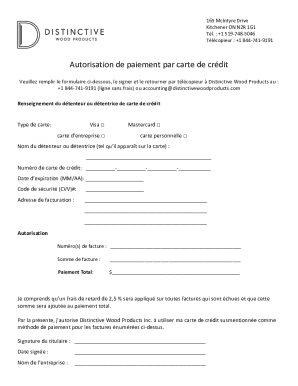

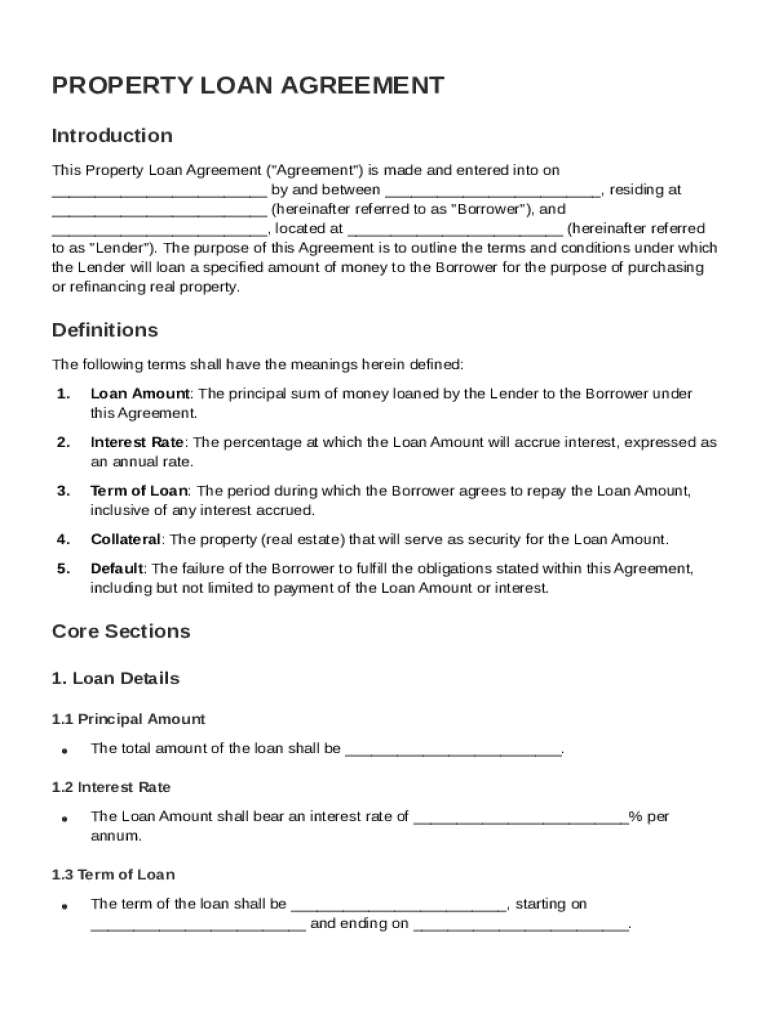

Property Loan Agreement Template free printable template

Show details

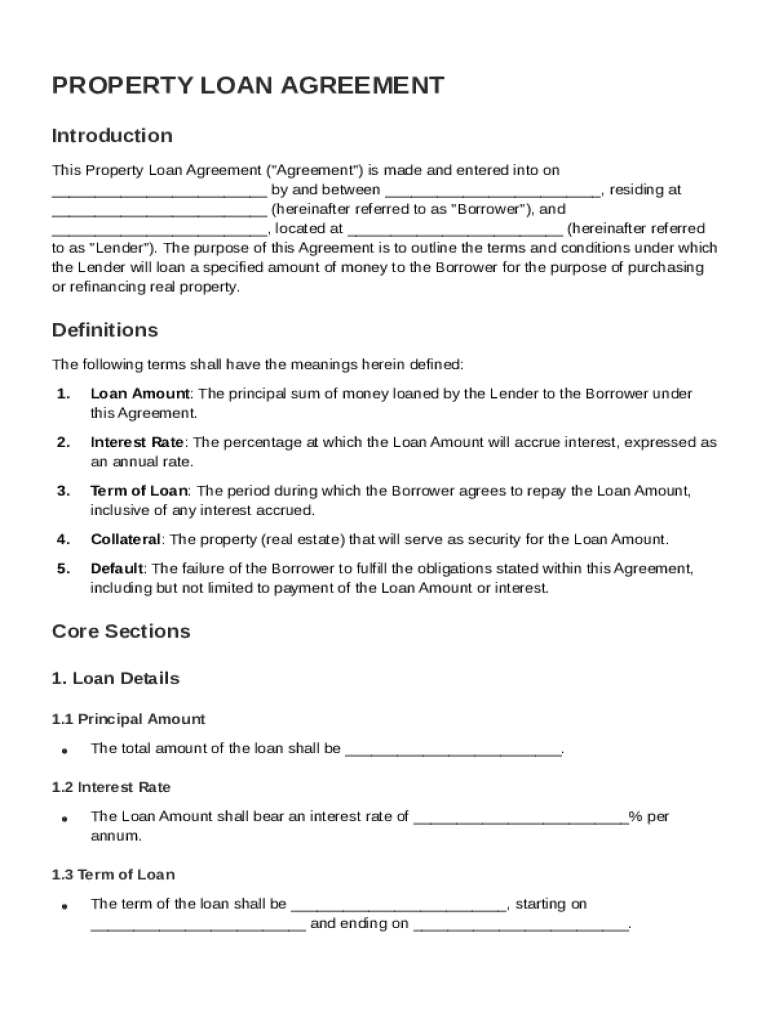

This document outlines the terms and conditions for a loan provided by a lender to a borrower for the purpose of purchasing or refinancing real property, including definitions of key terms, obligations

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Property Loan Agreement Template

A Property Loan Agreement Template is a standardized document outlining the terms and conditions between a lender and a borrower regarding the loan secured by real estate.

pdfFiller scores top ratings on review platforms

Great program

Very easy to use!

I am a very satisfied customer!

Very satisfied customer!

GOOD PROGRAM

Awesome

Its An AWESOME APP AS WELL AS A VERY HANDY APP FOR ANY JOB OR FOR EASY E- SIGNATURES SO VERY HELPFUL APP FOR ANYONE...!!!!!

came s supper handy for what i needed

Reliable

Reliable, does what it claims to. Best app for my needs.

Who needs Property Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Property Loan Agreement Template form

A Property Loan Agreement Template form is essential for individuals and teams involved in real estate transactions. It serves as a standardized framework to outline the terms between the borrower and lender clearly. In this guide, we will explore everything you need to know about this critical document.

What is a property loan agreement?

A Property Loan Agreement is a legal contract between a borrower and a lender outlining the terms of a loan. This agreement is vital in real estate transactions as it protects the interests of both parties involved.

-

It defines the loan terms, including the amount, interest rate, and repayment schedule.

-

This document is crucial to ensure clarity and prevent any disputes regarding the loan.

-

It outlines the responsibilities of both the borrower and the lender throughout the loan period.

What are the essential components of a property loan agreement?

Understanding the fundamental components of a Property Loan Agreement is crucial for effective management.

-

Specifies the total amount of money being borrowed, which may include fees and related costs.

-

Indicates whether the rate is fixed or variable, impacting total payment amounts over time.

-

Defines the duration of the loan, affecting the repayment structure and financial planning.

-

Details the property that will act as security for the loan, ensuring the lender’s interests are protected.

How to break down the loan details section?

The Loan Details section is a critical part of the Property Loan Agreement Template form. It must be filled out accurately to avoid misunderstandings.

-

The precise sum borrowed, which should be clearly specified in the agreement.

-

The agreed annual percentage or rate at which interest will be charged on the principal amount.

-

Indicates the exact start and end dates for the loan repayment period.

-

Details how often payments are to be made, including due dates for each installment.

What is collateral in property loan agreements?

Collateral is a foundational element in securing a Property Loan Agreement. It involves the property used as security for the loan.

-

The section should include the address and legal description of the property being used as collateral.

-

Establishes the lender's rights over the collateral in case of default by the borrower.

-

Specifies the borrower's responsibility to keep the collateral in good condition to avoid losing it.

What obligations does the borrower have?

Borrowers have several key obligations outlined in the Property Loan Agreement. These ensure a clear understanding of their commitments.

-

Borrowers must commit to making timely payments as scheduled in the agreement.

-

Borrowers are typically responsible for property upkeep to maintain its value.

-

This section outlines the implications if the borrower fails to meet their obligations, potentially leading to foreclosure.

What are the compliance and legal considerations?

Compliance with relevant laws is essential in a Property Loan Agreement. It protects both parties involved.

-

The agreement must specify the legal jurisdictions that govern the contract.

-

Local laws can significantly affect the integrity of the loan agreement and its execution.

-

Borrowers are often required to maintain insurance on the collateral to protect against loss.

How can pdfFiller assist in managing property loan agreements?

pdfFiller provides effective tools to manage Property Loan Agreement Template forms efficiently. Utilizing their platform enhances the document management experience.

-

Users can easily edit templates, tailoring them to individual needs through the platform’s user-friendly interface.

-

The eSigning feature allows for quick and secure electronic signatures, streamlining the process.

-

Teams can collaborate in real-time, ensuring all members can contribute and review documents.

-

The cloud-based accessibility allows users to manage their documents from anywhere, at any time.

What are the best practices for crafting your property loan agreement?

Crafting an effective Property Loan Agreement requires adherence to best practices for clarity and compliance.

-

Ensure that all terms are clear and understood to avoid future disputes.

-

Keep the agreement updated with any changes in terms or regulations to maintain its effectiveness.

-

It’s advisable to seek legal advice to ensure compliance with applicable laws and regulations.

How to navigate challenges in property loan agreements?

Navigating challenges during the loan period is essential for borrowers. Knowing your rights and options can prevent potential issues.

-

Understand your rights and the course of action available to you if you cannot meet your obligations.

-

Identify the methods for resolving conflicts without legal action, such as mediation.

-

Be aware of legal fees and additional costs associated with the agreement to avoid unexpected expenses.

How to fill out the Property Loan Agreement Template

-

1.Download the Property Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin filling in the parties' information, starting with the borrower’s full name and contact details.

-

4.Next, add the lender’s name and contact information.

-

5.Specify the property address to be financed in the designated field.

-

6.State the loan amount clearly, including any interest rate information.

-

7.Fill in the loan term, specifying the duration in months or years.

-

8.Include details about payment terms, such as monthly payment amounts and due dates.

-

9.Review sections regarding default and penalties to ensure clarity and understanding.

-

10.Sign and date the document, ensuring all necessary parties do the same before finalizing.

-

11.Save the completed document and consider sending copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.