Private Car Loan Agreement Template free printable template

Show details

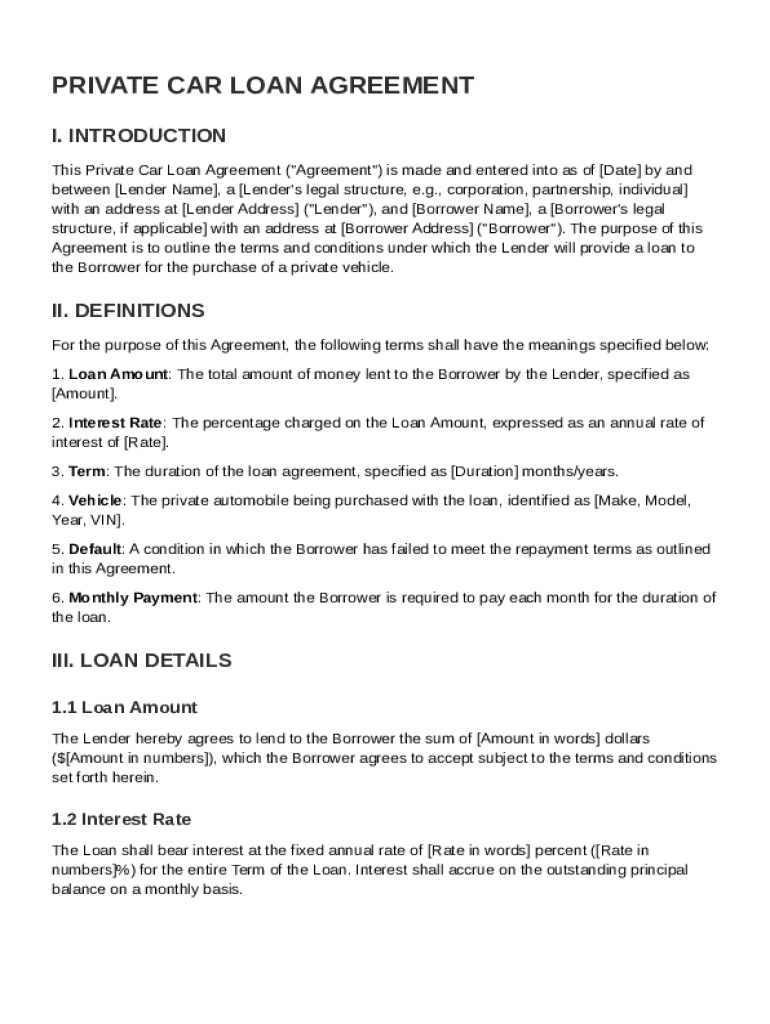

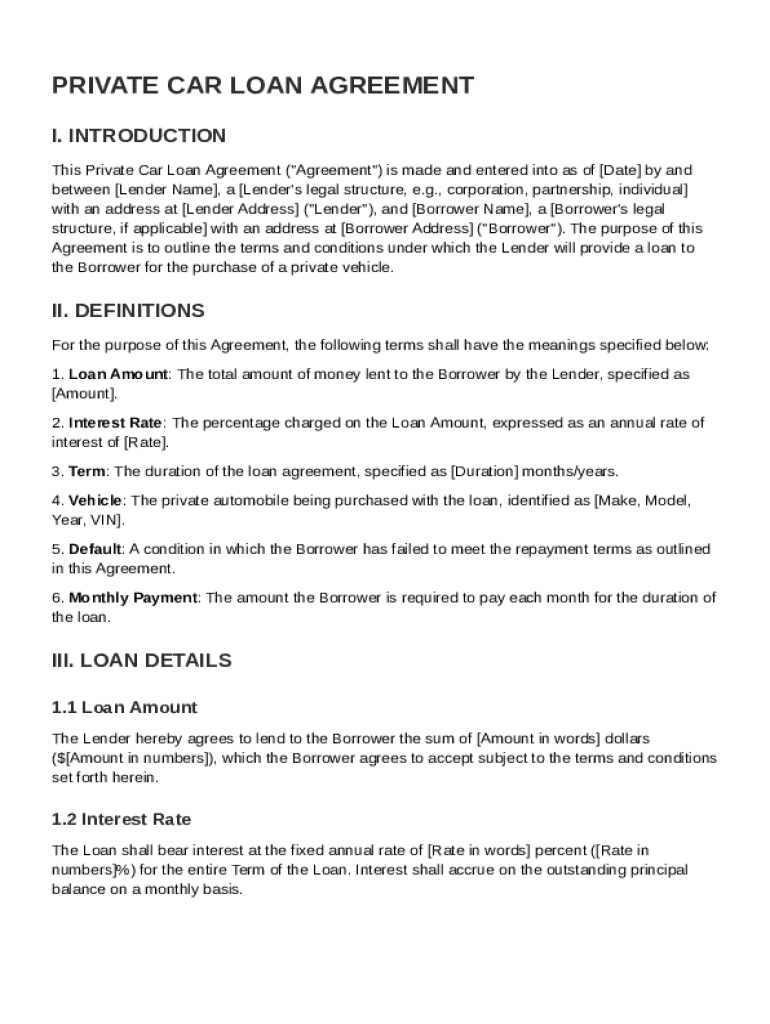

This document outlines the terms and conditions for a loan provided by the lender to the borrower for the purchase of a private vehicle.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Car Loan Agreement Template

A Private Car Loan Agreement Template is a legal document outlining the terms and conditions of a loan for purchasing a vehicle from a private seller.

pdfFiller scores top ratings on review platforms

I have trouble finding and saving old…

I have trouble finding and saving old proposals.

seems to work good!

hhhhhhhhhh

i think this program is very helpful and easy to navigate.

Usability

Very intuitive and user friendly.

i like it is user friendly

Great product!

Great product!! Especially for my chromebook.

Who needs Private Car Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Private Car Loan Agreement Template Guide

How to fill out a Private Car Loan Agreement form

Filling out a Private Car Loan Agreement form requires attention to detail and understanding of specific terms. Start by gathering personal information of both the lender and borrower, specifying loan amounts and interest rates, followed by outlining vehicle specifics. Use formatting tools to ensure the agreement is clear and comprehensive.

What is a Private Car Loan Agreement?

A Private Car Loan Agreement is a legal document drafted between a lender and a borrower that outlines the terms and conditions of a personal loan used specifically for purchasing a vehicle. Such agreements protect both parties by detailing the obligations, potential risks, and the repayment structure.

-

It is a contract between the lender and borrower that outlines the terms under which the borrower can use the loan to purchase a car.

-

A formal agreement helps prevent misunderstandings and conflicts that may arise, providing legal protection for both parties.

-

The lender provides the funds, while the borrower promotes responsibility for repayment, including principle and interest.

What should be included in the agreement?

Essential components of a Private Car Loan Agreement must be clearly defined to safeguard the interests of both the lender and borrower. This includes the loan amount and details about the car being financed. Clear specifications minimize ambiguities.

-

Clearly specify the total amount of money being lent for the vehicle purchase.

-

Explain how the interest rate is determined and its implications on total repayment.

-

Define the duration over which the borrower is expected to repay the loan.

-

Include comprehensive details about the vehicle, such as make, model, and VIN.

-

Outline the repayment plan detailing amounts due each month.

-

Elucidate what actions will be taken if the borrower defaults on payments.

How to complete the agreement step-by-step?

Completing the agreement is a meticulous task that should follow a systematic structure. Proper instructions will help both parties to fill in necessary information effectively.

-

Enter the lender and borrower information accurately to establish accountability.

-

Include the total loan amount requested along with the annual percentage rate.

-

Discuss and finalize the loan duration with regards to potential future financial obligations.

-

Detail each aspect of the vehicle, including its identification number (VIN) to prevent fraud.

-

Ensure that all necessary disclaimers appear clearly throughout the document.

How can you customize your agreement using pdfFiller?

To effectively manage a Private Car Loan Agreement, pdfFiller provides various functionalities that allow users to edit and tailor their documents.

-

Upload your pre-set agreement and make necessary adjustments using pdfFiller’s editing tools.

-

Leverage pdfFiller’s signature and form fields to personalize the agreement efficiently.

-

Once completed, easily save your document in multiple formats compatible with various platforms.

-

Utilize password protection and other measures to secure your completed agreements.

What are best practices for managing signatures and collaborations?

Incorporating eSignature tools enhances the signing process and ensures authenticity in the Private Car Loan Agreement.

-

Integrate eSignature solutions to make the signing process more efficient and legitimate.

-

Utilize shared editing features to maintain real-time communication with stakeholders.

-

Monitor any edits made by all parties to ensure accountability and transparency.

-

Implement access controls to safeguard sensitive information from unauthorized individuals.

What are the legal considerations for a Private Car Loan Agreement?

Legal compliance is crucial in structuring a Private Car Loan Agreement to avoid legal disputes and penalties.

-

Be aware of your region's lending laws and ensure your agreement adheres to these standards.

-

Create a structured agreement that complies with relevant consumer protection laws.

-

Stay clear of vague terms and never overcharge for interest to sidestep legal issues.

What additional resources are available?

Accessing supplementary resources further enhances your understanding of how to manage documents and agreements such as the Private Car Loan Agreement.

-

Learn about other useful templates that can complement your car loan agreement.

-

Explore various products that aid in document management and compliance.

-

Utilize pdfFiller’s customer support for assistance with unique document needs.

How to fill out the Private Car Loan Agreement Template

-

1.Open the Private Car Loan Agreement Template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and addresses of both the borrower and the lender in the designated fields.

-

4.Specify the loan amount being borrowed and the interest rate if applicable.

-

5.Include details about the car, such as make, model, year, and vehicle identification number (VIN).

-

6.Outline the repayment terms, including the duration of the loan and payment schedule.

-

7.Clearly state any penalties for late payments or defaults within the agreement.

-

8.Review all entered information for accuracy before finalizing the document.

-

9.Save the completed agreement and consider printing copies for both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.