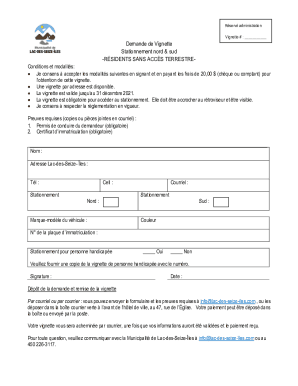

Promise to Pay Agreement Template free printable template

Show details

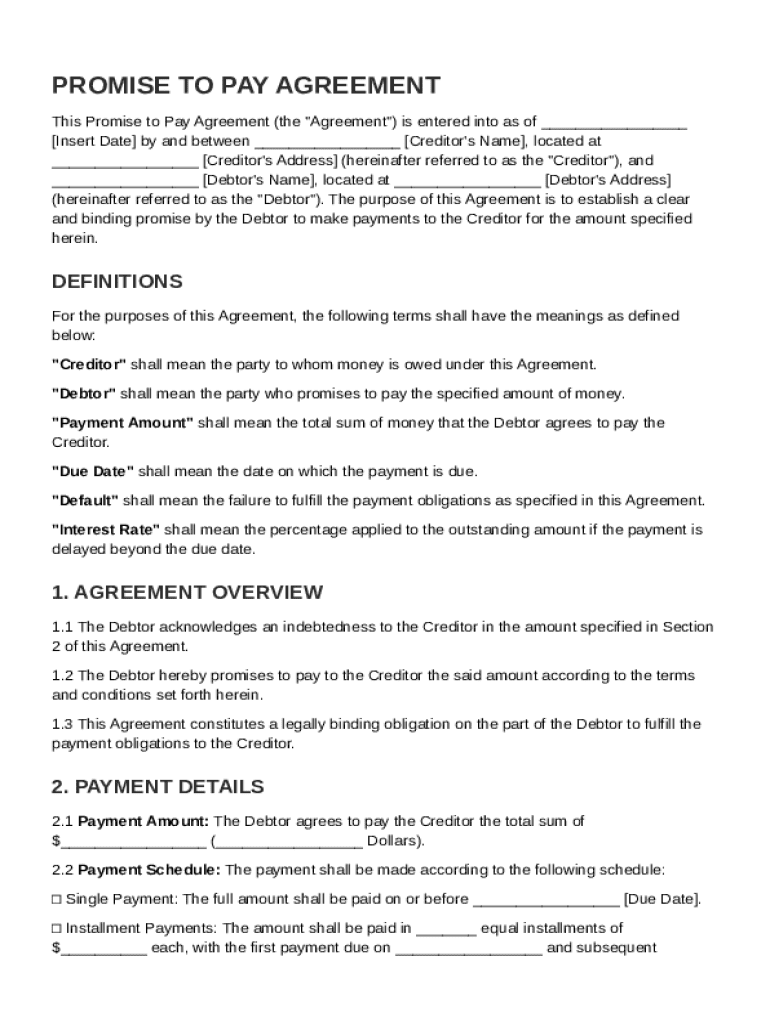

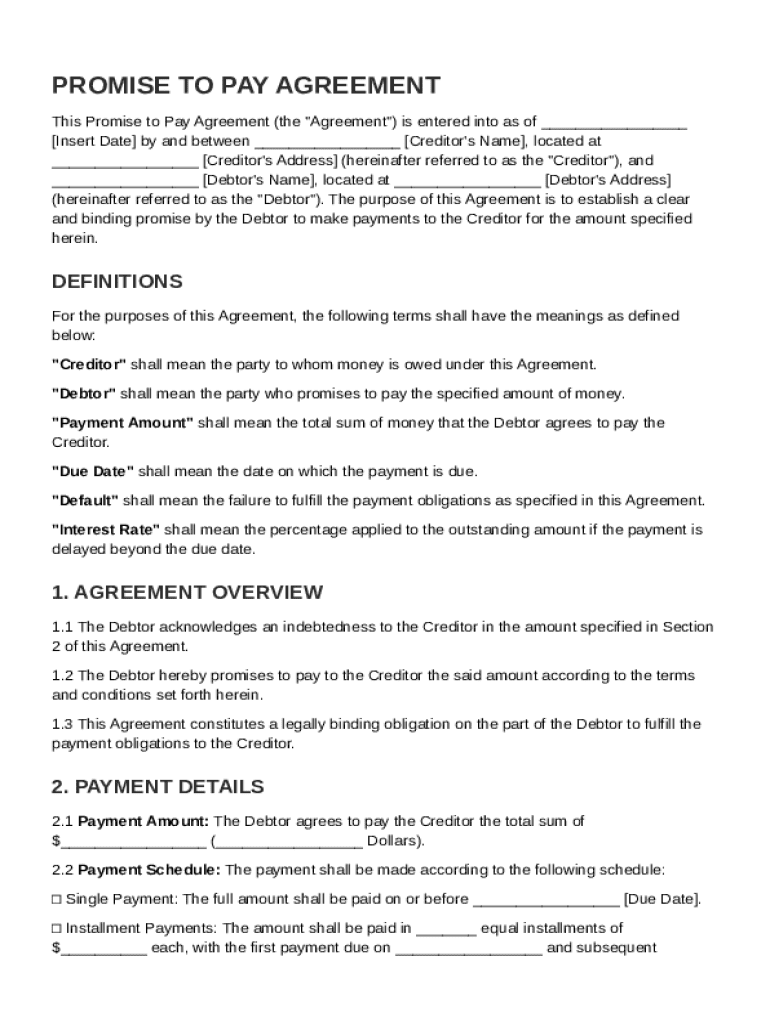

This document establishes a binding agreement between a debtor and creditor for the repayment of a specified amount of money under defined terms and conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promise to Pay Agreement Template

A Promise to Pay Agreement Template is a legal document in which one party agrees to repay a specific amount of money to another party within a defined timeframe.

pdfFiller scores top ratings on review platforms

Good

Good. Easy to use

Wait and see. No rush...

Like it

Me gusta, pero creo que tiene mas aplicaciones útiles que debería ver con más detalle:)

User Friendly and easy to use.

Simple to use(edit) and easy to upload & send to using various options

Who needs Promise to Pay Agreement Template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Promise to Pay Agreement

What is a Promise to Pay Agreement?

A Promise to Pay Agreement is a legally binding document outlining the borrower's commitment to repay a specified amount to the lender. This agreement is crucial in personal and business transactions, ensuring both parties understand their obligations. It typically includes essential components like payment amounts, due dates, and any potential interest rates, making it important for maintaining trust and clarity in financial dealings.

-

A Promise to Pay Agreement formalizes a debtor's commitment to repay a debt.

-

These agreements protect creditors and provide a clear structure for debt repayment.

-

Failure to comply with terms may lead to legal action against the debtor.

What are the essential elements of the agreement?

The core elements of a Promise to Pay Agreement include crucial information about both the creditor and debtor, alongside payment specifics. Collectively, these elements ensure all parties know their rights and responsibilities. This clarity helps minimize misunderstandings and legal disputes.

-

Include the creditor's name, address, and contact details.

-

Document the debtor's name, address, and phone number.

-

Clearly state the total amount owed.

-

Set a specific date for when the payment is due.

-

Specify any interest rates applicable to the borrowed amount.

-

Outline what constitutes a default and the penalties for failing to pay.

How do you fill out the agreement?

Filling out a Promise to Pay Agreement can be straightforward with the right tools. Select a form, gather the necessary information, and follow the provided steps to ensure accuracy and completeness.

-

Choose the appropriate template from pdfFiller that meets your needs.

-

Input creditor and debtor details accurately.

-

Clearly state the total amount due.

-

Make sure these sections reflect your agreement.

-

Include consequences of defaulting to protect yourself.

-

Use eSignature to validate the agreement legally.

What are the payment details to consider?

Understanding payment structures within your Promise to Pay Agreement is vital. Whether opting for a single payment or structured installments, clarity in the payment schedule can prevent confusion.

-

Determine if the debtor will make a single lump-sum payment or follow an installment plan.

-

Clearly outline the dates and amounts to ensure compliance.

-

Use available templates to visualize various options.

-

Include provisions to renegotiate terms if necessary.

What legal considerations should you keep in mind?

Local laws play a significant role in the validity of your Promise to Pay Agreement. It's essential to understand usury rates and compliance with applicable state and federal laws that may affect your terms.

-

Research how specific state regulations may impact your agreement.

-

Ensure your interest rate aligns with legal limits to avoid penalties.

-

Regularly check for updates on laws affecting your agreement.

-

Leverage resources available on pdfFiller to stay informed about compliance.

How can you leverage pdfFiller for document management?

pdfFiller offers robust features for editing and managing your Promise to Pay Agreement. These tools facilitate customization, collaboration, and efficient tracking, ensuring your documents are up-to-date and compliant.

-

Easily modify your agreement templates as needed.

-

Share documents and collaborate in real-time with stakeholders.

-

Monitor the status of your documents for better management.

-

Use electronic signatures to ensure legal validity of your contracts.

How to fill out the Promise to Pay Agreement Template

-

1.Open the Promise to Pay Agreement Template in pdfFiller.

-

2.Begin by entering the date at the top of the document where indicated.

-

3.Identify the parties involved by filling in the borrower’s and lender’s full names and addresses in the designated fields.

-

4.Clearly state the total amount to be repaid, ensuring you include both the principal and any agreed-upon interest.

-

5.Specify the repayment terms, including the due date and any payment schedule if applicable.

-

6.Review any default terms outlined in the document to ensure clarity on penalties or late fees.

-

7.Sign the agreement in the designated area and have the lender sign as well to finalize the contract.

-

8.Save a copy of the completed agreement for both parties' records and consider having it notarized for added legal assurance.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.