Private Lending Agreement Template free printable template

Show details

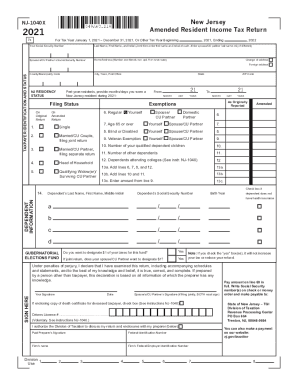

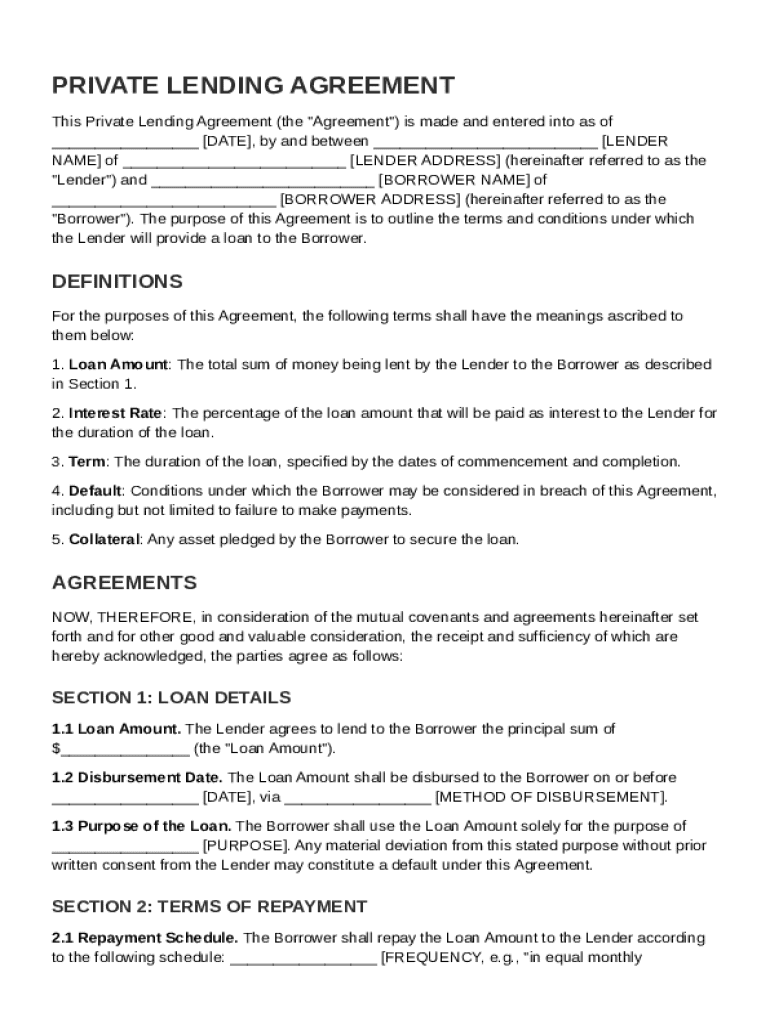

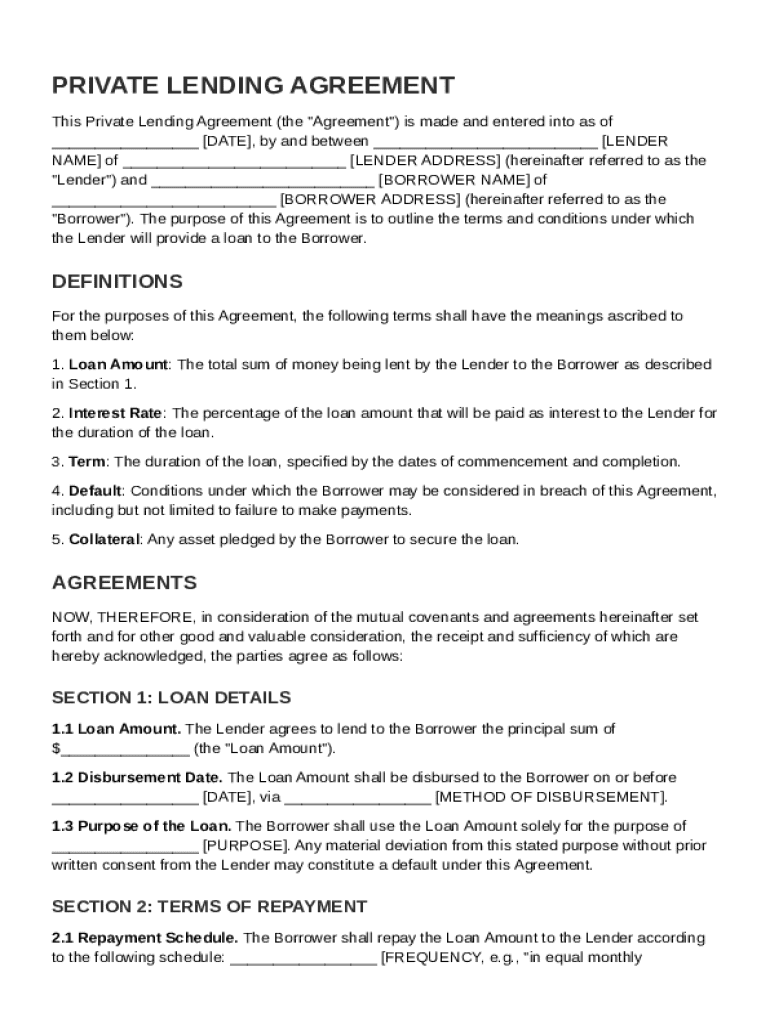

This document outlines the terms and conditions under which a lender provides a loan to a borrower, including definitions, loan details, repayment terms, interest terms, default remedies, collateral,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Lending Agreement Template

A Private Lending Agreement Template is a legal document outlining the terms and conditions between a lender and borrower for private loans.

pdfFiller scores top ratings on review platforms

fantastic resource

I am cancelling my subscription to PDFfiller. My husband and I got the covid virus and we cannot continue to pay for the subscription. Other than that, I absolutely loved the access to PDFfilller.

We would like become a distributor and sale partner for PDFfiller.

We will design documents and forms to sell through PDFfiller.

Many thanks in advance foryour cooperation.

Best regards,

Great!

Very pleased

Very Helpful with online applications process

Who needs Private Lending Agreement Template?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Private Lending Agreement Template Form

What is a Private Lending Agreement?

A Private Lending Agreement is a legal contract between a lender and a borrower outlining the terms of a loan. This agreement serves to protect both parties by clearly defining the obligations and rights involved in the lending process. Understanding the fundamental elements of a Private Lending Agreement is crucial to ensure a smooth transaction and legal compliance.

-

A legal document detailing the terms under which a borrower receives funds from a private lender.

-

It formalizes the loan, reduces misunderstandings, and provides legal recourse in case of default.

-

Commonly used among individuals, family members, or friends, and sometimes by small businesses for alternative financing.

What Are the Key Components of a Private Lending Agreement?

A well-structured Private Lending Agreement should cover several essential components to ensure clarity and legal enforceability. Including specific terms helps both parties understand their commitments and the repercussions of default.

-

These sections state the total amount being loaned, the interest applicable, the duration of the loan, and what collateral is held as security.

-

Specifies the events that will be considered a default, protecting the lender’s rights if the borrower fails to meet loan terms.

-

Unambiguous language in key areas avoids confusion and disputes, crucial for both parties' peace of mind.

How to Fill Out Your Private Lending Agreement Template

Filling out a Private Lending Agreement template requires careful attention to detail to avoid any potential issues. Ensuring clarity in the specifics outlined in this document is essential for a positive lending experience.

-

Begin by gathering all pertinent borrower and lender information, followed by filling in loan terms clearly.

-

Ensure that both parties' legal names and contact information are accurate to prevent any confusion.

-

Double-check all figures, terms, and conditions, and consider having a legal professional review the document before finalization.

How to Edit and Customize the Agreement with pdfFiller

Utilizing pdfFiller’s intuitive platform can facilitate the editing and customization of your Private Lending Agreement. This service empowers users to manage documents efficiently while ensuring all legal requirements are met.

-

Customize sections of your agreements easily with editing tools that allow you to adjust text and adjust format.

-

Adapt the standard terms to better suit your borrowing needs and ensure both parties agree on the specifics.

-

Gain access to your documents from any location, share effectively with stakeholders, and maintain organized records.

How to Manage Signing and Documentation

Signing and documenting your Private Lending Agreement is a key step in formalizing the loan process. This not only enhances trust but can also streamline future transactions.

-

Incorporate electronic signatures to expedite the signing process while keeping it secure and valid.

-

Ensure all parties review the document thoroughly and address any concerns before signing.

-

Store your signed agreements safely using pdfFiller to ensure they are easily retrievable when needed.

What Are the Repayment Terms and Compliance Considerations?

Understanding repayment terms and compliance with legal regulations is crucial for both borrower and lender. These factors affect ongoing responsibilities for loan management.

-

Identify whether a balloon payment, amortized schedule, or interest-only payments best fit your financial situations.

-

Research and adhere to any applicable regulations to safeguard both parties involved in the lending transaction.

-

Clearly outline the payment plans, penalties for late payments, and the method of payment in the agreement.

What to Do in Case of Default?

Navigating a default situation is complex, and having a plan in place can protect both lender and borrower. Knowing the appropriate steps can help mitigate losses.

-

Understand when a default occurs and the resolution options available, such as renegotiation or legal action.

-

Determine how collateral can be leveraged to secure the lender's interests should the borrower default.

-

In cases of unforeseen circumstances, negotiate changes to the agreement to maintain compliance and ensure repayment.

How to fill out the Private Lending Agreement Template

-

1.Open the Private Lending Agreement Template on pdfFiller.

-

2.Start by entering the date at the top of the document.

-

3.Fill in the lender's name and contact information in the appropriate fields.

-

4.Next, enter the borrower's details, including their full name and address.

-

5.Specify the loan amount in the designated section.

-

6.Indicate the interest rate and repayment terms, including due dates.

-

7.Outline any collateral securing the loan, if applicable.

-

8.Review the terms and conditions, ensuring they reflect the agreement between the parties.

-

9.Sign the document where indicated, ensuring all parties provide their signatures.

-

10.Save and download the completed agreement for both parties' records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.