Promissory Note Loan Agreement Template free printable template

Show details

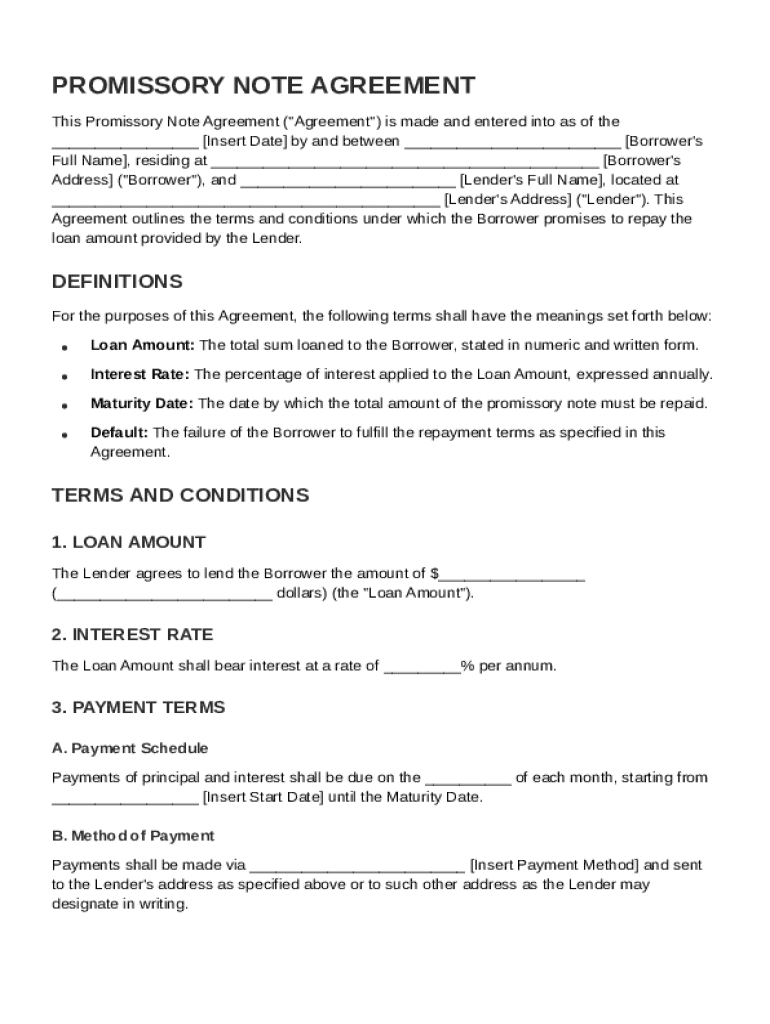

This document outlines the terms and conditions under which a borrower promises to repay a loan amount provided by a lender, including definitions, loan amount, interest rate, payment terms, maturity

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promissory Note Loan Agreement Template

A Promissory Note Loan Agreement Template is a legal document outlining a borrower's commitment to repay a loan under specified terms.

pdfFiller scores top ratings on review platforms

Once I was forced to purchase it I have used it's tools and support with files I need to update and/or add.

As an attorney, PDF Filler makes redaction for discovery easy. This product is a lifesaver in dealing with any type of litigation.

Support was excellent! I had trouble sending 28 page document and all I needed to do was change my setting and support showed me steps! Great job!!!

I have barely used this, but for what I've accomplished so far it is great!

Delivers desktop speed with a superb user interface - considerably better than anticipated. All at lower than brand leading cost.

Loyyang Alfred Moses David

In perth western australia

4 mayer close noranda 6062

ph 61405 384 842

Need help urgently. Do not requisite knowledge

bit coin

14kbbfdQQKbJ1bE7GnYNxsaEZNCuTjh8so

Bank Account

BANK OF melbourne

bsb 193-879

acc: 476-505-531

Who needs Promissory Note Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to a promissory note loan agreement template

This guide will help you understand how to fill out a Promissory Note Loan Agreement Template form effectively. The process involves knowing the definition, critical components, and additional factors that influence your agreement.

What is a promissory note agreement?

A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time or on-demand. The primary purpose is to serve as a legal document that outlines the terms of a loan.

-

Promissory notes are often used in both personal and business transactions to confirm loan terms clearly.

-

The basic components include the loan amount, interest rate, due date, and signature of the borrower and lender.

-

Ensuring clarity in loan agreements is crucial to avoid disputes and misunderstandings later on.

What are the key components of the agreement?

Understanding the key components of a promissory note is vital for both parties involved in the agreement. Each component carries specific implications.

Definitions

-

This is the total sum of money borrowed. For example, if you take a loan of $10,000, this amount is specified in the note.

-

The interest rate is the cost to borrow the money, typically expressed as an annual percentage. It determines how much more the borrower will repay over time.

-

This is the date by which the borrower agrees to pay back the loan completely. It's essential to set a clear deadline.

-

Default occurs when the borrower fails to meet the payment terms. This can lead to legal repercussions and added financial burdens.

Terms and conditions

-

The document should specify the total loan and any stipulations concerning its use.

-

Details on how the interest will accrue and be calculated should be included.

-

A breakdown of when payments are due and accepted methods, such as bank transfer or check, should be clarified.

-

Providing clear dates when payments are due adds structure to the agreement.

-

Potential penalties for missed payments must be communicated to the borrower.

How to fill out the promissory note agreement?

Filling out a promissory note requires careful attention to detail. Here’s a step-by-step guide that simplifies the process.

-

Begin by entering basic information such as the names of the borrower and lender.

-

Ensure all contact information, including addresses, is accurately included.

-

Having clear examples of completed forms can guide you through the process effectively.

-

When discussing interest rates or payment schedules, make sure to document any changes to the initial terms.

How to edit and manage your promissory note?

Managing a promissory note doesn’t stop once it’s filled out. With pdfFiller, you can make edits and store documents efficiently.

-

Editing PDFs and obtaining digital signatures can be done quickly and easily.

-

The ability to manage documents from any device ensures accessibility and convenience.

-

pdfFiller offers team collaboration features, which streamline document sharing and editing.

-

You can keep track of changes over time, ensuring all edits are accounted for.

What are the legal considerations and compliance basics?

Legal compliance is a critical aspect of any promissory note. Each region may have specific requirements that must be adhered to.

-

Make sure to understand the stipulations that apply within your jurisdiction regarding promissory notes.

-

Adhering to government regulations is crucial, especially in business transactions.

-

Utilizing digital forms can help maintain legality and organization in documentation.

-

Consulting with a legal professional during drafting ensures that all terms are enforceable.

How does a promissory note compare to other agreements?

Exploring alternatives to promissory notes can provide insight into what works best for your financial arrangements.

-

Unsecured promissory notes differ significantly, as they do not have collateral backing them.

-

Beyond promissory notes, several forms exist such as loan contracts and credit agreements.

-

Evaluate the financial arrangement and choose the most suitable document accordingly.

-

Awareness of typical mistakes, such as overlooked details, can prevent future issues.

How to fill out the Promissory Note Loan Agreement Template

-

1.Download the Promissory Note Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling out the date at the top of the document.

-

4.Enter the names and addresses of both the borrower and the lender in the designated fields.

-

5.Specify the principal amount of the loan clearly.

-

6.Indicate the interest rate, if applicable, and whether it is fixed or variable.

-

7.Define the repayment schedule, including the start date and due dates for each payment.

-

8.Include any late fees or penalties for missed payments.

-

9.Add any additional terms or conditions relevant to the loan agreement.

-

10.Review the filled document for accuracy and completeness.

-

11.Save the completed Promissory Note Loan Agreement Template as a PDF.

-

12.Share or print the document for both parties to sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.