Payroll Deduction Agreement Template free printable template

Show details

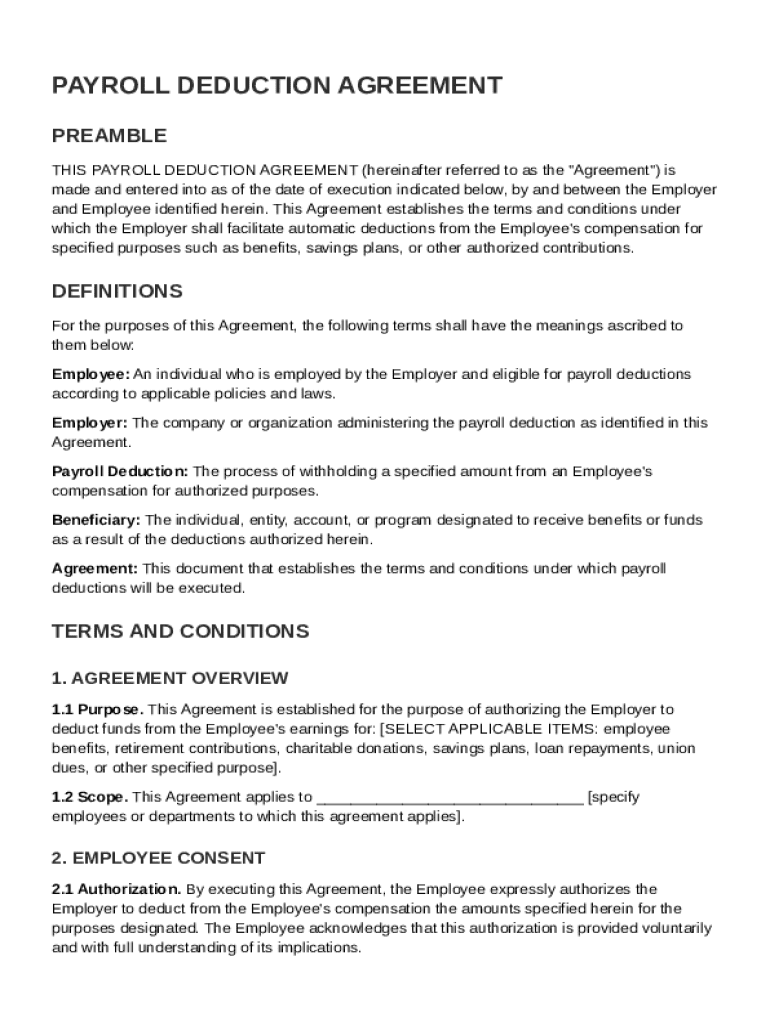

This document establishes the terms and conditions under which the Employer will facilitate automatic deductions from the Employee\'s compensation for specified purposes such as benefits, savings

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payroll Deduction Agreement Template

A Payroll Deduction Agreement Template is a document that authorizes the deduction of specified amounts from an employee's paycheck for various purposes such as benefits, savings plans, or charitable contributions.

pdfFiller scores top ratings on review platforms

Thank you

Thank you, I love to receive any updates and any concerns, please do contact me via email or cell phone number (928) 209-0853.

Easy to Use

Easy to use, fast and efficient! I am very pleased.

The entire staff including customer…

The entire staff including customer service, my managers and accounting have all made this process very streamlined and easy to follow. Everyone has been quite kind and ready to get me going. Because of those gestures and professionalism, I look forward to being a key member of your organization. Thank you, Robert Weiss

My first experience was great and…

My first experience was great and fulfilling - how can I add a new document which I can fill in?

Great customer service! They went above and beyond to refund my subscription and close my trail account.

great

Who needs Payroll Deduction Agreement Template?

Explore how professionals across industries use pdfFiller.

Payroll Deduction Agreement Template Guide on pdfFiller

This guide will help you understand how to fill out a Payroll Deduction Agreement Template form effectively. With the right approach, utilizing pdfFiller's tools, you can create a professional and compliant document in no time.

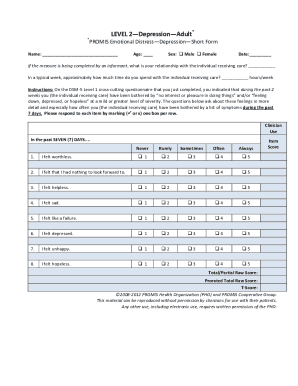

What is a Payroll Deduction Agreement?

A Payroll Deduction Agreement is a formal document that outlines the terms under which an employer is authorized to deduct specific amounts from an employee's paycheck. These deductions may include contributions to retirement plans, health insurance premiums, and other benefits. Understanding this agreement is essential for both employers and employees as it directly impacts employee earnings and financial planning.

-

A legally binding document detailing how and why deductions are made from an employee's wages.

-

They help facilitate the funding of essential employee benefits that would otherwise be difficult to manage.

-

It emphasizes transparency and consent, ensuring both parties understand the implications of salary adjustments.

What key terms are involved in Payroll Deductions?

It's important to understand the key terms associated with Payroll Deduction Agreements for proper compliance and administration.

-

The individual whose wages are being deducted, whose consent is required for the agreement.

-

The entity responsible for processing the deductions as per the agreed terms.

-

The portion of an employee's salary taken for various reasons, such as taxes or benefits.

-

The individuals or organizations that benefit from the deductions.

-

A document that formalizes the deduction arrangement between the employee and employer.

What is the purpose and scope of the agreement?

The Payroll Deduction Agreement serves to define what aspects of compensation can be accessed through deductions.

-

The agreement explicitly states what employees are permitting to be deducted from their salaries.

-

Common deductions include contributions to health insurance and retirement funds.

-

It is vital to clarify which employees this applies to, as well as any departmental or organizational discrepancies.

How can employees provide consent within the agreement?

Employee consent is crucial for any Payroll Deduction Agreement to be valid. This consent process protects both the employee's rights and the employer's obligations.

-

Employees provide consent by signing the agreement, which legally allows for deductions from their pay.

-

It is important for employees to understand that their consent is legally binding.

-

Employees can change their consent status by providing a written notice to the employer.

How to fill out the Payroll Deduction Agreement Template?

Filling out the Payroll Deduction Agreement Template is made simple with pdfFiller's platform, which offers a collaborative and user-friendly interface.

-

Users can follow guided steps within pdfFiller to complete the agreement accurately.

-

The platform provides tools for editing the document, electronically signing it, and sharing with relevant parties.

-

Double-check all information to align with legal standards and company policies.

How to manage your Payroll Deduction Agreements?

Effective management of Payroll Deduction Agreements contributes to organizational efficiency and employee satisfaction.

-

pdfFiller allows users to save documents securely and share them easily with stakeholders.

-

Teams can work together on documents, improving workflow and communication.

-

Stay organized by tracking all document changes and requests for revocation.

What are the options and tools available for payroll deductions?

When considering payroll deduction tools, comparing various options ensures that you make an informed choice tailored to your organization.

-

Explore various services that help manage payroll deductions, each with different features.

-

pdfFiller stands out with its intuitive design, robust features, and real-time collaboration capabilities.

-

The pdfFiller platform is straightforward, enabling users to navigate and perform tasks swiftly.

How to fill out the Payroll Deduction Agreement Template

-

1.Download the Payroll Deduction Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the employee's name and identification details at the top of the form.

-

4.Specify the amounts to be deducted and the purpose of each deduction in the designated fields.

-

5.Include the start date of the deductions to determine when they will commence.

-

6.Indicate the frequency of the deductions (weekly, bi-weekly, monthly, etc.) in the relevant section.

-

7.Require the employee's signature and date to authorize the deductions.

-

8.Review the filled document for accuracy and completeness before submitting.

-

9.Save a copy of the signed agreement for your records, and provide one to the employee.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.