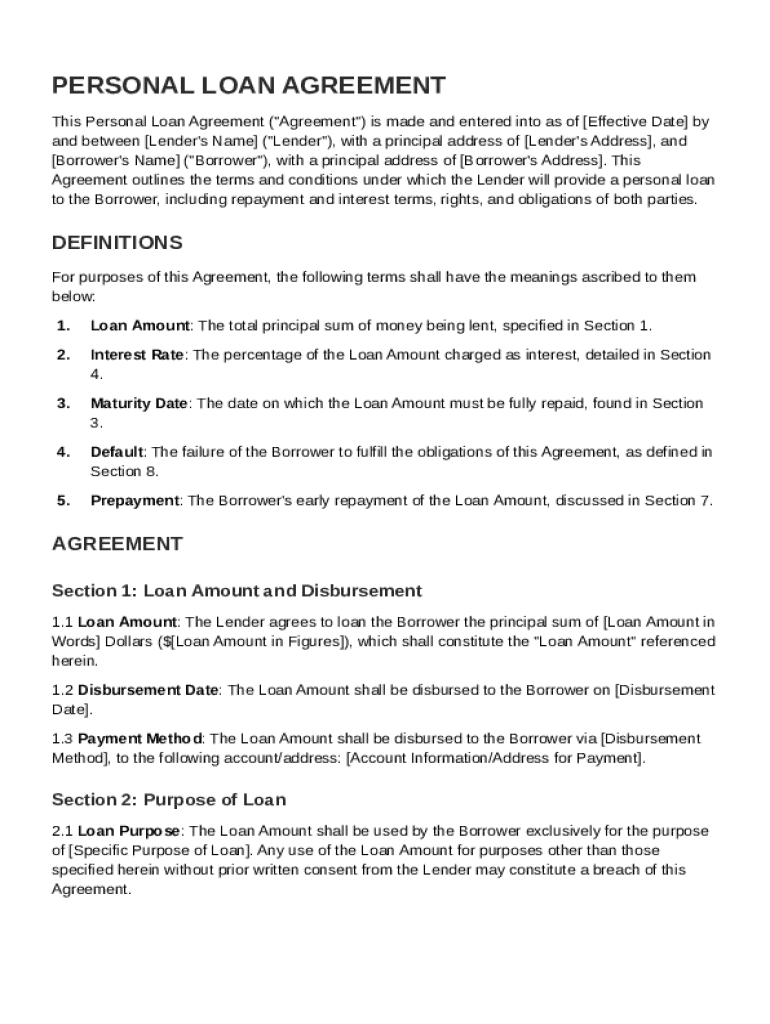

Personal Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a personal loan to a borrower, including repayment terms, interest rates, and obligations of both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Loan Agreement Template

A Personal Loan Agreement Template is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

It is phenomenal that you can upload the forms you need to fill them out as you see fit.

great product I can email it fax it keeps me fromm having to stop at truck stop to do it

this is the only application that I can fill in the Appraisal forms on my Mac Pro. the other softwares are just for Windows based programs. This does what the others do for less than half the cost.

Tons of aggravating forms out there that there's no simple way to complete. PDF filler has made my life better! Lots better!

I love PDFFiller, but I know I won't be using it often. I wish you guys have pay-per-use option instead of paying for a whole year. If not for this very important court doc I'm filling out, I won't even consider paying for a whole year.

I need to learn how to work around everything.

Who needs Personal Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Personal Loan Agreement Template on pdfFiller

If you want to create a Personal Loan Agreement Template form, using a structured format can save time and ensure clarity. This guide will walk you through the components, advantages of a template, navigational aids on pdfFiller, and more.

What is a personal loan agreement, and why is it important?

A Personal Loan Agreement is a legal document between a lender and a borrower that outlines the terms and conditions of a personal loan. Having this agreement in place is crucial as it protects the rights of both parties and provides a clear understanding of repayment terms.

What are the key components of a personal loan agreement?

-

Details about the lender including name and contact information.

-

The borrower's name and contact details must also be specified.

-

The specific sum of money being borrowed.

-

The rate charged for borrowing the money, usually expressed as a percentage.

-

Schedule of how and when repayments will be made.

What are the benefits of using a template for personal loan agreements?

Using a template simplifies the process of creating a personal loan agreement. It ensures all necessary components are included and minimizes the risk of overlooking crucial details, ultimately leading to fewer disputes down the line.

How can you navigate the Personal Loan Agreement Template on pdfFiller?

pdfFiller offers a user-friendly interface that allows for efficient editing of documents. The navigation is straightforward, allowing users to quickly access the Personal Loan Agreement Template and customize it to their needs.

What interactive tools are available for template customization?

-

Users can click on text fields to edit or input details specific to their agreement.

-

The option to add logos or other images adds a professional touch to the document.

-

Interactive highlight options help users identify which areas need completion.

How do you fill out essential sections of the personal loan agreement?

-

Ensure all relevant information including full names and contact details are correctly filled out.

-

Clearly mention the loan amount, as disputes often arise from misunderstandings in this area.

-

Clearly specify the interest rate and understand how it will affect repayments over time.

-

This date signifies when the loan must be repaid in full; pick a realistic timeframe.

-

Define conditions under which late payments may occur and whether early repayment penalties are applicable.

-

Clearly state the intended use of the loan, which can help in securing approval in some cases.

Why is it important to review and finalize the loan agreement?

Reviewing and finalizing a personal loan agreement is crucial to ensure clarity and mutual understanding. An oversight can lead to potential conflicts in the future.

What should be included in a comprehensive checklist for reviewing the agreement?

-

Double-check that no errors exist in personal information.

-

Ensure that the loan amount and repayment terms are correctly recorded.

-

Re-examine the interest calculation to prevent losses from miscalculations.

What collaborative options are available for signing?

pdfFiller allows for e-signature integration, enabling all parties to sign the document electronically. This feature streamlines the process of getting necessary approvals.

What common mistakes should be avoided when using a loan agreement template?

-

Inadequate details can lead to conflicts in understanding obligations and rights.

-

Always keep a copy of signed agreements for reference in future disputes.

-

Misunderstanding terms can have legal repercussions, so get clarification on anything ambiguous.

What updates and best practices should be followed for personal loan agreements?

Staying informed about legal changes regarding loan agreements ensures continuous compliance. Regularly review the terms of existing agreements to capture necessary updates.

How to ensure templates remain compliant and efficient?

-

Allocate time to review the templates against the latest regulations and modify as necessary.

-

Educate all parties involved about any changes in the agreements to avoid missteps.

In conclusion, a Personal Loan Agreement Template form is essential in protecting the interests of both lenders and borrowers. Utilizing tools like pdfFiller further simplifies the process of creating and managing such agreements efficiently.

How to fill out the Personal Loan Agreement Template

-

1.Download the Personal Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling in the date at the top of the document.

-

4.Enter the full name and address of the lender in the designated section.

-

5.Next, input the borrower's full name and address accurately.

-

6.Specify the loan amount being borrowed and ensure it is clearly stated.

-

7.Outline the interest rate and repayment terms in the relevant fields.

-

8.Include the loan duration and the dates for repayment installments.

-

9.If applicable, detail any additional fees or penalties for late payment.

-

10.Review all the filled information for accuracy before signing.

-

11.Save the completed document, and either print or share electronically as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.