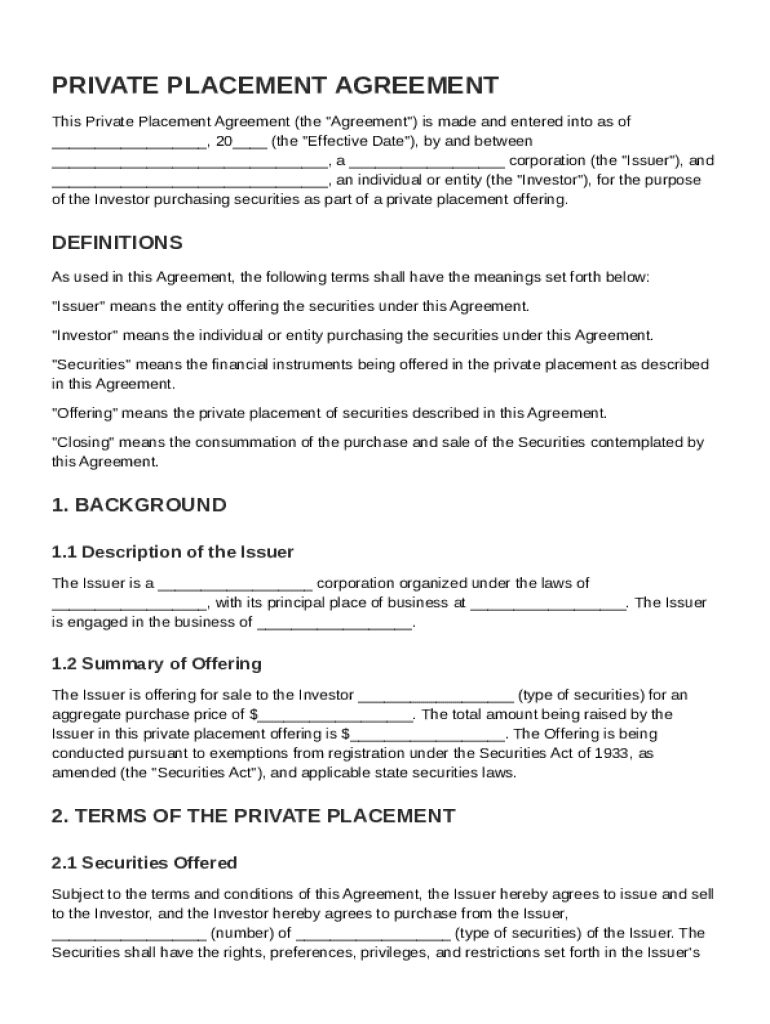

Private Placement Agreement Template free printable template

Show details

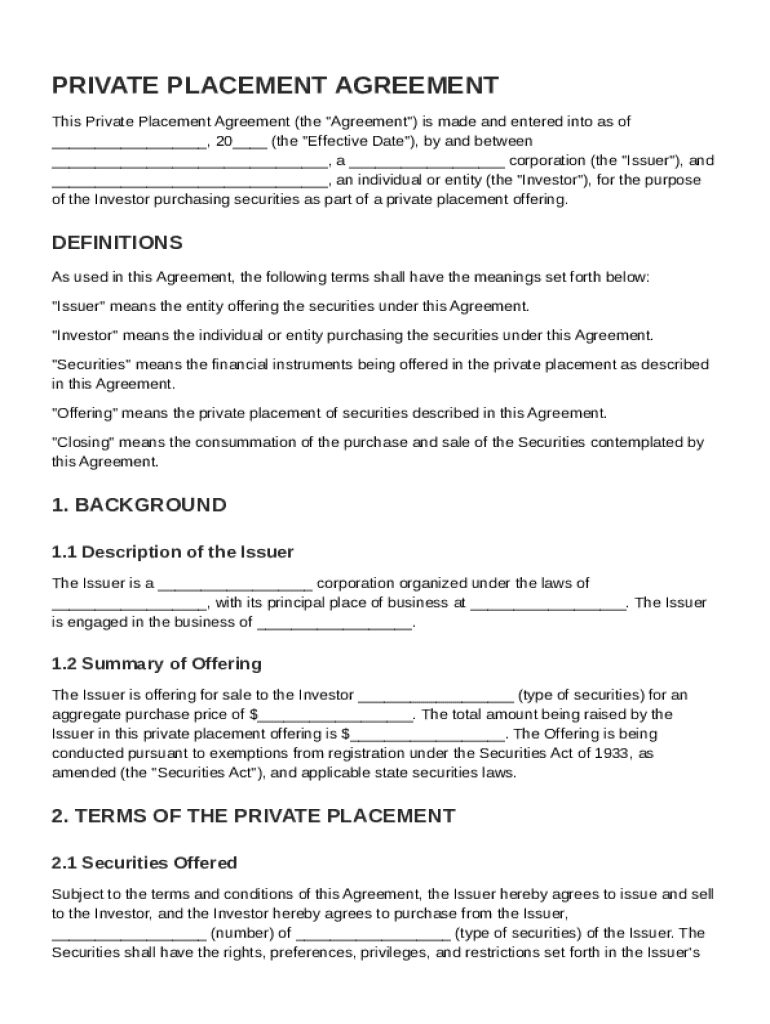

This document is a Private Placement Agreement detailing the terms, conditions, and obligations between an Issuer and an Investor for the purchase of securities as part of a private placement offering.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Placement Agreement Template

A Private Placement Agreement Template is a legal document that outlines the terms and conditions of a private investment offering, allowing companies to raise capital from selected investors without public solicitation.

pdfFiller scores top ratings on review platforms

it is so much easier to use than any…

it is so much easier to use than any other pdf filler app.

love this site

love this site. makes everything easier

Love it 10/10

Fantastic love it

very good app

everything is great

such a great program

Who needs Private Placement Agreement Template?

Explore how professionals across industries use pdfFiller.

Private Placement Agreement: A Comprehensive Guide

TL;DR: How to fill out a Private Placement Agreement Template form

To fill out a Private Placement Agreement Template form, start by understanding each party's role, including the Issuer and Investor. Next, detail the offering specifics, securities involved, and the terms of purchase. Make use of editing tools for customization and finalize by signing electronically.

What is a Private Placement Agreement?

A Private Placement Agreement is a legal document between a securities issuer and an investor or group of investors. These agreements are vital in investment transactions, allowing businesses to raise capital without undergoing the lengthy and costly public offering process. Key terms within the agreement include Issuer, Investor, Securities, Offering, and Closing.

Key components of a Private Placement Agreement

The core components of this agreement include the definitions and rights of the Issuer and Investor, the types of securities being offered, the details surrounding the offering, and the steps needed to finalize the transaction.

-

This is the entity offering the securities to raise capital.

-

This defines the roles and responsibilities of the purchaser.

-

These are the financial instruments being offered, such as stocks or bonds.

-

This outlines what is being offered, including amounts and terms.

-

These are the steps necessary to formally complete the transaction.

What sections are detailed in a Private Placement Agreement?

Each Private Placement Agreement includes specific sections that clarify important information necessary for both parties.

-

Provides clear definitions for terms like Issuer, Investor, Securities, Offering, and Closing.

-

Describes the Issuer's business and summarizes the Offering, including amount, type of securities, and pertinent legal compliance.

-

Details the Securities offered, Purchase price, and any rights or restrictions for the Investor.

How to fill out the Private Placement Agreement?

Filling out the Private Placement Agreement accurately is key for legal protection and clarity. This entails creating a personalized agreement by entering the relevant data pertaining to the Issuer and Investor, and outlining transaction details.

-

Follow the predefined fields in the pdfFiller platform to ensure no crucial information is missed.

-

Utilize editing tools to customize sections specific to your transaction.

-

Sign the completed agreement electronically to enable swift execution.

What are the legal considerations in Private Placement Agreements?

Legal compliance is a crucial component of Private Placement Agreements. The Securities Act plays a significant role in regulating these agreements, ensuring that both investors and issuers adhere to governing laws.

-

Different states may have unique requirements regarding private placements that must be adhered to.

-

Understanding the obligations imposed on issuers and investors to ensure compliance.

-

Engaging attorneys can help draft compliant agreements that reflect the rights and obligations of all parties.

How can pdfFiller help with document management?

pdfFiller is an innovative platform designed to streamline document management. With its cloud-based capabilities, users can create, edit, sign, and manage Private Placement Agreements efficiently, regardless of location.

-

Use tools to create tailored documents that suit your specific needs.

-

Facilitate teamwork and document sharing among stakeholders effortlessly.

-

pdfFiller ensures sensitive documents are stored securely in the cloud, safeguarding against unauthorized access.

Real-world applications and examples of Private Placement Agreements

Understanding how Private Placement Agreements function in real scenarios is invaluable. They are often utilized by startups to raise funds or by established companies to issue new stocks.

-

Analyzing an actual agreement can reveal the practical structure and provisions.

-

Examining notable cases helps to identify best practices that can be replicated.

-

Ensure transparency and clarity in communication to foster trust and mitigate risks.

How to fill out the Private Placement Agreement Template

-

1.Open the Private Placement Agreement Template in pdfFiller.

-

2.Begin by entering the company name and address at the top of the document.

-

3.Fill in the date of the agreement to establish the timeline.

-

4.Specify the details of the securities being offered, including type, quantity, and price.

-

5.Identify the investors who will be participating in the private placement by listing their names and contact information.

-

6.Incorporate any conditions or rights tied to the ownership of the securities, such as voting rights or dividend provisions.

-

7.Draft sections regarding confidentiality, indemnity, and limitations of liability as applicable.

-

8.Review all entries for accuracy and ensure that terms reflect the agreed-upon points.

-

9.Save the completed document and consider seeking legal advice before signing.

-

10.Distribute copies to all parties involved for acknowledgment and adherence.

What is a private placement agreement?

In a private placement, the issuer only discloses its financial information to its investors, and its bonds are not made available in the secondary market. The issuer hires a private placement agent to act as an underwriter. This agent finds and secures sophisticated institutional investors for the new issue.

What documents are needed for private placement?

Before issuing the private placement offer, the company must ensure the following: File Form PAS-3 with the Registrar of Companies. Submit a copy of the board resolution. Pay the required filing fees. Provide details of the proposed offer.

Is a ppm the same as a subscription agreement?

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

How do you write a private agreement?

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Describe how the contract will end. Say which laws apply and how disputes will be resolved. Include space for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.