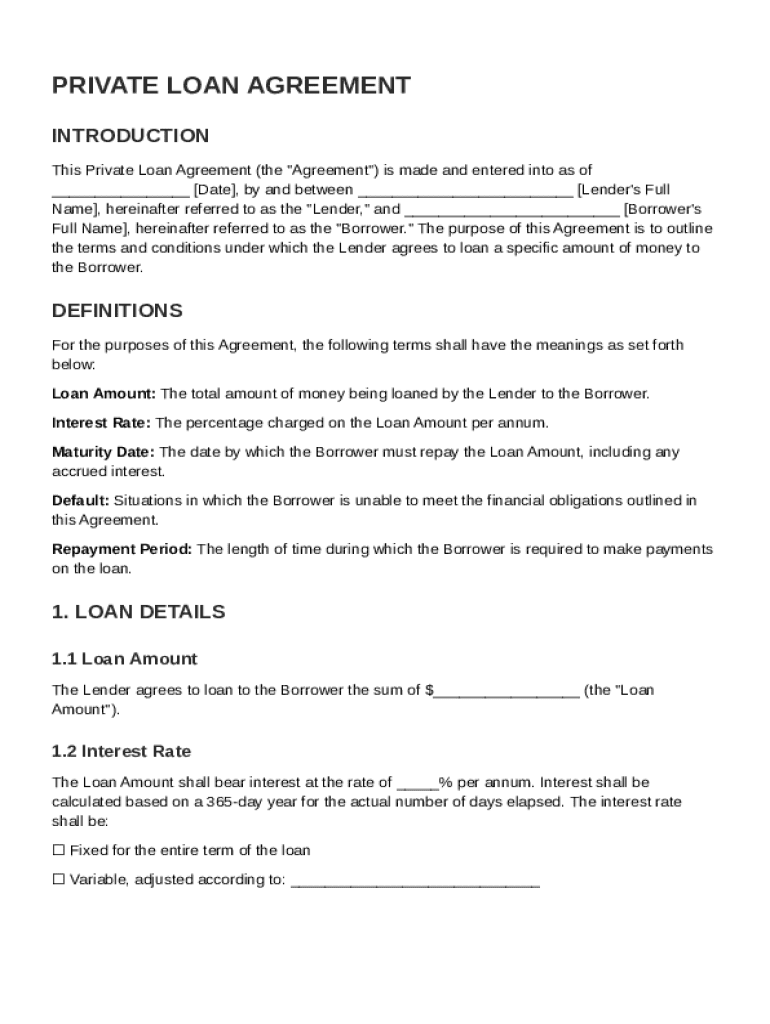

Private Loan Agreement Template free printable template

Show details

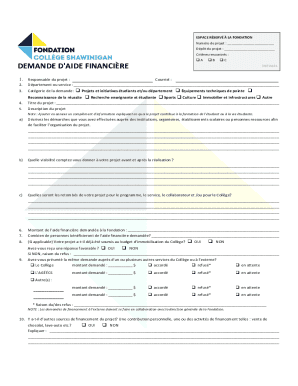

This document outlines the terms and conditions of a private loan agreement between a lender and a borrower, including loan amount, interest rate, repayment terms, and default remedies.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Loan Agreement Template

A Private Loan Agreement Template is a legal document outlining the terms of a loan between a private borrower and lender.

pdfFiller scores top ratings on review platforms

This page resolved my issue. Great to use it.

love it fast

If I had the option to put 100 stars, I would. This product is fantastic. There are small issues with reformatting, but I think the user can get over that.

very quick and learning process

Very helpful in finding documents related to importing to the US

Typing is easier to read than handwriting.

Who needs Private Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Comprehensive Guide to a Private Loan Agreement

How does a private loan agreement work?

A Private Loan Agreement is a crucial document that outlines the terms between a lender and a borrower. It serves to protect both parties by clearly stating the conditions of the loan. This article will guide you on how to fill out a Private Loan Agreement form effectively.

Filling out this form involves explicitly defining the roles, responsibilities, and expectations of each party. A well-structured agreement is essential for minimizing disputes and ensuring a smooth transaction.

What should you understand about private loan agreement templates?

Understanding a Private Loan Agreement Template is the first step in creating your document. These templates provide a foundation that can be customized to suit specific lending scenarios.

-

A Private Loan Agreement defines the loan's terms and conditions, ensuring commitment from both sides.

-

A well-structured document minimizes disputes and supports legal compliance.

-

Familiarity with essential components is vital for effective agreement creation.

What are the core components of a private loan agreement?

The core components of a Private Loan Agreement ensure clarity and mutual understanding. These elements help define the nature of the loan and guide the repayment process.

-

This includes names, addresses, and contact information necessary for identification.

-

Clearly state the loan amount to avoid misunderstandings.

-

Specify whether the rate is fixed or variable, affecting repayment amounts.

-

The maturity date defines when the loan must be fully repaid.

-

Outline what constitutes defaulting and the schedule for payments.

How do you fill out a private loan agreement?

Filling out a Private Loan Agreement involves several careful steps to ensure accuracy.

-

Input the dates and names of both parties at the top of the document.

-

Clearly outline the principal amount and the applicable interest rate.

-

Detail the repayment schedule and any relevant terms surrounding it.

-

Clearly define what constitutes a default and potential outcomes.

-

Include designated areas for both parties to sign and date.

What features does pdfFiller provide for editing and customizing?

pdfFiller enhances your document management experience through a variety of cloud-based tools. Its features are specially designed to facilitate editing, signing, and managing agreements efficiently.

-

Edit your documents in a secure, cloud environment accessible from anywhere.

-

Securely add electronic signatures, speeding up the signing process.

-

Work collaboratively with others on shared documents for improved efficiency.

-

Utilize cloud storage to manage and store agreements safely and efficiently.

How do you navigate the lending process?

Navigating the lending process can be daunting, but understanding the essential steps can simplify it significantly. Being informed allows you to make better decisions and negotiate favorable terms.

-

Follow a structured approach to ensure you meet all requirements.

-

Ensure that your agreement complies with regional lending laws to avoid complications.

-

Understand how your credit score affects the terms of the loan agreement.

-

Develop negotiation skills to secure the best loan terms possible.

What are the best practices for managing loan agreements?

Effective management of loan agreements is vital for both lenders and borrowers to ensure compliance with terms and repayment schedules.

-

Utilize tools to monitor payment schedules and set reminders for repayments.

-

Be open to renegotiating terms if circumstances change.

-

Maintain records of payments and agreements for legal protection.

-

Use pdfFiller to manage your documents, keeping everything organized and accessible.

How to fill out the Private Loan Agreement Template

-

1.Download the Private Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin filling in the borrower's information such as name, address, and contact details in the designated fields.

-

4.Enter the lender's information following the same process.

-

5.Specify the loan amount clearly in the appropriate section.

-

6.Outline the terms of repayment, including interest rate, payment schedule, and due date.

-

7.Include any prepayment penalties or late fees if applicable.

-

8.Review all entries for accuracy and completeness.

-

9.Finalize the document by adding signatures for both parties at the bottom of the agreement.

-

10.Save the completed Private Loan Agreement Template as a PDF file or share it directly through pdfFiller.

How to write a private loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

How to give someone a private loan?

The best way to loan money to family, friends, or businesses Get it in writing! When lending money, a written Loan Agreement or Promissory Note is your best friend. Choose an appropriate amount of interest. Set an appropriate repayment timeline. Consider asking for collateral or a Deed of Trust.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

How do I write a note for a personal loan?

A comprehensive promissory note typically includes: Names and contact information of the parties involved. Loan amount. Repayment terms. Interest rate (if applicable) Consequences of default (in case payments are missed) Governing law. Signatures of the borrower and lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.