?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

What is the wording for 30 day payment terms?

Under “30 days payment terms,” the buyer must pay the seller within 30 days after the invoice date. Depending on the agreement, these terms might also be phrased as “net 30” or include variations such as “30 days from receipt of goods” and “30 days after the end of the month.”

How do you write a 50% payment term?

A business owner may specify a "50/50" term, which means that a 50% deposit is payable on receipt of an order, and the balance is due on the customer's receipt of the product or service ("50% deposit, balance on delivery").

pdfFiller scores top ratings on review platforms

I found it relatively easy to use, it would be nice if it had an undo selection. And getting the right size font was not easy. Had to wait for print out to see.

This is the easiest PDF Filler that I have found. LOVE IT!

So Far I am impressed with the easy to use features and cannot believe what you can do on the most complicated to simply documents. Highly recommend!!

Great service. Have used more than I thought I would!

Great, easy to use, but WAY TOO expensive for someone who only needs it for a few docs...

PDFfiler seems to be a good site , unfortunately i am having a hard time navigating the site or able to find what i want

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.