Purchase House Agreement Template free printable template

Show details

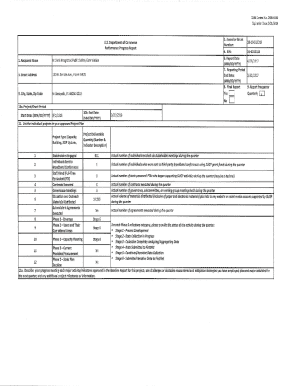

This document outlines the terms and conditions regarding the purchase of a house, including details about the parties involved, property description, purchase price, contingencies, disclosures, closing

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Purchase House Agreement Template

A Purchase House Agreement Template is a legally binding document that outlines the terms and conditions for the sale of a residential property between a buyer and a seller.

pdfFiller scores top ratings on review platforms

I like it and a little improvement would have been better like able to send w7 form and all kinds of form to IRS directly

This is so user friendly. I just love using this.

It's amazing. So glad I stumbled across it.

I'm just glad that I am now able to edit things in PDF form! YAY

Easy to use. Makes my work neat and tidy. I love it!

Don't recall having used any program so simple to use and self-explanatory. Plan on keeping a subscription for future use.

Who needs Purchase House Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Creating a Purchase House Agreement Template

How to effectively create a purchase house agreement template?

Creating a Purchase House Agreement Template form is crucial for buyers and sellers in real estate transactions. This guide provides a step-by-step approach to understanding and crafting an effective template that aligns with legal standards and best practices.

To fill out a Purchase House Agreement, begin by gathering required information, defining parties involved, and thoroughly describing the property. This ensures clarity and aligns expectations between buyers and sellers.

What is a Purchase House Agreement?

A Purchase House Agreement is a legally binding contract between a buyer and a seller that outlines the terms of the sale of a property. It serves to protect both parties and simplify the transaction process.

-

The agreement outlines the specifics of the transaction, ensuring both parties agree on key terms such as price, payment schedule, and contingencies.

-

Essentials like the purchase price, property description, and responsibilities of each party are included.

-

Each section of the agreement provides clarity and protects the interests of buyers and sellers, thus minimizing misunderstandings.

Who are the essential parties involved in this agreement?

The parties involved in a Purchase House Agreement are fundamental to its execution. Each role has specific responsibilities and requirements that must be clearly defined.

-

The seller is the individual or entity selling the property, while the buyer intends to purchase it. Understanding these roles is crucial for drafting an effective agreement.

-

Each party must provide their full legal names, addresses, and potentially other identification to ensure legal validity.

-

Providing contact details is essential for clear communication throughout the transaction process.

How to describe the property accurately?

A well-defined property description is vital to prevent future disputes regarding the property's identity. This description should include various legal requirements.

-

Include details such as the address, square footage, and specific features of the property in the description.

-

A legal description involves a precise identification of the property boundaries to eliminate ambiguities.

-

Appurtenances, such as garages or sidewalks, and any improvements made to the property should also be noted.

How does one calculate the purchase price?

Calculating the purchase price is central to the agreement. It reflects what buyers are willing to pay and what sellers agree to receive.

-

Consider market value, property condition, and any unique features of the property when setting the price.

-

This is a deposit made to demonstrate the buyer's serious intent to purchase the property, usually a percentage of the purchase price.

-

Outline the different payment methods available, such as cash, loan, or owner financing, and any timelines associated.

What are contingencies in a purchase agreement?

Contingencies are clauses that specify conditions under which the purchase agreement may become null or be adjusted. They protect the interests of both parties.

-

This contingency allows the buyer to cancel the agreement if they cannot secure financing within a specified timeframe.

-

Popular contingencies include inspection contingencies, appraisal contingencies, and sale of existing home contingencies.

-

These contingencies can delay the closing process but are essential for ensuring buyer safety and satisfaction.

How do fill out the purchase house agreement template?

Effectively filling out the Purchase House Agreement Template is key to a smooth transaction. A step-by-step approach simplifies this process.

-

Follow the template closely, ensuring all fields are filled out accurately and completely.

-

Utilize tools available on pdfFiller to edit, sign, and manage your agreement efficiently and securely.

-

Review all information for accuracy and compliance with local laws to avoid legal issues later.

Why is reviewing and finalizing the agreement important?

Reviewing and finalizing ensures that all details are correct and legally binding. Skipping this step can lead to problems in the transaction.

-

Consulting with a real estate attorney helps clarify any ambiguous terms and ensures compliance with applicable laws.

-

An escrow agent is often employed to manage the exchange of funds and ensure that all contractual conditions are met before closing.

-

Verify that all parties have signed and any necessary documents are submitted to prevent closing delays.

How to manage and store your completed purchase agreement?

Efficient document management post-agreement ensures easy access and collaboration. Utilizing resources like pdfFiller enhances this process.

-

Store your completed templates on pdfFiller's cloud platform to access them from anywhere.

-

Ensure compliance and security by using strong passwords and two-factor authentication for document access.

-

Utilize collaboration features from pdfFiller for team members to review and edit the agreement seamlessly.

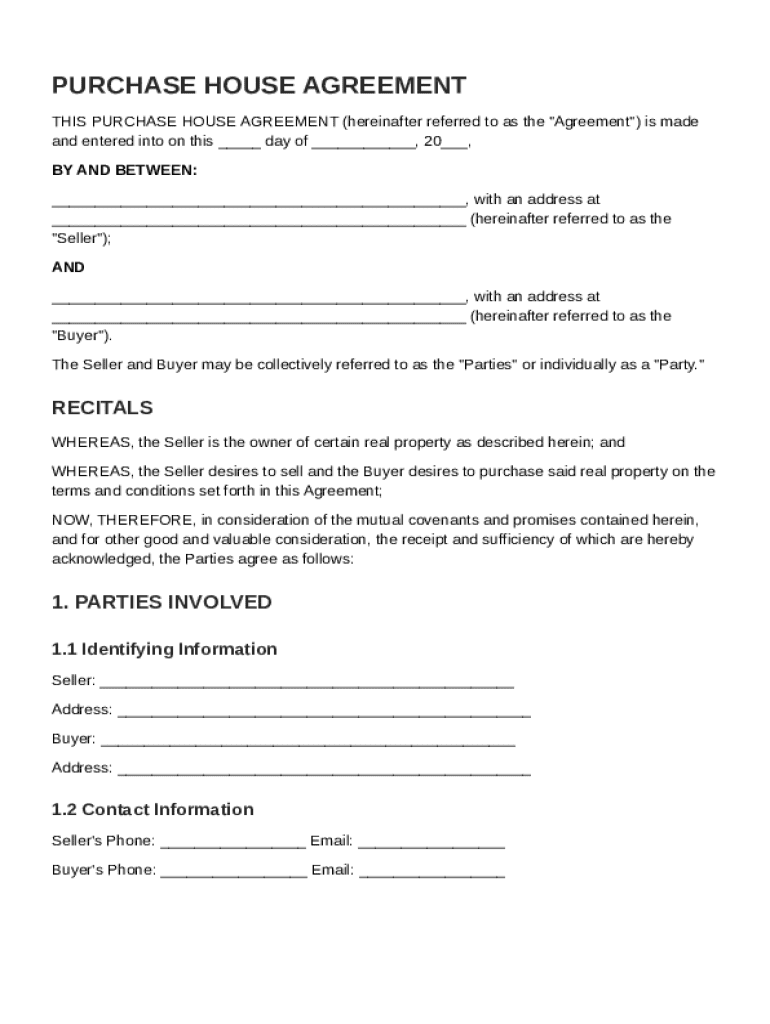

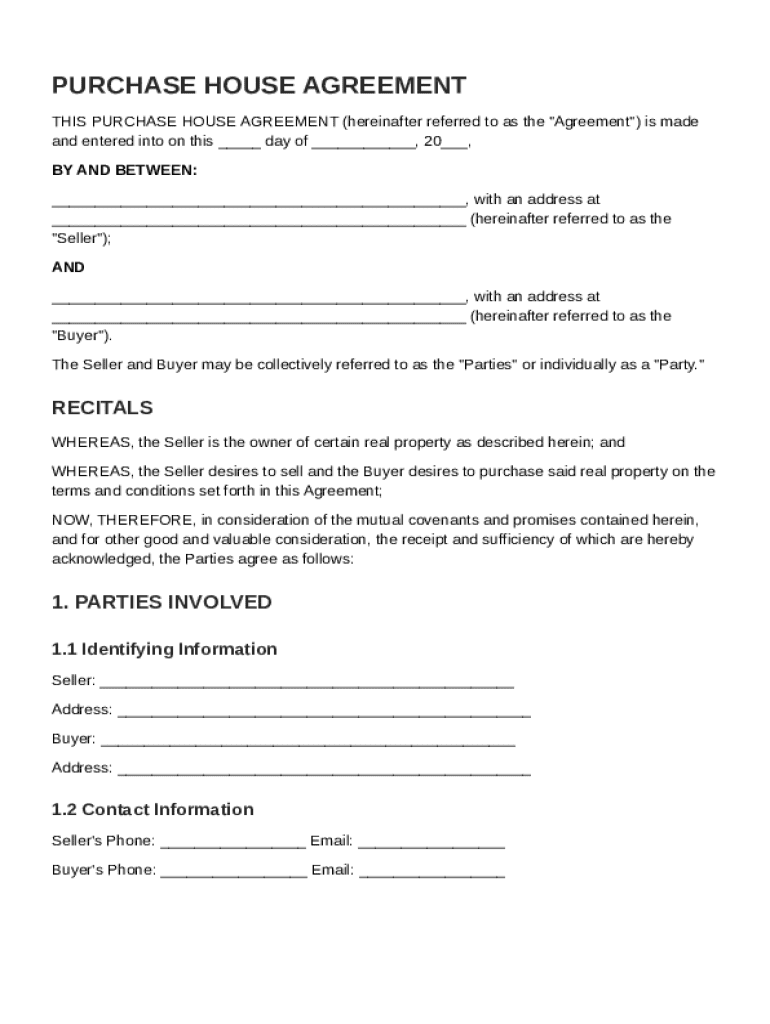

How to fill out the Purchase House Agreement Template

-

1.Open the Purchase House Agreement Template in pdfFiller.

-

2.Review the document for any pre-filled information that may already be present.

-

3.Begin by entering the buyer’s full name and contact information in the designated fields.

-

4.Next, input the seller’s full name and contact details, ensuring accuracy.

-

5.Fill in the property address, including street, city, state, and ZIP code.

-

6.Specify the purchase price and any deposits required by the seller.

-

7.Outline the terms of the sale, including any contingencies that may apply, such as financing or inspections.

-

8.Include important dates such as the agreement date, closing date, and any deadlines for inspections or financing.

-

9.Review all entered information for correctness and completeness before moving to the next step.

-

10.Once satisfied, utilize the options to electronically sign the document or share it with the involved parties for their signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.