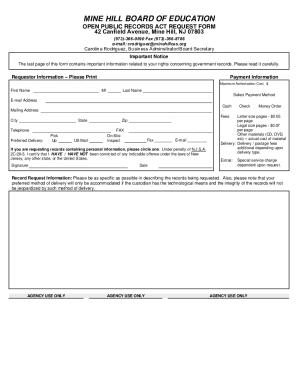

Personal Finance Agreement Template free printable template

Show details

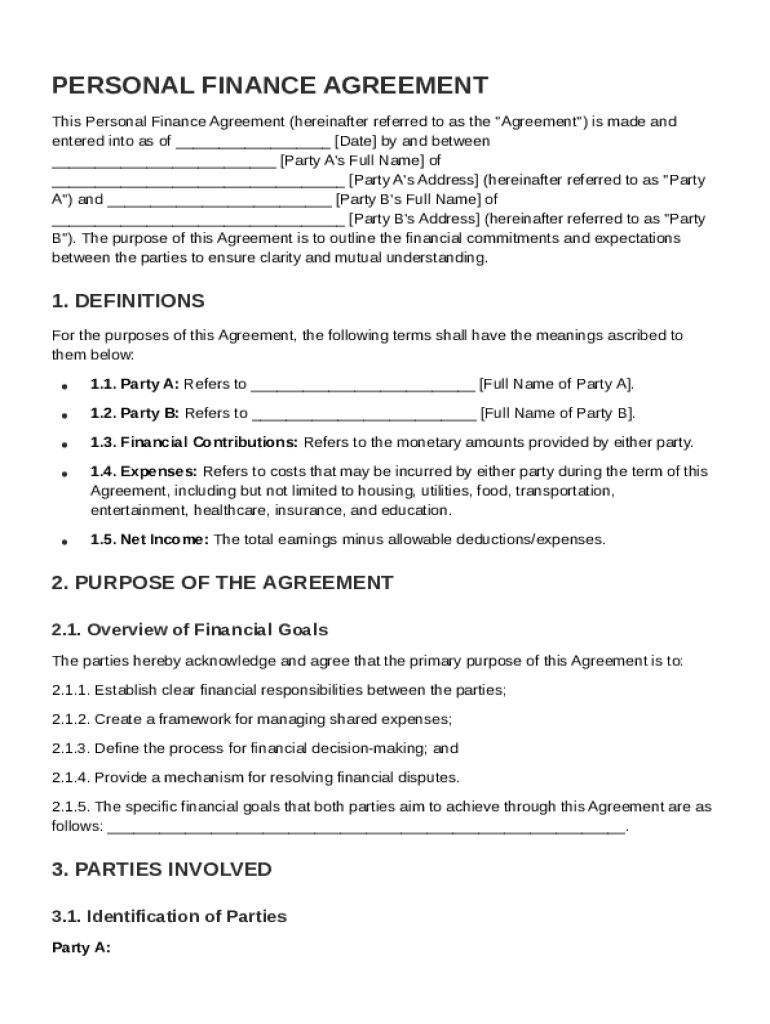

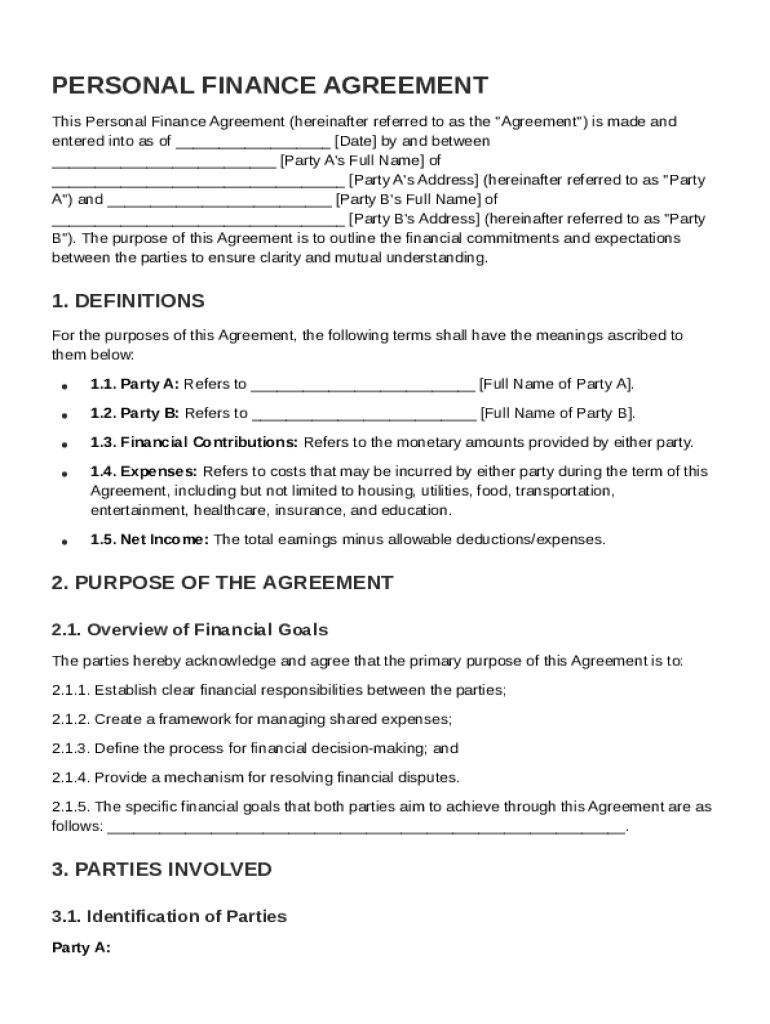

This document outlines the financial commitments and expectations between the parties (Party A and Party B) to ensure clarity and mutual understanding regarding shared expenses, financial contributions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Finance Agreement Template

A Personal Finance Agreement Template is a legal document outlining the financial terms and conditions agreed upon by parties in a financial transaction or arrangement.

pdfFiller scores top ratings on review platforms

It is good to way to send fax.

i love the customer experience

i love the customer experience, pretty fast respond, and helpful. I would like to give you 5 stars just because how fast your cs!

Awesome experience with pdffiller

My experience with pdffiller was great. After trying the app, I realised that I didn't need it. As I didn't cancel the subscription, I was charged when trial period was over. However, I sent a message to support and they were very efficient, professional, nice and helpful (Thank you, Roxie).In less than one hour I had my money back.It was one of my best experiences in these kind of situation.Thank you and congratulations to Roxie and all the team of pdffiller.You are awesome!!

Vey helpful app

I was surprised by how well this…

I was surprised by how well this program worked!!

So far it's good.

pdffiller guides you through filling tax forms and filing with IRS. Very easy.

Who needs Personal Finance Agreement Template?

Explore how professionals across industries use pdfFiller.

Personal Finance Agreement Template Guide

What is a personal finance agreement?

A Personal Finance Agreement is a legally binding document that outlines the financial commitments between parties, typically in relationships such as partners or family members. It is crucial for setting clear understanding of each party's roles and contributions, thereby minimizing potential conflicts.

These agreements often encompass aspects such as financial contributions, expenses, and revenue sharing. Utilizing a template from pdfFiller can streamline the creation process, ensuring all necessary components are addressed.

What are the key components of an effective agreement?

-

Clearly define the purposes and definitions used within the agreement to avoid misinterpretation.

-

Specify who is responsible for specific financial duties and contributions to ensure accountability.

-

Include a clause that outlines steps to take if disagreements arise, providing a clear mechanism for resolution.

How should parties identify themselves in the agreement?

Party A and Party B must be clearly identified. It's essential to include their full names, addresses, and identifying information such as Social Security Numbers or Tax ID, especially if financial transactions are based on these entities.

How do financial contributions work?

-

Financial contributions should be explicitly defined, detailing the amount each party is expected to contribute.

-

Outline whether contributions will be in cash, assets, or services, providing clarity on the nature of commitments.

What expenses should be included in the agreement?

-

Include shared household costs such as rent or mortgage, utilities, and maintenance.

-

Define how variable expenses, such as groceries and entertainment, will be managed and documented.

How to establish financial goals and responsibilities?

Begin by detailing specific financial objectives such as savings goals, investment plans, or debt repayment strategies. By defining responsibilities, each party can understand their roles in achieving these goals, ensuring commitment and accountability.

What processes should be in place for dispute resolution?

-

Outline the steps to take when a dispute arises, ensuring both parties understand the process.

-

Consider including a provision for mediation or arbitration to resolve disputes amicably without resorting to litigation.

What steps are involved in filling out the personal finance agreement template?

-

Start with entering basic details like names, dates, and contact information to personalize the document.

-

Clearly outline each party's financial contributions to maintain transparency.

-

Detail the shared expenses and management strategies to prevent confusion later.

-

Finalize the agreement by using pdfFiller to eSign, ensuring the document is secured.

How to manage your agreement with pdfFiller?

-

Use pdfFiller's interactive tools to make necessary adjustments to your document.

-

Invite multiple parties for collaboration on the document, ensuring a more comprehensive approach.

-

Access and manage your agreement from anywhere with pdfFiller’s cloud capabilities.

What related forms and templates should consider?

-

Explore the loan agreement template to discern which format works best for your situation.

-

Understand the benefits of using a Personal Finance Agreement compared to other options.

-

Check out other documents available on pdfFiller that assist in financial management.

How to fill out the Personal Finance Agreement Template

-

1.Download the Personal Finance Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editing interface.

-

3.Fill in the names and addresses of all parties involved at the top of the document.

-

4.Specify the financial terms, including the amount of money involved and the repayment schedule.

-

5.Detail any interest rates applicable to the agreement, if relevant.

-

6.Describe the purpose of the agreement clearly and concisely.

-

7.Include any conditions or contingencies that must be met for the agreement to remain valid.

-

8.Have all parties sign and date the document at the designated signature lines.

-

9.Save the completed document and share it with all parties for their records.

How do I write a simple personal loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What is an example of a financing agreement?

A loan is an example of a type of financing agreement. Financing agreements are often used by businesses that need capital for expansion or new equipment but don't have enough cash on hand or can't get traditional loans from banks because they are not credit-worthy.

Can I make a contract for a personal loan?

If you borrow or lend money to someone, consider writing a personal loan agreement to protect everyone involved. Even if you're exchanging money between family and friends, a personal loan agreement ensures everyone knows what the expectations of paying back the loan are upfront.

How to write an agreement to pay back money?

Key elements of a repayment agreement Parties involved. Clearly define the lender and borrower, including their contact information. Loan amount and interest. Specify the principal amount and any interest to be charged. Repayment schedule. Late fees: Outline any penalties for late payments. Default terms. Governing law.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.