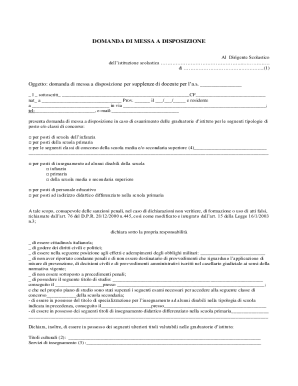

Real Estate Escrow Agreement Template free printable template

Show details

This document outlines the terms under which an Escrow Agent will hold funds and/or documents in escrow for the purchase of a property, detailing the roles of the Buyer and Seller, escrow instructions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Real Estate Escrow Agreement Template

A Real Estate Escrow Agreement Template is a legal document that outlines the terms and conditions under which a neutral third party holds funds or documents during a real estate transaction until certain obligations are met.

pdfFiller scores top ratings on review platforms

facil de usar

Great platform for forms and publications!!!

difficult to do on a phone because you can't read the font/type

Very good

So far my experience has been great!

perfect

Who needs Real Estate Escrow Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Guide to Real Estate Escrow Agreement Templates

In this guide, we will explore how to effectively use a Real Estate Escrow Agreement Template to facilitate smoother property transactions. Escrow agreements act as a security measure during real estate transactions, ensuring that both buyers and sellers fulfill their items of mutual obligation.

Understanding the Real Estate Escrow Agreement

An escrow agreement in real estate transactions refers to a neutral third party holding funds or documents until the agreed conditions are satisfied. This mechanism plays a crucial role in safeguarding the interests of both buyers and sellers by ensuring that funds are released only when all stipulated requirements are met.

-

An escrow agreement outlines the terms under which funds or property are held until certain conditions are met, offering protection to both parties.

-

By using escrow, parties can engage in trust-based arrangements where the release of funds is contingent upon verifiable actions, creating security in transactions.

What are the key components of the escrow agreement?

A comprehensive escrow agreement must contain several critical components that define its effectiveness. These components must clearly outline the obligations of all parties involved, deadlines, and terms under which the escrow agent will operate.

-

The preamble provides an overview of the agreement's effective date and clearly states the parties involved—essential for legal clarity.

-

This section includes key terminologies such as Escrow Agent, Escrow Funds, Closing, and Contingencies, which are essential for understanding the contract's stipulations.

What details must be included for the parties involved?

To ensure the seamless execution of the agreement, it is essential to gather comprehensive details from all parties involved in the transaction. These details create a transparent record and facilitate communication.

-

It is essential to provide accurate and complete information about the buyer, which includes name, address, phone, and email for effective communication.

-

Clarification on the required seller details helps verify identities and ensures transparency throughout the transaction process.

-

The escrow agent's contact information, along with licensing details, ensure they are properly qualified to handle the funds and documentation.

Why is a precise property description important?

A well-defined property description is paramount for the validity of an escrow agreement, as it prevents ambiguities that can lead to disputes. It provides layers of security against misrepresentations in real estate transactions.

-

An accurate description includes the street address, city, state, ZIP code, and legal description—ensuring all parties know exactly what property is involved in the transaction.

-

By having a clear description, the risk of legal disputes over property boundaries and ownership is significantly reduced.

What to include regarding the escrow amount and payment instructions?

Determining the escrow amount is critical and typically reflects a percentage of the purchase price. Clear payment instructions must be outlined to avoid any delays once the purchase agreement is reached.

-

Specifying the escrow amount ensures that both parties understand the financial commitments and expectations during the transaction process.

-

Outlining deadlines for deposits and how escrow funds will be managed is vital for adhering to the agreed timeline and maintaining trust.

What happens to escrow funds after closing?

Once the closing process is complete, it’s essential to have a plan for disbursing the escrow funds. This typically follows the successful fulfillment of all terms agreed upon in the escrow agreement.

-

A clear procedure for releasing escrow funds helps streamline the closing process, ensuring that all parties receive what is due.

-

Defining contingencies is vital to clarify the conditions under which the funds may not be disbursed, protecting both parties involved in the transaction.

What are contingencies and their implications?

Contingencies in an escrow agreement refer to conditions that must be fulfilled before funds are released. Understanding these clauses is crucial as they directly impact the transaction’s success.

-

Contingencies serve as protective measures, ensuring that certain conditions—like obtaining financing or seller disclosures—are satisfied before moving forward.

-

Failing to meet these contingencies can lead to delays or even cancellation of the transaction, highlighting the importance of clear communication and adherence to these terms.

How can pdfFiller assist in customizing your escrow agreement?

pdfFiller provides users with a powerful platform that allows them to customize their Real Estate Escrow Agreement Template easily. By utilizing interactive tools, you can quickly edit, sign, and collaborate on your documents.

-

Access to editing tools allows for quick adjustments to your template, ensuring it matches your specific transaction needs.

-

Implementing electronic signatures simplifies the signing process, enabling all parties to finalize the agreement securely and efficiently.

Where to find additional resources?

Being informed is key to navigating escrow agreements. Various guides and resources available through pdfFiller help clarify legal terminology and provide templates suited for unique real estate scenarios.

-

Reference additional templates relevant to real estate transactions through pdfFiller for comprehensive coverage.

-

Access guides that break down legal terminology, enhancing your understanding and enabling better navigation of agreements.

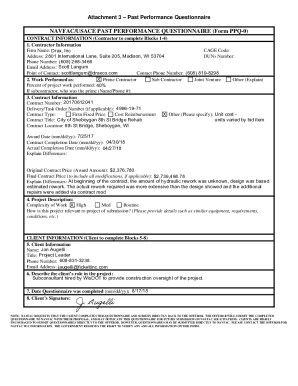

How to fill out the Real Estate Escrow Agreement Template

-

1.Obtain the Real Estate Escrow Agreement Template from a reliable source like pdfFiller.

-

2.Open the template in pdfFiller and begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and contact information of all parties involved, including buyers, sellers, and the escrow agent.

-

4.Specify the property details such as the address and legal description in the designated section.

-

5.Outline the terms of the escrow, including the purchase price, deposit amount, and timelines for payments.

-

6.Include any specific conditions or contingencies that must be met before the escrow can close.

-

7.Review the document to ensure all information is accurately reflected and make necessary adjustments.

-

8.Once completed, sign the document digitally or print it out for physical signatures from all parties.

-

9.Save a copy of the signed agreement in a secure location for future reference.

-

10.Distribute copies of the finalized agreement to all parties involved in the transaction.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.