Promissory Loan Agreement Template free printable template

Show details

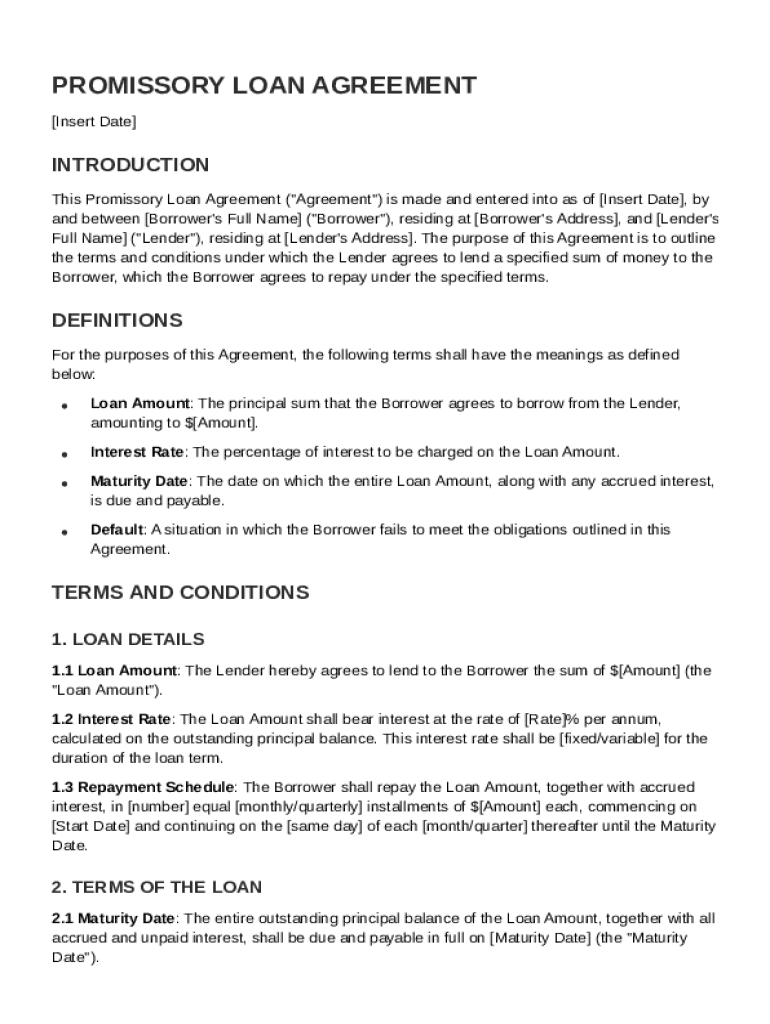

This document outlines the terms and conditions of a loan agreement between a borrower and a lender, including loan amount, interest rate, repayment schedule, and responsibilities of both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promissory Loan Agreement Template

A Promissory Loan Agreement Template is a legal document in which one party agrees to lend money to another party under specific terms and conditions for repayment.

pdfFiller scores top ratings on review platforms

iT IS AN ENJOYMENT. wORKS BETTER THAN OTHERS.

Sometimes confusing. Hard to remember to save docs as fillable pdf since it's a separate menu you have to click on to display.

Used once to extend lease. Plan to study further how I can use in my real estate rental business.

I dont use this often but when i do its a lifesaver.

Great customer service with quick response time too

Greatest app out there for managing, creating and editing PDFs

Who needs Promissory Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Promissory Loan Agreement Template Forms on pdfFiller

This guide provides essential information on filling out a Promissory Loan Agreement Template form using pdfFiller. By following the steps outlined herein, individuals and teams will gain clarity and efficiency in creating legally binding documents.

What is a promissory loan agreement?

A promissory loan agreement is a written contract in which one party agrees to pay a specific amount of money to another party under agreed-upon terms. This document serves as a legal assurance that a loan will be repaid, thereby outlining the rights and responsibilities of both the borrower and the lender.

-

The primary purpose of this agreement is to create a formal agreement about the loan to avoid disputes.

-

Typically includes loan amount, terms of repayment, interest rate, and signatures.

-

Clearly outlines expectations, making it critical for financial transparency and accountability.

What key terms should be included in a promissory loan agreement?

-

Specify the total amount borrowed, making it clear to both parties.

-

Discuss whether the rate is fixed or variable; this affects total repayment.

-

Indicates when the loan is due; critical for both parties to manage their finances.

-

Defines what constitutes a default and its consequences; avoids legal issues later.

How do you fill out the promissory loan agreement template?

Filling out a Promissory Loan Agreement Template on pdfFiller is straightforward. Users can follow a step-by-step guide to ensure completeness and compliance.

-

Navigate to the template page on pdfFiller, fill in required fields, and ensure accurate details.

-

Use pdfFiller's editing features, like drag-and-drop, to streamline the process.

-

Double-check all information for accuracy; overlooking these can lead to issues during enforcement.

How can you manage and edit your promissory loan agreement?

Managing completed agreements is easy with pdfFiller's document management platform, which offers tools for editing, signing, and sharing.

-

Store completed agreements securely in the cloud, accessible anytime.

-

Securely sign documents electronically, eliminating the need for physical papers.

-

Utilize features that enable teamwork when handling multiple agreements or large projects.

What are the legal considerations and compliance requirements for promissory loans?

Understanding local regulations is crucial to ensure that your promissory loan agreement is enforceable. Each region may have specific requirements that can affect the legality of loan agreements.

-

Research laws in your area, as they can differ significantly from one jurisdiction to another.

-

Ensure all agreements meet legal standards; consider consulting a legal expert.

-

Use templates tailored for various loan types to ensure proper language and terms.

What different types of promissory loans exist?

-

These loans require collateral; in case of default, the lender can claim the asset.

-

Do not require collateral but typically come with higher interest rates due to increased risk.

-

Secured loans are preferable for large sums, while unsecured loans might be suitable for smaller amounts.

-

Consider your financial situation, loan amounts, and the level of risk you're willing to take.

How can pdfFiller tools aid in document management?

pdfFiller provides a comprehensive suite of cloud-based document management features that enhance workflow and ensure document security. Their platform is designed to simplify the creation and management of documents, making it an essential tool for users.

-

Access documents from anywhere with internet connectivity, ensuring flexibility.

-

Streamlined processes for signing documents electronically, enhancing efficiency.

-

Intuitive design minimizes the learning curve, thereby improving user experience and productivity.

How to fill out the Promissory Loan Agreement Template

-

1.Download the Promissory Loan Agreement Template from pdfFiller or create a new document using the template feature.

-

2.Begin by filling in the date at the top of the document to indicate when the agreement is being made.

-

3.Next, clearly state the names and addresses of both the lender and the borrower in the designated fields.

-

4.Specify the loan amount in both numerical and written form to avoid confusion.

-

5.Include the interest rate applicable to the loan, if any. Clearly define whether it’s a fixed or variable rate.

-

6.Set the repayment schedule detailing when and how payments will be made (e.g., monthly, quarterly).

-

7.Outline the consequences of default, specifying any fees, penalties, or actions the lender may take.

-

8.Include any additional clauses that may be relevant, such as prepayment options or collateral requirements.

-

9.Finally, provide spaces for both parties’ signatures and date lines to confirm the agreement's acceptance and execution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.