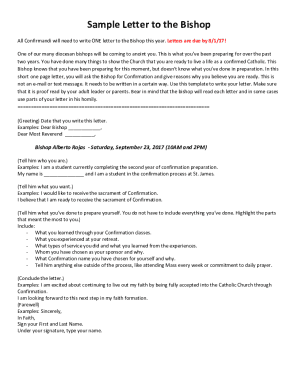

Payroll Service Level Agreement Template free printable template

Show details

This document outlines the terms and conditions for payroll services provided by a service provider to a client, including service definitions, responsibilities, performance metrics, incident management,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payroll Service Level Agreement Template

A Payroll Service Level Agreement Template outlines the expectations and responsibilities between a payroll service provider and their client regarding payroll processing and related services.

pdfFiller scores top ratings on review platforms

its easy to navigate and print documents.

It takes some getting use to deleting the existing example text and replacing with what you want for your document.

I am sruggling but I am learning how to use it.

Works perfectly for all of my dispatching needs!

As an upper limb amputee it is a great help in filling in forms

PDF filled has made my life with documentation ts so easy. Thank you!

Who needs Payroll Service Level Agreement Template?

Explore how professionals across industries use pdfFiller.

Payroll Service Level Agreement Template Guide

How does a Payroll Service Level Agreement (SLA) work?

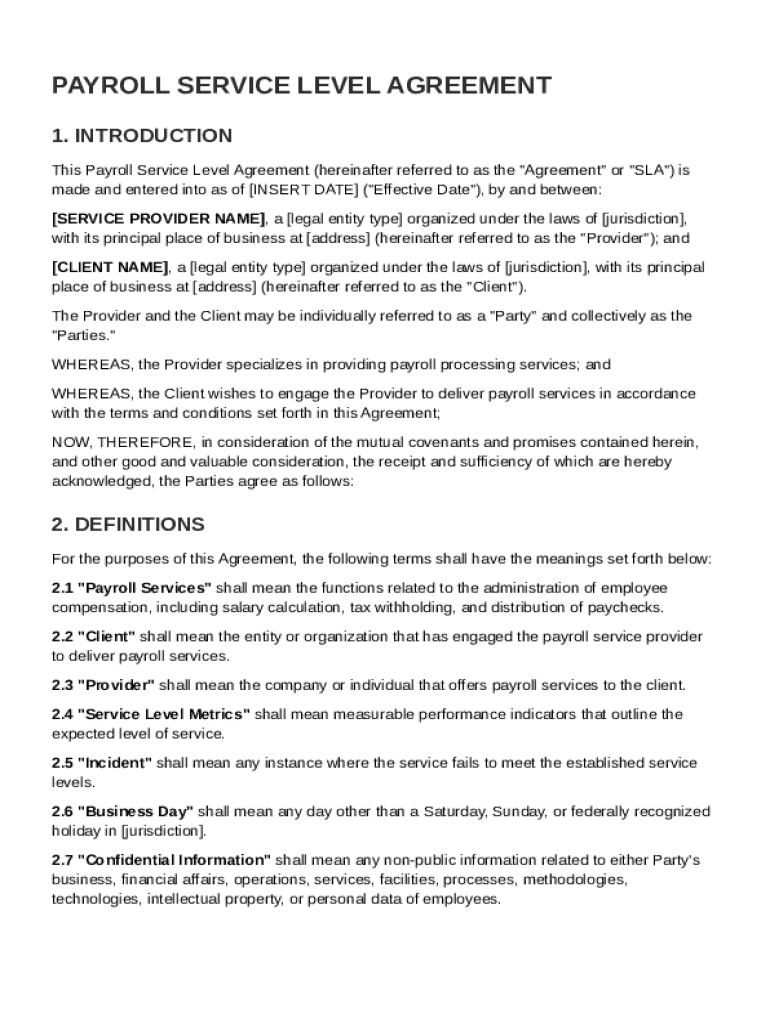

A Payroll Service Level Agreement (SLA) is a formal document that outlines the service expectations between clients and payroll service providers. It serves both as a guideline and a measurable tool for assessing service performance. Understanding the payroll SLA is crucial for establishing a transparent business relationship, ensuring accountability, and fostering trust.

-

This document defines the specific services to be provided and outlines the expected service levels.

-

A well-structured SLA helps in protecting both parties' interests by clarifying responsibilities and expectations.

-

Common elements include service descriptions, performance metrics, reporting frequencies, and remedies for service failure.

What key elements should be included in the Payroll SLA?

A comprehensive Payroll SLA encompasses various key elements that outline the scope and responsibilities of both parties. These elements ensure clarity and compliance throughout the business relationship.

-

The document begins with a summary that states the purpose and the specific payroll services covered.

-

These objectives define what the SLA aims to achieve, such as accuracy of payroll processing and timely disbursements.

-

Clarification of each party's role ensures all players understand their responsibilities.

-

Establishing a review schedule helps maintain service quality and compliance with the outlined provisions.

-

This section should clearly state the terms of service and any conditions that may affect the agreement.

How can you fill out your Payroll SLA?

Filling out your Payroll SLA requires attention to detail and comprehension of the specific service components. Following a step-by-step approach can simplify the process considerably.

-

Begin by filling in the critical details, including the date of the agreement, names of the service provider and client.

-

Specify which payroll services will be covered under this SLA, such as payroll processing and tax compliance.

-

Identify the key performance indicators (KPIs) that will measure the effectiveness of the services.

-

Detail the process for reporting any incidents of service failure and the timeframe for resolution.

-

Incorporate clauses that protect sensitive information shared between parties.

What are the best practices for customizing your Payroll SLA template?

Tailoring your Payroll SLA template enhances its relevance and utility. Customization ensures that the document meets specific business needs and operates efficiently.

-

pdfFiller offers a user-friendly interface for editing and customizing your Payroll SLA to fit specific circumstances.

-

Utilize interactive elements such as text fields and checkboxes to simplify the filling process.

-

Collaborate seamlessly with stakeholders using eSignature and sharing features to ensure everyone is on the same page.

What challenges may arise in implementing Payroll SLAs?

Successfully implementing a Payroll SLA can come with potential challenges. Being proactive about these issues ensures a smoother adaptation process.

-

Regularly assess the SLA performance to identify service gaps and address them promptly.

-

Implement scheduled reviews to refine the SLA continually and adapt to changing business needs.

-

Establish clear communication channels to handle disputes as soon as they arise.

What are the legal and compliance considerations concerning Payroll SLAs?

Understanding the legal and compliance landscape governing Payroll SLAs is imperative for safeguarding your business interests. Non-compliance can lead to significant legal repercussions.

-

Keep informed about local payroll regulations that may impact your SLA and ensure compliance.

-

Document all compliance-related activities and requirements clearly in the SLA.

-

Recognize the risks associated with non-compliance, including fines and reputational damage.

Why should businesses use a Payroll SLA?

A Payroll SLA offers numerous benefits that enhance the business relationship between clients and payroll service providers. From improved accountability to measurable performance improvements, these advantages can significantly contribute to business efficiency.

-

An SLA clearly outlines service deliverables, ensuring clients know what to expect.

-

By defining responsibilities, both clients and providers can hold each other accountable.

-

SLAs provide a solid framework for monitoring service effectiveness and enhancing performance over time.

How can you leverage the Payroll SLA for business success?

Utilizing a well-structured Payroll SLA can significantly positively impact your business's operational efficiency. Implementing strategic action points helps in maximizing its potential.

-

Constantly monitor and evaluate the impact of the SLA to ensure it meets the business goals.

-

Develop action points and workflows that make SLA adherence straightforward for all parties involved.

-

Utilize insights gathered from the SLA to inform future payroll management decisions and strategies.

How to fill out the Payroll Service Level Agreement Template

-

1.Begin by downloading the Payroll Service Level Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the sections to familiarize yourself with the content.

-

3.Start with the 'Parties Involved' section, filling in the names and addresses of both the client and the payroll service provider.

-

4.Proceed to the 'Duration of Agreement' section and specify the start and end dates of the agreement.

-

5.Next, fill in the 'Services Provided' section, detailing all payroll-related services to be performed by the provider.

-

6.In the 'Service Levels' section, outline the expected timelines for payroll processing, reporting, and error resolution.

-

7.Complete the 'Responsibilities' section, clarifying both the client’s and provider's obligations regarding the payroll process.

-

8.Fill in the 'Payment Terms' section to specify fees, payment schedules, and any additional charges.

-

9.Finally, review the entire document for accuracy before submitting it for signatures. Once complete, save the signed document for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.