Peer to Peer Loan Agreement Template free printable template

Show details

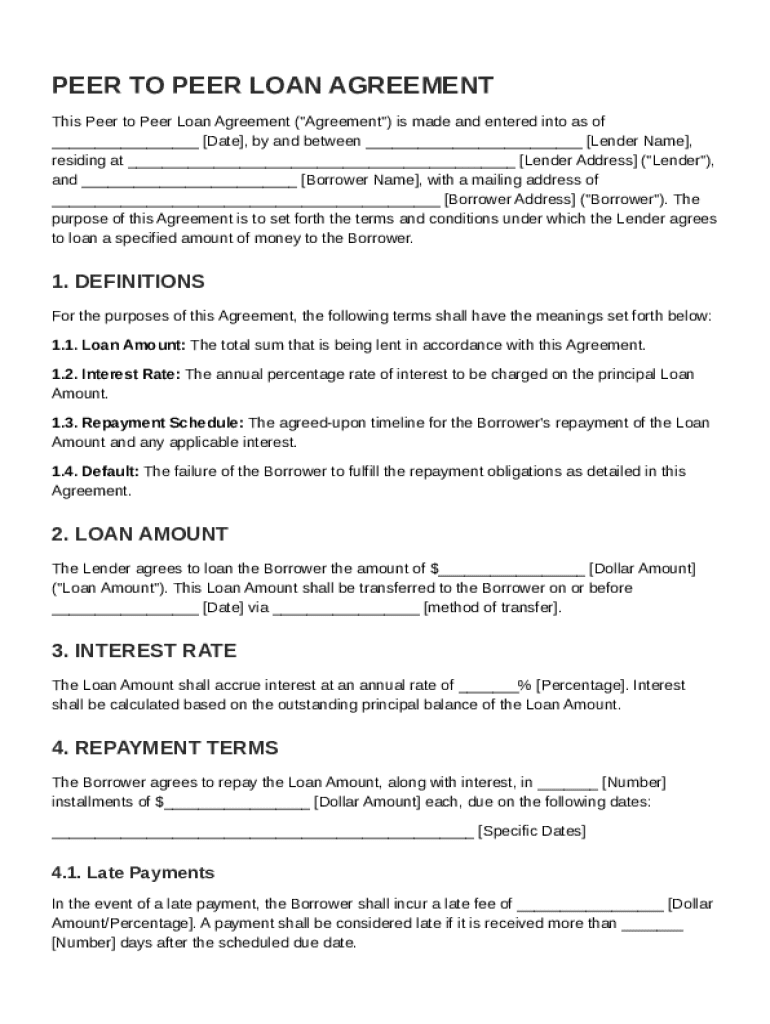

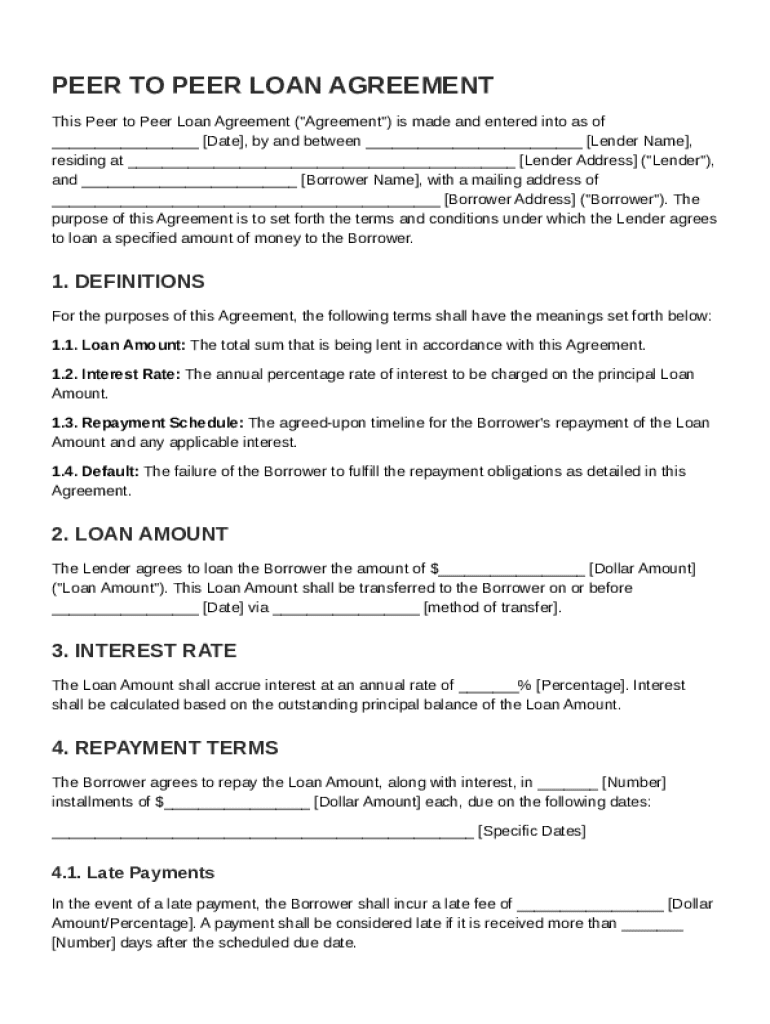

This document outlines the terms and conditions under which a specified amount of money is loaned from a lender to a borrower, including definitions, loan amount, interest rate, repayment terms, default

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Peer to Peer Loan Agreement Template

A Peer to Peer Loan Agreement Template is a legal document outlining the terms and conditions of a loan between individual lenders and borrowers without the involvement of traditional financial institutions.

pdfFiller scores top ratings on review platforms

made a very complicated job so much simple

It's a great product, when i can figure out how to use it. But that could be my issue.

Excellent program, I have been able to accomplish all that I need with every document I have ever handled.

Easy to use. Questions answered promptly.

It has mad my job easier finding form that I need

I love the convenience of sending a fax from anywhere I have a wifi connection. The ease of filling PDF documents is great compared with other programs.

Who needs Peer to Peer Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide on Peer to Peer Loan Agreement Template

Peer to Peer Loan Agreement Template is crucial for ensuring a clear understanding and formalization of loan terms between individuals. This guide will help you navigate the intricacies of P2P loans, highlight essential components, and provide insights on filling out a loan agreement effectively.

-

Grasp the fundamentals of peer to peer lending compared to traditional methods.

-

Learn about critical terms like loan amount and repayment schedule.

-

Step-by-step guide on completing the Peer to Peer Loan Agreement Template.

What are peer to peer loans?

Peer to peer lending allows individuals to borrow and lend money directly without going through a traditional financial institution. Unlike banks, which typically facilitate loans between borrowers and lenders, peer to peer platforms connect investors with individuals seeking funds. This often results in competitive interest rates and a more personalized lending experience.

-

P2P lending is a method of borrowing and lending money without an intermediary.

-

Traditional loans involve banks or credit unions that assess creditworthiness and typically charge higher fees.

-

P2P lending can offer lower interest rates and more flexible repayment options.

What are the key components of a peer to peer loan agreement?

Understanding the key components of a Peer to Peer Loan Agreement is essential for both lenders and borrowers. Each element contributes to the clarity of the agreement, ensuring that both parties are aligned on expectations and obligations.

-

Includes loan amount, interest rate, and repayment schedule to avoid confusion.

-

Clearly defining these terms can protect both parties in adverse situations.

-

Adjust template fields according to the specific needs of your agreement.

How to fill out the peer to peer loan agreement template?

Filling out the Peer to Peer Loan Agreement Template can be straightforward if you follow a systematic approach. Below are detailed steps to ensure accuracy and completeness.

-

Include the lender's full name, address, and contact details.

-

Fill in the borrower's information, specifying the lent amount and repayment dates.

-

Utilize pdfFiller to modify sections of the template easily, ensuring all information is clear and correct.

How to understand the loan amount and interest rate?

The loan amount and interest rate are critical aspects in any Peer to Peer Loan Agreement Template, as they directly affect the financial burden of the borrower and the compensation for the lender. Documenting these elements accurately ensures legality and transparency.

-

Specify the total money being lent and how it will be disbursed.

-

Clearly outline the interest rate, its basis, and how it's calculated over the loan duration.

-

Discuss average interest rates within the P2P lending landscape.

What is a repayment schedule?

Establishing a repayment schedule is essential to keep the lending process organized and predictable. A well-defined schedule benefits both borrower and lender by outlining when payments are due and what they entail.

-

Design a timeline for repayments that is manageable for the borrower but aligns with lender expectations.

-

Outline any fees or penalties associated with late payments to prevent misunderstandings.

-

Leverage pdfFiller's functionality to set reminders for both parties about upcoming payments.

How to handle defaults and prepayments?

Defaults and prepayments are crucial concepts in a Peer to Peer Loan Agreement Template. Understanding their implications can minimize risk for both borrowers and lenders.

-

Clearly define situations that will lead to a default, ensuring both parties are aware.

-

Discuss the fallout from a default for both borrower and lender, including collections actions.

-

Establish rules for early payments and any penalties or benefits involved.

How to finalize and manage your agreement?

Finalizing the Peer to Peer Loan Agreement Template involves ensuring all information is correct, legally binding, and securely stored. Effective management of the agreement is key to maintaining compliance and smooth operations.

-

Use pdfFiller for safe eSigning and to store your document securely in the cloud.

-

Allow both parties to review, suggest changes, and finalize the document efficiently.

-

Keep copies of the agreement easily accessible and organized for future reference.

What compliance considerations exist for peer to peer loans?

Compliance is a significant factor in peer to peer lending, especially regarding legal requirements that vary by region. Understanding these implications helps to mitigate potential risks.

-

Research and understand local lending laws and regulations they must adhere to.

-

Implement measures that ensure legal compliance and document integrity in all transactions.

-

Utilize pdfFiller to maintain the legality and integrity of your documents.

How to fill out the Peer to Peer Loan Agreement Template

-

1.Download the Peer to Peer Loan Agreement Template from pdfFiller.

-

2.Open the file in pdfFiller and review the pre-filled sections.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Input the full names and addresses of both the lender and borrower in the designated fields.

-

5.Specify the loan amount and interest rate clearly in the sections provided.

-

6.Fill in the repayment schedule, including the start date, duration, and payment intervals.

-

7.Include any additional terms such as collateral or late payment penalties if applicable.

-

8.Review all entered information for accuracy and completeness before finalizing the document.

-

9.Once confirmed, save the document and download it for both parties to sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.