Personal Debt Agreement Template free printable template

Show details

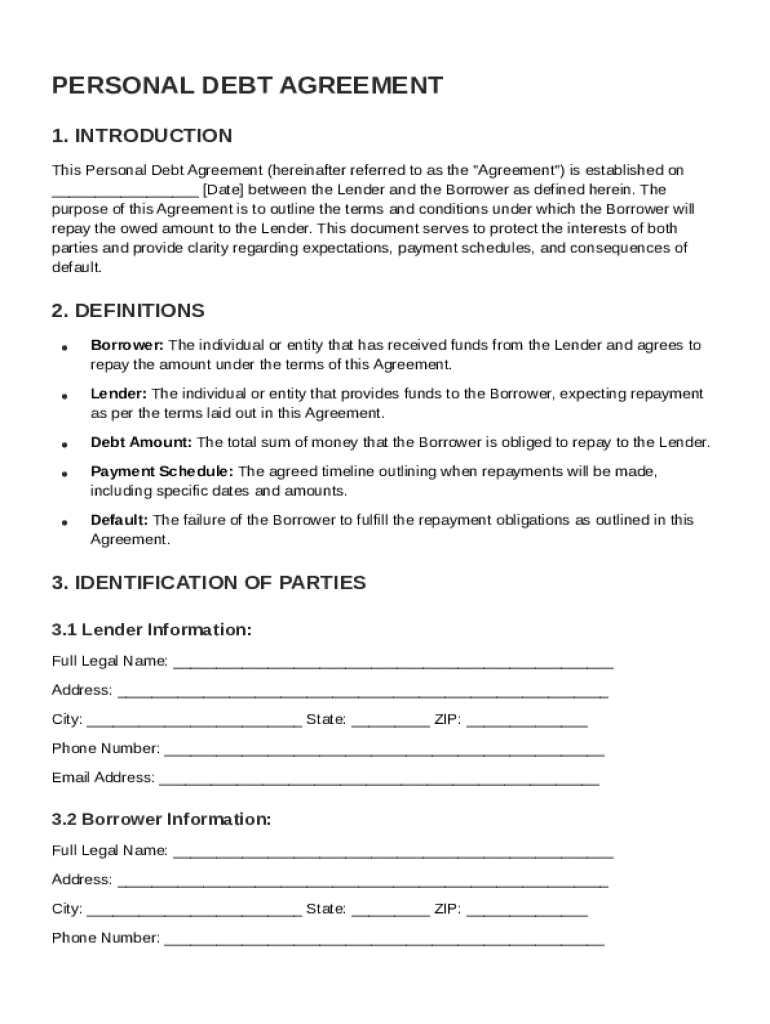

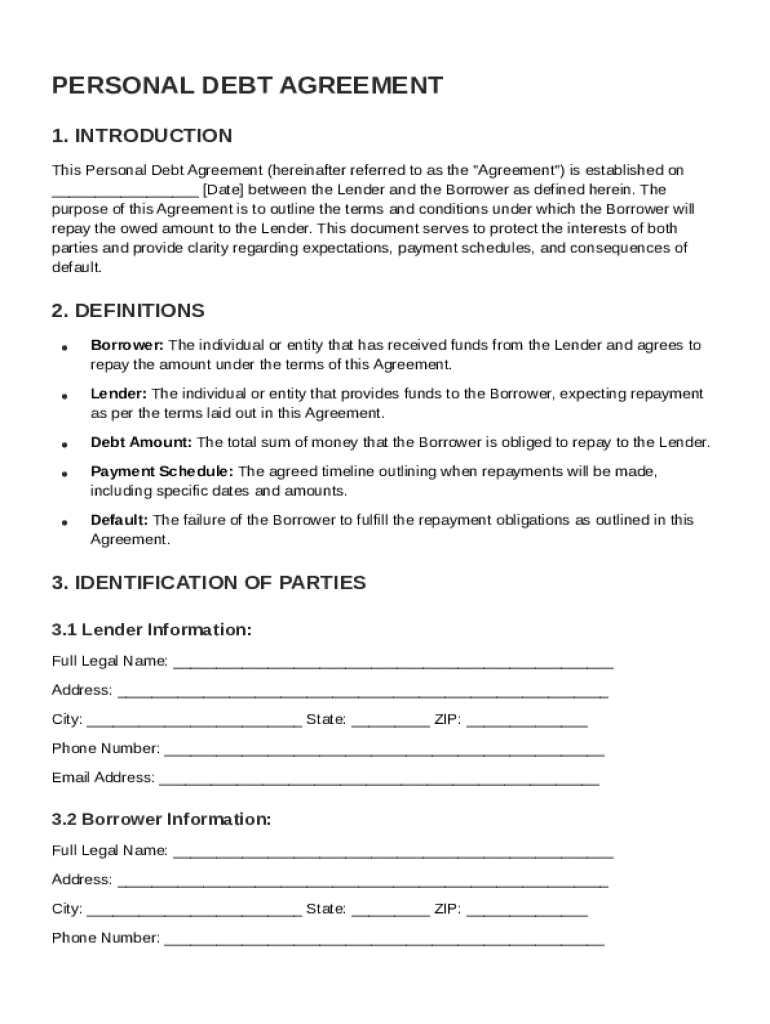

This document outlines the terms and conditions under which the Borrower will repay the owed amount to the Lender, ensuring clarity regarding expectations, payment schedules, and consequences of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Debt Agreement Template

A Personal Debt Agreement Template is a formal document used to outline an arrangement between a debtor and a creditor regarding the repayment of personal debt.

pdfFiller scores top ratings on review platforms

Excellent Services

sastisfactory

I think I will stay on after my trial period is over

Great

Options provided to apply e-signature

Quite user-friendly

Who needs Personal Debt Agreement Template?

Explore how professionals across industries use pdfFiller.

Personal Debt Agreement Template Guide

How to fill out a Personal Debt Agreement Template form

Filling out a Personal Debt Agreement Template form involves several key steps: understanding the content required, accurately entering information, and ensuring legal compliance. Follow our comprehensive guide to complete your form correctly, ensuring all necessary elements are covered for both parties involved.

What are Personal Debt Agreements?

A Personal Debt Agreement is a formal arrangement between a borrower and a lender to outline the terms of a debt. This agreement helps clarify each party’s obligations, reducing the potential for disputes. Both lenders and borrowers benefit from these agreements as they provide legal documentation that helps manage expectations.

-

Clarifies the exact financial relationship and obligations between the parties.

-

Protects lenders’ investments while providing borrowers a structured repayment plan.

-

Often necessary for personal loans, home purchases, and settling financial disputes.

What are the key elements of a Personal Debt Agreement?

Understanding the component parts of a Personal Debt Agreement is crucial for both parties. Each section serves a specific purpose that ensures clarity and legal standing.

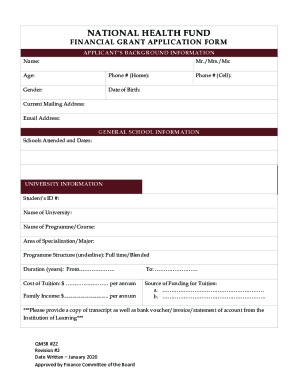

Identification of Parties

-

Full legal name, address, and contact details ensure the lender can be readily contacted.

-

Similarly, the borrower must provide their complete legal identity to avoid future disputes.

What details should be included about the debt?

-

A clear statement of the total debt that is being agreed upon.

-

Sometimes necessary to clarify the issue surrounding the loan, especially in personal loan situations.

What are the terms of repayment?

-

Clearly defines how much the borrower owes in total.

-

Specifies any interest accruing on the borrowed amount and how that affects total repayment.

-

Outlines when payments are due and how much each payment will be, enhancing transparency.

How to fill out your Personal Debt Agreement Template?

Completing the Personal Debt Agreement Template should be done carefully to ensure accuracy and compliance.

-

Follow each prescribed section methodically to avoid leaving out critical information.

-

Double-check all information entered and clarify any ambiguities before submission.

-

Avoid vague terms and unverified data to prevent future complications.

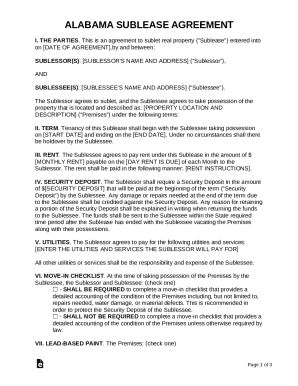

What are the legal considerations?

Signatures play a crucial role in validating the Personal Debt Agreement. They signify that both parties agree to the terms laid out in the document.

-

Without signatures, the agreement could be deemed invalid in a court of law.

-

PdfFiller offers eSignature functionalities that simplify the process of signing documents securely.

-

Ensure you understand any region-specific regulations concerning debt agreements.

How to manage your Personal Debt Agreement?

Managing your Personal Debt Agreement effectively can help streamline repayments and maintain good relationships between lenders and borrowers.

-

Utilize financial tools to keep up with scheduled payments and adjustments.

-

Use pdfFiller's features to modify your Personal Debt Agreement when necessary.

-

Consider involving a financial advisor for complex agreements to ensure all bases are covered.

Why are Personal Debt Agreements important?

Personal Debt Agreements are crucial in establishing clear expectations between lenders and borrowers. They serve as legal documentation that protects both parties and facilitates smoother financial transactions.

-

They provide a structured framework that prevents misunderstandings and disputes.

-

Leveraging pdfFiller's tools can enhance document management for Personal Debt Agreements, making the process more efficient.

How to fill out the Personal Debt Agreement Template

-

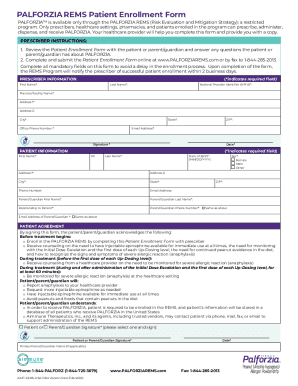

1.Open the Personal Debt Agreement Template on pdfFiller.

-

2.Begin by entering your personal information, including your full name, contact details, and address.

-

3.Next, provide details about the creditor, including their name and contact information.

-

4.Specify the total amount of debt you owe in the designated field.

-

5.Outline your proposed repayment plan, including payment amounts and frequency.

-

6.Include a section for any additional terms or conditions that either party wishes to include.

-

7.Review the entire document for accuracy and completeness.

-

8.Save your changes and download the completed template.

-

9.Consider having the document reviewed by a legal professional before signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.