Purchase Money Security Agreement Template free printable template

Show details

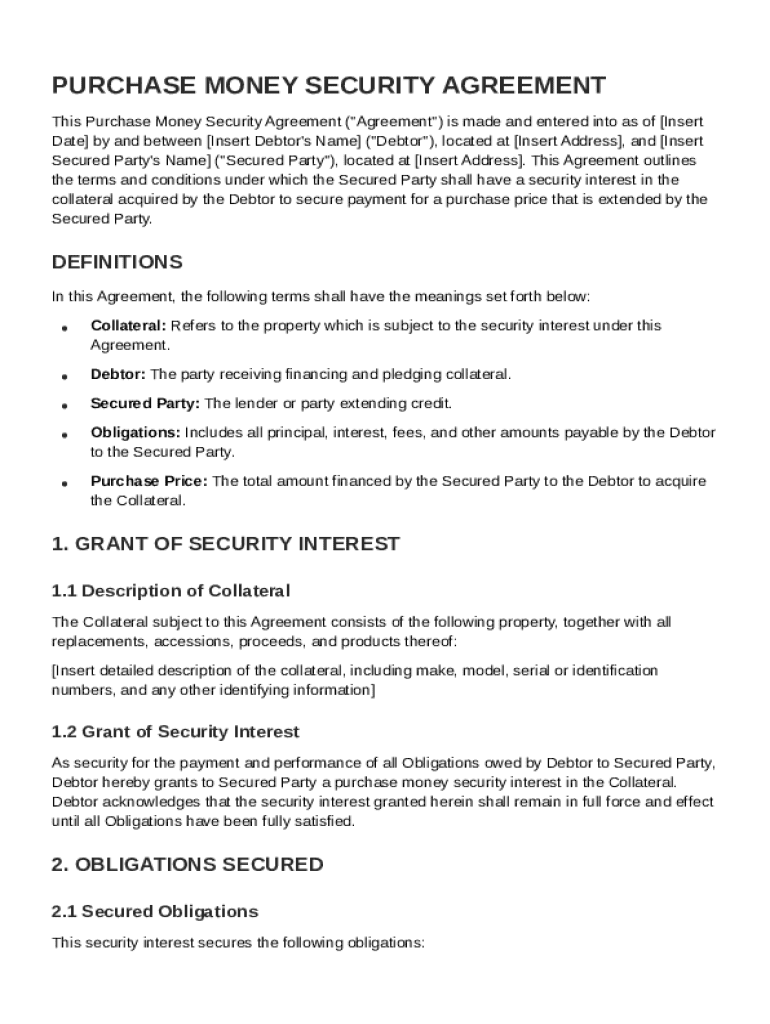

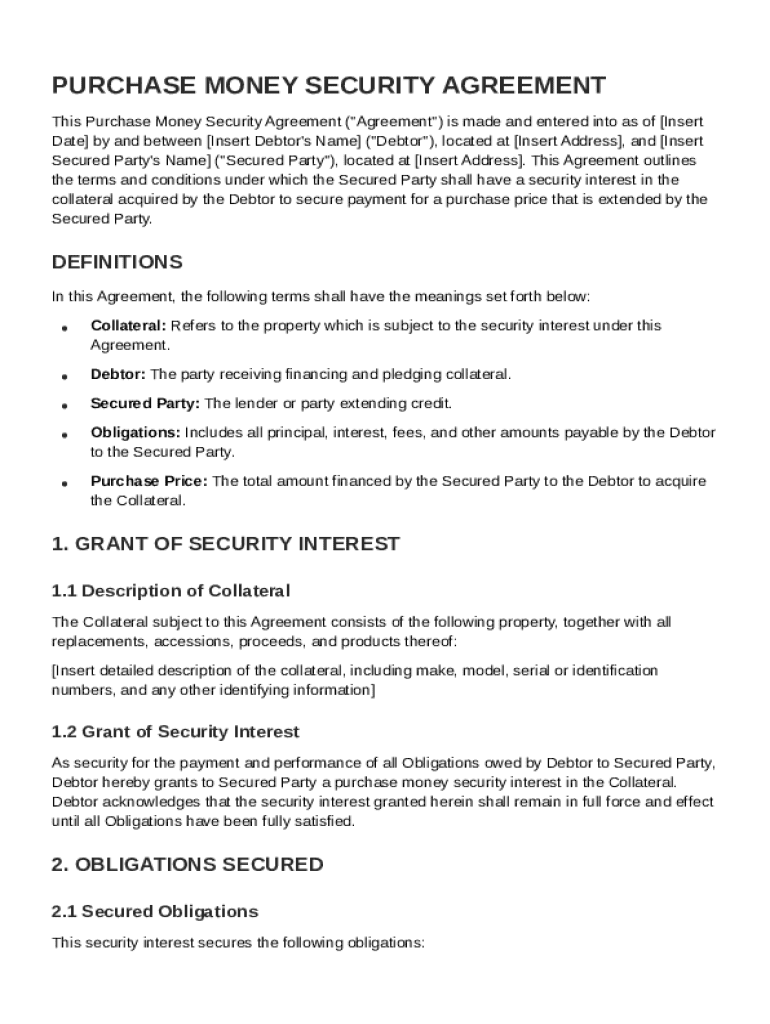

This document is a legal agreement outlining the terms and conditions under which a secured party obtains a security interest in the collateral acquired by the debtor to secure payment for a purchase

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Purchase Money Security Agreement Template

A Purchase Money Security Agreement Template is a legal document that outlines the terms under which a buyer secures financing for the purchase of goods, allowing the seller to retain a security interest in the goods until paid in full.

pdfFiller scores top ratings on review platforms

It's easy to use

It's easy to use, the only thing is that you can download documents directly to your computer with the free trial.

Only used it once for two forms

Only used it once for two forms. Seems to work very well.

i found this site very good and dose…

i found this site very good and dose what it advertised to do and would recommend it

I HAVE ENJOYED YOUR CONVERSATION AND…

I HAVE ENJOYED YOUR CONVERSATION AND KEEP ON HELPING US WITH MORE INFORMATION

very good

very good, intuitive, user friendly software.

Good

Good and easy to use

Who needs Purchase Money Security Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Purchase Money Security Agreement Template form

Understanding the Purchase Money Security Agreement

A Purchase Money Security Agreement (PMSA) is a legal document that creates a security interest in collateral purchased with borrowed funds. This agreement is crucial in asset financing, allowing lenders to secure repayment by holding a claim against the property. The legal implications of a PMSA include the protection of both the lender's and borrower’s rights, ensuring obligations are met effectively.

-

The legal foundation governing the use of collateral in securing loans.

-

Leveraging PMSAs facilitates greater confidence in lending transactions.

-

Ensures that both debtor and secured party understand their rights and obligations.

What are the key components of the agreement?

The structure of a PMSA revolves around essential components that define its purpose. The roles of the debtor, who is the borrower, and the secured party, typically the lender, must be precisely stated within the contract. Additionally, crucial definitions such as collateral (the asset secured), obligations (the responsibilities of the debtor), and purchase price (the cost of the collateral) need to be clearly laid out for the agreement to be enforceable.

-

Identify who has which responsibilities within the agreement.

-

Clearly state what is included to avoid future disputes.

-

Understanding the process by which collateral guarantees the loan.

How to complete the agreement step-by-step?

Filling out a Purchase Money Security Agreement requires attention to detail. Start with the Agreement Date and ensure the Debtor’s and Secured Party’s names are correctly listed. Providing a detailed description of the collateral ensures clarity and specificity, while accurately inputting the Purchase Price establishes the financial particulars of the agreement.

-

Fill out this information accurately to avoid ambiguity.

-

Include specifics such as make, model, and identification numbers.

-

Define the financial obligations clearly to avoid misinterpretation.

How to grant a security interest effectively?

Formally granting a purchase money security interest involves documenting the secured party's rights concerning the collateral until all obligations are fulfilled. Retaining rights ensures the secured party can reclaim the collateral if necessary. Legal considerations, such as state laws and the potential for disputes, are critical for both parties.

-

Execute documents that specify the nature of the interest.

-

This ensures the secured party's investment is protected.

-

Understand relevant laws that govern PMSAs in your area.

What defines secured obligations under PMSA?

Secured obligations under a PMSA are what the debtor owes the secured party, typically linked to the terms laid out in the agreement. Understanding the connection to promissory notes, which are written promises to pay a specified amount, is vital. These obligations tie into broader financial responsibilities that the debtor must adhere to in order to uphold the agreement.

-

Highlight the need for clear financial commitments to avoid confusion.

-

Clarifying how these notes operate within the PMSA framework.

-

Understanding all linked responsibilities prevents legal issues.

How can pdfFiller assist with your PMSA needs?

pdfFiller provides users easy access to a Purchase Money Security Agreement Template. The platform allows for seamless editing and signing of the form online and offers collaborative tools for teams. This ensures that the process of completing the PMSA is efficient, secure, and user-friendly.

-

Navigate through the templates section for easy retrieval.

-

Guided instructions help you complete the form seamlessly.

-

Enhanced teamwork features make document management easier.

What are common mistakes to avoid in PMSAs?

Many common mistakes can undermine a Purchase Money Security Agreement. Incomplete information or vague collateral descriptions can lead to legal issues, while mismatched parties’ names and addresses may cause confusion. Understanding the implications of the security interest is crucial for both parties to minimize misunderstandings.

-

Ensure all fields are filled out accurately to prevent disputes.

-

Double-check details for accuracy to avoid potential conflicts.

-

Recognizing the gravity of the agreement can prevent future issues.

What compliance and legal considerations should you bear in mind?

Every Purchase Money Security Agreement must comply with regulatory frameworks relevant to your industry or region. It's crucial to ensure the agreement meets state-specific requirements, as this can affect its enforceability. The consequences of non-compliance can be severe for both the debtor and the secured party, ranging from legal challenges to financial losses.

-

Understanding the laws applicable to your situation is vital.

-

Each state may have unique requirements that must be met.

-

Legal disputes and potential penalties highlight the need for clear agreements.

How to fill out the Purchase Money Security Agreement Template

-

1.Access pdfFiller and select the Purchase Money Security Agreement Template from the templates available.

-

2.Begin filling in the 'Buyer Details' section with the full name and address of the buyer; ensure accuracy to avoid future disputes.

-

3.Next, fill in the 'Seller Details' section with the full name and address of the seller or lending institution; this should match legal business records.

-

4.Specify the 'Collateral Description' by providing a detailed description of the goods being purchased; include make, model, and serial numbers if applicable.

-

5.Proceed to fill in the purchase price in the designated section, clearly stating the total amount to be financed.

-

6.Include terms regarding interest rates, payment schedule, and any applicable fees to clarify obligations under the agreement.

-

7.Review all filled sections for accuracy and completeness; ensure no sections are left blank.

-

8.Once all fields are completed, save the document and proceed to obtain signatures from both parties in the designated signature areas.

-

9.After signing, ensure each party receives a copy of the final signed agreement for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.