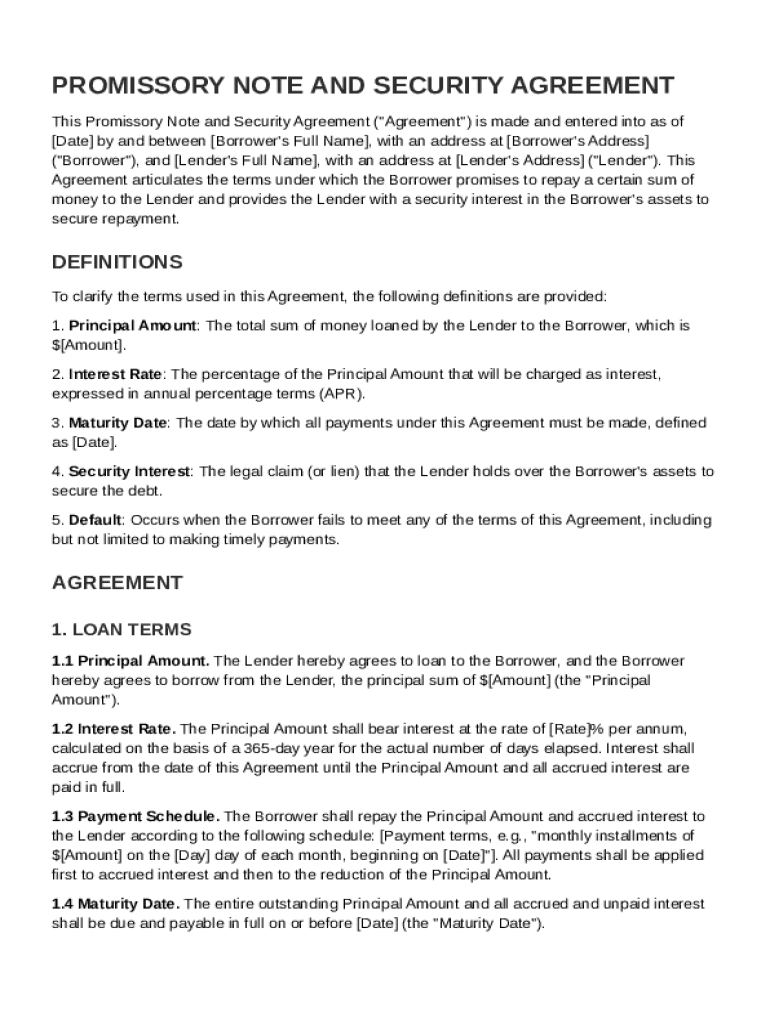

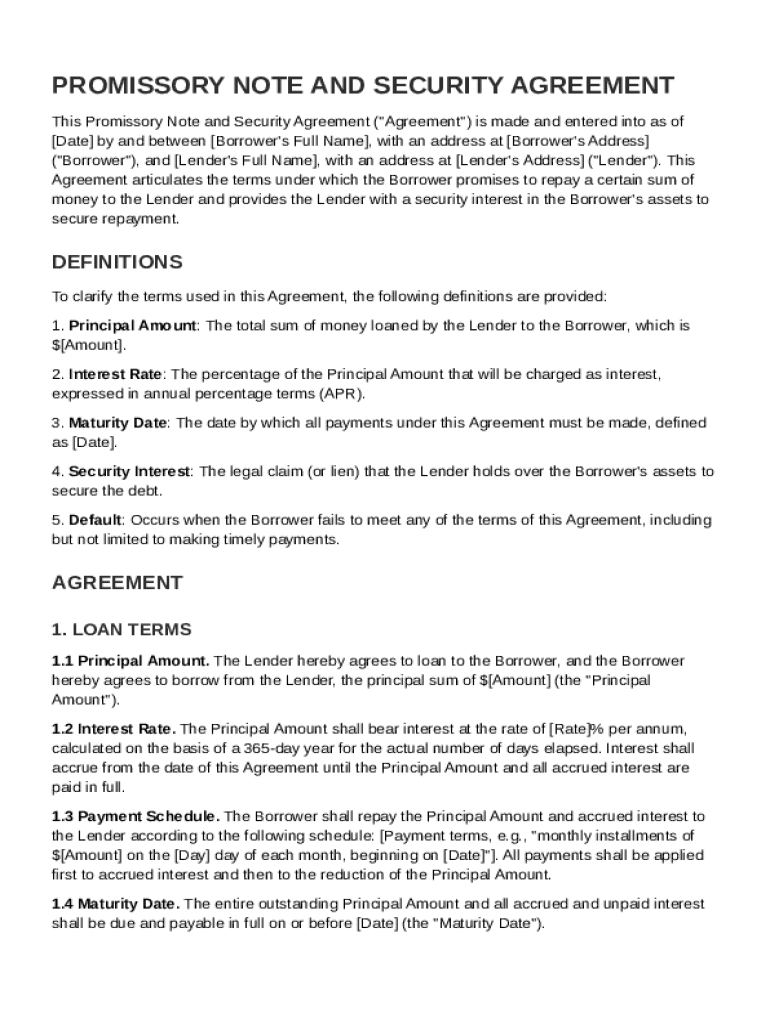

Promissory Note and Security Agreement Template free printable template

Show details

This document outlines the terms under which a borrower promises to repay a loan to a lender, including definitions, loan terms, security interests, representations and warranties, covenants, events

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promissory Note and Security Agreement Template

A Promissory Note and Security Agreement Template is a legal document outlining the terms of a loan and the collateral securing it.

pdfFiller scores top ratings on review platforms

i love it ive been using it 2 years now!

i love it ive been using it 2 years now!

Quick and easy to use.

Quick and easy to use.

Everything was fine

Everything was fine. I love using pdffiller!

great!

great

travail parfaitement

Who needs Promissory Note and Security Agreement Template?

Explore how professionals across industries use pdfFiller.

Promissory Note and Security Agreement Template

How to fill out a Promissory Note and Security Agreement template form

To fill out a Promissory Note and Security Agreement template, begin by gathering the necessary information such as the names of the Borrower and Lender, the Principal Amount, and the terms of the agreement. This guide will walk you through each step to ensure your document is complete and compliant.

Understanding the Promissory Note and Security Agreement

A Promissory Note and Security Agreement formalizes a loan transaction between a Borrower and a Lender. This document outlines the terms of repayment and the consequences of non-compliance, serving both parties' interests legally.

-

This document details a promise to repay a loan and the security offered to back this promise.

-

The Borrower is the individual or entity receiving funds, while the Lender provides the funds under specified terms.

-

The agreement is legally binding, meaning both parties must adhere to its terms to avoid legal penalties.

What are the essential components of a Promissory Note?

Understanding the essential components is crucial for drafting a valid Promissory Note. Each element plays a critical role in determining the agreement's enforceability.

-

This is the total sum of money borrowed, which is foundational to the loan agreement.

-

Typically expressed as an Annual Percentage Rate (APR), it determines the cost of borrowing.

-

This specifies when the loan must be repaid in full, including interest.

-

An asset pledged as collateral; if the Borrower defaults, the Lender can claim this asset.

-

The circumstances under which the Borrower fails to repay the Loan, leading to various consequences.

How do you fill out the template step-by-step?

Filling out the template is straightforward, but attention to detail is essential. Follow these steps carefully.

-

Ensure accurate names and contact details for both Borrower and Lender are entered.

-

Clearly state the exact amount being borrowed.

-

Outline how the interest will be calculated and any other conditions.

-

Detail when and how repayments will be made.

-

Check for accuracy before both parties sign to make it legally binding.

Comparative analysis: Secured vs. Unsecured Promissory Notes

Deciding between secured and unsecured notes is crucial based on risks and protection. Each type serves different financial contexts.

-

Secured notes are backed by collateral, while unsecured notes are not.

-

Use secured notes when the Lender wants assurance against potential default.

-

The Lender faces the risk of losing money without collateral if the Borrower defaults.

How can pdfFiller tools help manage your document?

pdfFiller provides an integrated suite of tools enabling users to effectively create and manage Promissory Notes. Collaboration, editing, and secure signing capabilities are all designed to enhance user experience.

-

Easily modify text, add fields, and customize your note with intuitive editing tools.

-

Sign your document electronically, ensuring signatures are valid and legally recognized.

-

Multiple users can access and edit the document simultaneously, promoting efficiency.

-

Store your completed forms securely and access them anytime from anywhere.

What are the legal compliance and local considerations?

Ensuring compliance with local laws is essential when drafting a Promissory Note. Different regions may have unique requirements that affect how agreements must be structured.

-

This prevents legal disputes and ensures enforceability of the agreement.

-

Requirements may vary and could include notarization, witness signatures, or specific language.

-

Drafting incorrectly can lead to enforceability issues or unintended liabilities.

How to fill out the Promissory Note and Security Agreement Template

-

1.Download the Promissory Note and Security Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller, ensuring all fields are visible.

-

3.Start by filling in the borrower's name and address in the designated fields.

-

4.Enter the lender's name and address next to the borrower's details.

-

5.Specify the loan amount in the appropriate section.

-

6.Outline the interest rate and the repayment schedule, including due dates.

-

7.Provide details about the collateral securing the loan.

-

8.Review the template for any optional clauses you may wish to include.

-

9.Sign the document, ensuring that both parties provide their signatures where required.

-

10.Save the completed document and share it with the involved parties via email or printing.

Is a security agreement the same as a promissory note?

A security agreement is the contract that protects a promissory note with collateral. The security agreement might describe the property or assets put up for collateral and will detail whether the lender can hold the collateral or how the lender can seize the collateral should non-payment occur.

How to write a secured promissory note?

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. Repayment schedule. Any interest on the loan. The details of the collateral.

Is a promissory note used as a security for a mortgage?

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

How do you perfect a security interest in a promissory note?

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.