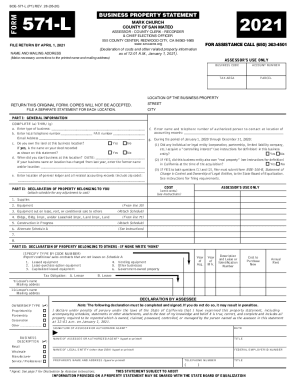

Profit Sharing Agreement Template free printable template

Show details

This document outlines the terms and conditions for the sharing of profits between two parties involved in a business venture, detailing their responsibilities, profit distribution, and dispute resolution

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Profit Sharing Agreement Template

A Profit Sharing Agreement Template is a legal document that outlines the terms and conditions under which profits will be shared among parties involved in a business venture.

pdfFiller scores top ratings on review platforms

great

user friendlly

Very easy to use

Best App ! Very handy!!

I wish it was a little easier to type things into my papers however I am getting the hang of it, I dont like that sometimes I will click in an area and the typing bar doesnt appear where I clicked on, but near the area, sometimes thats in the middle of a line on the page and thats annoying.

I love it..... It help me out so much. Thank you for making this for small business. I love it again !!!

Who needs Profit Sharing Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to profit sharing agreement template

A Profit Sharing Agreement Template form is essential for businesses aiming to establish clear terms for sharing profits among partners or stakeholders. This guide provides in-depth insights into how to create and utilize this template effectively.

What is a Profit Sharing Agreement?

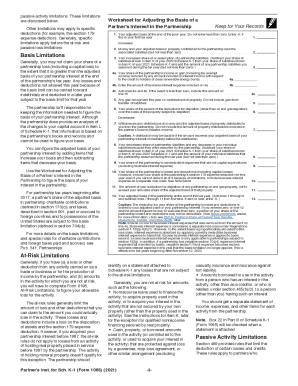

A profit sharing agreement is a legal document outlining how profits generated from a business venture will be distributed among the involved parties. Utilizing a template helps ensure consistency, clarity, and legal compliance in profit-sharing arrangements. Key legal considerations include the definitions of net profits, tax implications, and potential liabilities.

-

This agreement specifies how profits will be allocated between parties, crucial for partnership transparency.

-

A template standardizes the agreement, reducing the risk of misunderstandings and legal complications.

-

Includes understanding tax obligations, the legal standing of the agreement, and enforceability.

Who are the parties involved in the agreement?

Defining the parties in a profit sharing agreement is critical for clarity. Typically, there are two main parties, often referred to as Party A and Party B. Accurately specifying the details of these parties helps prevent disputes and ensures proper recognition within legal contexts.

-

Clearly identify the entities or individuals involved to establish roles within the agreement.

-

Correct identification prevents future legal conflicts and confusion regarding responsibilities.

-

Select parties based on their roles, contributions, and the overall impact on the business venture.

What are the key elements of the Profit Sharing Agreement?

Key elements in a profit sharing agreement ensure that all parties understand their rights and obligations. These components can include the effective date, business venture description, how net profits are calculated, and distribution methods for the profits.

-

Formalizes when the agreement is established and when the terms become operational.

-

Clearly outlines the business’s focus, scope, and the operations involved.

-

Net profits should be explicitly defined to avoid misinterpretation and mitigate disputes.

-

Clarifies how and when profits will be distributed, which affects cash flow and party relations.

What are the responsibilities of the parties?

Outlining the responsibilities of each party involved in the agreement fosters accountability. This section should detail each party’s contributions to the business venture and clarify their roles and liabilities within the collaborative framework.

-

Clearly delineate who is doing what to avoid overlaps and ensure efficient operations.

-

Each party must comprehend their legal standing as per the agreement to avoid potential conflicts.

-

Use clear language and structured formatting to prevent ambiguity in the responsibilities outlined.

How does termination affect profit sharing?

The termination clause describes the conditions under which the profit sharing agreement can be dissolved. It's imperative to outline what happens to profit distribution upon termination, ensuring all parties have a clear understanding of the implications.

-

Outline specific triggers for termination, such as breach of contract or mutual consent.

-

Clarify how profits will be handled upon dissolution, preventing unexpected outcomes for any party.

-

Provide a step-by-step process in the agreement for terminating the contract, ensuring all parties are informed.

What are indemnification clauses?

Indemnification clauses protect parties from losses incurred due to another party’s actions. These clauses are vital in safeguarding the interests of all parties involved in the agreement.

-

Acts as a safeguard against legal actions or claims arising from operational decisions.

-

Include details on coverage, limitations, and the claims process to ensure clarity.

-

Consider case studies where indemnification clauses were invoked to highlight their importance.

How do you edit and sign the agreement with pdfFiller?

Using pdfFiller streamlines the creation and editing process of your Profit Sharing Agreement. This platform allows users to make necessary adjustments, electronically sign the document, and collaborate easily with other stakeholders.

-

Begin with a template and customize it to fit your specific business needs efficiently.

-

Follow user-friendly prompts within pdfFiller to securely sign the document from any device.

-

Share the document digitally, allowing for comments and edits, making collaboration hassle-free.

How to manage your Profit Sharing Agreement?

Proper management of your profit sharing agreement is crucial for compliance and review. Using tools like pdfFiller, you can store documents securely in the cloud, track amendments, and ensure that your agreements remain up-to-date.

-

Utilize cloud storage features to protect sensitive information and facilitate access from any location.

-

Document changes directly within the platform to provide a clear history of the agreement's evolution.

-

Follow regulatory guidelines for document retention and openness to audits.

What common mistakes should be avoided?

When drafting a profit sharing agreement, it’s easy to overlook critical details. Common mistakes include neglecting important terms, unclear responsibilities, and failing to keep the agreement updated as business conditions change.

-

Every important aspect must be captured to prevent future disputes and confusion.

-

Ambiguous roles can lead to misunderstandings and could negate the purpose of the agreement.

-

Regular review is essential to ensure the agreement remains relevant and enforceable.

What is the future of profit sharing agreements?

Profit sharing agreements are evolving, with new trends and technologies shaping how they are developed and executed. As industries change, so do the legal landscapes that regulate these agreements.

-

Profit sharing is becoming more common in different sectors, expanding from traditional partnerships to cooperative business models.

-

Technological advancements simplify the creation and management of these agreements, promoting transparency.

-

Stay informed about upcoming legislation that could affect how these agreements are structured.

How to fill out the Profit Sharing Agreement Template

-

1.Download the Profit Sharing Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and review the pre-filled sections.

-

3.Insert the names of all parties involved at the beginning of the document.

-

4.Specify the profit-sharing percentages for each party in the designated section.

-

5.Outline the terms and conditions of the profit-sharing arrangement, including how and when profits will be distributed.

-

6.Include any additional clauses or provisions that are relevant to the agreement.

-

7.Review the entire document for accuracy and completeness.

-

8.Sign the agreement electronically using pdfFiller's signing features, or print it for manual signatures.

-

9.Save a copy of the finalized agreement for all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.