Private Mortgage Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions for a loan provided by a lender to a borrower, secured by a mortgage on a specified property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

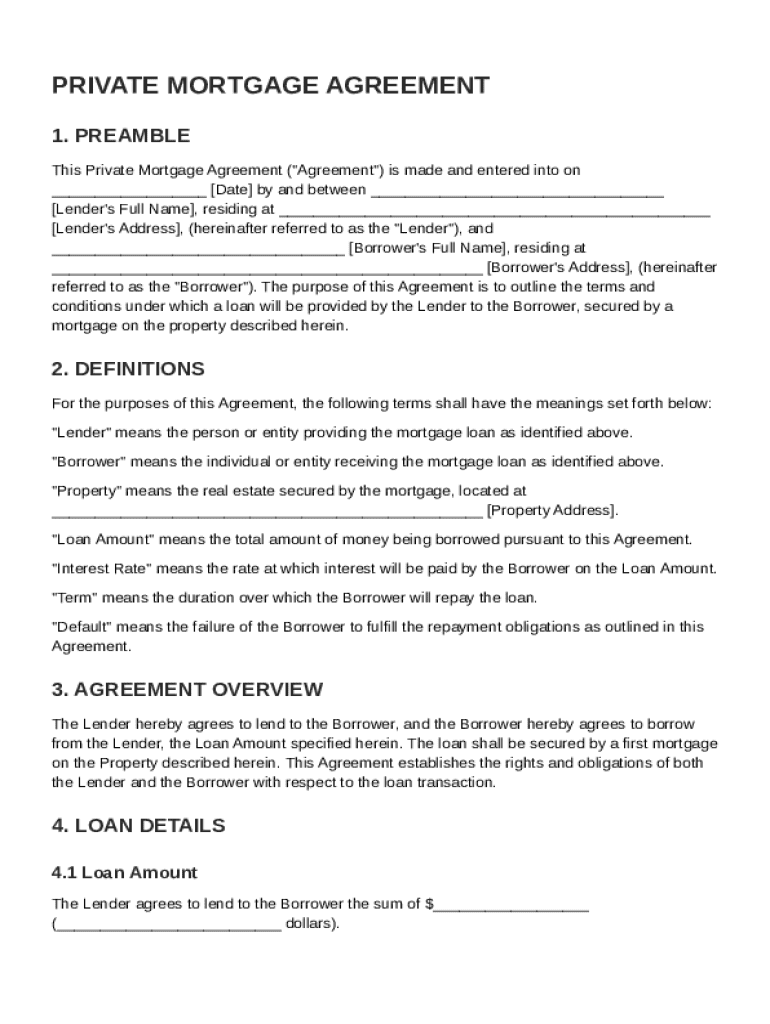

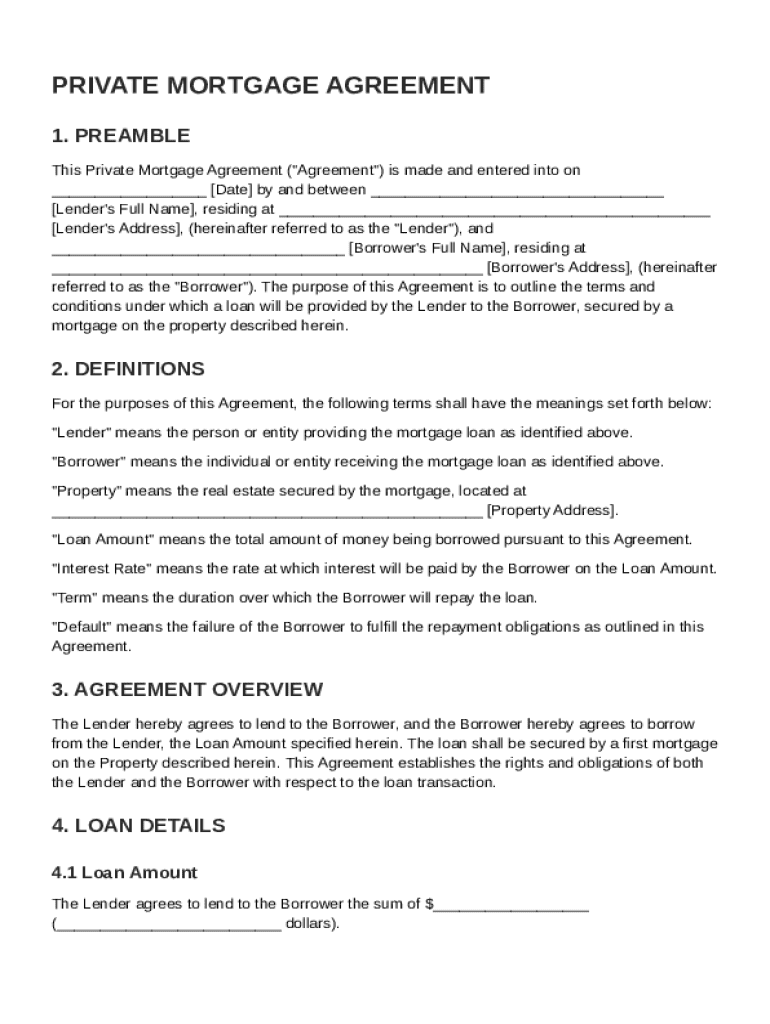

What is Private Mortgage Agreement Template

A Private Mortgage Agreement Template is a legal document outlining the terms and conditions of a loan between a private lender and a borrower for purchasing property.

pdfFiller scores top ratings on review platforms

Not bad but would benefit to learn more.

Very useful website. Has helped in the processing of many of our business documents.

I am having problems finding documents in the library. Please let me know if there is an easier way. Thank you

Only used once but had good experience with it

It needs better way for positioning pictures at document while also visualizing it

There are sometimes problems with the # of characters and making corrections. Otherwise I prefer it to filling out things by hand.

Who needs Private Mortgage Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Private Mortgage Agreement Template on pdfFiller

Creating a Private Mortgage Agreement Template form can streamline your loan process. This guide offers step-by-step instructions on how to fill out the template effectively, ensuring that both lenders and borrowers have a clear understanding of their responsibilities.

What is a Private Mortgage Agreement?

A Private Mortgage Agreement is a legal document that outlines the terms under which a lender loans money to a borrower for purchasing property. It allows individuals to establish a loan agreement outside traditional banking systems, which can offer more flexible terms.

-

This agreement serves as a legal instrument that details the contractual relationship between the lender and borrower.

-

Important elements include loan terms, parties involved, interest rates, and property descriptions.

-

It minimizes misunderstandings and provides legal protection for both parties.

What are the essential elements of a Private Mortgage Agreement?

-

The roles of the lender and borrower should be clearly articulated in the document.

-

A thorough description of the property that secures the loan is crucial for clarity.

-

Specify the total sum to avoid disputes—detailing the exact amounts lends legal clarity.

-

The rate should be clearly stated and should comply with relevant state laws.

-

Indicate how long the borrower has to pay back the loan, including implications of early repayment.

How do you create your Private Mortgage Agreement?

-

Prepare by collecting all personal and property details required for the agreement.

-

Access the Private Mortgage Agreement Template through pdfFiller, where you can fill in necessary fields.

-

Ensure all terms and conditions are clearly defined to avoid ambiguity later.

-

Utilize pdfFiller’s tools to customize your agreement according to specific needs.

What does the form-filling process look like?

-

Fill in accurate details to avoid potential legal issues.

-

Provide a legal description to ensure the property is correctly identified.

-

Clearly specify amounts, interest rates, and payment schedules for transparency.

-

Complete with signatures and dates, adhering to legal standards.

How can you manage your Private Mortgage Agreement with pdfFiller?

-

Utilize cloud storage options for safe document management.

-

Share the agreement easily for review and feedback directly through pdfFiller.

-

Ensure the agreement's authenticity with legally binding electronic signatures.

-

Keep track of all changes made over time, which is vital for maintaining legal integrity.

What common issues and considerations should you be aware of?

-

Both parties should be aware of default implications, including potential foreclosure.

-

Certain states have specific regulations that must be adhered to, which can vary significantly.

-

Failure to follow legal stipulations can lead to costly legal battles.

What additional resources are available on Private Mortgage Agreements?

-

Access guides and resources hosted on pdfFiller for further information.

-

Explore more about document preparation and effective management.

How to fill out the Private Mortgage Agreement Template

-

1.Download the Private Mortgage Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the date of the agreement in the designated section.

-

4.Fill in the lender's full name and contact details accurately.

-

5.Input the borrower's full name and contact information as well.

-

6.Specify the loan amount in numerical and written form.

-

7.Detail the interest rate and repayment terms, including start and end dates.

-

8.Include any collateral information if applicable.

-

9.Make sure to outline the payment schedule clearly.

-

10.Review the legal clauses and modify them if necessary to fit your agreement.

-

11.After completing all fields, save your document.

-

12.Print the agreement for both parties to sign, ensuring both retain a copy.

How to write a private loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

What is a private mortgage?

A private mortgage is a type of mortgage loan whereby funds can be sourced from another person or business rather than borrowing from a bank or other finance provider. The private lender could be family, friends or others with personal relationships to the borrower.

How to create a simple mortgage?

Firstly, they are created by executing a mortgage deed, which outlines the terms and conditions of the mortgage agreement. Secondly, the mortgagee (lender) has the right to sell the property without the intervention of the court in case of default by the mortgagor (borrower).

What is a short term financing agreement?

A short term credit agreement is a contract between a lender and a borrower in which the borrower agrees to repay the loan within a set period of time. This type of agreement is typically used for short-term financing, such as bridge loans or lines of credit.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.