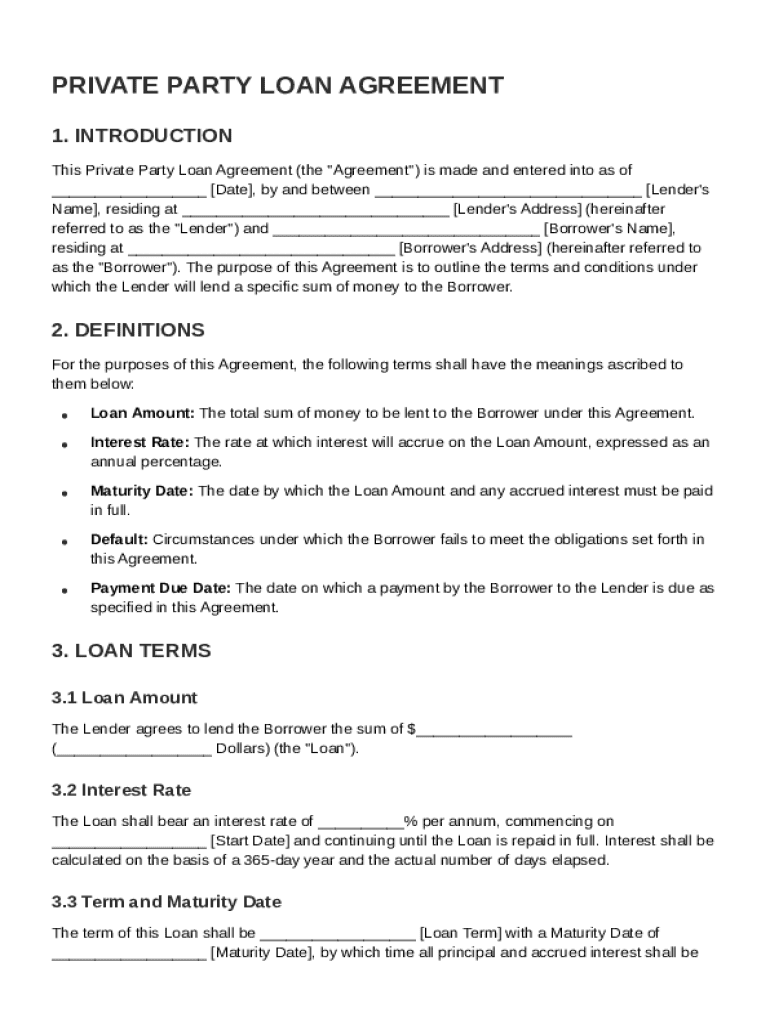

Private Party Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a Lender will lend a specific sum of money to a Borrower, including definitions, loan terms, repayment conditions, and provisions related

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

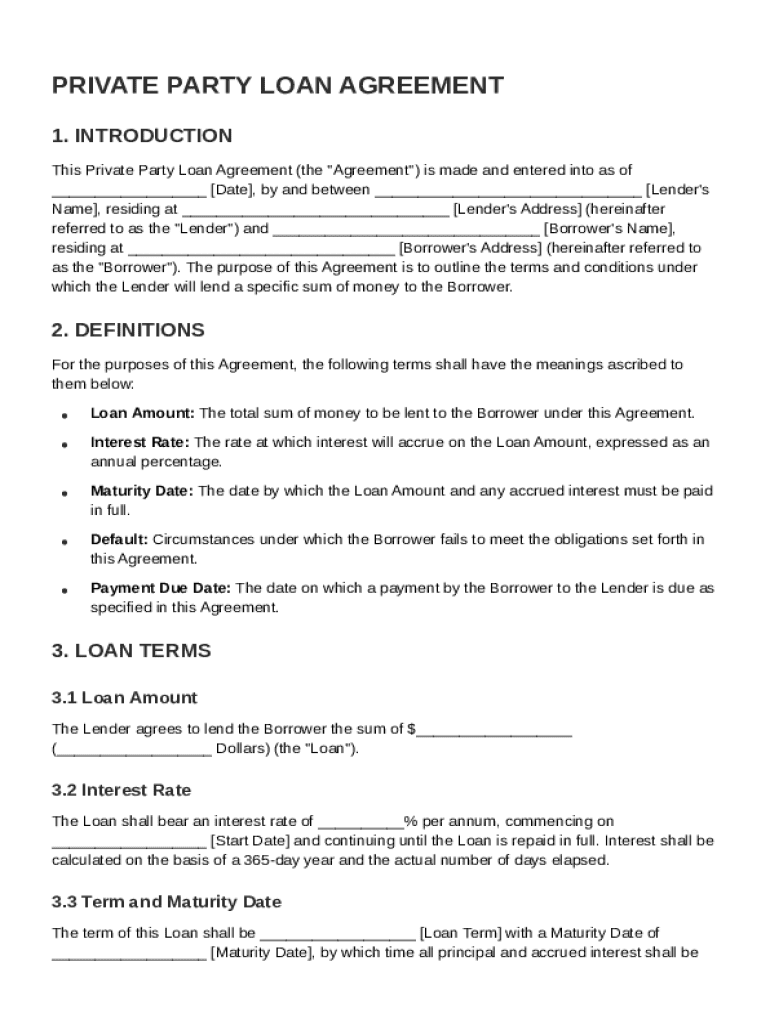

What is Private Party Loan Agreement Template

A Private Party Loan Agreement Template is a legal document outlining the terms and conditions of a loan between two private parties.

pdfFiller scores top ratings on review platforms

I my opinion PDFfiller is great. There is no need for a very expensive program to do simple editing or creating forms

Great Program, to expensive. Needs a spell checking device

Does what it is intended to do. Easy to use. Worth the investment.

Great Product with tremendous attributes.

good program except can not move text boxes to fit into forms.

I LOVED IT, BUT I REALIZED THAT I THOUGHT THIS WAS SOMETHING I WOULD NEED ALL THE TIME AND IT IS NOT, SO SORRY TO SAY... I WILL BE CANCELING THIS PDF FILLER AT THIS TIME.. BUT I KNOW WHEN AND IF I NEED SOMETHING. I KNOW WHO I CAN COUNT ON AND WHO I CAN REFER TO IF PEOPLE ARE LOOKING FOR CERTAIN FORMS. THANK YOU

Who needs Private Party Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

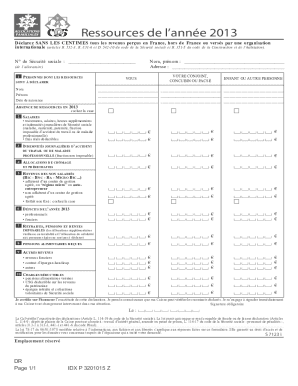

Your complete guide to the private party loan agreement template form

A private party loan agreement template form is a crucial document that outlines the terms of a loan between individuals or entities outside of traditional banks. This guide will help you understand how to fill out this form effectively.

What are private party loan agreements?

Private party loan agreements are contracts between individuals or businesses that pertain to loans without the involvement of banks. They allow for greater flexibility in terms and conditions, which can significantly benefit both parties.

-

These agreements serve as legally binding documents that protect both the lender and borrower, ensuring clarity in transactions.

-

Private loans can often offer more favorable terms than traditional bank loans, such as lower interest rates depending on the relationship between parties.

-

It's critical to comply with relevant laws to avoid potential disputes; understanding these legal implications is key before signing an agreement.

What are the essential components of a private party loan agreement?

Every private party loan agreement should include several essential components to ensure clarity and legality.

-

This is the date on which the agreement is signed and takes effect. It marks the beginning of the loan term.

-

Full names and contact information should be documented to identify the parties involved.

-

This includes the loan amount, interest rate, maturity date, and conditions in case of default.

-

Indicating when payments are due helps maintain accountability for timely repayments.

How do you specify loan terms in the contract?

Defining loan terms is essential for clarity and mutual agreement between parties.

-

Consider the borrower's needs and ability to repay. Calculations should be transparent and agreed upon.

-

Discuss factors that affect interest rates, like personal credit history and market conditions.

-

The maturity date is vital for the repayment schedule and must be agreed upon to avoid confusion.

-

Clearly define what constitutes default and the subsequent repercussions to avoid misunderstandings.

-

Outline whether repayments are monthly or quarterly and the specifics of how these will be structured.

How to fill out the private party loan agreement template?

Filling out a private party loan agreement template is straightforward if you follow a systematic approach.

-

Begin with entering the borrower’s and lender’s details, then proceed to outline the loan specifics including amounts and terms.

-

pdfFiller provides an easy-to-use platform to edit and manage your document seamlessly online.

-

Be sure to double-check key fields to minimize errors, ensuring that both parties have a clear understanding of their obligations.

How does editing and eSigning make it easier?

Utilizing digital tools enhances the efficiency of filling out and managing loan agreements.

-

pdfFiller’s editing capabilities allow for seamless modifications and real-time collaboration between lenders and borrowers.

-

Using eSignatures ensures legal acceptance and provides a quick way to finalize agreements without physical meetings.

-

The platform allows multiple users to work on the document simultaneously, promoting transparency and cooperation.

How to manage your loan agreement effectively?

Managing a loan agreement post-signing is vital for its longevity and effectiveness.

-

Keep track of payment schedules and modify your agreement if circumstances change.

-

Periodically revisit the terms to adjust for situations like late payments or changes in financial conditions.

-

Be proactive in addressing potential issues, whether that involves renegotiating terms or seeking legal advice.

What are common challenges in private loans?

Navigating the world of private loans can present various challenges that require careful consideration.

-

Many believe that private loans do not require documentation when in fact, a formal agreement protects both parties.

-

Disagreements can arise; having a clear contract makes resolving disputes simpler and less contentious.

-

For serious issues or uncertainties, seeking legal advice is always advisable to navigate complexities.

In conclusion, the private party loan agreement template form is an invaluable tool for anyone looking to formalize a loan between individuals. Understanding the various components and procedures highlighted in this guide will empower you to fill out this critical document confidently. With pdfFiller, you can edit, eSign, and manage your agreements all in one place, making document management both efficient and hassle-free.

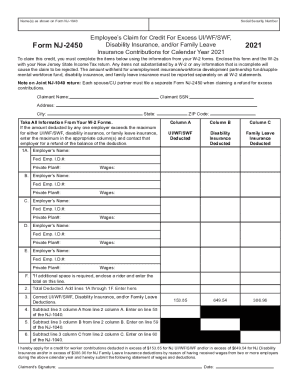

How to fill out the Private Party Loan Agreement Template

-

1.Download the Private Party Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the lender's full name and contact information at the top of the document.

-

4.Next, input the borrower's full name and contact details in the designated section.

-

5.Specify the loan amount being borrowed in clear figures and words to avoid ambiguity.

-

6.Fill in the interest rate you both agree upon, citing whether it is fixed or variable.

-

7.Define the repayment terms, including the schedule of payments, due dates, and methods of repayment.

-

8.Include any additional clauses that you both wish to add, such as penalties for late payment or conditions for early repayment.

-

9.Once all information is accurately filled in, review the document for completeness and correctness.

-

10.Finally, save the document and print it out for both parties to sign, ensuring that each retains a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.