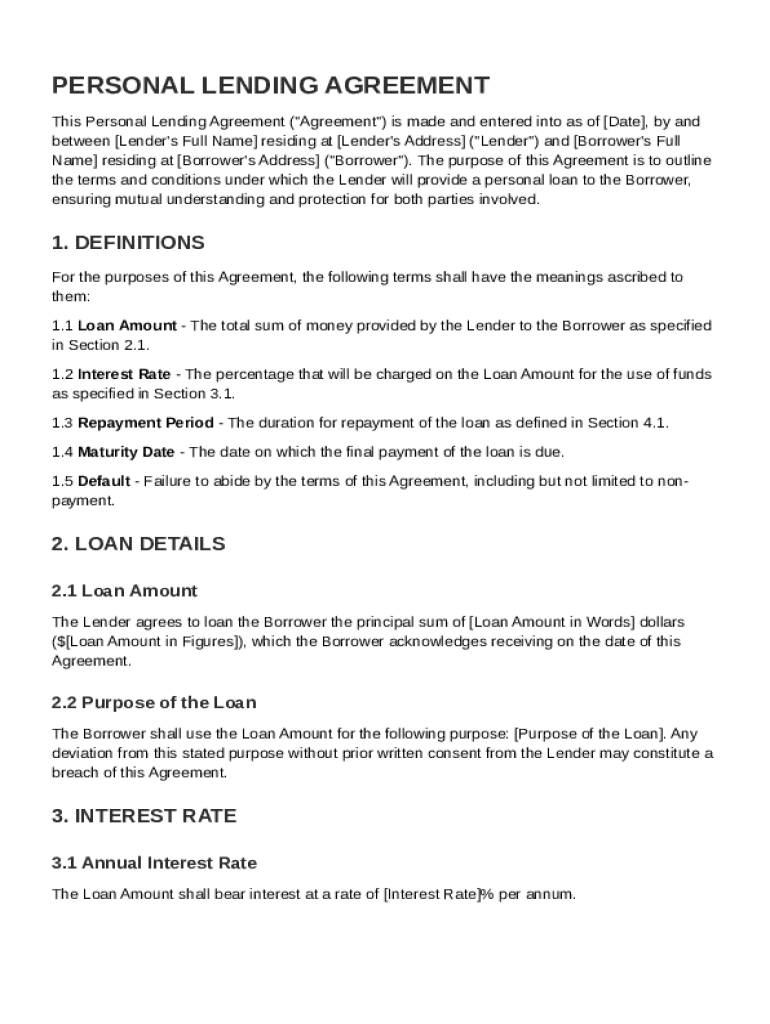

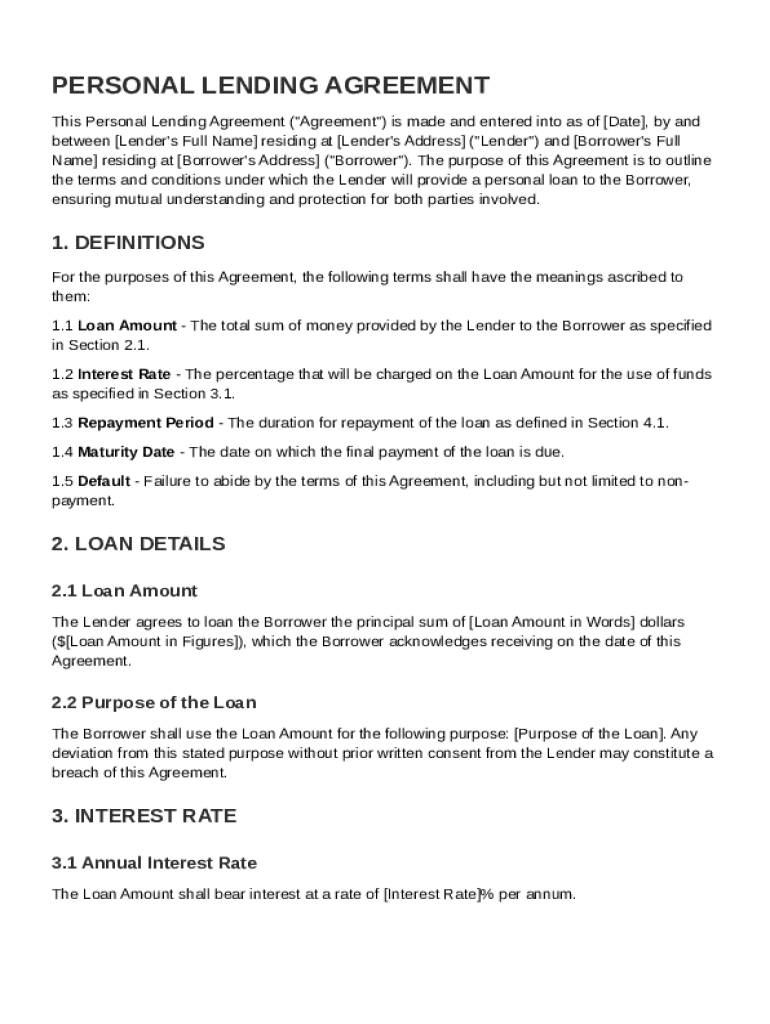

Personal Lending Agreement Template free printable template

Show details

This Agreement outlines the terms under which a personal loan is provided by the Lender to the Borrower, including details about the loan amount, interest, repayment terms, and remedies in case of

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Lending Agreement Template

A Personal Lending Agreement Template is a legal document that outlines the terms and conditions under which one party lends money to another.

pdfFiller scores top ratings on review platforms

1

I came across your website quite by accident. It has completely made my life simpler. I am extremely happy with my find

Very easy and fast. I like it.

PERFECT

N/A

It's perfect for editing paperwork

Who needs Personal Lending Agreement Template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Personal Lending Agreement Template

How does a personal lending agreement work?

A Personal Lending Agreement is a document used to formalize a loan between individuals, defining the terms and conditions under which the loan is given. This agreement protects both the lender and borrower by clearly outlining responsibilities, thereby helping to avoid misunderstandings. It is particularly important in personal loans, as these transactions often lack the legal frameworks observed in more formal lending institutions.

Understanding personal lending agreements

Understanding the fundamental aspects of a Personal Lending Agreement is crucial for both parties involved. This document serves to clarify expectations and legal obligations, enhancing transparency in financial interactions.

-

A Personal Lending Agreement is crucial as it provides a legal framework and clarity for both parties involved, preventing potential disputes.

-

The main parties are the Lender, who provides the money, and the Borrower, who agrees to repay it under specified terms.

-

These agreements carry significant legal implications; failing to comply can lead to legal action or financial penalties.

What are the essential components of the agreement?

A well-structured Personal Lending Agreement should include specific components to ensure that all terms are explicitly defined. This reduces the likelihood of misunderstandings between the lender and the borrower.

-

Both parties should provide full names and addresses to establish identity and jurisdiction.

-

This details how much is being lent and sets clear expectations for repayment.

-

Outlines whether the loan has a simple or compound interest rate and clarifies how this will be calculated.

-

Specifies how long the borrower has to repay the loan, which affects monthly payments.

-

This is the final date by which the loan must be fully repaid.

-

Details what happens if the borrower fails to make payments, mitigating risk for the lender.

How do you fill out the personal lending agreement?

Filling out a Personal Lending Agreement template requires careful attention to detail. A step-by-step approach ensures that all necessary information is provided accurately, reducing the risk of disputes later.

-

Start by gathering necessary personal details and the specifics of the loan to accurately fill out the agreement.

-

Detailed explanations of each section guide users to provide correct information.

-

Avoid skipping important sections or miswriting information, which could lead to legal complications.

-

Before finalizing the document, always review it for errors and ensure compliance with local laws.

How can you edit and customize your agreement?

Editing a Personal Lending Agreement can be daunting, but tools like pdfFiller make it much easier. Users can customize documents to address specific needs, ensuring accuracy and legal compliance.

-

Using pdfFiller, individuals can easily modify existing templates to fit their unique situations.

-

Consider the implications of changing terms in the agreement, ensuring that all parties remain protected.

-

Utilizing feedback tools allows for real-time collaboration and adjustments.

-

Keep track of all changes made to safeguard against disputes regarding document alterations.

Why is signing the personal lending agreement important?

Signing a Personal Lending Agreement not only formalizes the loan but also adds a layer of legal protection for both parties. Having signatures on record verifies that both parties have agreed to the contract.

-

Electronic signatures are legally binding and provide a convenient way to finalize agreements remotely.

-

Using pdfFiller, you can sign documents efficiently without the need for paper.

-

Ensure that both parties are present during signing, or utilize secure eSigning methods.

-

Maintain a copy of the signed agreement for future reference and as proof of the loan contract.

How to manage your personal lending agreement?

Managing a Personal Lending Agreement effectively involves tracking repayments and keeping clear records. This helps maintain accountability and can assist in mitigating defaults.

-

Regularly check payment dates to ensure timely returns and follow up with reminders when necessary.

-

If terms need to be changed due to unforeseen circumstances, document the modifications formally.

-

Use digital tools for maintaining detailed records of all transactions related to the loan.

-

In the case of defaults, engage openly with the other party to find a feasible resolution before escalating issues.

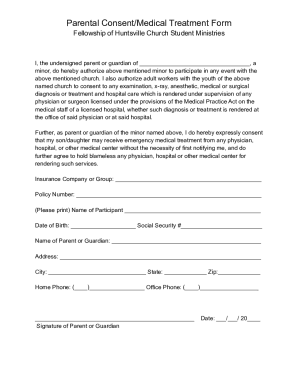

How to fill out the Personal Lending Agreement Template

-

1.Open the Personal Lending Agreement Template on pdfFiller.

-

2.Review the template to understand the sections included, such as loan amount, interest rate, repayment terms, and signatures.

-

3.Begin by filling in the names and contact information of both the lender and the borrower.

-

4.Specify the loan amount in a clear statement along with the currency.

-

5.Set the interest rate, if applicable, and make sure it complies with local laws regarding personal loans.

-

6.Outline the repayment schedule, including due dates and installment amounts or if it's a single payment due at the end.

-

7.Add any additional terms, such as prepayment options or penalties for late payment.

-

8.Review the entire document for accuracy and completeness before signing.

-

9.Save the filled document and share it with all parties involved for signature confirmation.

How do I write a simple personal loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Can I make a contract for a personal loan?

If you borrow or lend money to someone, consider writing a personal loan agreement to protect everyone involved. Even if you're exchanging money between family and friends, a personal loan agreement ensures everyone knows what the expectations of paying back the loan are upfront.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

How do I write a note for a personal loan?

A comprehensive promissory note typically includes: Names and contact information of the parties involved. Loan amount. Repayment terms. Interest rate (if applicable) Consequences of default (in case payments are missed) Governing law. Signatures of the borrower and lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.