Private Placement Subscription Agreement Template free printable template

Show details

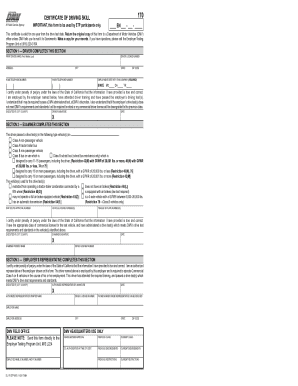

This document serves as a subscription agreement between a company and a subscriber for the purchase of shares in a private placement offering, outlining the terms, representations, warranties, and

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Placement Subscription Agreement Template

A Private Placement Subscription Agreement Template is a legal document used to outline the terms and conditions under which investors agree to purchase securities directly from a company.

pdfFiller scores top ratings on review platforms

etter than I imagined. Get court access, and you will be a hero...

Once I got use the new software I was feeling more confident.

For the forms used it was easy to put the text in just the right box

I haD an outstanding issue with CONCERNS AND CHAT SPECIALIST your order and HAS been able to resolve it with PDFfiller directly, Customer Care Resolution service, . RYAN S. WAS GREAT IN RESOLVING MY CONCERNS. THANK YOU,JACQUELINE NESBITT

Excellent! But I'm a farmer and only use it once a year!!!

When I used pdffiller, the recipients could not open the file.

Who needs Private Placement Subscription Agreement Template?

Explore how professionals across industries use pdfFiller.

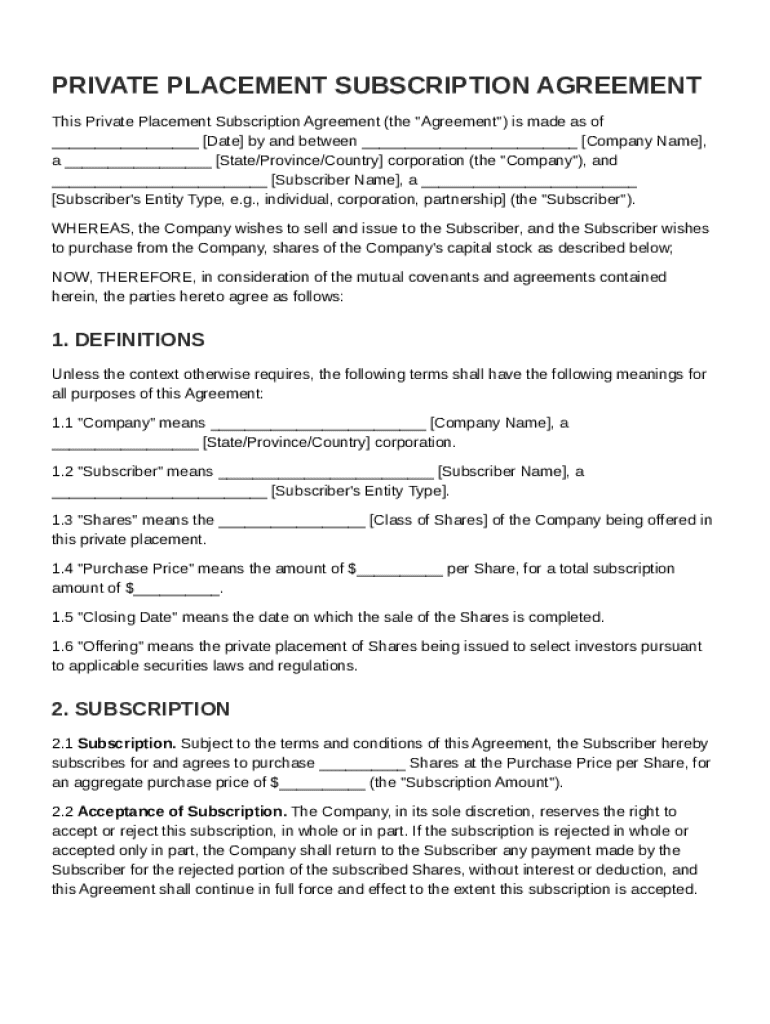

Understanding the Private Placement Subscription Agreement Template

When considering investment opportunities through a Private Placement Subscription Agreement Template, the process can seem daunting. This guide aims to clarify the key aspects of such an agreement, ensuring both companies and subscribers can navigate the complexities with ease.

What are the key terms essential to the agreement?

Defining the key terms is a critical step in formulating a Private Placement Subscription Agreement. Each term lays the groundwork for a transparent and legally binding transaction.

-

Identifies the issuer along with the relevant state and country of incorporation, ensuring clarity on the entity involved.

-

Specifies the entity type of the investor, such as an individual or corporation, which determines the rights and obligations set forth in the agreement.

-

Clearly outlines the class of shares being offered, which is crucial for understanding the type of equity being purchased.

-

Details the cost per share and total subscription commitment, allowing subscribers to fully understand their financial obligations.

-

Indicates when the transaction will be completed, providing a timeline for both parties involved.

-

Describes the private placement offering and its compliance with relevant securities laws, ensuring legal protocols are met.

How do navigate through the subscription process?

Understanding the subscription process is vital for both subscribers and companies. Proper navigation can minimize misunderstandings and foster successful investment transactions.

-

Emphasizes the agreement made by the subscriber to purchase shares at the specified price, forming the core of the legal commitment.

-

Clarifies the company’s right to accept or reject the subscription, making it essential for managing subscriber expectations.

-

Outlines the protocol for returning payments on rejected subscriptions, emphasizing the no-interest policy, which protects both parties.

What should know about the private placement offering?

The private placement offering is often crafted to meet specific fundraising needs while attracting suitable investors. Understanding its nuances can significantly affect investment success.

-

Explains the rationale behind launching a private placement, often aimed at raising capital for business expansion or project funding.

-

Defines who can participate in the offering, which varies according to applicable securities regulations, ensuring only qualified entities are involved.

-

Identifies the advantages for potential subscribers, including higher potential returns on investment compared to traditional public offerings.

What tips are useful for using pdfFiller’s editing features?

With tools like pdfFiller, editing your Private Placement Subscription Agreement Template becomes more manageable and efficient. Knowing how to leverage these features can streamline the subscription process.

-

Instructions on modifying template fields directly within pdfFiller enhance usability, ensuring the final document meets all requirements.

-

Overview of how to electronically sign and date agreements seamlessly, facilitating faster transactions.

-

Features that allow for team collaboration before finalizing subscriptions, improving the accuracy and efficacy of the agreement.

What are the compliance and legal considerations?

Compliance with local and federal regulations is non-negotiable in any investment process. Awareness of these legalities can protect companies and investors alike.

-

Outlines local compliance necessities relevant to your private placement, ensuring that all legal bases are covered.

-

Emphasizes the criticality of having a legal professional review the agreement prior to execution, reducing liabilities.

-

Highlights potential risks and strategic considerations for subscribers, aiding in informed decision-making.

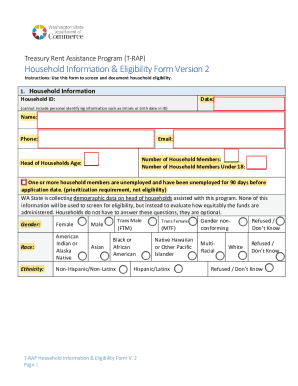

How to fill out the Private Placement Subscription Agreement Template

-

1.Download the Private Placement Subscription Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling in the company name and address where indicated on the document.

-

4.Input the details of the securities being offered, including the type and number of shares.

-

5.Fill in the purchase price per security and the total number of securities the investor intends to purchase.

-

6.Include the investor's name and contact information in the designated fields.

-

7.Provide any specific terms or conditions agreed upon between the company and the investor, if applicable.

-

8.Review all entered information for accuracy before finalizing the agreement.

-

9.Once reviewed, save the completed document in the desired format, or send it directly to the involved parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.