Promissory Note Payment Agreement Template free printable template

Show details

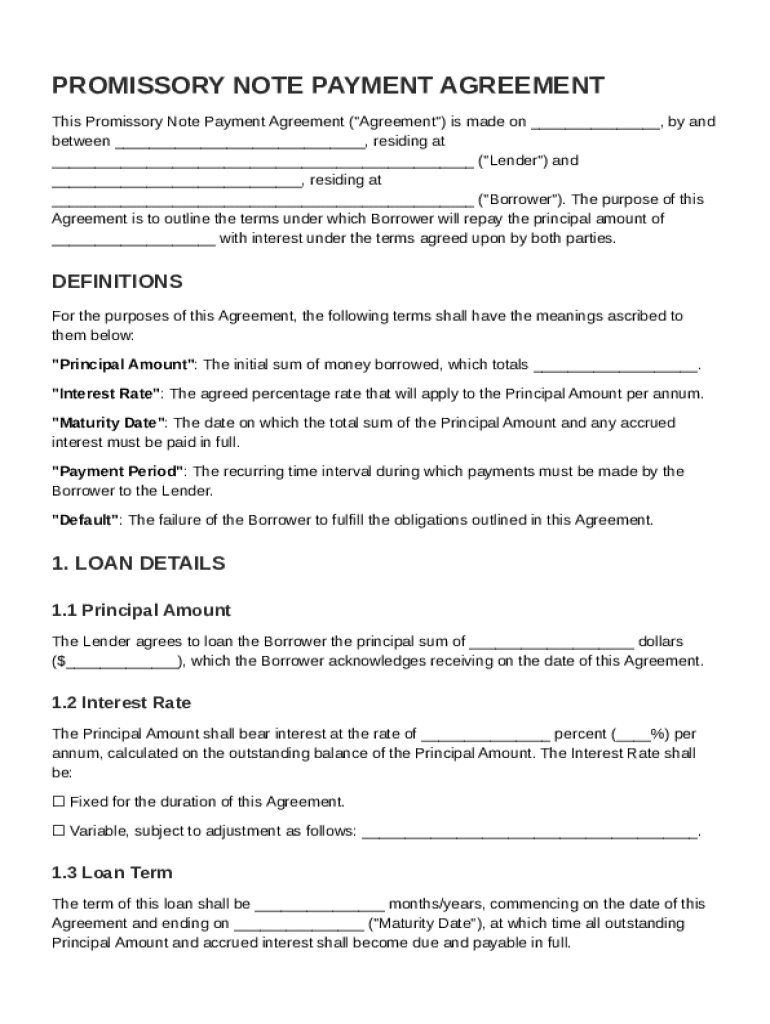

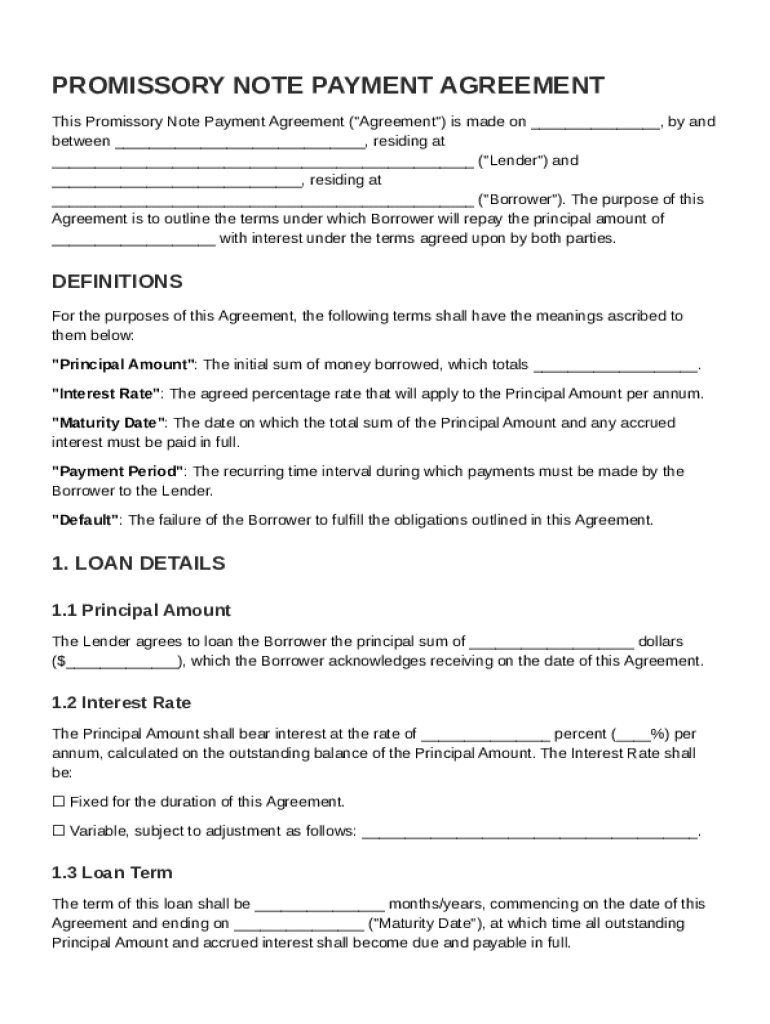

This Agreement outlines the terms under which a Borrower repays a loan, including Principal Amount, Interest Rate, Maturity Date, and payment terms.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

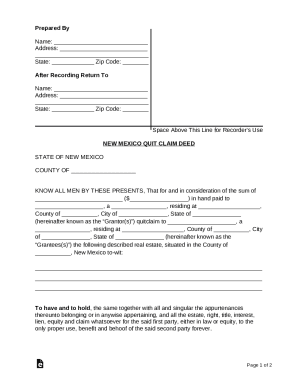

What is Promissory Note Payment Agreement Template

A Promissory Note Payment Agreement Template is a legal document wherein one party promises to pay a specified sum to another party under agreed terms.

pdfFiller scores top ratings on review platforms

very satisified with this program.It is…

very satisified with this program.It is going to helpme get the things i need to get done.Thank you

The program works amazing wish it was…

The program works amazing wish it was easier to inport templates for medical billing documentation, but we made it work

LOVE THIS WEBSITE AMAZING

LOVE THIS WEBSITE AMAZING

simple

simple, easy

works well.

works well, easy to use.

Basically does what I need

Basically does what I need. Could use better Help function. Example: I haven't figured out how to control the type font used nor how to match existing fonts in a document.

Who needs Promissory Note Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Landing Page for Promissory Note Payment Agreement Template on pdfFiller

How to fill out a Promissory Note Payment Agreement Template form

To fill out a Promissory Note Payment Agreement Template form, start by defining the principal amount, interest rate, and maturity date. Ensure you include payment terms and methods for repayment. Finally, customize the template using pdfFiller's editing tools and eSigning features to create a legally binding agreement.

Understanding the Promissory Note Payment Agreement

A Promissory Note Payment Agreement is a legal document wherein one party agrees to pay a specified sum of money to another. Its primary purpose is to formalize loan terms and conditions, providing security to both lenders and borrowers. Understanding this agreement is crucial, as it governs the terms of repayment and the obligations involved.

-

It clearly outlines the borrower's commitment to repay the loan under specified terms.

-

These agreements help in managing loans effectively, minimizing misunderstandings between involved parties.

-

By signing, both parties enter a legally binding contract that enforces the terms laid out in the document.

What are the key components of the Promissory Note Payment Agreement?

A robust Promissory Note contains several essential components that define the financial relationship between the lender and the borrower. Each component serves a specific purpose and should be clearly articulated in the agreement for it to hold legal weight.

-

This is the total amount borrowed, which serves as the basis for interest calculations.

-

It's crucial to distinguish between fixed and variable rates, as they greatly affect repayment amounts.

-

This date indicates when the loan needs to be fully repaid, impacting the borrower’s financial planning.

-

Specifies the frequency of payments, such as weekly or monthly, which influences cash flow management.

-

Includes standard terms that delineate liability and obligations for both parties.

How to craft your loan details

Correctly outlining loan details in your agreement is critical. This involves not just stating the amounts but also justifying the terms of the loan and ensuring clarity in payment instructions.

-

Clearly state how this figure was determined to build trust and transparency.

-

Base your choice on current market rates or negotiation with the lender, providing examples can enhance comprehension.

-

Include flexibility to adjust terms based on individual circumstances or future negotiations.

-

Mark clear payment dates within the agreement to avoid defaults and clarify expectations.

How to structure your repayment plan

A well-structured repayment plan is essential for the successful execution of the Promissory Note Agreement. Clear payment terms ensure that both borrower and lender are in sync regarding when and how payments will be made.

-

Consider unique schedules such as weekly or quarterly options that best suit the borrower’s financial situation.

-

Clarify how these amounts are calculated to prevent confusion and potential disputes.

-

Utilize pdfFiller's features to set up automatic reminders and streamline multiple payment methods.

-

Outline what actions to take in the event of default to protect both the lender's and borrower's interests.

Filling out and customizing your agreement on pdfFiller

pdfFiller allows users to fill out and customize Promissory Note templates with ease, ensuring no detail is overlooked. The platform offers multiple tools to enhance the agreement's structure and digital reliability.

-

Utilize the provided tools and templates in pdfFiller to streamline the creation process.

-

Collaborate on the document in real-time, which improves accuracy and efficiency.

-

The platform offers eSigning to ensure the agreement holds legal weight without the need for physical paperwork.

-

pdfFiller allows users to save, manage, and share finalized documents easily, simplifying the overall process.

What are the compliance and best practices for using Promissory Notes?

Using a Promissory Note entails understanding the legal landscape surrounding these documents, including compliance issues that may arise in your region. Ensuring that you meet industry standards helps mitigate risks associated with poorly structured agreements.

-

Understand the specific regulations in your region that govern Promissory Notes to avoid legal issues.

-

Beware of vague wording and lack of clarity, which can lead to disputes.

-

Staying informed about common practices can preemptively solve potential compliance issues.

-

Leverage pdfFiller’s tools to maintain compliance and accuracy in your agreements.

How does pdfFiller stand out in document management?

In the crowded document management space, pdfFiller distinguishes itself by offering unique advantages tailored for users looking to streamline their workflow. User testimonials affirm the platform's reliability and efficiency in managing documents effectively.

-

While providers may offer similar services, pdfFiller combines usability with powerful features.

-

Features such as collaboration tools make pdfFiller invaluable for teams working remotely.

-

Success stories from satisfied users enhance the credibility of pdfFiller’s platform.

-

Demonstrated advantages in collaborative features make it easier for teams to produce accurate documents.

How to fill out the Promissory Note Payment Agreement Template

-

1.Open the Promissory Note Payment Agreement Template in pdfFiller.

-

2.Begin by entering the date at the top of the document to signify when the agreement is being made.

-

3.Fill in the name and contact information of the borrower in the designated fields, ensuring accuracy for future correspondence.

-

4.Next, enter the lender's name and contact details similarly to maintain clarity in communication.

-

5.Specify the principal amount being borrowed in words and numerals to avoid any confusion regarding the sum.

-

6.Outline the interest rate, if applicable, ensuring it complies with legal requirements and is clearly stated.

-

7.Detail the repayment schedule, including the frequency of payments, due dates, and any grace periods if applicable.

-

8.Include any late fees or penalties for missed payments to establish clear consequences for non-compliance.

-

9.Check all provided information for accuracy before signing to ensure consensus on terms.

-

10.Finally, both the borrower and lender should sign the agreement and date it to validate the contract and make it legally enforceable.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.