Real Estate Jv Agreement Template free printable template

Show details

This Agreement establishes the terms and conditions for collaboration between two parties to acquire, manage, and dispose of real estate assets for profit.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Real Estate Jv Agreement Template

A Real Estate JV Agreement Template is a legal document outlining the terms and conditions of a joint venture between parties for real estate investment.

pdfFiller scores top ratings on review platforms

Thanks, I'm getting used to how to use it.

Of all the form filers I've used, this is by far the most user-friendly

Just starting to use it, but so far so good!

Good. I would like more font choices for signatures.

It was fairly easy to search out IRS forms but then you find out they're not usable because they're in Red!?! Also it said if you paid for a one-year subscription you save 65%, but the yearly cost was exactly the same as paying monthly and you didn't know this until you processed your payment???

A lot of features to learn, but all seem to work very well.

Who needs Real Estate Jv Agreement Template?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Real Estate JV Agreement Template Form

What is a real estate joint venture agreement?

A Real Estate Joint Venture Agreement (JV Agreement) is a legal document outlining the terms and conditions under which two or more parties collaborate to invest in real estate. This agreement is crucial in managing the contributions, responsibilities, and distributions of profit among the parties involved. Properly understanding this agreement ensures that both parties' interests are protected.

-

A formal arrangement between parties to pool resources for real estate investments while sharing profits and losses.

-

Joint ventures allow investors to undertake larger projects, diversify risks, and leverage complementary skills.

-

Important terms in a JV include 'Joint Venture', 'Property', 'Capital Contributions', 'Distributions', and 'Management Responsibilities'.

How do you break down the components of the agreement?

Understanding the components of a Real Estate JV Agreement is essential for clarity and functionality. Each section defines the partnership's structure, addressing initial setup steps to financial commitments.

-

Outlines the purpose and the initial steps necessary to create the joint venture, including legal incorporation.

-

Establishes where the partnership will operate, which is vital for logistical and legal operations.

-

Details each party's financial commitments, ensuring transparency and accountability.

Who are the parties in the joint venture?

Identifying the parties involved is crucial, as each has specific roles and responsibilities. Clarity in this area prevents misunderstandings and disputes later.

-

It's important to define what each party contributes in terms of expertise, capital, and management.

-

Establish structured methods for communication and decision-making, essential for effective collaboration.

-

Understanding the legal responsibilities helps in mitigating risks and ensuring that all parties adhere to the law.

How do you identify the right project for a joint venture?

Selecting the right project is critical for the success of a joint venture. Various criteria must be considered to ensure the project's viability and alignment with both parties' strategic goals.

-

Evaluate location, market demand, and financial feasibility to ensure project success.

-

Consider residential, commercial, and mixed-use investments based on market trends and strategic goals.

-

Analyze past successful ventures for insights and strategies that can be replicated.

What are effective funding and acquisition strategies?

Securing funding and developing acquisition strategies are vital for executing a joint venture. Understanding the various funding sources and structuring your approach is essential for financial stability.

-

Differentiate between equity and debt financing to create a balanced funding strategy.

-

Draft a comprehensive funding plan that includes capital calls to ensure liquidity.

-

Follow due diligence practices during acquisitions to safeguard against potential risks.

How do you manage fees and distributions?

Understanding how fees and distributions work is key to maintaining a fair and functional partnership. Addressing these elements early can prevent disputes as the project unfolds.

-

Clarify different types of fees such as management, acquisition, and disposition fees.

-

Set up clear terms of profit sharing to avoid conflicts later.

-

Be aware of tax implications on distributions to manage financial outcomes effectively.

How do you manage ongoing operations of the joint venture?

Ongoing management is crucial for the success of the joint venture. Regular reporting and performance monitoring can help in assessing the project’s progress and making necessary adjustments.

-

Focus on stabilizing operations during early phases to set a solid foundation.

-

Implement a schedule for reporting to facilitate transparency and accountability.

-

Adopt best practices to ensure a successful joint venture, such as developing a formal communication strategy.

How can pdfFiller enhance your real estate joint venture agreement?

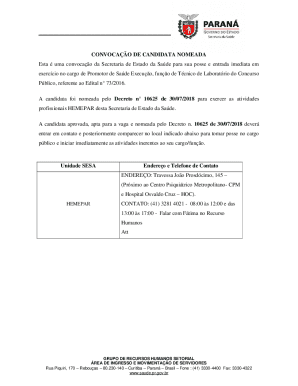

pdfFiller streamlines the process of managing your Real Estate JV Agreement Template form. With tools to edit, sign, and share, it becomes effortless to handle your documents securely and collaboratively.

-

Quickly access your agreement template and edit it in real-time using pdfFiller.

-

Utilize secure online signing features to ensure your document is authenticated.

-

Enhance teamwork with collaborative tools that make document management seamless and efficient.

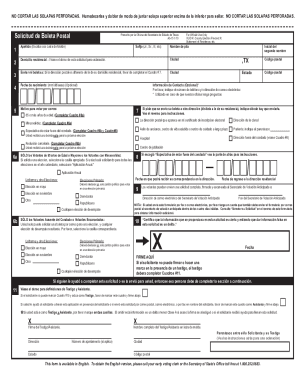

How to fill out the Real Estate Jv Agreement Template

-

1.Download the Real Estate JV Agreement Template from the preferred source.

-

2.Open the document in pdfFiller.

-

3.Begin by entering the names and addresses of all parties involved in the joint venture at the designated sections.

-

4.Specify the details of the property or properties covered by the agreement, including ownership percentages.

-

5.Outline the purpose of the joint venture, detailing the intended goals and objectives regarding the property investment.

-

6.Add terms regarding the financial contributions of each party, including investment amounts and payment schedules.

-

7.Include provisions for the distribution of profits, losses, and responsibilities of each party in the joint venture.

-

8.Review the sections for any additional clauses relevant to the agreement, such as exit strategies or dispute resolution methods.

-

9.Ensure all fields are completed accurately before moving to sign the document electronically if needed.

-

10.Save and download the completed agreement for your records and to share with the other party.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.