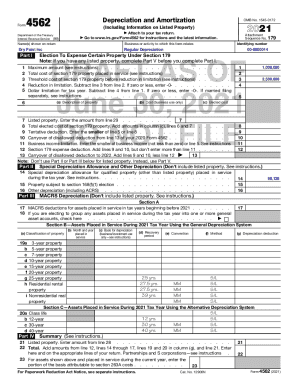

Real Estate Broker Commission Agreement Template free printable template

Show details

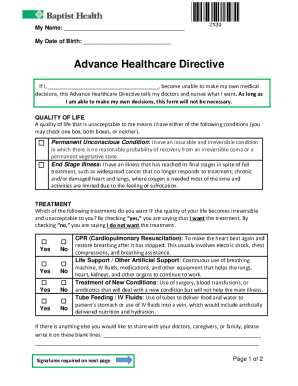

This document outlines the terms and conditions of the agreement between a licensed real estate broker and a client for the provision of real estate services, including commission details and responsibilities

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Real Estate Broker Commission Agreement Template

A Real Estate Broker Commission Agreement Template is a legal document outlining the terms and conditions under which a broker earns a commission for facilitating a real estate transaction.

pdfFiller scores top ratings on review platforms

simple to use and does what it says it will do.

It's a good and intuitive product. the only technical glitch is that some of the larger text boxes are shifted over to the right by a fraction of an inch and outside the printable area of most printers.

Very user friendly site. I did lose my first document, since I didn't select the 'DONE' box first. Maybe just a little pop up message on how important that step is would be helpful.

I have only had my account with you for one day, haven't used it enough to see how well it works yet It has been very helpful in completing the forms I needs to file

How can I use this subscription on my lap top as well this desk top

This is my first time usin anything like this and it was for an emergency case. and so far everything has gone well, I will complete this week and hope to continue my membership

Who needs Real Estate Broker Commission Agreement Template?

Explore how professionals across industries use pdfFiller.

Real Estate Broker Commission Agreement Guide

How to fill out a Real Estate Broker Commission Agreement form?

To fill out a Real Estate Broker Commission Agreement form, first, ensure you have all necessary details such as the names of the parties involved, the property details, and the commission percentage. Carefully specify the terms of representation, including the broker's obligations and any disclosures required. Lastly, review the agreement for accuracy before including signatures.

What is the purpose of the Real Estate Broker Commission Agreement?

The Real Estate Broker Commission Agreement serves as a formal contract between a broker and their client to outline the terms of their business relationship. This document ensures clarity on roles, responsibilities, and financial compensation related to real estate transactions, thus protecting both parties' interests.

-

Defines the Agreement and its significance: It ensures the broker's commission is secured upon closing a deal.

-

Clarifies roles of the Broker and the Client: It establishes mutual expectations regarding representation and services.

What are the key definitions in the Agreement?

-

A broker is a licensed professional who facilitates real estate transactions, representing buyers or sellers in negotiations.

-

The Client is any individual or entity engaging the services of the broker, typically the property owner or buyer.

-

Commission usually refers to the fee paid to the broker, often calculated as a percentage of the property sale price.

-

The Property encompasses the real estate assets being bought or sold under the Agreement.

-

Transactions covered can include sales, leases, and other real estate dealings negotiated by the broker.

What is covered in the scope of services provided?

The scope of services outlines the obligations and responsibilities the broker commits to in the transaction. It details what marketing efforts will be undertaken, any additional client services, and how long these services are expected to last.

-

Marketing obligations: The broker must promote the property effectively to reach potential buyers.

-

Additional services: This could include staging, open houses, and individual consultations with clients.

-

Duration and conditions: Clearly outline the timeframe for services rendered and any conditions that may affect these obligations.

How is the commission structure designed and payments made?

Understanding the commission structure is crucial as it determines how brokers get compensated for their efforts. Commissions are generally calculated based on a percentage of the sale price, and payment timelines vary based on closing and other factors.

-

Methodologies for calculating commissions: This can vary by transaction type, typically a percentage of the final selling price.

-

Timing of payments: Commissions are often paid at closing but can have different arrangements based on negotiations.

-

Scenarios affecting payments: Delays due to contingencies in the sale can alter when a broker receives their commission.

What are successors and assigns clauses?

Successors and assigns clauses specify that rights and obligations within the Agreement can be transferred or assigned to other parties. This is significant in real estate as ownership can change hands, and the terms of the Agreement remain enforceable.

-

Definition: These terms indicate parties who may take over rights and responsibilities under the Agreement.

-

Impact on Agreements: Understanding how successor clauses work is essential for ensuring continuity under changing circumstances.

-

Examples: Changes might include a sale of the property or changes in parties representing a business.

How do tenant representation clauses function?

Tenant representation clauses are vital for agreements that involve leasing properties. These clauses outline the broker's duties to represent tenants in negotiations, ensuring their needs are prioritized.

-

Significance: These clauses clarify how the broker supports tenants seeking property rentals.

-

Broker responsibilities: This can include negotiating lease terms and ensuring tenant rights are protected.

-

Examples: Scenarios may involve a tenant seeking a specific type of commercial space or apartment.

What are owner disclosure requirements?

Owner disclosure requirements are legal obligations for property owners to share known issues or defects with potential buyers or renters. This transparency protects all parties and mitigates the risk of disputes later in the transaction process.

-

Necessary disclosures: Homeowners must reveal known problems like structural issues or pest infestations.

-

Penalties for non-disclosure: Failing to disclose relevant information can lead to substantial legal consequences.

-

Local regulations: Understanding state and local laws surrounding disclosure can vary and should be adhered to.

What are representations and warranties?

Representations and warranties are assurances provided by both brokers and clients regarding specific aspects of the Agreement. These statements can play an essential role if disputes arise, clarifying the expectations and the responsibilities of each party.

-

Definitions: These terms often cover the authority of parties and the condition of the property.

-

Implications: Clear representations can help avert misunderstandings and protect interests in a court of law.

-

Dispute resolutions: Properly crafted warranties can ease the process of resolving disagreements.

Why is the entire agreement clause important?

The entire agreement clause solidifies that the document serves as the full and final agreement between the parties, voiding previous negotiations. This clause is crucial as it limits the scope for miscommunications and misunderstandings after signing.

-

Importance: It helps confirm that only the contents of this document shall govern the transaction.

-

Protection for parties: Ensures neither side can claim additional unagreed terms after signing.

-

Amendments: Any changes must be documented in writing and agreed upon by both parties involved.

How to utilize the pdfFiller platform for your agreement needs?

pdfFiller is a powerful tool enabling easy editing and management of the Real Estate Broker Commission Agreement Template form. Users can access a range of features, including eSigning for convenient approvals and secure sharing options, enhancing the document handling experience.

-

Editing: Easily modify the agreement's content, ensuring all necessary information is accurate and up-to-date.

-

eSigning functionalities: Securely sign documents electronically without needing printed copies.

-

Managing agreements: Utilize online storage solutions for easy access and collaboration among multiple users.

What are best practices for completing the Broker Commission Agreement?

Completing a Broker Commission Agreement accurately is essential to ensure that all parties' interests are represented. Identifying common pitfalls can help streamline this process, enabling effective communication and collaboration.

-

Common mistakes: Ensure there are no omitted sections or unclear terms in the Agreement.

-

Information inclusivity: Include every relevant detail to avoid conflicts during or after the transaction.

-

Collaboration encouragement: Promote dialogue between the broker and the client for better understanding.

What compliance considerations should be kept in mind?

Navigating the legal landscape of real estate can be complex. Compliance with local regulations is critical to ensure valid action in the market. It's essential to remain informed and prepared for compliance issues specific to the industry.

-

Local regulations: Different regions may enforce unique rules that could impact agreement validity.

-

Compliance issues: Watch for anti-trust laws, fair housing rules, and other key policies.

-

Best practices: Regularly consult with legal professionals to stay abreast of changes in real estate law.

How to fill out the Real Estate Broker Commission Agreement Template

-

1.Start by downloading the Real Estate Broker Commission Agreement Template in PDF format from pdfFiller.

-

2.Open the document in the pdfFiller editor to begin filling it out.

-

3.Enter the names and contact information of both the broker and the client at the top of the agreement.

-

4.Specify the property address involved in the transaction clearly.

-

5.Outline the commission structure, including the percentage or flat fee the broker will receive upon the successful sale of the property.

-

6.Include any conditions that may affect the commission, such as performance benchmarks or timeframes.

-

7.Review the agreement to ensure all details are accurate and complete.

-

8.Add a section for signatures, ensuring both parties can sign electronically or print and sign.

-

9.Save the filled-out document and share it with all parties for their records.

How do you write a simple commission agreement?

Follow these suggestions to minimize risk when drafting and signing a commission agreement. Use a Commission Agreement Template. Define Worker Type and Commission Structure. List All Activities That Will Provide Commission Pay. Define the Commission Rate. Identify Any Potential Bonuses Above And Beyond Commission.

What is the commission for most real estate agents?

Of course, real estate commissions can be negotiated, and nowadays the total typically runs somewhere closer to 5 percent. The exact terms of an agent's commission will vary from sale to sale, and can also depend on the region and which firm they work for.

Which agreement best protects a listing broker's commission?

The Exclusive Right to Sell Agreement protects the broker's commission by providing that the seller must pay the broker even if the property is sold through the efforts of the seller or the efforts of another broker without the participation of the listing broker.

What is an example of a brokerage commission?

Brokerage commissions can vary depending on the broker, the type of service provided, and the specific financial products being traded. For example, a client may pay a brokerage commission of $10 for each stock trade, or a percentage (e.g., 1%) of the total value of a bond transaction.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.