Personal Loan Family Loan Agreement Template free printable template

Show details

Este documento establece los trminos y condiciones para un acuerdo de prstamo personal entre un prestamista y un prestatario en el contexto familiar.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

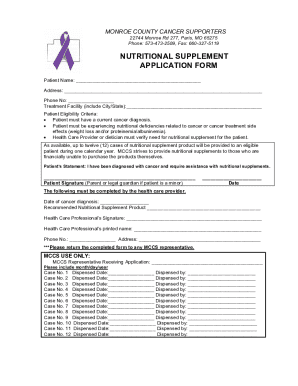

What is Personal Loan Family Loan Agreement Template

A Personal Loan Family Loan Agreement Template is a formal document outlining the terms of a loan made between family members.

pdfFiller scores top ratings on review platforms

It's a great idea man!

Very easy to use

Very easy to use, gets the job done!

All's good. Figuring it out as I go. Thank you.

Great

Still learning

good

Who needs Personal Loan Family Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Personal Loan Family Loan Agreement Guide

This guide explains how to create a Personal Loan Family Loan Agreement Template, ensuring that both lenders and borrowers understand the terms and implications of their arrangement.

What is a Personal Loan Family Loan Agreement?

A Family Loan Agreement is a written contract between family members that sets out the terms under which one party (the lender) provides money to another (the borrower).

-

This is a formal agreement to lend money within a family, which may include specifications such as the loan amount, repayment terms, and interest rates.

-

Having a physical contract helps prevent misunderstandings and provides legal protection if disputes arise.

-

It ensures transparency between the parties involved and establishes legal backing for the transaction.

What are the Essential Components of a Family Loan Agreement?

-

Each agreement should begin with a clear introduction outlining the purpose of the loan and the parties involved.

-

These are crucial elements that should be defined early in the agreement to ensure all parties have a clear understanding of the terms.

-

Specifying the total loan amount and the manner in which the funds will be disbursed prevents ambiguity.

-

Clearly outline when payments are due, the method of payment, and any late fees associated with missed payments.

Why Should You Use a Family Loan Agreement?

-

Written agreements provide a clear outline of expectations, aiding in avoiding potential misunderstandings.

-

Having a formal agreement protects both parties’ interests, making them more likely to adhere to the terms.

-

Clear terms can minimize disputes, helping to maintain family harmony during the borrowing process.

How Can You Create Your Family Loan Agreement?

-

Before proceeding, evaluate the potential benefits and risks of lending money to family.

-

Select a reputable Family Loan Agreement Template form from sources like pdfFiller.

-

Complete all necessary sections with precise information including names, loan amounts, and terms.

-

Both parties should review the agreement thoroughly and make necessary adjustments before signing.

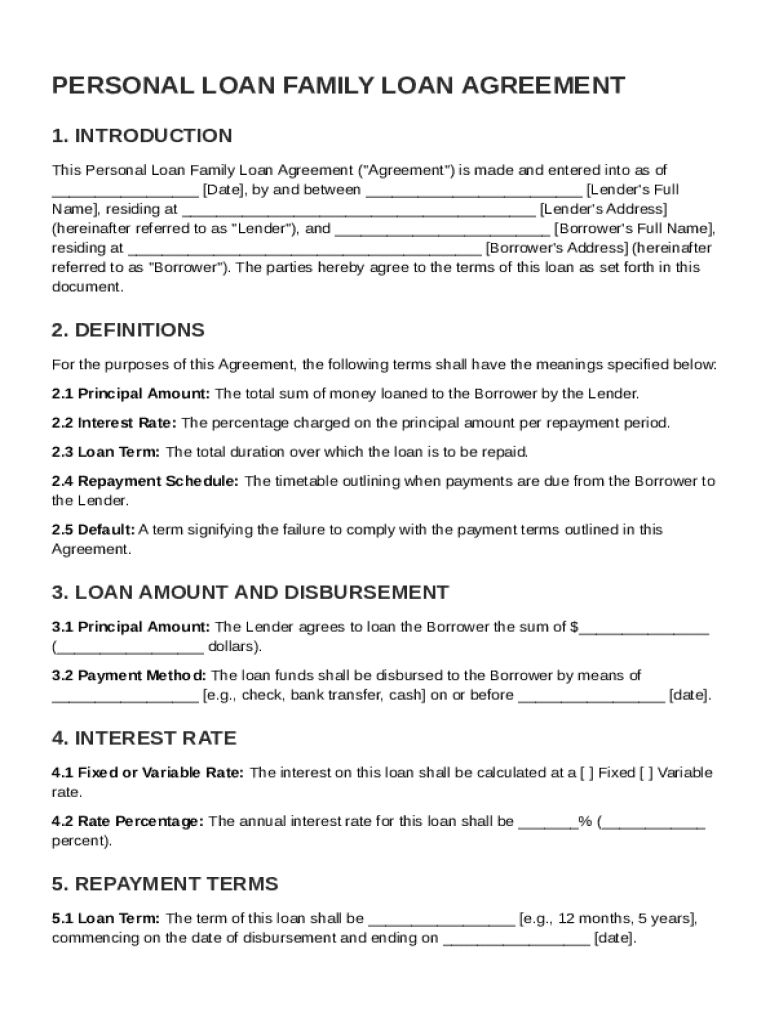

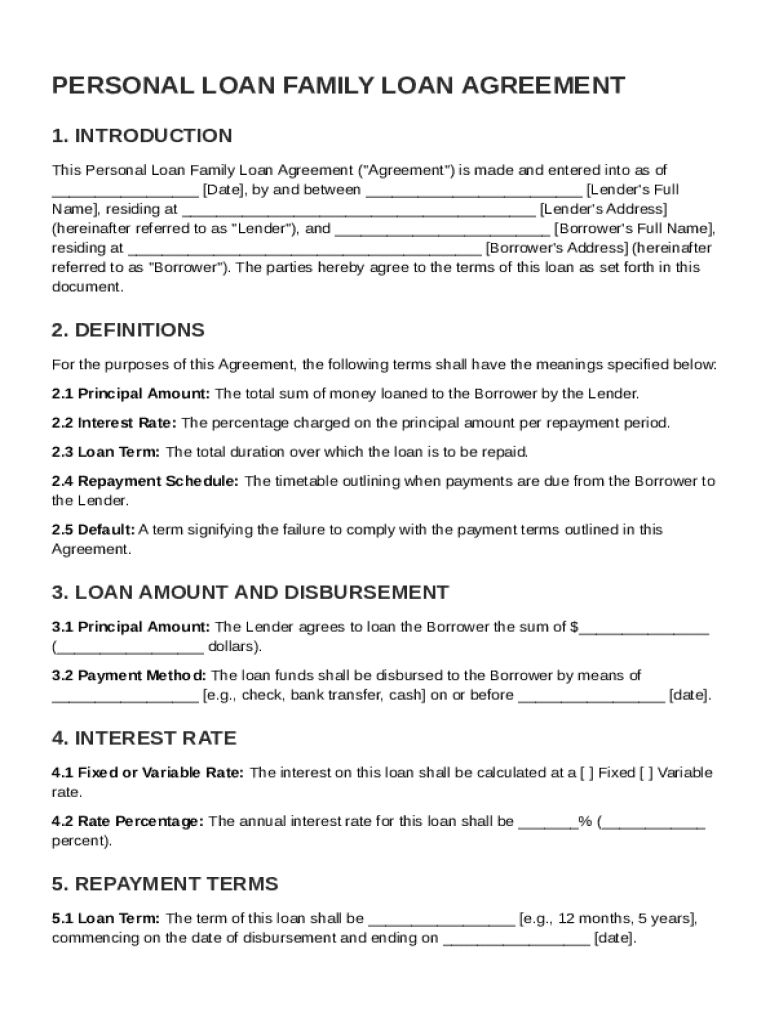

What Does a Sample Agreement Look Like?

A practical template can be invaluable when drafting your Family Loan Agreement.

-

Typically organized with sections for parties involved, terms of the loan, and signatures.

-

Include vital information such as loan amount, duration, payment schedule, and interest rates.

-

While templates provide a solid foundation, customizing them to suit your specific situation is crucial.

How Do Interest Rates and Repayment Schedules Work?

-

Understanding the difference is crucial; fixed rates remain the same while variable rates can fluctuate.

-

A well-structured repayment schedule is vital for both parties to manage expectations.

-

Defining consequences for failure to repay helps both parties understand the implications of defaulting.

What Are Early Repayment Policies?

-

Early repayment can save on interest payments and shorten the loan term.

-

Some agreements may impose fees for early payment, which should be explicitly stated.

-

Understanding how partial prepayments work can be beneficial for managing repayment plans.

How Can You Manage Your Family Loan Agreement with pdfFiller?

-

This platform allows users to easily create and modify loan agreements as needed.

-

With pdfFiller, you can collaboratively edit and electronically sign the agreement, streamlining the process.

-

You can safely store documents and track updates from anywhere, ensuring that your agreements are always accessible.

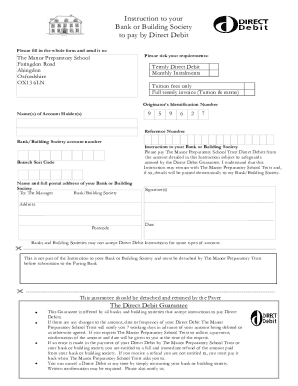

How to fill out the Personal Loan Family Loan Agreement Template

-

1.Step 1: Download the Personal Loan Family Loan Agreement Template from pdfFiller.

-

2.Step 2: Open the template in the pdfFiller editor.

-

3.Step 3: Fill in the names and contact information of both the lender and the borrower.

-

4.Step 4: Specify the loan amount to be lent.

-

5.Step 5: Clearly state the interest rate, if applicable, and the repayment schedule.

-

6.Step 6: Include terms for late payments or defaults to protect both parties.

-

7.Step 7: Review the entire document for accuracy and completeness.

-

8.Step 8: Sign the agreement digitally, and request the borrower to do the same.

-

9.Step 9: Save the completed agreement and ensure both parties have copies for their records.

How do I write a loan agreement between families?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

How do I write a simple personal loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to ask family for a personal loan?

Prepare Your Case : Before you ask, clearly outline why you need the loan, how much you need, and how you plan to repay it. Choose the Right Time : Find a moment when your parents are relaxed and open to conversation. Be Honest and Direct : Start the conversation by expressing your need for financial help.

What is the structure of a personal loan agreement?

A personal loan agreement outlines repayment terms between the lender and the borrower. Information included on personal loan agreements include the names of both parties, the date of the agreement, the principal loan amount, the interest rate, and repayment terms.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.