Receivables Purchase Agreement Template free printable template

Show details

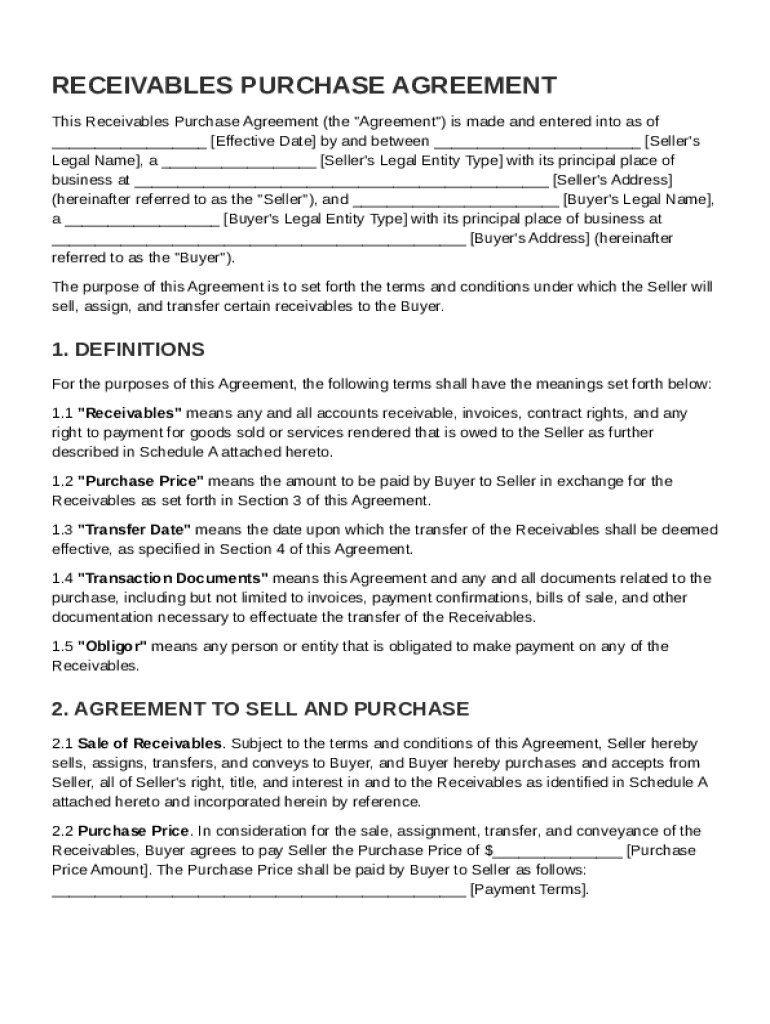

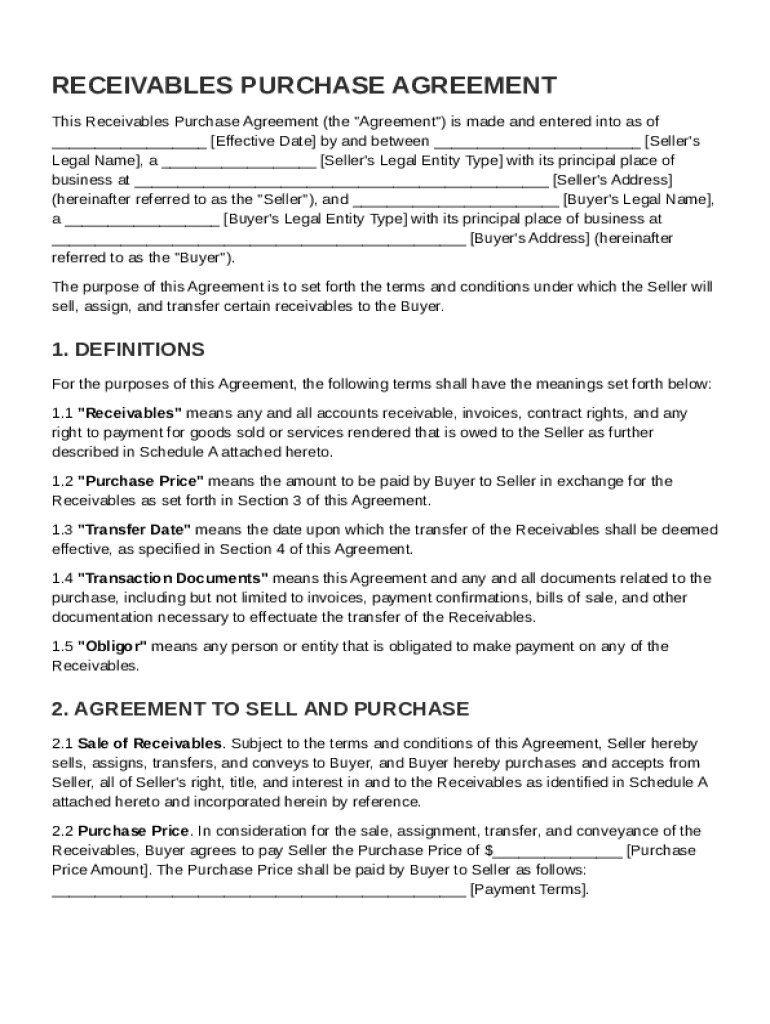

This document outlines the terms and conditions under which a Seller sells certain receivables to a Buyer, including definitions, representations, warranties, and obligations of both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Receivables Purchase Agreement Template

A Receivables Purchase Agreement Template is a legal document that outlines the terms under which a seller sells its accounts receivables to a buyer.

pdfFiller scores top ratings on review platforms

Really useful !

You can do eveything you have to do with pdfFiller, really useful website when you have a lot of documents to fill in,w tihout having to print them ! :)

great program

Great website!!

So far I love this service! Only had some tech issues yesterday and they were addressed quick by your tech support. I love the layout, it's very easy to navigate, and the editing options on the top bar also make it super easy to check, sign, and type just about anywhere in the document. I love it!

Great for people like me that have not so neat handwriting when filling out a PDF form. Also signature feature is a real plus. 5 Stars

very intuitive to use!

It was hard to change font in fill section

Who needs Receivables Purchase Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Receivables Purchase Agreement Template

How do you define a Receivables Purchase Agreement?

A Receivables Purchase Agreement is a financial document where a seller agrees to sell their receivables to a buyer for a specific purchase price. This agreement facilitates cash flow for the seller while providing the buyer with a chance to earn profits from the receivables. It is an essential tool for businesses looking to stabilize their finances and optimize their working capital.

-

The primary purpose is to transfer a seller's receivables in exchange for immediate cash, aiding in liquidity.

-

The two main parties are the seller, who provides the receivables, and the buyer, who purchases them.

-

Such agreements are crucial in financial transactions to clarify rights, obligations, and expectations.

What are essential components of a Receivables Purchase Agreement?

An effective Receivables Purchase Agreement contains several key components that define the relationship between the seller and buyer. These detailed sections ensure both legality and clarity, protecting the interests of both parties involved.

-

Identifying the seller's legal status is essential for establishing legal accountability.

-

The buyer's information is also critical for the same reasons as the seller's.

-

This establishes when the agreement becomes active and enforces the terms.

-

Specific receivables being transferred must be clearly outlined.

-

How the purchase price is determined should be thoroughly explained for transparency.

How do you define key terms in a Receivables Purchase Agreement?

Understanding the terminology in a Receivables Purchase Agreement is vital for both parties. Defined terms clarify expectations and help prevent disputes during the agreement's term.

-

Receivables are amounts owed to a business for goods sold or services provided.

-

The purchase price is usually based on the total value of the receivables, deducted by any fees or discounts.

-

This date marks when the ownership of the receivables transfers from the seller to the buyer.

-

These are necessary to detail the agreement's execution and support its enforceability in a court of law.

-

An obligor is the party that is required to pay the receivables; understanding this responsibility is essential.

How do you fill out the Receivables Purchase Agreement?

Filling out a Receivables Purchase Agreement requires attention to detail, as inaccuracies can lead to legal complications. Here is a guide to ensure correctness and completeness.

-

Begin by entering the correct names of parties involved followed by the date of the agreement and listed receivables.

-

Avoid vague descriptions and ensure to review for any omissions before finalizing.

-

pdfFiller offers features like text fields and eSignature options, which simplify document completion and signing.

-

Consider adding clauses that cater to specific business needs, subject to legal review.

What is the review process for the Receivables Purchase Agreement?

Reviewing the Receivables Purchase Agreement is crucial for ensuring all terms are clear and agreeable. Collaboration with legal counsel is advisable for any potential compliance issues.

-

Engage legal counsel to evaluate the terms for any legal loopholes or ambiguities.

-

Confusion about terms can lead to conflict; thus, clarity is key to maintaining a smooth transaction.

-

Leverage pdfFiller's tools for document sharing and feedback, which enhance communication among stakeholders.

How to edit and manage the Receivables Purchase Agreement with pdfFiller?

Managing document versions and edits is simplified with pdfFiller's robust platform, which enhances collaboration while maintaining compliance.

-

Users can easily modify text, add clauses, or amend details within the agreement.

-

The electronic signature feature provides a secure way to obtain signatures without the hassle of printing.

-

pdfFiller allows users to keep track of past versions, ensuring all changes are documented.

-

Automatic logging of edits helps ensure that all modifications comply with legal standards.

What are common questions about Receivables Purchase Agreements?

Common queries arise regarding the practical applicability and legal ramifications of Receivables Purchase Agreements. Understanding these can aid in navigating potential issues.

-

Businesses frequently utilize these agreements to improve cash flow or investigate immediate asset liquidation.

-

In cases of default, sellers should consult legal professionals to address potential recovery options.

-

The terms can be legally enforced, making it advisable to have strong documentation in place.

How to fill out the Receivables Purchase Agreement Template

-

1.Open the Receivables Purchase Agreement Template in pdfFiller.

-

2.Begin by filling in the date of agreement at the top of the document.

-

3.Enter the names and addresses of both the buyer and seller in the designated sections.

-

4.Specify the terms of the purchase, including a detailed list of the receivables being sold.

-

5.Indicate the purchase price and payment terms clearly, including any conditions for payment.

-

6.Include any representations and warranties as required in the agreement.

-

7.Review the sections related to default, remedies, and dispute resolution.

-

8.Sign and date the agreement at the designated signature lines and ensure all parties also provide their signatures.

-

9.Save the completed document and consider consulting a legal professional for review before executing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.