Pro Rata Rights Agreement Template free printable template

Show details

This document outlines the terms and conditions under which an investor can purchase additional shares of a company\'s equity securities to maintain their proportional ownership. It includes definitions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

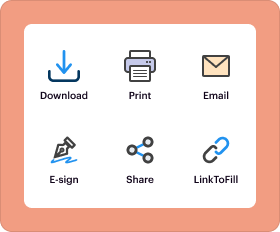

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Pro Rata Rights Agreement Template

A Pro Rata Rights Agreement Template is a legal document that outlines the rights of existing investors to maintain their percentage of ownership in a company during future financing rounds.

pdfFiller scores top ratings on review platforms

This is the most useful tool! When i first started using it, I had no idea how much I would later come to depend on PDF Filler! Thanks for making my home business a lot more productive. I've purchased a lot of tools to make things a lot easier but none have really delivered in the way PDFfiller has since it seems much of operating a small business (and life in general) is all about filling out form after form, lol.

Very easy to use. Simple directions and ease of use.

Great site! Very user-friendly, and saves me so much time. The template feature is awesome!

WORKS EXCELLENT, SAVES A LOT OF TIME INSTEAD OF WRITING

Works pretty good, but I'm learning the software

I love it!!! i paid an accountant twice this amount the do exactly what I've done here. it suits my needs perfectly.

Who needs Pro Rata Rights Agreement Template?

Explore how professionals across industries use pdfFiller.

Pro Rata Rights Agreement: Comprehensive Guide

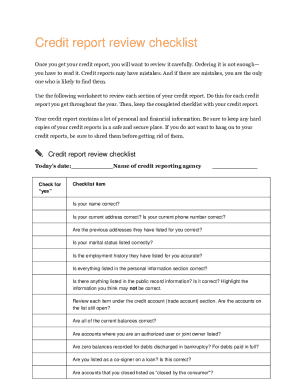

How to fill out a Pro Rata Rights Agreement form

Filling out a Pro Rata Rights Agreement is straightforward. Gather essential information such as the company name, state of incorporation, and the investor's name. Ensure that you complete every section accurately to avoid common pitfalls, creating a valid and binding agreement.

What are Pro Rata Rights?

Pro Rata Rights are provisions allowing investors to maintain their proportional ownership percentage in a company when new equity is issued. This is crucial in preventing dilution of their investment.

-

They ensure that existing investors can invest additional funds in future financing rounds to preserve their stake.

-

Proportional ownership ensures that investors' influence within the company remains stable as it grows.

-

Typically engaged during subsequent funding rounds or equity financing, where new shares are issued.

What are the essential components of a Pro Rata Rights Agreement?

A well-crafted Pro Rata Rights Agreement includes several key components that lay the foundation for the agreement's intent and function.

-

Clearly identify the investor and the company, as they are the primary parties to the agreement.

-

Define when the agreement takes effect and the legal jurisdiction it falls under.

-

Detail the types of shares or securities covered under the agreement, including definitions.

-

Include definitions for terms like Financing Round and Pro Rata Portion to avoid ambiguity.

How do fill out the Pro Rata Rights Agreement?

Filling out this agreement requires careful attention to detail. Start by gathering necessary information about the company and the investor.

-

Ensure you have the company name, state of incorporation, and investor name ready before starting.

-

Follow the guidelines set forth in the template to ensure completeness and accuracy.

-

Common errors include omitting information or misinterpreting terms, so refer back to the definitions provided.

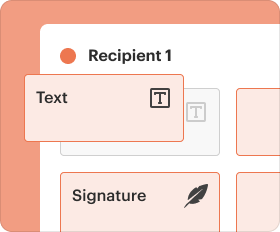

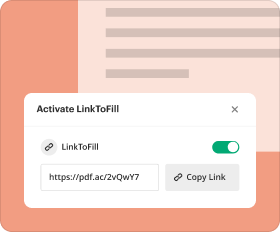

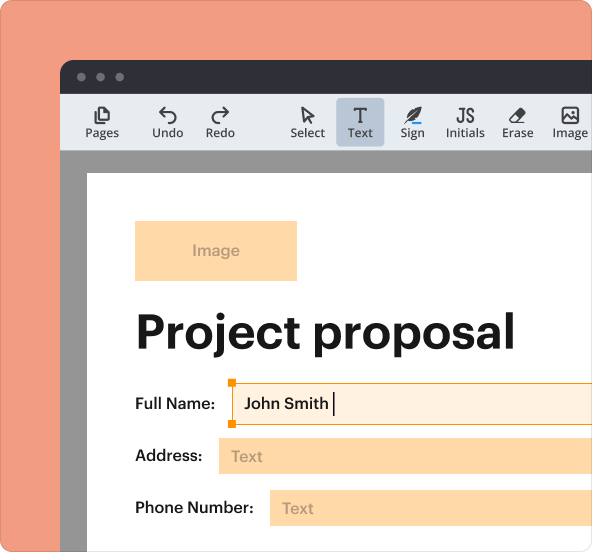

How to edit and customize your agreement on pdfFiller?

pdfFiller provides a user-friendly platform for customizing your Pro Rata Rights Agreement efficiently.

-

Engage with tools for editing text, adding images, or inserting signatures directly onto the pdf.

-

Once customized, easily save to different formats or export for sharing purposes.

-

Utilize collaboration features within pdfFiller to receive input from legal advisors or team members.

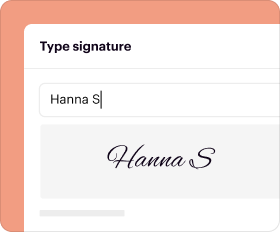

What is the role of eSignature in a Pro Rata Rights Agreement?

The convenience of eSigning documents using a cloud-based platform offers several benefits.

-

ESigning eliminates the need for printing, scanning, and mailing, speeding up the process.

-

Follow the platform's prompts to electronically sign your Agreement seamlessly and securely.

-

Ensure your eSignature meets legal standards for validity and traceability.

How to manage your Pro Rata Rights Agreement post-signing?

Post-signing, effective management of your agreement is crucial for ongoing compliance and reference.

-

Utilize pdfFiller's document storage to keep your agreement accessible at all times.

-

Maintain version histories for clarity if changes arise over time.

-

Utilize reminder features to ensure timely decision-making during future financing rounds.

What should know about compliance considerations for Pro Rata Rights Agreements?

Compliance considerations are critical for ensuring the smooth execution of a Pro Rata Rights Agreement.

-

Understanding state laws governing securities is essential for maintaining compliance.

-

Consult with legal professionals versed in investment agreements to avoid regulatory issues.

-

Employ resources such as the SEC or local legal services to remain informed on compliance matters.

How to fill out the Pro Rata Rights Agreement Template

-

1.Download the Pro Rata Rights Agreement Template from pdfFiller or upload your existing document.

-

2.Start by entering the company name at the top of the template in the designated field.

-

3.Fill in the names and addresses of all parties involved, including investors and the company.

-

4.Specify the percentage of ownership that each investor currently holds in the company.

-

5.Include the terms of the pro rata rights, such as the conditions under which these rights can be exercised.

-

6.Add any additional clauses or provisions relevant to the agreement, ensuring they align with legal requirements.

-

7.Review all filled sections for accuracy and completeness.

-

8.Once everything is correct, use the e-signature feature to sign the document digitally.

-

9.Finally, save the completed agreement and share it with all parties involved for their records.

What is a pro rata rights agreement?

Pro rata rights represent an agreement between an investor and a company, whereby the company provides the investor the right — but not the obligation — to participate in one or more future rounds of financing. Companies typically award these rights to select (not all) investors.

How to calculate pro rata rights?

The amount due to each shareholder is their pro rata share. This is calculated by dividing the ownership of each person by the total number of shares and then multiplying the resulting fraction by the total amount of the dividend payment.

What is an example of a pro rata clause?

A term meaning proportionately; apportioned according to a relative amount. For example, if two lenders each hold 50% of the loan, a pro rata distribution of a principal payment received by the borrower would mean that each lender would receive 50% of the principal payment.

What are the pro rata rights of SAFE note?

Pro-rata rights allow SAFE investors to maintain their ownership percentage by having the right (but not the obligation) to participate in future equity financing rounds on a pro-rata basis.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.