Private Party Car Loan Agreement Template free printable template

Show details

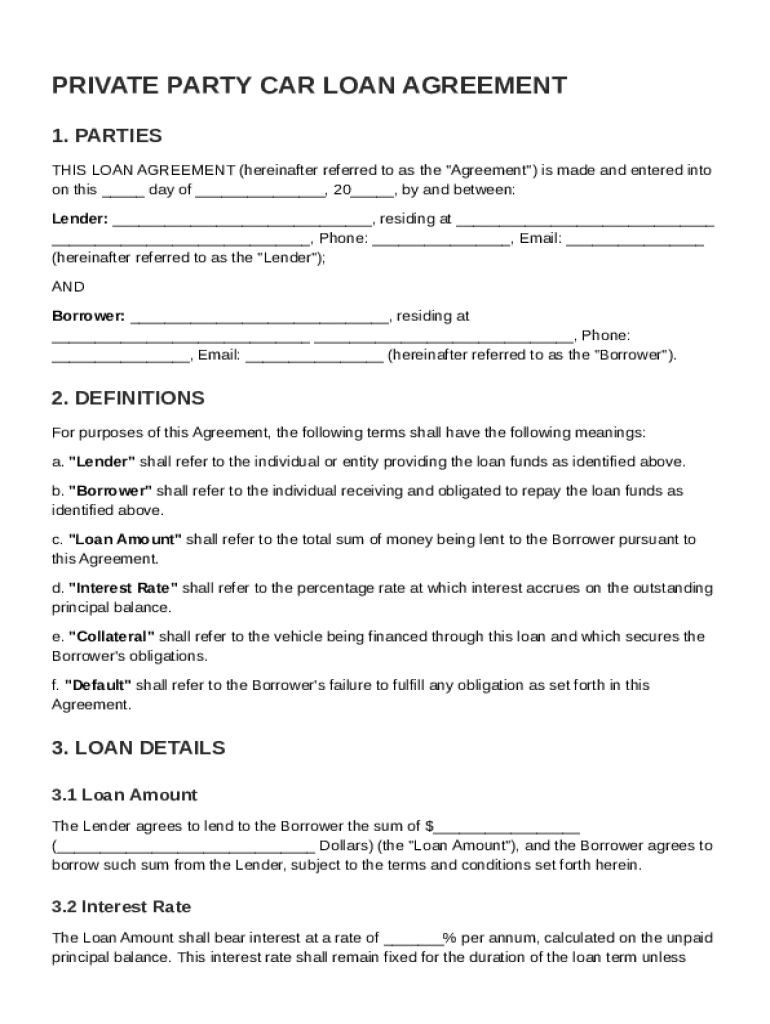

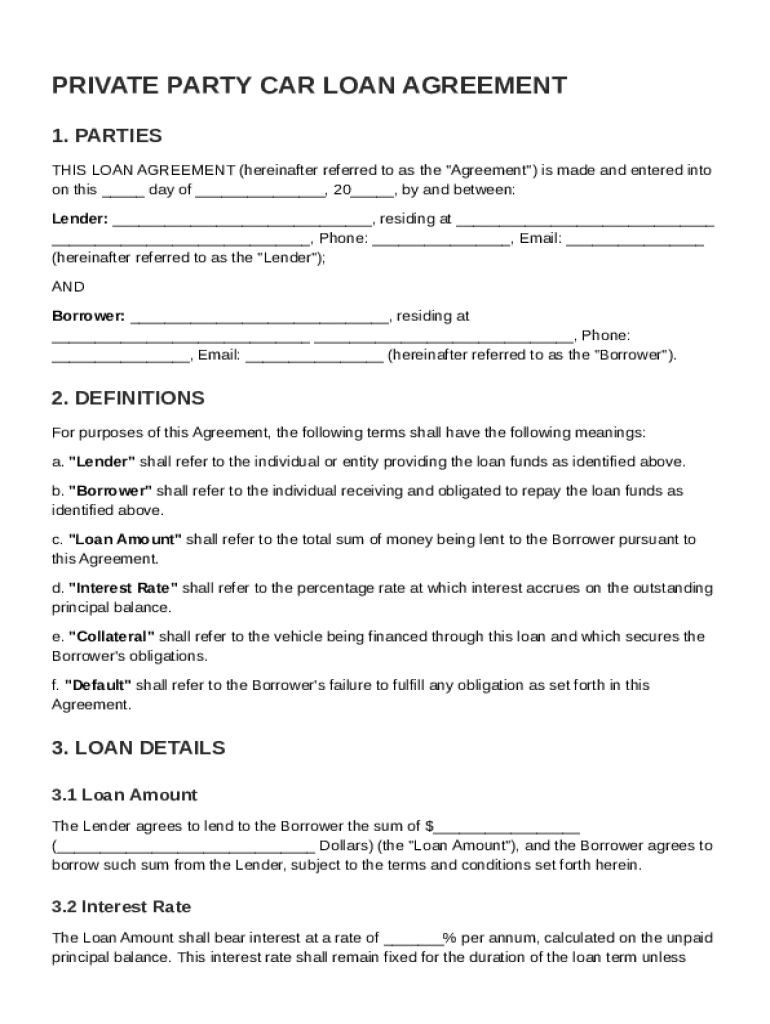

This document is a loan agreement between a private lender and a borrower for financing a vehicle, outlining terms such as loan amount, interest rate, repayment schedule, and conditions of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Party Car Loan Agreement Template

A Private Party Car Loan Agreement Template is a legal document outlining the terms and conditions of a car loan agreement between a private lender and a borrower.

pdfFiller scores top ratings on review platforms

It was really hard to find certain features like consolodating multiple PDFS into one. I also thought the package I bought came with the signature signing option - and apparently it didn't. 180/year is a lot to NOT have that feature. That's the main reason I chose it over others.

Very simple and incredibly useful. This is my secret weapon as I can change, modify or update any PDF document and have it ready to go within minutes. Probably my most useful app.

ok cost me money so my daughter can go to school for scholarships

Needs to have more intuitive directions. Overall satisfied.

Easy to use, fantastic for all your fill in needs.

I'm amazed at how well it does with filling and editing. There are sooooo many features that I am still learning. Great product.

Who needs Private Party Car Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Private Party Car Loan Agreement Guide

Completing a Private Party Car Loan Agreement form can simplify the financing process between individuals. This guide will help you understand all necessary components, how to fill out the form, and the management of your agreement.

What is a Private Party Car Loan Agreement?

A Private Party Car Loan Agreement is a legal document that formalizes the loan between a lender and a borrower, outlining the terms of the loan such as interest rate, duration, and payment method.

-

This agreement serves to protect the interests of both parties by clearly defining expectations and responsibilities.

-

The lender provides the loan amount, while the borrower agrees to pay it back according to the terms set forth.

-

A written document reduces potential disputes and provides a clear record of the arrangement.

What are the essential components of the agreement?

A well-structured Private Party Car Loan Agreement includes a variety of essential components that ensure clarity and legal enforceability.

Parties involved

-

Both parties must be clearly identified with legal names.

-

Include essential contact details such as phone numbers and email addresses for smooth communication.

Key definitions

-

This refers to the total money loaned, which should be explicitly stated.

-

Clearly outline whether it is fixed or variable, as it significantly impacts repayments.

-

Define what, if any, asset secures the loan and why this is critical for both parties.

-

Describe what constitutes a default and the implications it has for the borrower.

How do you detail loan terms?

The loan terms and details must clearly outline the financial obligations of the borrower.

What information is included in the loan amount and payment schedule?

-

Provide a detailed breakdown of how funds will be allocated if applicable.

-

Specify the loan period in months to establish clear repayment timelines.

How are interest rates explained?

-

Detail how interest is calculated annually, including any fees that might apply.

-

Discuss the pros and cons of interest rate types to help borrowers choose wisely.

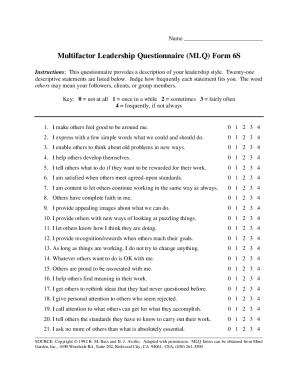

How to fill out the Private Party Car Loan Agreement form?

Filling out the Private Party Car Loan Agreement form correctly is crucial for legal safety and clarity.

-

Use pdfFiller’s interface to fill the form by following the intuitive prompts.

-

Take advantage of interactive tools to make annotations and sign electronically.

-

Check for missing signatures or incorrect amounts to prevent any future conflicts.

Managing your completed agreement

Post-completion management of your agreement ensures that both parties honor their commitments.

-

Utilize pdfFiller tools for secure electronic signatures that maintain legal validity.

-

Share the document with trusted parties for review and discussion effortlessly.

-

Leverage cloud features to store and access your documents from anywhere.

What are the compliance and legal considerations?

Understanding compliance helps ensure the legality of your car loan agreements.

-

Be aware of local laws that may affect your agreement; consult legal counsel if necessary.

-

Familiarize yourself with terminology often included in loan agreements.

-

Certain states may require notarization or witness signatures for stronger legal standing.

How to fill out the Private Party Car Loan Agreement Template

-

1.Download the Private Party Car Loan Agreement Template from a trusted source or pdfFiller.

-

2.Open the template in pdfFiller and start by entering the date of the agreement at the top of the document.

-

3.Fill in the names and addresses of both the borrower and the lender in the designated fields.

-

4.Specify the details of the vehicle being financed, including make, model, year, VIN, and purchase price.

-

5.Indicate the loan amount, interest rate, repayment terms, and payment schedule clearly.

-

6.Include any additional terms and conditions agreed upon between the parties, such as late payment penalties or prepayment options.

-

7.Review the entire document for accuracy, ensuring all information is correct and complete.

-

8.Once satisfied, print the agreement for both parties to sign and date it, retaining copies for their records.

How to write a private loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.