Personal Loan Between Family Agreement Template free printable template

Show details

This document establishes the terms and conditions regarding the loan of money between family members, detailing the expectations and obligations of both the lender and borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Loan Between Family Agreement Template

A Personal Loan Between Family Agreement Template is a formal document outlining the terms and conditions of a loan given between family members.

pdfFiller scores top ratings on review platforms

I THINK I FINALLY THE FORM OUT BUT STILL HAVE TO SEND IT THE FILES TO THE IRS.

Sam resolved my issue right away. Sam was prompt with the response ms in the chat

Straightforward, easy to use. Pleasantly surprised by fast and polite customer support.

Sam resolved my issue right away. Sam was prompt with the response ms in the chat

Straightforward, easy to use. Pleasantly surprised by fast and polite customer support.

Your company is great

Your company is great. At this time, the govt is advising us to show them payroll and W2. W. On this note I will conceal my free trial. Sincerely. Elizabeth Obi

Who needs Personal Loan Between Family Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Personal Loan Between Family Agreement Template on pdfFiller

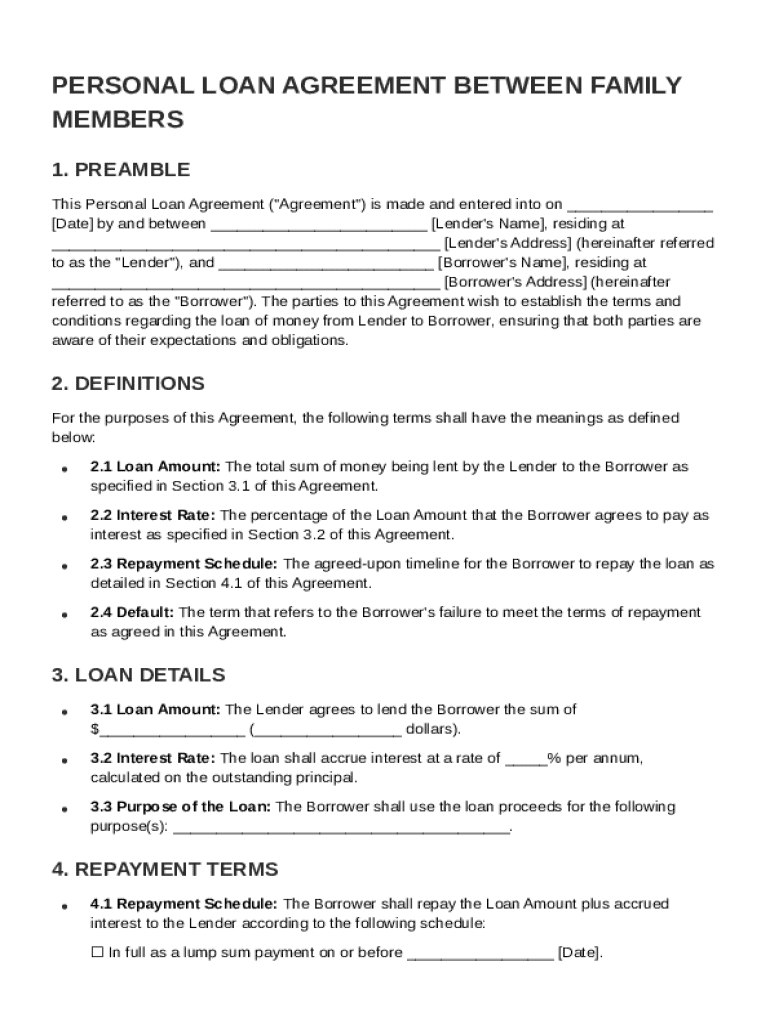

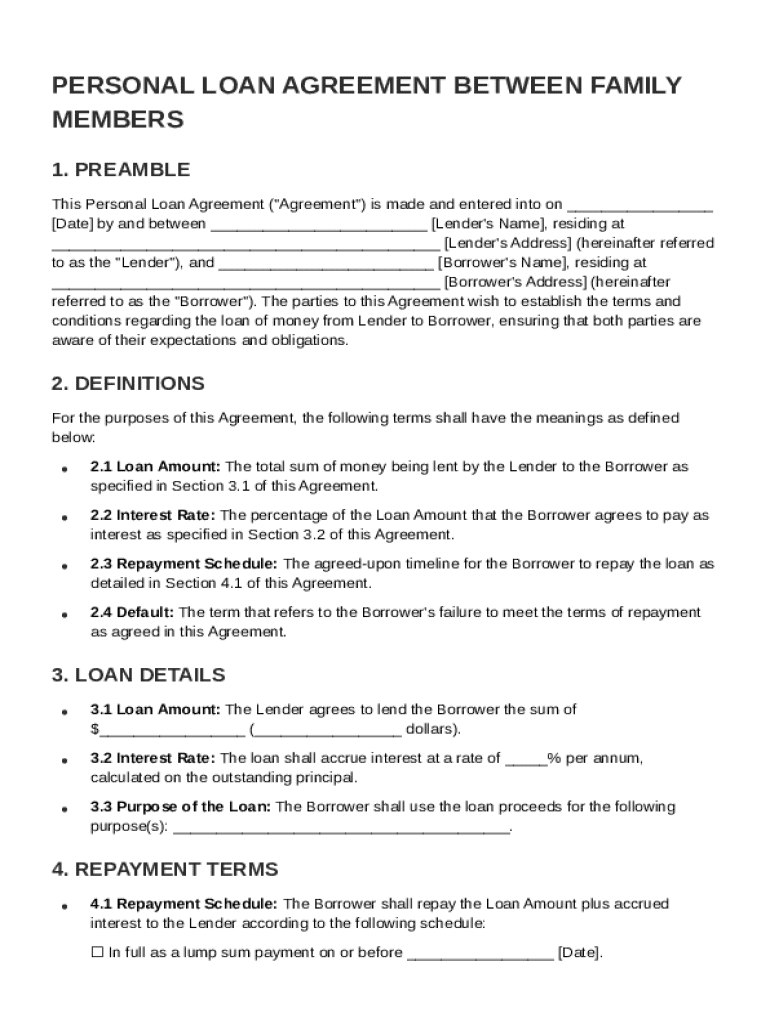

How do you define a Personal Loan Agreement?

A personal loan agreement between family members is a legal document that outlines the terms of borrowing money within a family. This agreement serves to clarify the expectations of both the lender and the borrower and can help to prevent conflicts. Unlike traditional bank loans, family loans are often more flexible and may carry little to no interest.

-

Specifies the financial arrangement between family members.

-

Familial loans often have fewer requirements and can strengthen relationships.

-

Proper documentation helps prevent misunderstandings and enforces accountability.

What are the key components of a Family Loan Agreement?

A comprehensive family loan agreement should include essential components such as the names and addresses of both the lender and borrower. Critical terms like the loan amount, interest rate, repayment schedule, and procedures in case of default should also be clearly defined to protect all parties involved.

-

Names and addresses of the lender and borrower set the stage.

-

Clearly defined terms ensure everyone understands the agreement.

-

Specifying the loan’s purpose informs its terms and conditions.

How do you create a Family Loan Agreement?

Creating a family loan agreement involves detailed steps to ensure clarity and legality. Start by determining the loan amount and interest rate. Next, outline the purpose of the loan and establish clear repayment terms, including payment methods and due dates. Finally, ensure both parties sign the document, utilizing pdfFiller for an efficient eSignature process.

-

Discuss and agree on a fair loan amount and interest rate.

-

Be specific about how the funds will be utilized.

-

Include specific payment dates and methods.

-

Ensure signatures from both parties using pdfFiller's electronic signature functionality.

Can you provide a Sample Personal Loan Agreement?

It's beneficial to start with a sample format for personal loan agreements, which indicate the standard structure and necessary elements. Always tailor this template to suit your specific needs, ensuring it reflects the agreement between the lender and borrower accurately. pdfFiller offers great editing features that allow users to customize templates easily.

-

A structured outline that assists in drafting your agreement.

-

Modification to meet unique personal circumstances enhances relevance.

-

Utilize pdfFiller tools to customize your agreement.

Why use a Family Loan Agreement?

Using a family loan agreement presents several advantages, such as flexibility in terms compared to traditional financial institutions. Lower interest rates can ease the financial burden, and the process can foster trust and strengthen familial relationships, providing both emotional and financial support.

-

Terms can be adjusted as needed to fit both parties.

-

Savings on interest rates compared to banks can be significant.

-

Supporting each other financially can deepen family connections.

How do you navigate potential issues and defaults?

When engaging in family loans, it’s crucial to be aware of common pitfalls, such as lack of clear communication, which can lead to misunderstandings and conflict. In the event of default, discussing options for resolution amicably without resorting to legal measures is advisable.

-

Identify and address potential miscommunication before it escalates.

-

Discuss contingency plans openly with all involved.

-

Explore informal mediation options before pursuing legal action.

How can pdfFiller help manage your loan agreements?

pdfFiller streamlines the process of filling out, editing, and eSigning family loan agreements, making management efficient. The cloud-based platform allows for easy access and collaborative editing, ensuring all documentation is current and compliant.

-

Quick document fill-in, editing, and signing processes available.

-

Access documents anytime from anywhere eases collaboration.

-

Features for ensuring your loan agreements meet necessary regulations.

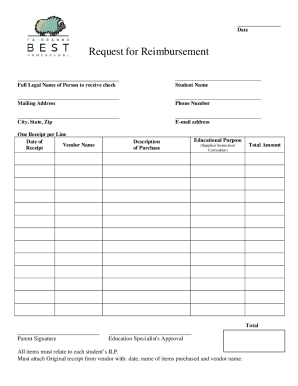

How to fill out the Personal Loan Between Family Agreement Template

-

1.Download the Personal Loan Between Family Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the names and contact information of both the lender and borrower in the designated fields.

-

4.Specify the loan amount clearly in the appropriate section of the document.

-

5.Include the interest rate, if applicable, and ensure it complies with local regulations.

-

6.Fill out the repayment schedule, detailing the amount of each installment and the due dates.

-

7.Add any collateral terms, if relevant, to guarantee the loan.

-

8.Review all the provided information for accuracy and completeness.

-

9.Sign the document electronically using pdfFiller's e-signature feature.

-

10.Save or print the agreement for both parties to keep a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.