Promissory Agreement Template free printable template

Show details

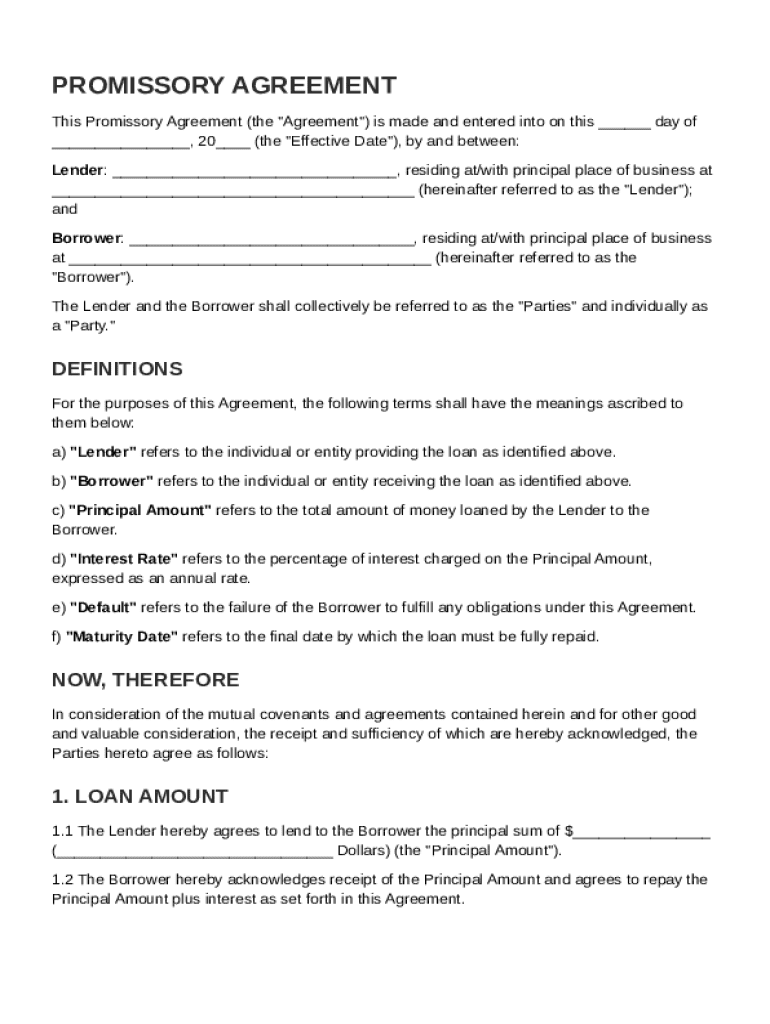

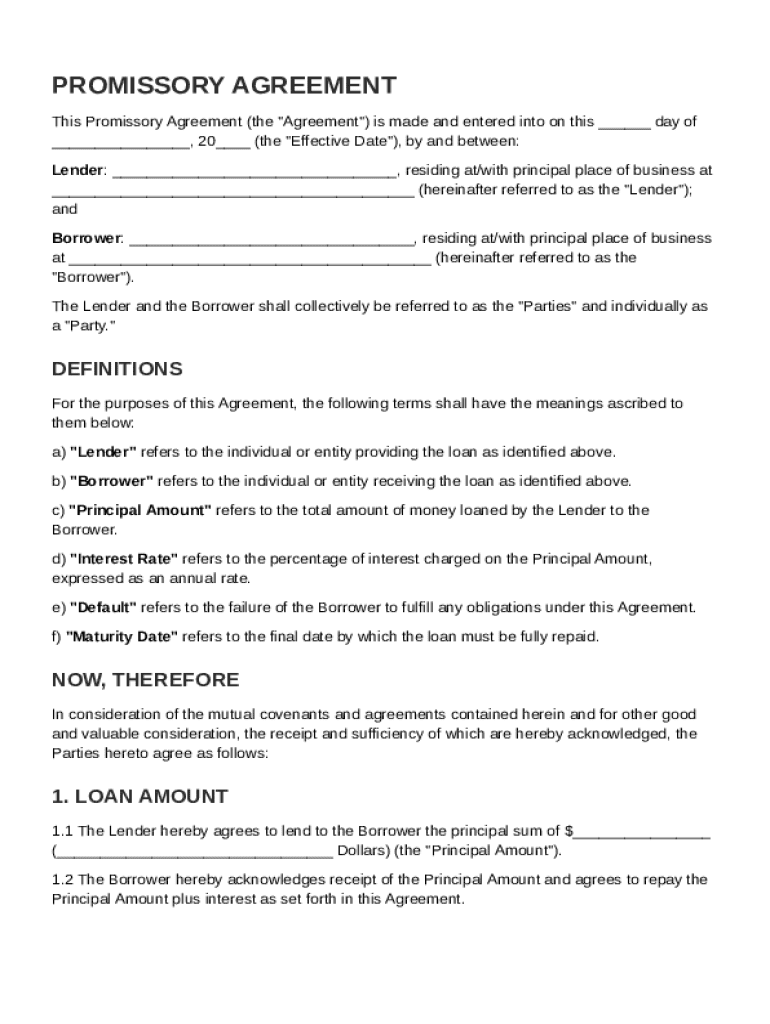

This document serves as a legal agreement outlining the terms of a loan between a Lender and a Borrower, including definitions, repayment terms, interest rates, and legal obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promissory Agreement Template

A Promissory Agreement Template is a legal document wherein one party agrees to pay a specific amount of money to another party under agreed-upon terms.

pdfFiller scores top ratings on review platforms

a ten

Easy to use

THEY MAKE IT EASY TO USE AND UNDERSTAND TO GET THE DOCUMENTS YOU NEED

Medical doctor

Actually editing my papers and lieratures and pdfs making them more good looking and more professional

It can upload update and recreat documents in a very professional way acutallly i do use these in my work

Yes some editing buttons r felt missing i think sometime i had to go to microsoft office then copy past but the problem is i cant do that as theformatting is dufferent so i would prefer to but genuine more options in side the app

It's so easy to use

This tool makes my pdf works in a very quick and easy way

There is any bad experiences in my pdf works

VERY GOOD EXPERIENCE

Who needs Promissory Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Promissory Agreement Template Guide

How to fill out a Promissory Agreement Template form

A Promissory Agreement is a written promise from one party to another to repay a specified amount of money, often with interest, within a designated time frame. Filling out a Promissory Agreement Template accurately is crucial to ensure legal validity and protection for both the lender and borrower.

Understanding Promissory Agreements

A Promissory Agreement is essential for outlining the terms of a loan, acting as a legal document evidencing that one party owes money to another. It defines the obligations of both parties and is significant in preventing potential conflicts.

-

This agreement serves as a formal record of a loan, stipulating repayment terms to ensure accountability.

-

It's used when lending or borrowing money to clarify terms and conditions, minimizing risks and misunderstandings.

-

Important terms include 'principal amount,' 'interest rate,' and 'maturity date,' each pivotal to the agreement's enforceability.

What are the Components of the Promissory Agreement?

A well-structured Promissory Agreement includes several key components that must be accurately completed to ensure clarity and legality.

-

Include the name, address, and contact details of the lender.

-

Document the borrower's full name, address, and any identification details.

-

Clearly specify how much money is being lent.

-

State whether it’s fixed or variable, and describe how it will be calculated.

-

Outline what constitutes a default, including missed payments.

-

Define the date the loan is to be fully repaid.

How to fill out the Promissory Agreement Template?

Following a step-by-step approach simplifies filling out the Promissory Agreement Template and minimizes mistakes.

-

Start by filling in the lender and borrower information, then detail the loan amount, interest rate, and repayment terms.

-

Ensure all names are spelled correctly and that monetary values are accurate.

-

Use pdfFiller’s features to simplify the process, offering templates and digital signing options.

What are some best practices for editing and customizing your agreement?

Customization enhances the clarity of your Promissory Agreement to fit specific situations and needs.

-

Access pdfFiller for tools that allow easy modification and updating of your documents.

-

Keep terminology consistent and clear, and ensure all fields reflect accurate and updated information.

-

Choose editable formats that suit your workflow and ensure interoperability with other software.

What are your options for signing the Promissory Agreement?

Signing solidifies the agreement's terms and can be done effectively with various methods.

-

Digital signatures, facilitated by pdfFiller, provide a secure way to sign and save documents.

-

In many jurisdictions, eSignatures hold the same legal weight as traditional signatures.

-

Store the signed documents securely and maintain copies for your records.

How to manage your Promissory Agreement effectively?

Effective management ensures compliance and timely payments, thus reducing risks.

-

Keep all documentation organized and easily accessible for reviews and reconciling.

-

Regularly check payment schedules to promptly address any missed payments.

-

Benefit from cloud storage for enhanced data security and easy accessibility.

What are the compliance and legal considerations?

Understanding compliance ensures that the Promissory Agreement adheres to required legal standards.

-

Research local laws regulating Promissory Agreements to ensure adherence.

-

Ignoring compliance can lead to legal disputes and potential penalties.

-

Utilize pdfFiller tools that provide updated information and draft templates adhering to current regulations.

How does a Promissory Agreement compare with other financial agreements?

Differentiating between various types of financial agreements helps in choosing the right option for your needs.

-

While both documents involve borrowing money, Promissory Agreements are often less formal and may not require collateral.

-

Secured agreements involve collateral, while unsecured agreements do not, affecting the terms and interest rates.

-

Review options like Unsecured Promissory Note Templates to find what best fits your needs.

How to fill out the Promissory Agreement Template

-

1.Access the Promissory Agreement Template on pdfFiller.

-

2.Review the template to understand the required sections, including borrower and lender information.

-

3.In the first section, enter the full name and address of the borrower and the lender.

-

4.Specify the loan amount in numerical and written form to avoid misunderstandings.

-

5.Choose the repayment terms, including the interest rate, payment schedule, and due dates.

-

6.Include any collateral details if applicable, and state the consequences of a default.

-

7.Review the template for completeness and accuracy, making adjustments as necessary.

-

8.Sign and date the document, and ensure the lender does the same to validate the agreement.

-

9.Save the filled template in a secure location and consider distributing copies to all parties involved.

How to write a promissory agreement?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

Does Microsoft Word have a promissory note template?

Begin by locating a suitable promissory note template. You can find templates within Word's template library or download them from reputable online sources. Look for templates that adhere to legal standards and include essential sections such as identification of parties, loan amount, payment terms, and interest rates.

How do you write a promise to pay agreement?

How do I write a Promise to Pay? Title: Clearly label the document as a “Promise to Pay” or “Promissory Note.” Date: Include the date of the agreement. Parties Involved: Specify the names and addresses of both the lender and borrower. Principal Amount: Clearly state the amount of money being borrowed.

What is a promissory note example?

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.